简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Price Forecast: Bounce Remains Unconvincing Ahead of Fed - Levels for XAU/USD

Abstract:Gold Price Forecast: Bounce Remains Unconvincing Ahead of Fed - Levels for XAU/USD

Gold Price Outlook:

Global bond yields are off their yearly highs, which have given gold prices a reason to trade higher in recent days.

However, the inflation/reflation thematic back-and-forth takes center stage with the March Fed meeting tomorrow, meaning that another spike in global bond yields could hurt gold prices down the road.

According to theIG Client Sentiment Index, gold prices have a bullish bias in the near-term.

Gold Prices Off Lows Ahead of FOMC

Gold prices have rallied over the past week after reaching a make-or-break level of technical support at the start of March. Coinciding with global bond yields pulling back from their yearly highs, there has been a substantive reason for gold prices to bounce.

But not all is sanguine. The technical damage wrought in recent weeks and months has not been undone, and the fundamental outlook has been damaged thanks, in part, to the rise in real US yields. As the inflation/reflation thematic back-and-forth takes center stage with the March Fed meeting tomorrow, meaning that another spike in global bond yields could hurt gold prices down the road.

LONG-TERM FUNDAMENTALS MATTER, BUT…

Its important to view recent price action across asset classes through the lens of asset allocation and risk-adjusted returns. Gold, like other precious metals, does not have a dividend, yield, or coupon (as noted earlier), thus a jump in both US nominal and real yields presents a problem. Moreover, rising US Treasury yields, narrowing the gap with key metrics like US S&P 500 dividend yield (and above that, the earnings yield), are provoking reallocation not just in commodities, but equities and FX as well.

Bond markets are the ‘tail that wags the dog,’and while longer-term fundamentals matter, a rapid advance in yields can provoke short-term havoc that runs counter to longer-term expectations (in this case, which is a steady erosion in real yields due to the combination of loose monetary policy and expansionary fiscal policy).

Gold Prices, Gold Volatility Out of Sync

Historically, gold prices have a relationship with volatility unlike other asset classes. While other asset classes like bonds and stocks dont like increased volatility – signaling greater uncertainty around cash flows, dividends, coupon payments, etc. – gold tends to benefit during periods of higher volatility.

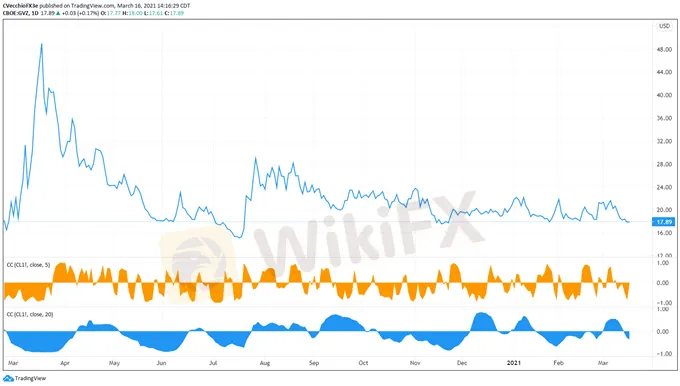

GVZ (Gold Volatility) Technical Analysis: Daily Price Chart (March 2020 to March 2021) (Chart 1)

Gold volatility has continued to pullback from its early-March peak, approaching its lowest closing level since November 2020. Gold volatility (as measured by the Cboes gold volatility ETF, GVZ, which tracks the 1-month implied volatility of gold as derived from the GLD option chain) is trading at 17.89, far below the yearly high set during the first week of February at 24.03. The 5-day correlation between GVZ and gold prices is -0.04 while the 20-day correlation is -0.35. One week ago, on March 9, the 5-day correlation was -0.33 and the 20-day correlation was +0.48.

Gold Price Rate Technical Analysis: Daily Chart (March 2020 to March 2021) (Chart 2)

In the last gold price forecast update, it was noted that “if gold prices are going to find a bottom, this may be an ideal place from a technical perspective.” Indeed, gold prices rallied from key confluence: the 38.2% Fibonacci retracement of the 2015 low/2020 high range at 1682.27; the 61.8% Fibonacci retracement of the 2020 low/high range at 1689.74; and longer-term bull flag support (as measured from the August 2020 and January 2021 highs measured against the November 2020 low).

But gold prices have yet to make a meaningful technical rebound. Still below the 50% Fibonacci retracement of the 2020 low/high range, gold prices are enmeshed in their daily EMA envelope, which is attempting to shift from bearish to neutral positioning. Daily Slow Stochastics have risen back to their median line, but daily MACD remains well-below its signal line.

More constructive price action is likely required before traders can have more confidence in the gold price rebound.

Gold Price Technical Analysis: Weekly Chart (October 2015 to March 2021) (Chart 3)

It‘s been previously noted that “further downside from here (below the 50% Fibonacci retracement of the 2020 low/high range) would warrant a reconsideration the 1Q’21 forecast, which suggests that gold prices could hit new highs this quarter.” Such reconsideration was trigged with the drop below 1763.36. With gold prices making a technical ‘last stand’ of sorts, the technical outlook may soon erode from neutral to bearish below 1682.27, the 38.2% Fibonacci retracement of the 2015 low/2020 high range.

IG CLIENT SENTIMENT INDEX: GOLD PRICE FORECAST (March 16, 2021) (CHART 4)

GOLD CLIENT POSITIONING

Gold: Retail trader data shows 83.30% of traders are net-long with the ratio of traders long to short at 4.99 to 1. The number of traders net-long is 0.20% lower than yesterday and 1.62% lower from last week, while the number of traders net-short is 2.49% higher than yesterday and 14.29% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Gold price trend may soon reverse higher despite the fact traders remain net-long.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Inflation hot at 13-year high, what will happen to gold?

Inflation hot at 13-year high, what will happen to gold?

Optimism Ahead Of Bank Of Canada Decision

Optimism Ahead Of Bank Of Canada Decision

FX Week Ahead - Top 5 Events: Chinese, Mexican, US Inflation Rates; BOC & ECB Rate Decisions

FX Week Ahead - Top 5 Events: Chinese, Mexican, US Inflation Rates; BOC & ECB Rate Decisions

Find Your Forex Entry Point: 3 Entry Strategies To Try

Find Your Forex Entry Point: 3 Entry Strategies To Try

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator