Score

FXCentrum

Seychelles|2-5 years|

Seychelles|2-5 years| https://www.fxcentrum.com

Website

Rating Index

Contact

Licenses

Licenses

Licensed Institution:WTG LTD

License No.:SD055

Single Core

1G

40G

1M*ADSL

- The Seychelles FSA regulation with license number: SD055 is an offshore regulation. Please be aware of the risk!

Basic information

Seychelles

SeychellesUsers who viewed FXCentrum also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

fxcentrum.com

Server Location

Slovakia

Website Domain Name

fxcentrum.com

Server IP

37.9.175.26

Genealogy

VIP is not activated.

VIP is not activated.Company Summary

| Aspect | Information |

| Company Name | FXCentrum |

| Registered Country/Area | Seychelles |

| Founded Year | 2021 |

| Regulation | Regulated by the FSA |

| Market Instruments | Forex, Commodities, Metals, Indices, Stocks & ETFs |

| Account Types | Floating Bonus, Margin Bonus, Scalping Margin Bonus |

| Minimum Deposit | 10 USD for USD accounts |

| Maximum Leverage | Up to 1:1000 |

| Spreads | Starting from 0.3 pips for major currency pairs |

| Trading Platforms | FXC Trader (Web, Desktop, Mobile) |

| Customer Support | Phone at (+248) 263-0501 or email at support@fxcentrum.com |

| Deposit & Withdrawal | Visa, Mastercard, AstroPay, USDT TRC20 Tether, Korapay, Help2Pay, BTC, Thunder X Pay, UPI (India), Online Naira, Ozow, NetBanking (India), MoonPay, Perfect Money, PIX (Brazil), and Prompt Pay QR |

| Educational Resources | Articles, ebooks, basic video education, webinars |

FXCentrum Overview

FXCentrum, established in Seychelles in 2021, offers a wide array of trading assets, including Forex, commodities, metals, indices, and stocks & ETFs.

Advantages include competitive spreads starting from 0.3 pips, various payment methods, user-friendly platforms accessible via web and mobile, no deposit fees, low minimum deposit of 10 USD, and leverage up to 1:1000.

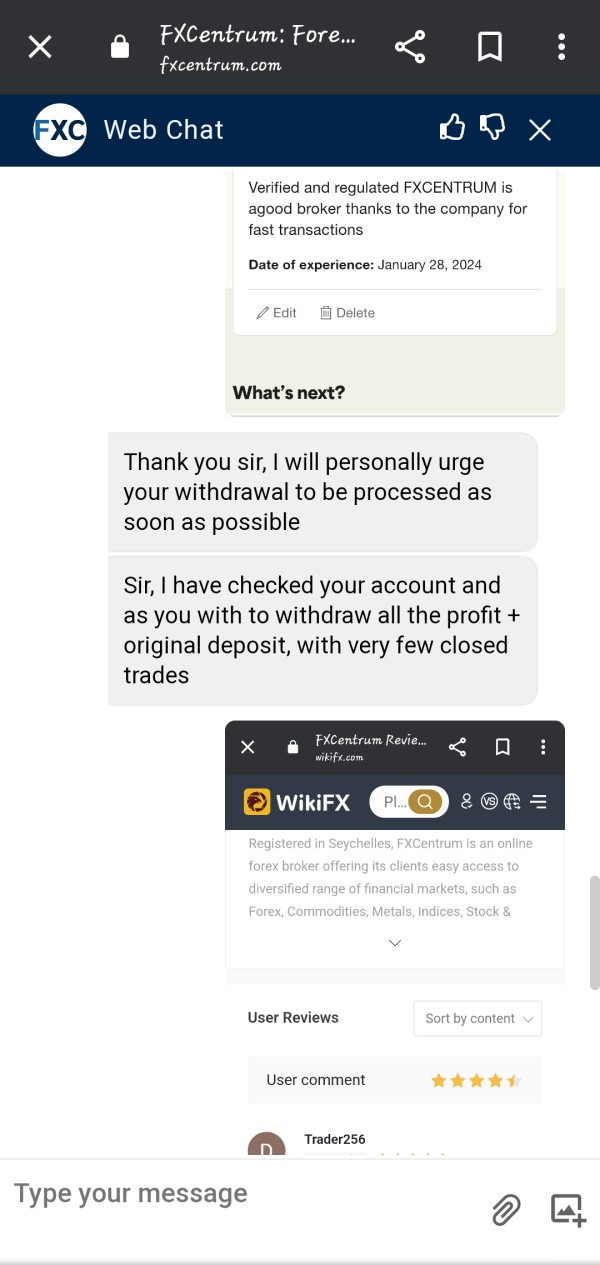

However, some users have reported difficulties with withdrawals, and the platform lacks support for MT4/MT5. Regulated by the Seychelles Financial Services Authority (FSA), FXCentrum provides a regulated trading environment.

Regulatory Status

FXCentrum is regulated by the Seychelles Financial Services Authority under a Retail Forex License (License No.: SD055).

This oversight framework provides traders on the platform with a level of assurance regarding the adherence to financial regulations. Being regulated by the Seychelles Financial Services Authority signifies that FXCentrum operates within the legal framework set forth by the regulatory body, ensuring transparency and accountability in its operations.

Pros and Cons

| Pros | Cons |

| Competitive spreads for major currency pairs, starting from 0.3 pips | Some users have reported difficulties with withdrawals |

| Wide range of payment methods available | MT4/5 not available |

| User-friendly trading platform accessible via web, desktop, and mobile | |

| No deposit fees charged | |

| Low minimum deposit requirement of 10 USD for USD accounts | |

| Regulated by the FSA | |

| Leverage up to 1:1000 |

Market Instruments

FXCentrum provides a wide range of trading assets to its users, including Forex, Commodities, Metals, Indices, and Stocks & ETFs.

Forex trading involves currency pairs, commodities encompass precious metals and energy resources, while indices represent baskets of stocks from specific regions or industries.

Additionally, the platform offers access to individual stocks and exchange-traded funds (ETFs), enabling traders to capitalize on specific companies or sectors.

Account Types

FXCentrum offers three distinct account types: Floating Bonus, Margin Bonus, and Scalping Margin Bonus.

The Floating Bonus account features a 50% bonus on all deposits with no upper limit. With a minimum deposit requirement of 10 USD and leverage of 1:1000, this account might suit beginners or those looking for flexible trading conditions. However, scalping is strictly prohibited, making it less suitable for high-frequency traders.

In contrast, the Margin Bonus account provides a 100% bonus, up to 100,000 USD, attracting traders interested in maximizing their initial investment. With similar deposit and leverage requirements as the Floating Bonus account, it appeals to a broad range of traders.

Additionally, the Scalping Margin Bonus account, with its 50% bonus, up to 10,000 USD, targets traders who prefer unrestricted scalping strategies. The higher minimum deposit of 1000 USD reflects its focus on more experienced traders with larger capital.

Despite the differing bonus structures, all accounts offer similar withdrawal processing times and VIP withdrawal options, ensuring convenience for users across the board. Additionally, the Margin Bonus and Scalping Margin Bonus accounts feature cashback incentives based on trading volume, further enhancing their attractiveness to active traders.

| Feature | Floating Bonus | Margin Bonus | Scalping Margin Bonus |

| BONUS for all deposits | 50% no upper limit | 100% - up to 100 000 USD | 50% - up to 10 000 USD |

| Minimum deposit | 10 USD | 10 USD | 1000 USD (no bonus if deposit <1000 USD) |

| Minimum lot position | 0.5 (5 on indices) | 0.01 | 0.5 (5 on indices) |

| Leverage on the account | 1:1000 (or less by choosing from client portal) | 1:1000 | 1:200 |

| Copytrading | Allowed | Allowed | Allowed |

| Scalping | Strictly forbidden. Positions must be opened for a minimum of 3 minutes (180 seconds). If scalping is detected, the account will be closed, the remaining balance sent back (no profits), and a 10% transaction fee applied. | Strictly forbidden. Positions must be opened for a minimum of 3 minutes (180 seconds). If scalping is detected, the account will be closed, the remaining balance sent back (no profits), and a 10% transaction fee applied. | Allowed without limits |

| Cashback | No, only on margin accounts | 2 USD per 100 000 volume (e.g., 2 USD per 1 lot traded on forex) | 5 USD per 100 000 volume (e.g., 5 USD per 1 lot traded on forex) |

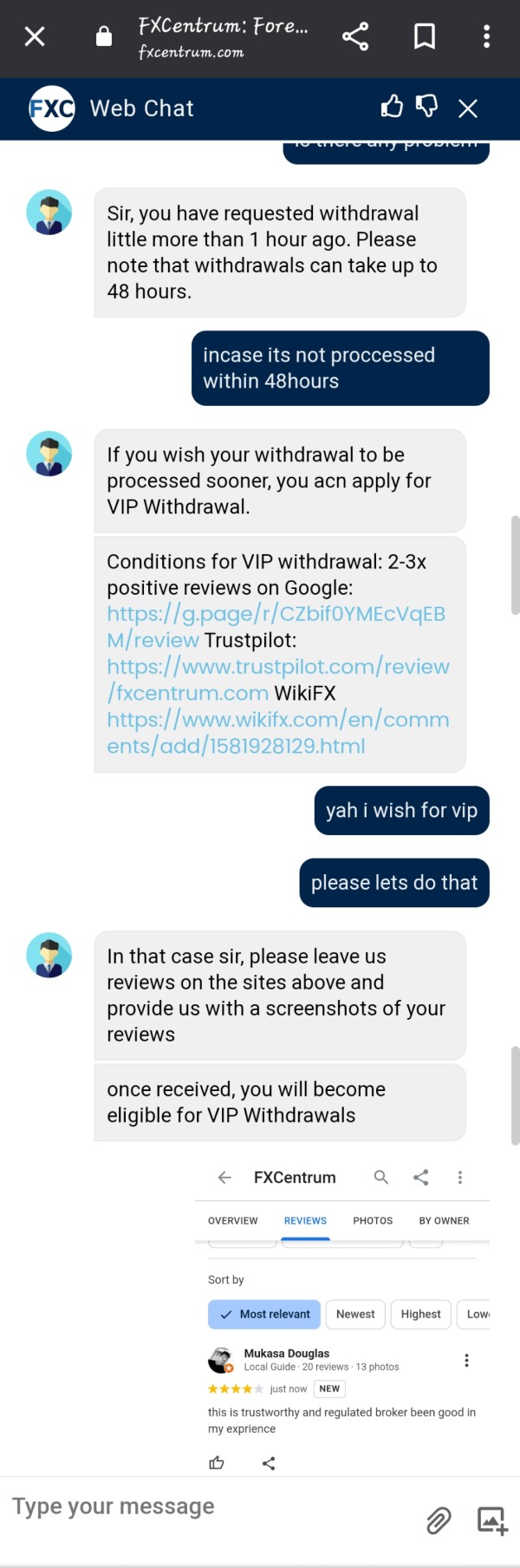

| Withdrawal classic | Up to 48h on working days, 20 USD per withdrawal | Up to 48h on working days Verified KYC, 20 USD per withdrawal | Up to 48h on working days Verified KYC, 5% (min 100 USD per withdrawal) |

| Withdrawal VIP | Available | Available | Available |

| Monthly swapback | 5% if deposits in a month are 5 000 USD. 10% if deposits in a month are 10 000 USD |

How to Open an Account?

- Visit the FXCentrum website: Go to the official FXCentrum website to begin the account opening process.

- Choose account type: Select the type of account you wish to open, such as Floating Bonus, Margin Bonus, or Scalping Margin Bonus.

- Complete registration: Fill out the required registration form with your personal details, including name, email address, and phone number. You also need to provide identification documents for verification purposes.

- Fund your account: Once your registration is complete and verified, fund your account with the minimum deposit requirement of 10 USD for USD-denominated accounts. You can choose from a variety of payment methods offered by FXCentrum.

Leverage

FXCentrum offers varying maximum leverage across its account types.

The Floating Bonus and Margin Bonus accounts both provide a maximum leverage of 1:1000, allowing traders to potentially amplify their positions by a thousand times relative to their initial investment.

In contrast, the Scalping Margin Bonus account offers a maximum leverage of 1:200, which is comparatively lower but still provides ample opportunity for traders to capitalize on market movements.

Spreads & Commissions

FXCentrum offers competitive spreads, with starting spreads as low as 0.3 pips for major currency pairs like EUR/USD and GBP/USD, making it an attractive option for traders looking to minimize trading costs.

Trading Platform

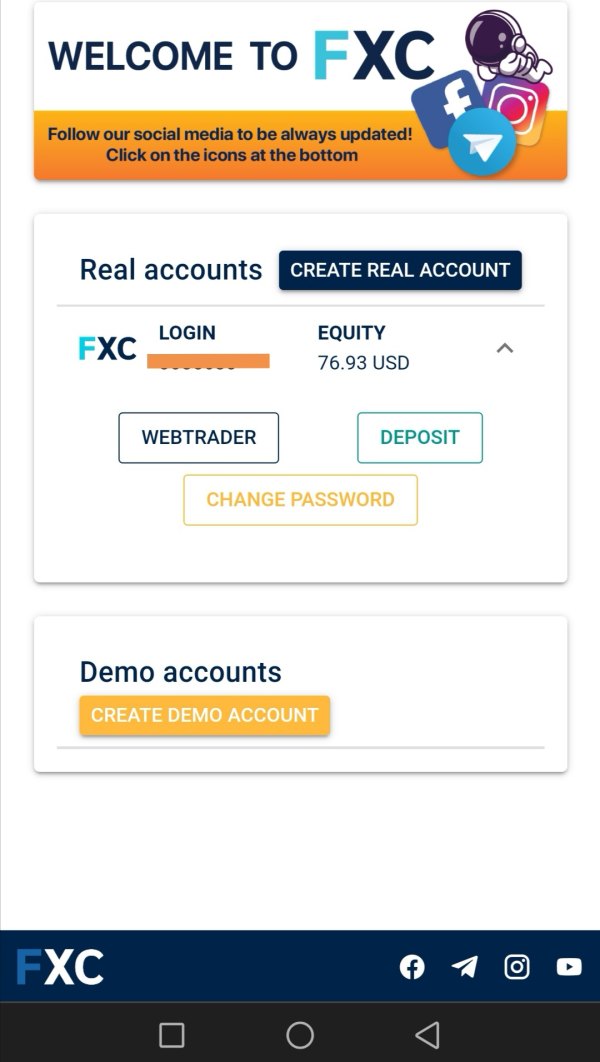

FXCentrum offers its proprietary trading platform called FXC TRADER, available for download on Google Play and the App Store, as well as accessible via web and desktop.

The platform is suitable for traders of all levels, boasting a user-friendly interface for both beginners and experienced traders. With over 20,000 traders already using the platform, FXC TRADER provides access to a wide range of features, including copy trading, a popular strategy in the forex and cryptocurrency markets.

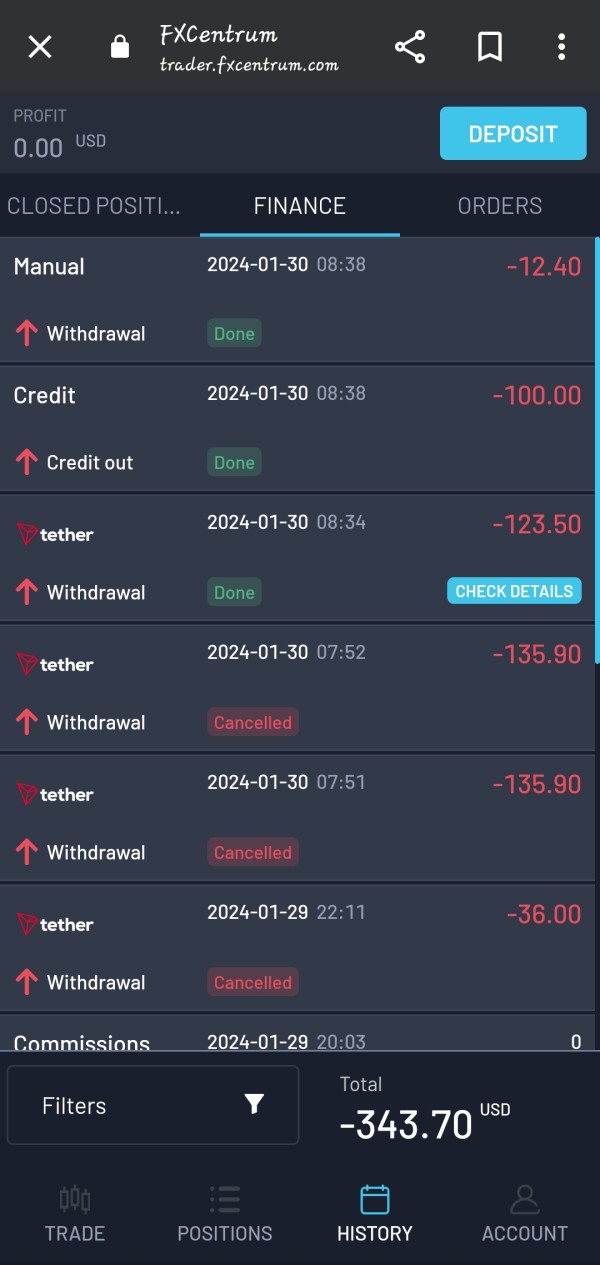

Deposit & Withdrawal

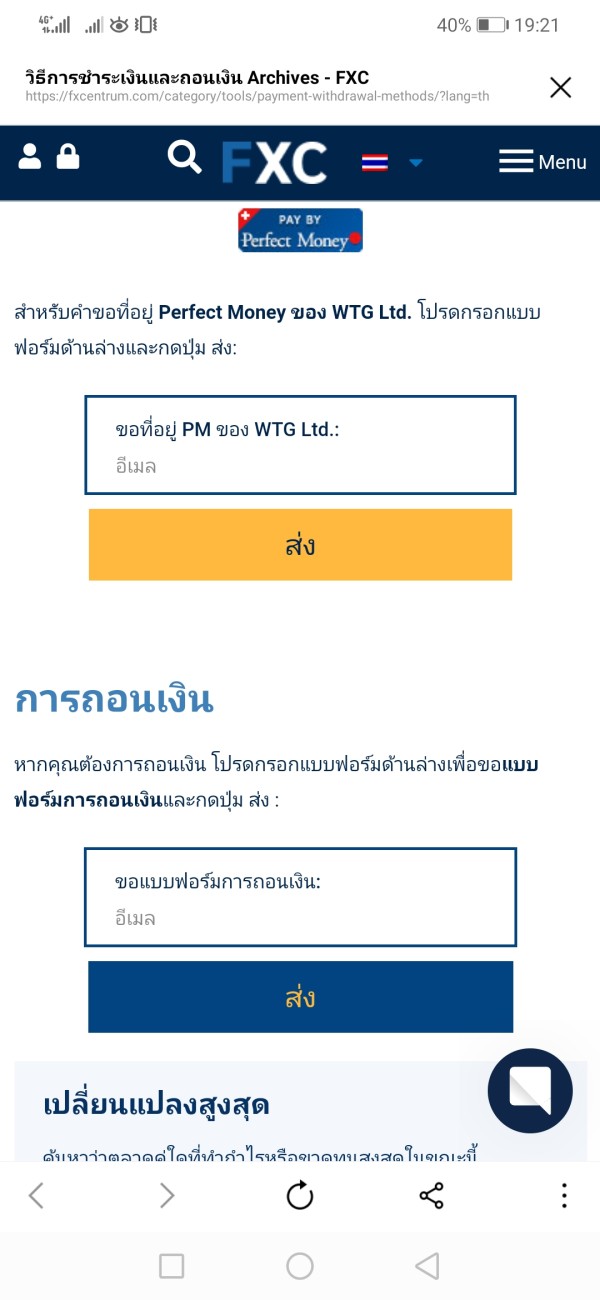

FXCentrum offers a wide range of payment methods. These methods include Visa, Mastercard, AstroPay, USDT TRC20 Tether, Korapay, Help2Pay, BTC, Thunder X Pay, UPI (India), Online Naira, Ozow, NetBanking (India), MoonPay, Perfect Money, PIX (Brazil), and Prompt Pay QR. This extensive selection ensures accessibility and convenience for traders around the world, whether they prefer traditional payment methods like credit/debit cards or digital currencies like Bitcoin and Tether.

The minimum deposit and withdrawal amounts on FXCentrum are standardized, with a minimum deposit requirement of 10 USD for USD accounts and 10 EUR for EUR accounts. The low minimum deposit threshold ensures that traders can start trading with a relatively small initial investment, making the platform accessible to a wide range of individuals, including those with limited capital.

In terms of fees, FXCentrum imposes no deposit fees, allowing users to fund their accounts without incurring additional charges.

For withdrawals, the platform offers a favorable fee structure, with no withdrawal fees for the first withdrawal in a month. However, subsequent withdrawals within the same month are subject to fees: the second withdrawal incurs a fee of 10 USD, while from the third withdrawal onwards, a fixed fee of 2.5% is applied.

Customer Support

FXCentrum provides customer support through several channels.

For assistance, users can contact them at (+248) 263-0501 or reach out via email at support@fxcentrum.com for general inquiries andpartners@fxcentrum.comfor partnership-related matters. Their dedicated team addresses customer queries promptly and efficiently.

Educational Resources

FXCentrum offers a variety of educational resources to support traders at all levels.

From articles covering basic terminology to more advanced topics tailored for professionals, the platform serves various learning needs. Additionally, daily news updates keep traders informed about market developments. The inclusion of ebooks and webinars provides comprehensive learning opportunities, covering various asset classes such as Forex, Metals, Commodities, and Stocks & ETFs.

Exposure

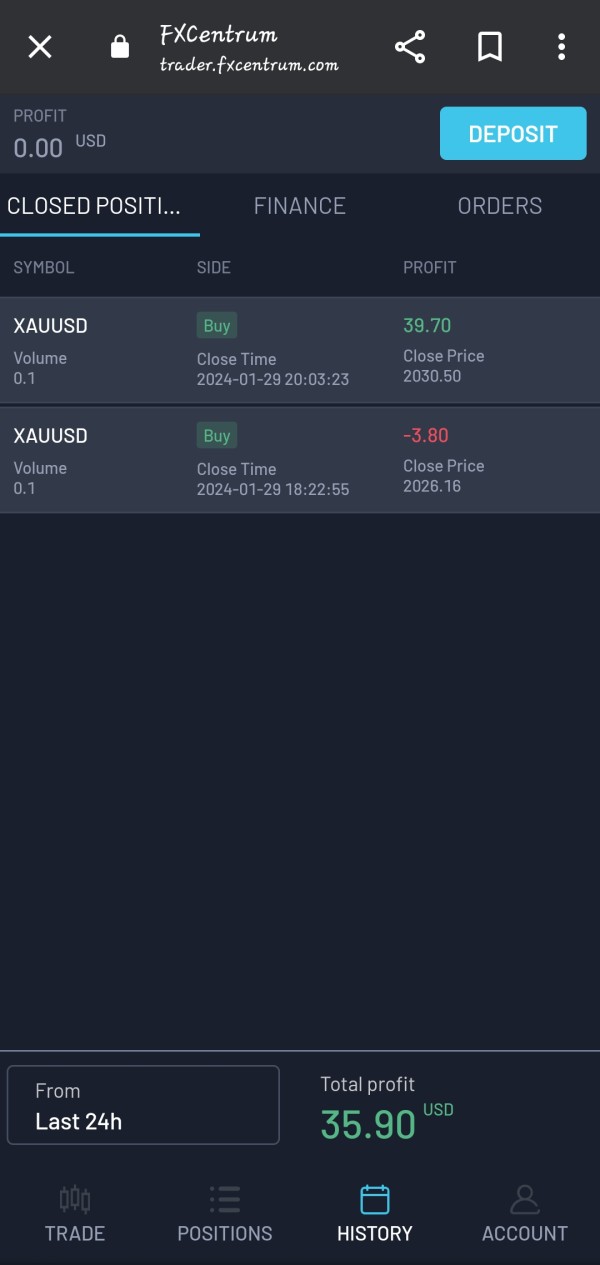

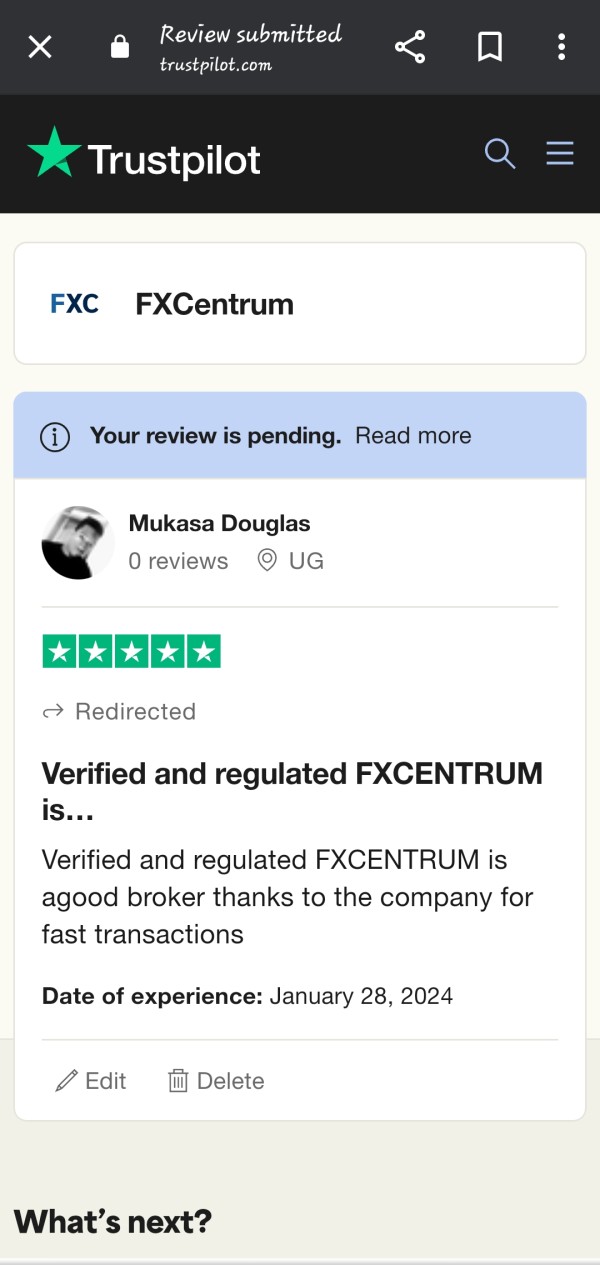

FXCentrum has faced four instances of user exposure, including complaints related to pyramid schemes, withdrawal difficulties, and allegations of scams.

These incidents can undermine trust and confidence among traders, potentially influencing their trading decisions and overall experience on the platform. Traders become wary of depositing funds or engaging in transactions, fearing similar issues.

Conclusion

In conclusion, FXCentrum offers traders a competitive trading environment with advantages such as competitive spreads, a wide range of payment methods, user-friendly platforms, no deposit fees, and high leverage.

However, it's not without its drawbacks, including reported withdrawal difficulties and the absence of support for popular trading platforms like MT4/MT5.

Despite these challenges, FXCentrum's regulation by the Seychelles Financial Services Authority (FSA) provides a level of oversight and accountability.

FAQs

What is the minimum deposit required to open an account with FXCentrum?

The minimum deposit is 10 USD for USD-denominated accounts.

Does FXCentrum charge any deposit fees?

No, FXCentrum does not charge any deposit fees.

What types of trading instruments are available on FXCentrum?

FXCentrum offers a range of instruments including Forex, commodities, metals, indices, and stocks & ETFs.

What is the maximum leverage offered by FXCentrum?

The maximum leverage offered by FXCentrum is up to 1:1000.

Is FXCentrum regulated?

Yes, FXCentrum is regulated by the Seychelles Financial Services Authority (FSA).

Keywords

- 2-5 years

- Regulated in Seychelles

- Retail Forex License

- Suspicious Scope of Business

- Medium potential risk

- Offshore Regulated

Review 92

Content you want to comment

Please enter...

