简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Prices May Rise Despite Muddled Yellen Remarks and Here is Why

Abstract:GOLD PRICE OUTLOOK:

Gold prices may rebound after Treasury Secretary Janet Yellen clarified her interest rate comments

Market remains jittery about rising inflation and worsening pandemic situations in some emerging markets, buoying demand for gold

Gold prices may aim to breach US$ 1,800 – an important psychological resistance level

Gold prices rose slightly during Wednesday‘s APAC trading session after falling nearly 0.8% a day ago. US Treasury Secretary Janet Yellen clarified that she wasn’t trying to predict interest rate hikes to rein in inflation pressure following a hawkish-biased comment on Tuesday. Markets have perhaps over-reacted on her earlier words, underscoring the fragility of risk assets amid fears about tapering Fed stimulus. A stronger US Dollar index pulled gold prices lower on Tuesday before giving up some gains. This could provide a basis for gold to recover some lost ground and move higher.

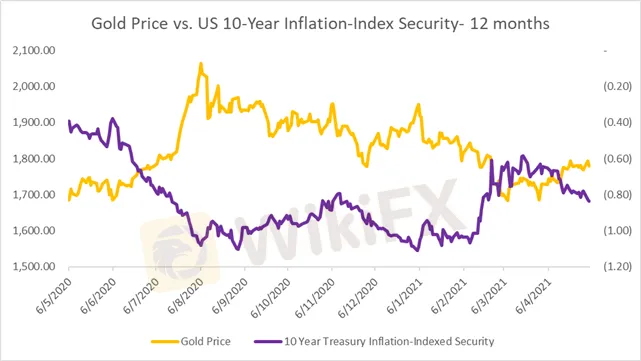

The recent rise in base metal, energy and agriculture prices has led to higher inflation expectations, which may boost the appeal of gold as a perceived inflation hedge. Signs of quickening price growth have pulled real yields (nominal yield – inflation) lower this week. The rate of the 10-year inflation-indexed security fell 6bps to -0.84% from -0.78% seen last Friday. Lower real yields may serve as a positive catalyst for gold prices, as the opportunity cost of holding the non-interest-bearing metal decreases.

Although recent robust US economic data pointed to a stronger-than-expected recovery, the outlook remains clouded by a third viral wave that hit many other parts of the world. This could lead to weaker overseas demand, delays in economic reopening and supply chain disruptions. Against this backdrop, the Federal Reserve may continue to adopt accommodative monetary policy until its long-term inflation and employment targets are met. The central banks dovish stance is backed by Fed Chair Jerome Powell and President of the New York Fed John Williams, both of whom said it is still far to consider tightening.

Gold Prices vs. US 10-Year Inflation-Index Security

Looking ahead, the US ADP private payrolls report will be closely eyed alongside several speeches from Fed official today. Thursday‘s BoE interest rate decision and Friday’s US nonfarm payrolls print will also be watched by gold traders for clues about inflation and the strength of the US Dollar. Higher-than-expected job creation may strengthen yields and the US Dollar, potentially weighing on precious metal prices. The reverse may be true if the numbers disappoint. Find out more from the DailyFX calendar.

Technically, gold has likely entered an “Ascending Channel” as highlighted on the chart below. An upward channel is formed by consecutive higher highs and higher lows and can be easily recognizable as a trending market. The ceiling and the floor of the channel can be viewed as immediate resistance and support levels respectively.

On the gold chart, the “Ascending Channel” is part of a larger “Double Bottom” pattern, which hints at further upside potential. A key resistance level can be found at US$ 1,800, breaking above which would likely intensify near-term buying pressure and carve a path for price to challenge US$ 1,818 – the 5

0% Fibonacci retracement.

Gold Price – Daily Chart

==========

WikiFX, a global leading broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

╔════════════════╗

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

╚════════════════╝

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Weekly Fundamental Gold Price Forecast: Hawkish Central Banks a Hurdle

WEEKLY FUNDAMENTAL GOLD PRICE FORECAST: NEUTRAL

Gold Prices at Risk, Eyeing the Fed’s Key Inflation Gauge. Will XAU/USD Clear Support?

GOLD, XAU/USD, TREASURY YIELDS, CORE PCE, TECHNICAL ANALYSIS - TALKING POINTS:

British Pound (GBP) Price Outlook: EUR/GBP Downside Risk as ECB Meets

EUR/GBP PRICE, NEWS AND ANALYSIS:

Dollar Up, Yen Down as Investors Focus on Central Bank Policy Decisions

The dollar was up on Thursday morning in Asia, with the yen and euro on a downward trend ahead of central bank policy decisions in Japan and Europe.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator