简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Is Forex Made for a Long Term?

Abstract:A large part of the experienced traders started trading on the forex spot first. But when their time horizon grew longer, they preferred to invest in stocks.

A large part of the experienced traders started trading on the forex spot first.

But when their time horizon grew longer, they preferred to invest in stocks.

Is it incompatible with the medium/long term investment in the currencies? This is what we see in this article.

Some disadvantages of a long-term forex strategy

Amateur traders (not to be confused with beginners) who just start to make profits from the forex are sometimes afraid of going into stocks later.

Instead, they think that in order to make more profits, they can change the time horizon and switch to a long-term investment in the currencies.

Then they will find themselves confronted with several problems.

A long-term strategy surely requires much more capital and it makes sense: the stop will be very far then, and if they want to keep a satisfactory position size, they will need much more money.

Also, once they start to have a little experience, they may not have the patience to wait for an appearing signal and have the risk of entering at the wrong time.

But that's not all: beyond a certain period of time, the trend is irreparably reversed, making it impossible to hold the positions for more than one or two years at most.

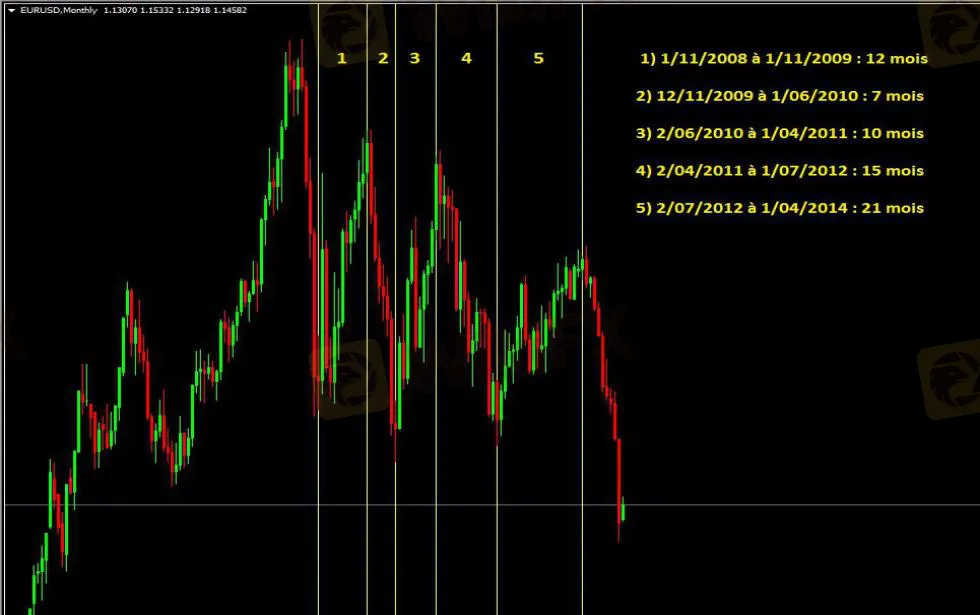

To convince yourself of this, just take a closer look at the chart of the EUR/USD pair since 2008:

We have a long way from investing in equities, which allows us to hold well the stocks after 5 years and which, in addition, allows us to benefit from dividends.

How about the medium term?

If the long term is not a possible option, on the other hand, the medium term is quite possible, for its part.

Nevertheless, forex is a market that has many qualities.

The volume of trade remains very high, which allows it to offer good liquidity to traders.

We also see in the example chart that the price movement remains very clean (at least for EUR/USD, but this also concerns most of the major pairs).

All of this makes it easier to take positions at the right time for those who look for medium-term investing, a way to get a higher return.

Not to mention that at such a level, stress becomes almost nonexistent, unlike short-term trading, since there is no need to follow the price movement hour by hour (or worse: minute by minute).

It will still be necessary to pay more attention to the economic situations of the countries (or economic zones) to which the currencies that make up the pairs traded on the market belong.

Last tips

Changing the time horizon should not be done lightly.

Wanting to hold onto forex for a longer time is commendable, but don't just do it anyhow.

Before taking a position, you can, for example, observe where the historical levels were as they have constituted psychological benchmarks on which other investors may react more or less violently.

However, if you really want to get a good return in the medium/long term, I would like to advise you to give priority to stocks.

(Source: https://www.en-bourse.fr/le-forex-est-il-fait-pour-le-long-terme/?gclid=EAIaIQobChMImdjgsIS96wIVk6yWCh3NgQW5EAAYASAAEgKDjfD_BwE )

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Weekly Fundamental Gold Price Forecast: Hawkish Central Banks a Hurdle

WEEKLY FUNDAMENTAL GOLD PRICE FORECAST: NEUTRAL

Gold Prices at Risk, Eyeing the Fed’s Key Inflation Gauge. Will XAU/USD Clear Support?

GOLD, XAU/USD, TREASURY YIELDS, CORE PCE, TECHNICAL ANALYSIS - TALKING POINTS:

British Pound (GBP) Price Outlook: EUR/GBP Downside Risk as ECB Meets

EUR/GBP PRICE, NEWS AND ANALYSIS:

Dollar Up, Yen Down as Investors Focus on Central Bank Policy Decisions

The dollar was up on Thursday morning in Asia, with the yen and euro on a downward trend ahead of central bank policy decisions in Japan and Europe.

WikiFX Broker

Latest News

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Broker Review: Is Exnova Legit?

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator