简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Lower-Than-Expected NFP Highlights Further USD Downsides

Abstract:The Non-Farm Payrolls (NFP) report released on Dec. 4 missed the market expectation and highlighted job market weakness.

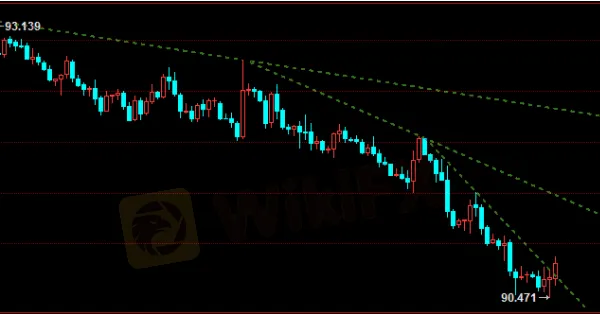

WikiFX News (7 Dec.) - The Non-Farm Payrolls (NFP) report released on Dec. 4 missed the market expectation and highlighted job market weakness. As a result, the US dollar declined to around 90.47, a low last seen over two-and-a-half years ago.

The latest NFP report missed the market expectation of 469k, with 245k new roles created in November. The Fed is expected to announce that it will purchase more longer-dated US bonds at 2020s last FOMC meeting. Markets also hope to see its efforts in keeping longer-term interest rates lower to help consumer borrowing and in boosting the ailing jobs market.

In addition, news about the vaccine roll-out inoculation in the UK fuels a risk-on move in the market, further dampening the haven dollar.

The dollars bull run was at an end, said Fund Managers at the Reuters Global Investment Summit, who are positioning for a weaker-dollar world.

Technically speaking, the dollar has fallen below the 94 barrier with no substantial support at 90, suggesting a breach below 90 is a matter of time amid the dollar's enduring downtrend.

All the above is provided by WikiFX, a platform world-renowned for forex information. For details, please download the WikiFX App: bit.ly/wikifxIN

Chart: Trend of the DXY

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Volkswagen agrees deal to avoid Germany plant closures

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator