简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

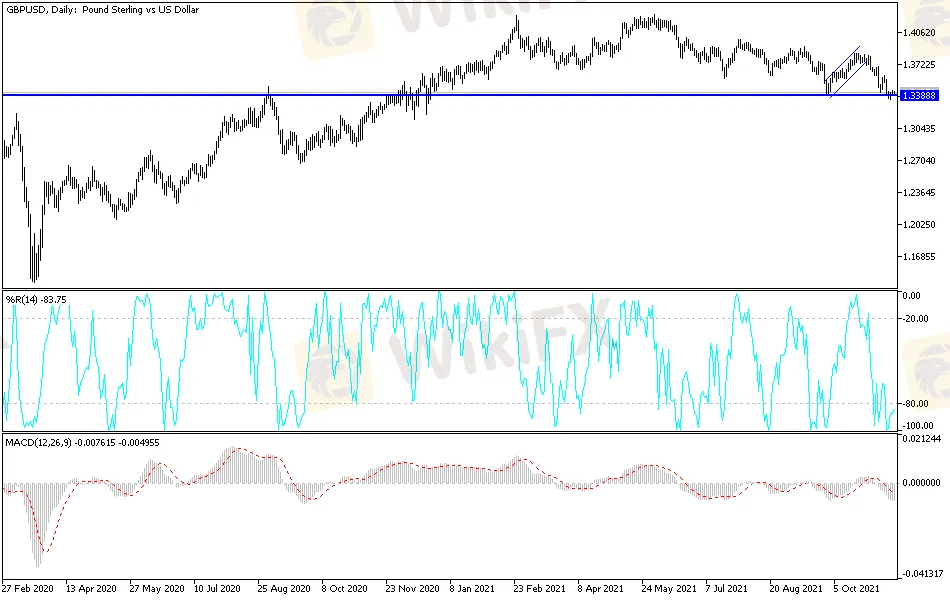

GBP/USD Technical Analysis: Attempts to Recover

Abstract:The British pound has once again defied the strength of the US dollar. This is again related to expectations of imminent tightening of the Bank of England's policy, despite the setback it suffered from its last announcement. Upcoming data this week will be important for those expectations. The strength of the dollar pushed the GBP/USD to retreat to the 1.3352 support level at the end of last week's trading, and attempts to recover moved the pair towards the 1.3450 resistance level before settling around the 1.3425 level as of this writing. The Bank of England is hinting at the December meeting as an opportunity to move its policy toward tightening to counter hyperinflation, which explains the recent steadfastness of the pound. Some analysts have noted technical indications that this corrective movement may extend further over the coming days. The testimony of policy makers in England (BoE) in Parliament as well as employment figures, inflation and retail sales are important to investor

The British pound has once again defied the strength of the US dollar. This is again related to expectations of imminent tightening of the Bank of England's policy, despite the setback it suffered from its last announcement. Upcoming data this week will be important for those expectations. The strength of the dollar pushed the GBP/USD to retreat to the 1.3352 support level at the end of last week's trading, and attempts to recover moved the pair towards the 1.3450 resistance level before settling around the 1.3425 level as of this writing. The Bank of England is hinting at the December meeting as an opportunity to move its policy toward tightening to counter hyperinflation, which explains the recent steadfastness of the pound. Some analysts have noted technical indications that this corrective movement may extend further over the coming days. The testimony of policy makers in England (BoE) in Parliament as well as employment figures, inflation and retail sales are important to investor sentiment.

GBP/USD remains in a multi-month bearish trend and some analysts say it could eventually move as low as the 200-week moving average located at 1.3165 on Friday, although much will depend over the coming days on the data due this week in addition to the continuation of the sharp bullish trend for the dollar lately.

The US dollar has strengthened significantly after inflation data last week sent prices up the entire market - a 0.25% increase in the fed funds rate range for both the third and last quarters of 2022, as market pricing also suggests equivalent price moves are likely in 2023. However, the 2023 price steps have not yet been fully priced in, so there is still room for the market to bet more on this possibility. In addition to a rate hike in interest rates in 2024 in part because it was as recently as June in 2019, the maximum fed funds rate range of 25 basis points is set at 2.5%.

This puts a floor under the dollar and keeps the upside risks alive for the dollar as well as the downside risks for the pound.

Technical analysis

On the daily chart, the GBP/USD is still moving within its bearish channel. Some technical indicators signaled moving towards oversold levels, but investor sentiment will remain the main driver of the currency pair in the coming days, as both currencies await data. The bears' targets stand at 1.3350, 1.3270 and 1.3180.

On the upside, the bulls need break through the resistance 1.3620 and then 1.3700 to bring about a real and strong change in the general trend, which is still bearish.

The pound will be affected by the announcement of the average wage in Britain, along with the rate of change in employment and the unemployment rate in the country. The US dollar will react to the announcement of US retail sales figures and the industrial production rate.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Ghana Trader Jailed for $300K Forex and Crypto Scam

US Dollar Surge Dominates Forex Market

Hong Kong Police Bust Deepfake Crypto Scam Syndicate Involving $34 Million

Is it a good time to buy Korean Won with the current depreciation?

Pepperstone Sponsored the "Aston Martin Aramco Formula One Team"

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Soegee Futures Review: Should You Trust This Broker?

Malaysian Pilot Loses RM1.36 Million in UVKXE Investment App Scam

Indonesia officially joins the BRICS countries

Attention! Goldman Sachs Cuts Gold Target to $2910

Currency Calculator