简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Bundesbank Says Banks Must Ready for Greater Crisis Strains

Abstract:LISTEN TO ARTICLE 2:26 SHARE THIS ARTICLE ShareTweetPostEmailGermanys financial system should prep

Germanys financial system should prepare for increasing strains as a result of company failures and rising indebtedness, ensuring that credit will continue to flow, according to the Bundesbank.

“The effects of the real economic crisis have not yet fully arrived in the German financial system,” the central bank said in its Financial Stability Review published Tuesday. “Enterprises solvency problems are likely to become all the more noticeable in the financial system the longer the crisis continues,” with market valuations only partially reflecting economic fundamentals.

The Bundesbank predicts insolvencies will rise by more than 35% by the first quarter of next year and argued German banks will probably be able to cope. At the same time, it cautioned that projections remain highly uncertain given the severity and the unprecedented nature of the coronavirus shock.

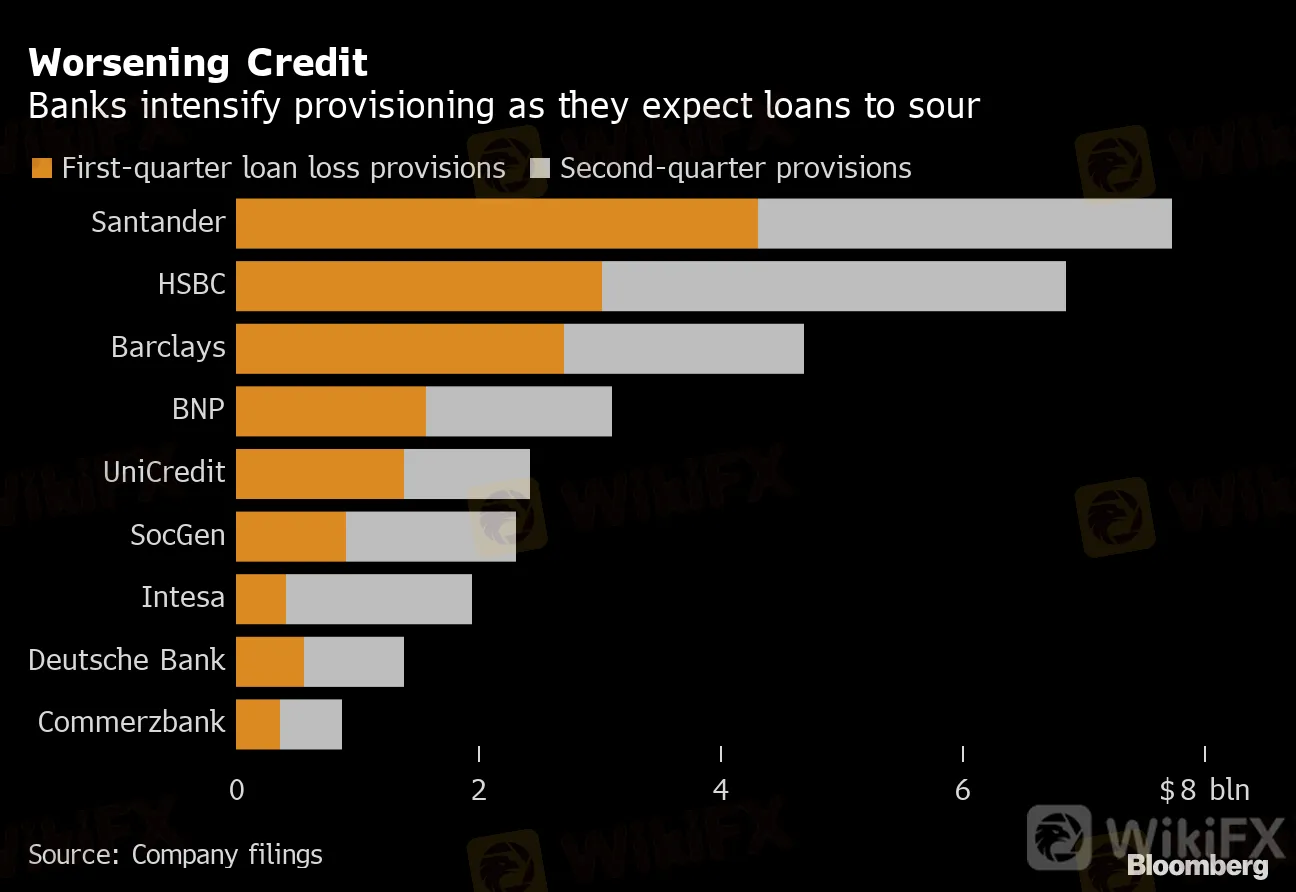

Worsening Credit

Banks intensify provisioning as they expect loans to sour

Source: Company filings

“Corporate insolvencies will increase, and this will also lead to higher provisioning and losses with the banks, but the banks actually have buffers available that they can use to buffer those shocks and continue lending,” Bundesbank Vice President Claudia Buch said in an interview with Bloomberg Television. “Banks should use those buffers to make sure -- to the extent that losses start kicking in -- that we dont have a deleveraging of the banking sector.”

Many businesses are struggling to survive after the pandemic forced governments around the world to introduce wide-ranging lockdowns earlier this year. With infections rising again, German politicians are trying to prevent similar restrictions to protect the economy, even though some curbs have been put in place.

The Bundesbank predicts output will recovery gradually, thanks to abundant monetary and fiscal stimulus.

At the same time, it highlighted markedly higher debt levels in the private, as well as the public, sector as a risk.

Lenders could be forced to increase loss allowances, and the European Central Bank could face pressure to keep monetary policy loose. “That is why a rigorous reduction of the sometimes very high levels of debt will be vital after the crisis,” the Bundesbank said.

The Dutch central bank warned in its financial stability report on Tuesday that the worst may be yet to come for banks. While the countrys financial system has been resilient so far, governments, regulators and central banks should continue their support measures, President Klaas Knot said.

Read more:

|

— With assistance by Matthew Miller

(Adds Buch comments in fourth paragraph, DNB report in ninth paragraph.)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

Volkswagen agrees deal to avoid Germany plant closures

Geopolitical Events: What They Are & Their Impact?

Webull Canada Expands Options Trading to TFSAs and RRSPs

CySEC Launches Redesigned Website Packed with New Features

WikiFX Review: Is PU Prime a decent broker?

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

Currency Calculator