简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

AUD/USD Drops as Vaccine-Induced Worries Plague Economic Reopening Hopes

Abstract:AUD/USD Drops as Vaccine-Induced Worries Plague Economic Reopening Hopes

AstraZeneca road bump injects fear into markets as Europes vaccine rollout is further slowed

Asia-Pacific markets are likely to move lower as the global economic recovery is put in jeopardy

The risk-sensitive AUD/USD is in danger of taking out monthly lows and continuing lower

Concern over the global economic recovery ramped up on Tuesday, causing a risk-off move to vibrate through markets as the global Covid-19 rollout hit a road bump. The National Institute of Allergy and Infection Diseases announced that AstraZeneca's disclosures may have included outdated data after receiving information from the company's independent data-monitoring board.

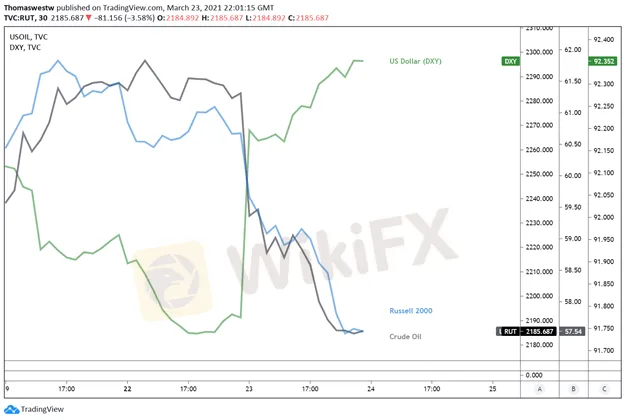

The vaccine blunder caused energy markets to plunge, with crude and brent oil prices sinking over 6%. The hard hit on oil prices sank the small-cap Russell 2000 index over 3.5% during Tuesdays New York trading session. The tech-heavy Nasdaq pushed 0.53% lower while the S&P 500 and Dow Jonesdropped 0.76% and 0.94%, respectively.

Elsewhere, the safe-haven US Dollar shifted higher in response to the risk aversion injected into markets. Investors are concerned that Europes economic reopening will be stalled due to the AstraZeneca shot being its primary vaccine in the continent. Treasuries also received strong bids across the curve, pushing yields lower.

RUSSELL 2000, CRUDE OIL, US DOLLAR – 30 MINUTE CHART

Chart created with TradingView

WEDNESDAY‘S ASIA-PACIFIC OUTLOOKWednesday’s Asia-Pacific session will likely see a spillover of risk aversion from the US session. Japan‘s Nikkei 225 moved 0.61% lower on Tuesday, while South Korea’s KOSPI recorded a 1.01% loss. In Hong Kong, the Hang Seng Index (HSI) fell 1.34%. The CSI 300 closed down by 0.95%, although it recovered into the latter half of the session from deeper losses.

Markit Economics reported March PMI data for Australia earlier today, which shows a recovery in the services sector. According to the DailyFX Economic Calendar, services PMI crossed the wires at 56.2 versus expectations of 53.8, and up from the prior months read of 53.4. However, the risk-sensitive Australian Dollar failed to react to the upbeat economic news.

The Australian economy has made a healthy recovery from the depths of the Covid-19 pandemic. Australia received a boost to its vaccine rollout efforts earlier this week when Canberra gave the go-ahead for local manufacturing of the AstraZeneca vaccine. However, as previously mentioned, the shot has run into road bumps, which may explain some of the weaknesses seen in the Aussie-Dollar. Treasury Secretary Steven Kennedy spoke this morning, stating that the economy has gained back 85% of the Covid-induced decline.

AUD/USD TECHNICAL OUTLOOKThe Australian Dollar is extending an overnight move lower against the US Dollar, with its March lows in danger of giving out. AUD/USDs 100-day Simple Moving Average (SMA) sits just below current prices and may offer an area of support. A break below that and the 0.76 psychological level will shift into focus. Coupled with a bearish MACD, AUD may continue sinking against the US Dollar.

AUD/USD DAILY CHART

Chart created with TradingView

-----------------

WikiFX, the world's No.1 broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Easy Trading Online Awarded “Best Forex Broker - Asia” at Wiki Finance EXPO 2024 Hong Kong

We are thrilled to announce that Easy Trading Online has been awarded the “Best Forex Broker - Asia” at the Wiki Finance EXPO 2024 Hong Kong! This prestigious recognition underscores our commitment to excellence and dedication to providing top-notch services to our clients.

Celebrating Excellence of Easy Trading Online at 2024 FastBull Awards Ceremony

On the evening of April 28, Easy Trading Online proudly received the 'Most Trusted Forex Broker' award at the BrokersView 2024, hosted by Fastbull. This accolade is a testament to our steadfast dedication to providing reliable and superior trading services in the forex and CFD brokerage industry.

Easy Trading Online Shines as Gold Sponsor at BrokersView Expo Dubai 2024

The BrokersView Expo Dubai 2024 is a premier event in the financial industry, bringing together top financial institutions, brokers, and technology providers from around the globe. As the Gold Sponsor of BrokersView Expo Dubai 2024, Easy Trading Online took the opportunity to showcase our latest products, service technologies, and core competitive advantages in the forex trading field.

Easy Trading Online at the Wiki Gala Night

On the 23rd of March, the Easy Trading Online family had the distinguished pleasure of being the Table Sponsor at the prestigious Wiki Gala Night. As we reflect on the event, it’s with a sense of pride and joy that we share the highlights and our takeaways from an evening that was as inspiring as it was splendid.

WikiFX Broker

Latest News

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Broker Review: Is Exnova Legit?

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator