简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Resurgence of Covid-19 May Hamper EUR

Abstract:Recently, the increasing infections of the coronavirus in Europe are threatening the bloc's economic recovery.

WikiFX News (27 Oct.) - Recently, the increasing infections of the coronavirus in Europe are threatening the bloc's economic recovery. The European Central Bank (ECB) is under the pressure of launching more policies to support the economy, which may weigh on the euro.

It is reported that France registered over 50,000 new cases yesterday. Meanwhile, Germany announced that it would introduce new restrictions for those municipalities deemed as at high risks of infection.

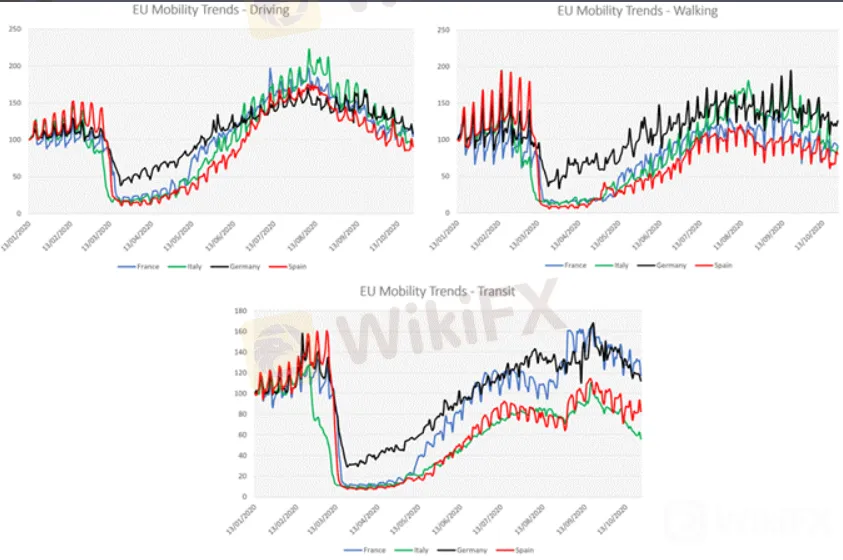

Besides, the latest economic data begins to show the negative impact of restrictions. Euro-zone services PMI fell to 46.2 in October, undershooting market expectations of 47, while all three mobility metrics (walking, driving, and transit) continue to slide lower.

The coronavirus developments in the bloc will likely influence the euro's trajectory ahead of the ECB's monetary policy meeting on October 29, heaping pressure on the ECB to launch more monetary policies to support the economy and in turn capping the euro.

EUR/USD remains skewed to the downside since the RSI failed to climb above 60 and get into bullish territory.

EUR/JPY may extend its decline from the yearly high of 127.07 as the price failed to breach the psychological resistance of 125.

All the above are provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App: bit.ly/wikifxIN

Chart: Trend of three mobility metrics

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GemForex - weekly analysis

The week ahead: Currency Price action at the mercy of the Macro Sentiment

EURUSD Price May Retest $1.1206 Level Before Bullish Reversal Commence

EURUSD is pulling back

EUR/USD Price Analysis: Downside bias remains intact, 1.1250 likely at risk

EUR/USD looks south, with 1.1250 at risks amid firmer USD, yields. Bearish RSI supports the potential move lower towards 1.1200. 1.1300 is the level to beat for the EUR bulls for any meaningful recovery.

CDU's Leadership Election May Affect EUR

The German election will definitely affect the euro's trends.

WikiFX Broker

Latest News

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

JUST Finance and UBX Launch Multi-Currency Stablecoin Exchange

XM Revamps Website with Sleek Design and App Focus

TradingView & Mexico’s Uni. Partnership, to Enhance Financial Education

Something You Need to Know About SogoTrade

Global Shift in Cryptocurrency Taxation: Italy and Denmark Chart New Paths

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

eToro Launches Global-Edge Smart Portfolio: A Balanced Approach to Growth and Stability

Currency Calculator