简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Oil slips as demand worries offset hopes for stimulus

Abstract:Oil prices fell on Tuesday as demand concerns driven by COVID-19 outweighed hopes that U.S. lawmakers and the White House were nearing an agreement on a new stimulus package to revive the world's biggest economy.

Oil prices fell on Tuesday as demand concerns driven by COVID-19 outweighed hopes that U.S. lawmakers and the White House were nearing an agreement on a new stimulus package to revive the world's biggest economy.

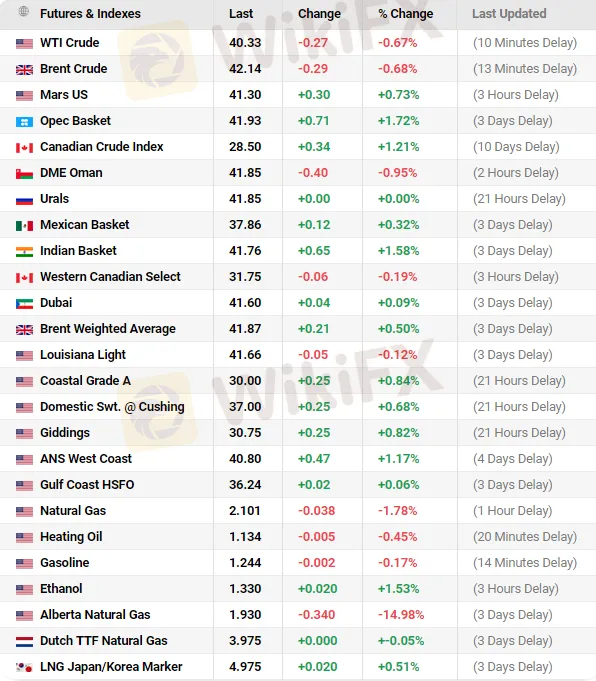

U.S. West Texas Intermediate (WTI) crude futures slipped 17 cents, or 0.4%, to $40.43 at 0120 GMT, while Brent crude futures also fell 17 cents, or 0.4%, to $42.26 a barrel. Both benchmarks rose about 1% on Monday.

Brent and WTI in August hit their highest levels since early March on optimism over rising fuel demand and major oil producers' strong compliance with promised supply cuts, but have since dropped by about $3 on demand worries.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Top 10 Trading Indicators Every Forex Trader Should Know

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Currency Calculator