简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How To Use Technical Analysis For Day Trading

Abstract:Day trading refers to the starting or opening and ending of a trade on the same day. Though this trading system is more common among experienced traders, some beginning traders use this system as well. The forex market is very big and day trading as we all know is risky especially when you lack the experience. However, it is very profitable for experienced traders.

Day trading refers to the starting or opening and ending of a trade on the same day. Though this trading system is more common among experienced traders, some beginning traders use this system as well. The forex market is very big and day trading as we all know is risky especially when you lack the experience. However, it is very profitable for experienced traders.

A lot of traders still indulge in it due to the benefits it brings like not having to face any loss that happened at night and the way the process is so fast.

To make the game of day trading more profitable especially for beginning or inexperienced traders, we will be looking at how to use technical analysis while trading in this article. Sit tight!

So, What is Technical Analysis?

Technical analysis is a system of analysis or studying of forex data where the focus is on historical prices and price trends. This is based on the fact that trends go in a cyclical manner hence it repeats itself after a while. Therefore, a technical analyst tries to decipher what future trends may be by using past trends.

Pros Of Using Technical Analysis

• It gives analyst and traders knowledge about the best times in trading sessions to either start a trade or end a trade.

• Traders are able to make wise choices and it gives an impression of the market direction.

• You get to know before hand about any sensitive changes that may occur in the market.

• Anyone can carry out an analysis because it is low price and you dont have to break the bank.

Cons Of Technical Analysis

• The analysis is solely based on the presumptive principle that history repeats itself.

• No analysis is a hundred percent accurate as the market is very sensitive.

In summary, every trader must learn how to carry out technical analysis due to its immense benefits. To be successful, implementing effective risk management and money management techniques are important and this can be facilitated with technical analysis.

How Is Technical Analysis Carried Out?

For those wondering how technical analysis is carried out, we will discuss this now.

Technical Analysis revolves around the principle of demand and supply and some supposed beliefs regarding the repetition of market trends. This way market trends, sentiments, rise in demand and a host of other factors are studied and conclusions are drawn.

The bulk of technical analysis is done by analyzing prices and charts. Now, lets quickly take examples on how to go about it using the best tools.

The best and most popular tools used for technical analysis include : the Bollinger band, relative strength index and MACD lines.

There are important factors to look out for when using the above tools. They include:

• Patterns of securities

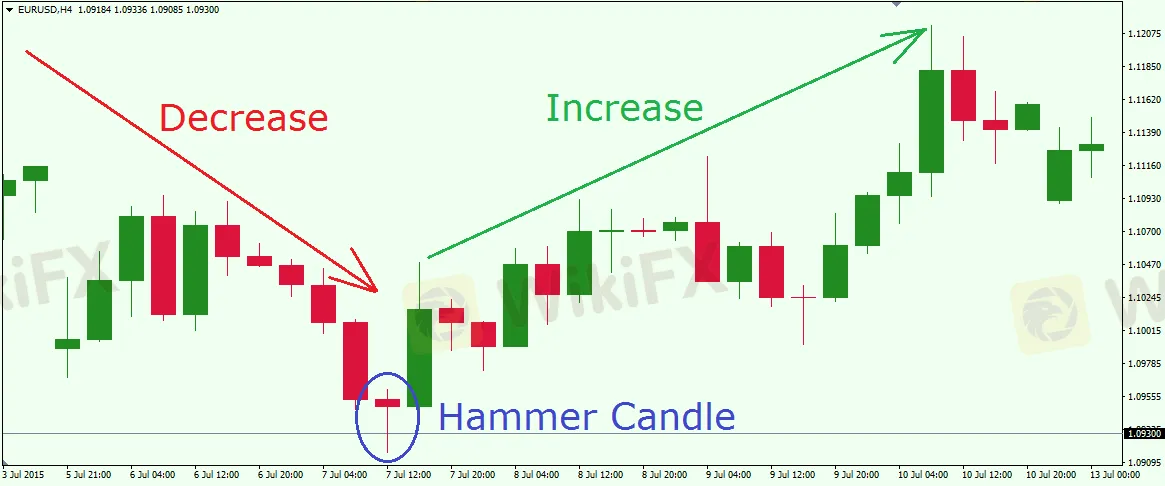

Every technical analyst is familiar with the term “trend line”. A trend line is simply a line that shows the trend of commodities. This is important to study as they are seen on charts. By following the trend line, you can see the rise and fall in the price of a commodity. Taking this into consideration, you can follow the trend to decipher future trends or price of the commodity.

Being able to predict future trends will give you an edge on day trading since it is often swift with very little time to speculate.

•Direction of the market

The guiding principle in technical analysis and determination of the direction of the market is that prices go in a rotational manner. After a while, prices repeat at calculated intervals of time. This is very important in day trading.

Day traders have to be more calculative and in the know of this trends. It will be a guiding light for which commodities to trade or not, when to trade or quit a trade and the kind of profit margin to expect.

•Price action

From technical analysis, you can get a rough idea of a commodity's price action. It will prepare you for a fall or rise in price of a commodity. Therefore, helping you trade the safe way.

•Volume

A day trader that has not understood volume properly probably should not be day trading. This is not an exaggeration. Volume shows the percentage of the market that trades a commodity and the volume is recorded for a time frame of averagely 24 hours. Now, you get what I mean.

The volume for a given commodity is shown as a bar below the line for price action. When the bar is high, it simply means a large number of the market is trading that commodity and if it is low, it signifies a lower number is not trading the commodity.

Analyzing the market percentage will help you gauge the worthiness of a commodity and if it is worthwhile opening a trade. Also, the security that comes with high bars helps traders make wiser choices. So, learn how to evaluate volumes and use it as a guide for your day trading.

•Momentum

This has to do with changes in prices either fall or rise over a period of time. The momentum shows the speed of price change. This is another very important factor in technical analysis. This is often analyzed using the above stated relative strength index.

Since it deals with speed, you will be able to see when a commodity is being bought excessively or is not being bought by a large population of the market. This is another friendly guide as it helps you quickly decide if trading a commodity is worth it or not. And, remember, time is precious to day traders so this is a factor to be on the look out for.

Generally, technical analysis is of high value because unlike fundamental analysis it focuses on price and price changes. Although, there are factors to look out for and great indicators to ease the process of analyzing, nothing is completely certain in the forex market. Therefore, focus on improving your ability to analyze the market technically as it will help you in your career as a day trader.

Technical analysis remains the most handy and effective tool available to day traders.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Key Forex Strategies

New to forex trading and looking for simple and effective trading strategies? We got you covered! In this quick guide, we'll explain some of the key forex strategies which are easy to digest. So, let's start!

Fundamental vs Technical Analysis

Fundamental and technical analysis play some of the most influential and critical roles in making trading decisions amongst traders today. They are widely accepted by stock, foreign exchange, indices and cryptocurrency traders worldwide. Traders use either or both of the methods to make key trading decisions in their respective markets.

Going Short of JPY Is Boosted by Yellen’s Remark on Interest-Rate Hikes Again

When interviewed by Bloomberg, Yellen, the U.S. Treasury Secretary, indicated that the USD 4-trillion budget released by Biden would be beneficial to America even if it may increase inflation and interest rates.

Brent oil is predicted of bullish repricing by Goldman Sach

According to Goldman Sachs' head of energy research, a nuclear deal between the U.S. and Iran could send energy prices higher - even if it means more supply in the oil markets. Talks are ongoing in Vienna between Iran and the six world powers - the U.S., China, Russia, France, U.K., and Germany - trying to salvage the 2015 landmark deal. Officials say there's been progress, but the conclusion of the negotiations remains unclear and oil prices have been soaring as a result.

WikiFX Broker

Latest News

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Webull Canada Expands Options Trading to TFSAs and RRSPs

CySEC Launches Redesigned Website Packed with New Features

WikiFX Review: Is PU Prime a decent broker?

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

Currency Calculator