简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Goldman Joins JPMorgan in Building Singapore Forex Trading Hub

Abstract:Goldman Sachs Group Inc. is joining the likes of JPMorgan Chase & Co. and BNP Paribas SA in setting up a foreign-exchange trading and pricing platform in Singapore.

Follow Bloomberg on LINE messenger for all the business news and analysis you need.

Goldman Sachs Group Inc. is joining the likes of JPMorgan Chase & Co. and BNP Paribas SA in setting up a foreign-exchange trading and pricing platform in Singapore.

The platform will go live in the first quarter of next year, with Singapore becoming the companys fourth global currency pricing engine, Goldman said in a statement. The others are in London, Tokyo and New York.

“We continue to actively develop our presence in Singapore and have seen consistent growth of our franchise here over a number of years in both FX and broader global markets,” E.G. Morse, Chief Executive of Goldman Sachs Singapore Pte., said in the statement.

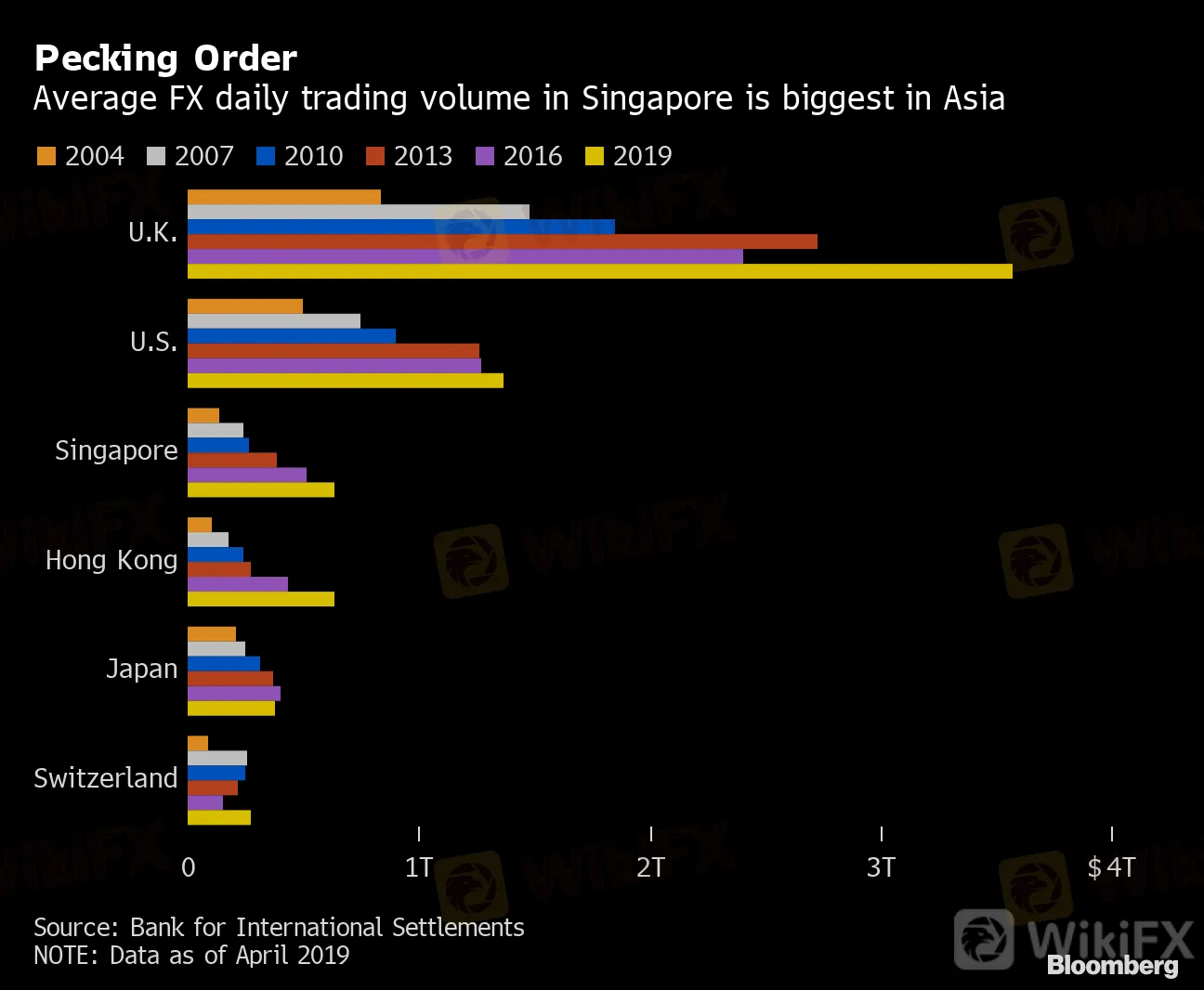

Pecking Order

Average FX daily trading volume in Singapore is biggest in Asia

Source: Bank for International Settlements

NOTE: Data as of April 2019

Singapore‘s currency market saw average trading volumes of $633 billion a day in April 2019, according to the latest data available from the Bank for International Settlements. That’s higher than Hong Kong and Japan, and trails only the U.K. and U.S., the data showed.

Goldman will bring its execution algo for non-deliverable fowards to “enhance the depth and sophistication of the Asian FX market,” said Gillian Tan, executive director of financial markets development at Singapores central bank.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Webull Partners with Coinbase to Offer Crypto Futures

eToro Expands Nationwide Access with New York Launch

Why Is UK Inflation Rising Again Despite Recent Lows?

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Google Warns of New Deepfake Scams and Crypto Fraud

Currency Calculator