Review 92

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

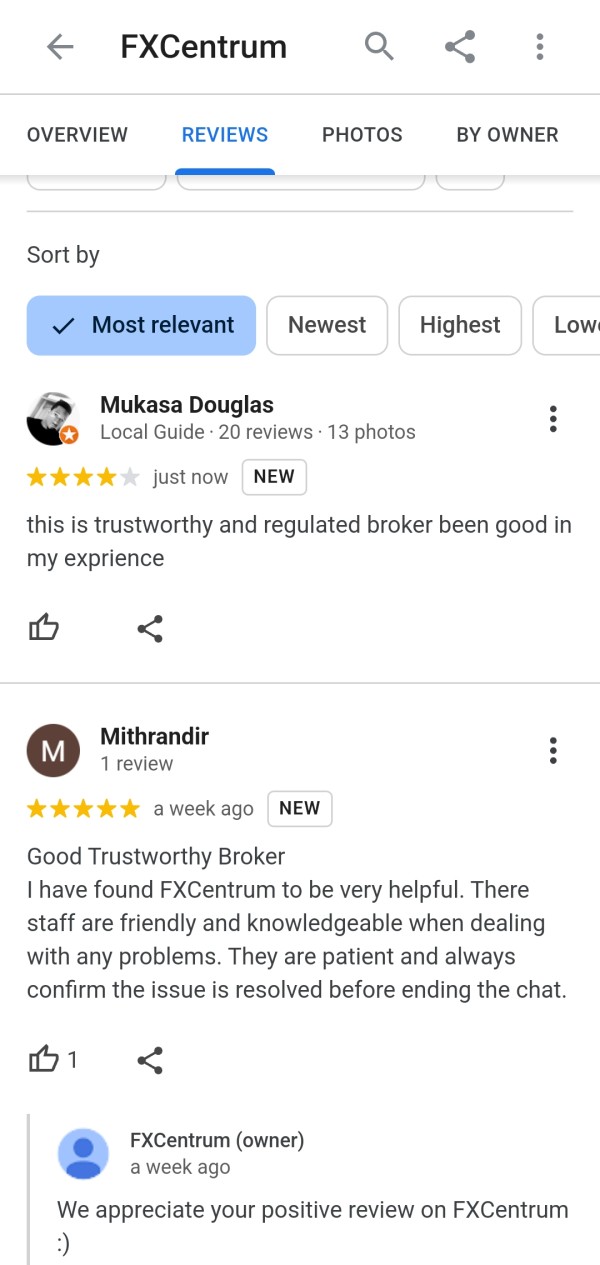

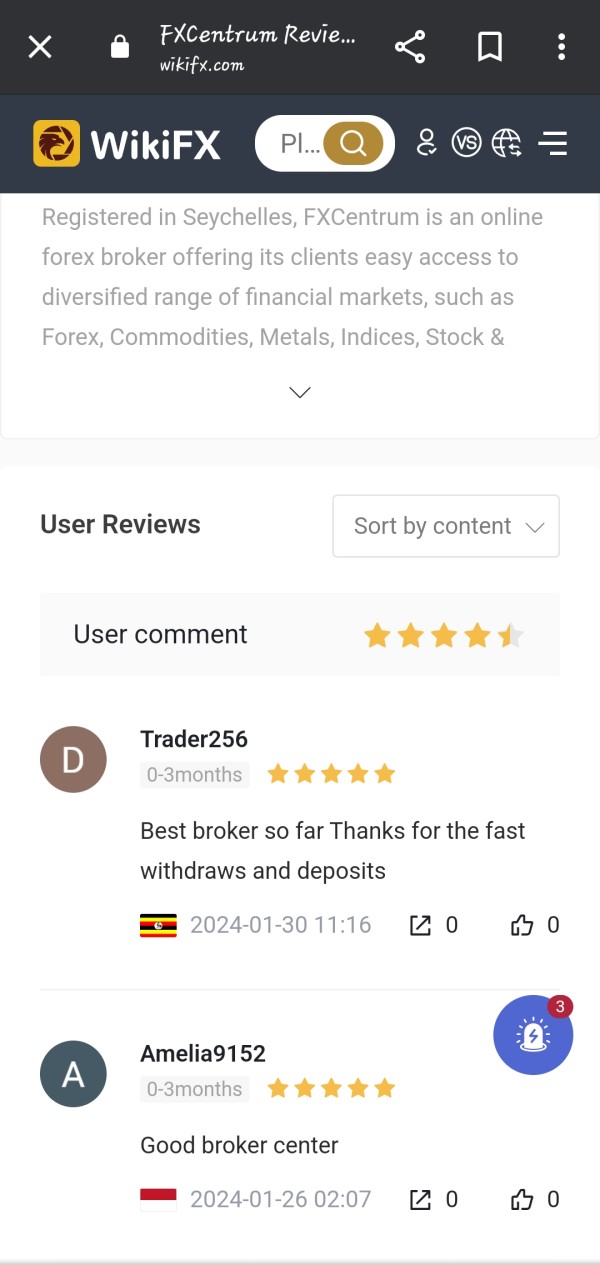

Trader256

Uganda

This broker charged me 10% of my erned profits and my deposited money saying I should trade for atleast 2 months and withdraw only profits please stay away

Exposure

01-30

Hong Kong

I applied for a withdrawal of 10,000 yesterday, but I haven't withdrawn yet. . . . . . . . .

Exposure

2023-03-14

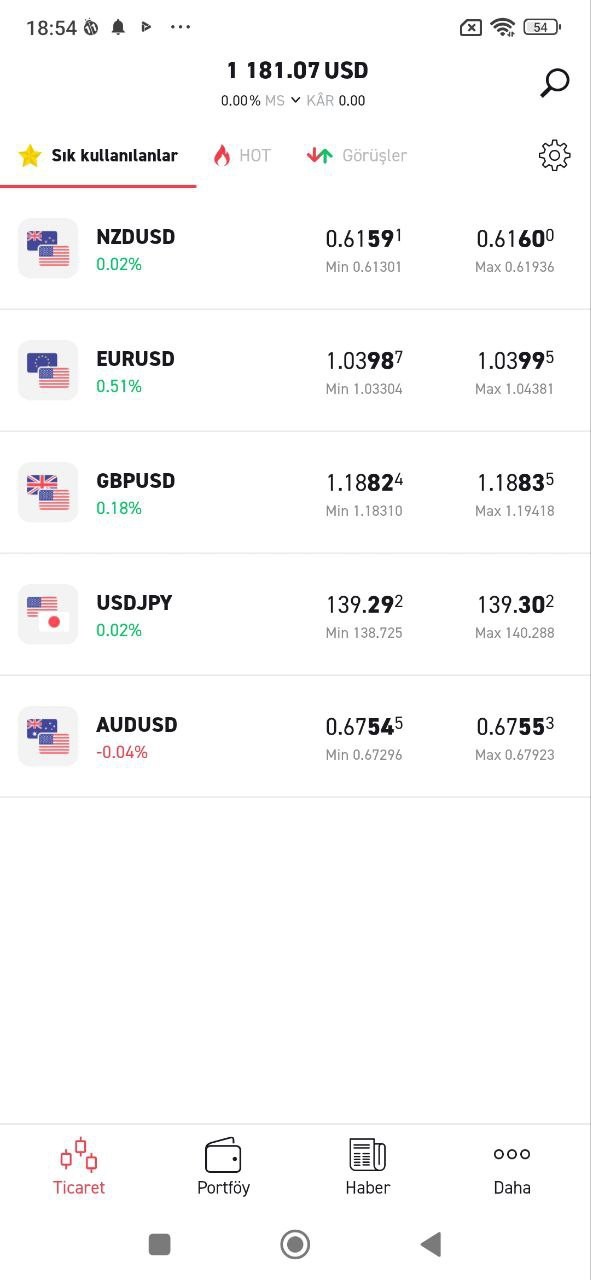

ahmet123

Turkey

Hello friends I trusted fxcentrum I made a deposit of 400 USD and reached a total of 1181 USD I wanted to withdraw money they returned me only 400 this company does not pay earnings do not believe this company is fake I was a victim do not be a victim fxcentrum is a completely fake company

Exposure

2022-11-21

FX2329808150

Thailand

It is able to make a deposit but unable to withdraw money. In case of withdrawing money, you must enter your email address to request a withdrawal form from your account only! But no email reply about FXC Withdrawal Forms. Even agents in Thailand can't help at all

Exposure

2022-01-12

FX1047973873

Colombia

The maximum leverage is 1:1000, the minimum deposit is $10 and the minimum spread is less than half a pip... Do you think this company FXCentrum is excellent? Do not fall in the trap! The most important thing is safety. If all your money is cheated, what is the point of other trading conditions?

Neutral

2022-11-27

Juciee

Nigeria

FXCentrum has a solid regulatory background and provides traders with a user-friendly platform. They seem to have put a lot of effort into making the trading experience smooth and secure.

Positive

07-17

FX4282695973

Indonesia

Best broker Deposits and withdrawals are very easy Thank you fxcentrum, always success

Positive

06-03

Thị Lan

Vietnam

100% deposit bonus💴💴💴, fast customer service📞, fast withdrawal... Cannot find a perfect broker like FXCentrum👍👍👍

Positive

05-22

SRIYATI

Indonesia

Friendly support and quick action. User-friendly application interface. Fast withdrawal process.

Positive

05-20

ASROFIYAH

Indonesia

Amazing exchange for trading and for new users there is a welcome bonus... Oh my goodness 🤩 Great Trading Platform! Fxcentrum is a trusted broker with a No Deposit Bonus, this is amazing.

Positive

05-02

HENDRO WIBOWO

Indonesia

Good Trusted Broker I found FXCentrum very helpful. The staff there are friendly and knowledgeable when dealing with any issues

Positive

04-26

FX2291111344

India

Greatest broker I ever seen.😍😍

Positive

04-24

FX3136425680

Indonesia

Fxc fast deposit and wd ....safe for our fund

Positive

04-24

FX3373317711

Australia

Good Trusted Broker I have found FXCentrum very helpful. easy and good service

Positive

04-17

FX2375013784

Indonesia

reliable and trustworthy broker very satisfying thank you

Positive

04-15

Lasiman

Indonesia

First trade using app FXCtrader, it is very simple and actually price, Don't worried if you want to Investment your funds in FX Centrum broker, it is recommended broker I give review for this broker 5 stars

Positive

2023-12-21

Santosh khndare

India

They are really good , they provide me 4 firgures withdrawal

Positive

2023-12-07

Susilo1849

Indonesia

I tried this broker for the first time, the service was very good, deposits and withdrawals were clear and easy, the trading terminal was also easy to understand. recommendation for traders to join FXCentrum. The best broker

Positive

2023-12-07

Shivukumar mulimani

India

Best broker to chose for 2024.

Positive

2023-12-07

Loisbilab

Taiwan

Fxcentrum is the best broker i ever met. I have nice experience with them.

Positive

2023-08-30