简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Price Forecast

Abstract:Gold prices have traded around 1760 all of October, with any upside moves quickly reversed.

It‘s been previously discussed that October tends to be a bullish month for gold prices, typically as risk appetite wanes in other parts of financial markets. But this October, there’s much ado about nothing – so far. Gold prices traded up near 1760 on October 1, and since then, have spent every day trading right around 1760.

Now that the US debt ceiling debate has been kicked down the road to December, and fears around China‘s property market are simmering – some days bring worse news than others, but nothing too significant yet – there aren’t many viable catalysts for a significant gold price rally on the horizon. And with the fact remaining that the FOMC continues to offer clear signals that tapering is arriving soon, gold prices still have considerable fundamental headwinds working against them.

Historically, gold prices have a relationship with volatility unlike other asset classes. While other asset classes like bonds and stocks don‘t like increased volatility – signaling greater uncertainty around cash flows, dividends, coupon payments, etc. – gold tends to benefit during periods of higher volatility. Recent signs of falling gold volatility aren’t a good omen for gold prices.

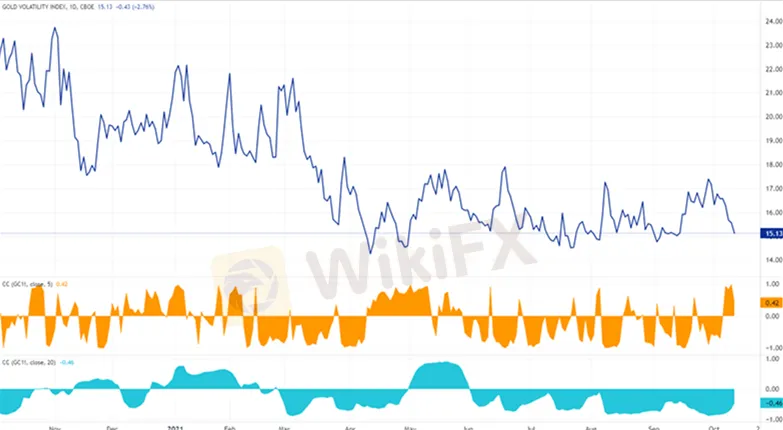

Gold volatility (as measured by the Cboes gold volatility ETF, GVZ, which tracks the 1-month implied volatility of gold as derived from the GLD option chain) was trading at 16.52. The relationship between gold prices and gold volatility is normalizing, insofar as the 5-day correlation is becoming less positive this week while the 20-day correlation remains in negative territory. The 5-day correlation between GVZ and gold prices is +0.42 while the 20-day correlation is -0.46. One week ago, on October 5, the 5-day correlation was -0.70 and the 20-day correlation was -0.84.

Gold prices‘ technical structure on the weekly timeframe remains weak in spite of the recent rebound on lower timeframes. The weekly 4-, 13-, and 26-EMA envelope’s negative slope remains in place, while weekly MACD continues to drop further below its signal line. Weekly Slow Stochastics are holding at the median line, however. For now, the outlook persists that “selling the rally may be the modus operandi henceforth.”

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The U.S. dollar index and U.S. Treasury yields rebounded at the same time; gold fell by more than 1%!

The initial value of the US S&P Global Manufacturing PMI in August was 48, which was lower than expected and the lowest in 8 months; the service PMI was 55.2, which exceeded the expected 54. The number of initial jobless claims in the week ending August 17 was 232,000, slightly higher than expected, and the previous value was revised from 227,000 to 228,000. Existing home sales in July increased for the first time in five months. The PMI data was lower than expected, which was bad for the US eco

The U.S. dollar index returned to the 103 mark; gold once plunged nearly $40 from its intraday high!

The monthly rate of retail sales in the United States in July was 1%, far exceeding expectations; the number of initial claims last week was slightly lower than expected, falling to the lowest level since July; traders cut their expectations of a rate cut by the Federal Reserve, and interest rate futures priced that the Federal Reserve would reduce the rate cut to 93 basis points this year. The probability of a 50 basis point rate cut in September fell to 27%. The data broke the expectation of a

Gold Price Stimulates by Geopolitical Tension

Gold prices experienced their largest gain in three weeks, driven by escalating tensions in the Middle East and the easing of the U.S. dollar as markets await the crucial CPI reading due on Wednesday. Gold has surged to an all-time high above $2,460, as uncertainties surrounding developments in both the Middle East and Eastern Europe persist push the demand for safe-haven assets higher.

Types of gold: How to build a gold investment plan

As investors seek stability and diversification in their portfolios, especially in uncertain economic periods, gold stands out as one of the best options. How many types of gold exist? Before diving into golden investments, it's crucial to grasp the various forms that gold can take.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Scope Markets Review: Trustworthy or Risky?

Currency Calculator