Score

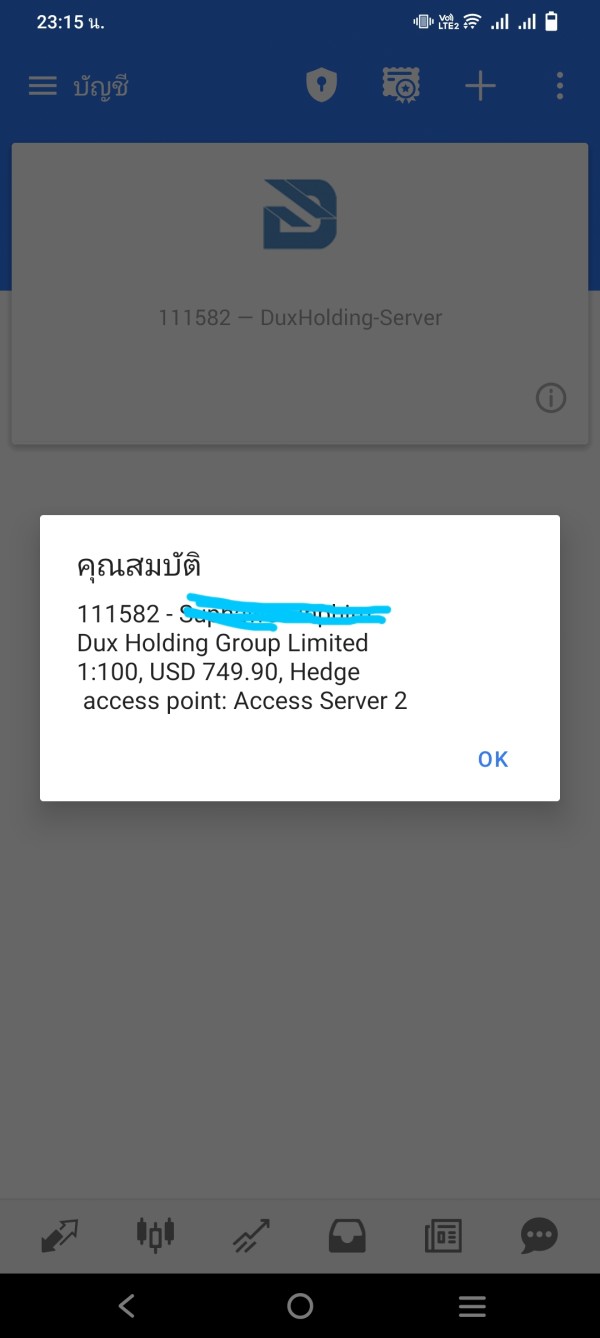

Dux Holding

Hong Kong|2-5 years|

Hong Kong|2-5 years| https://besintmt.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Hong Kong

Hong KongUsers who viewed Dux Holding also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Neex

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

besintmt.com

Server Location

Singapore

Website Domain Name

besintmt.com

Server IP

141.136.47.141

Company Summary

| Aspect | Information |

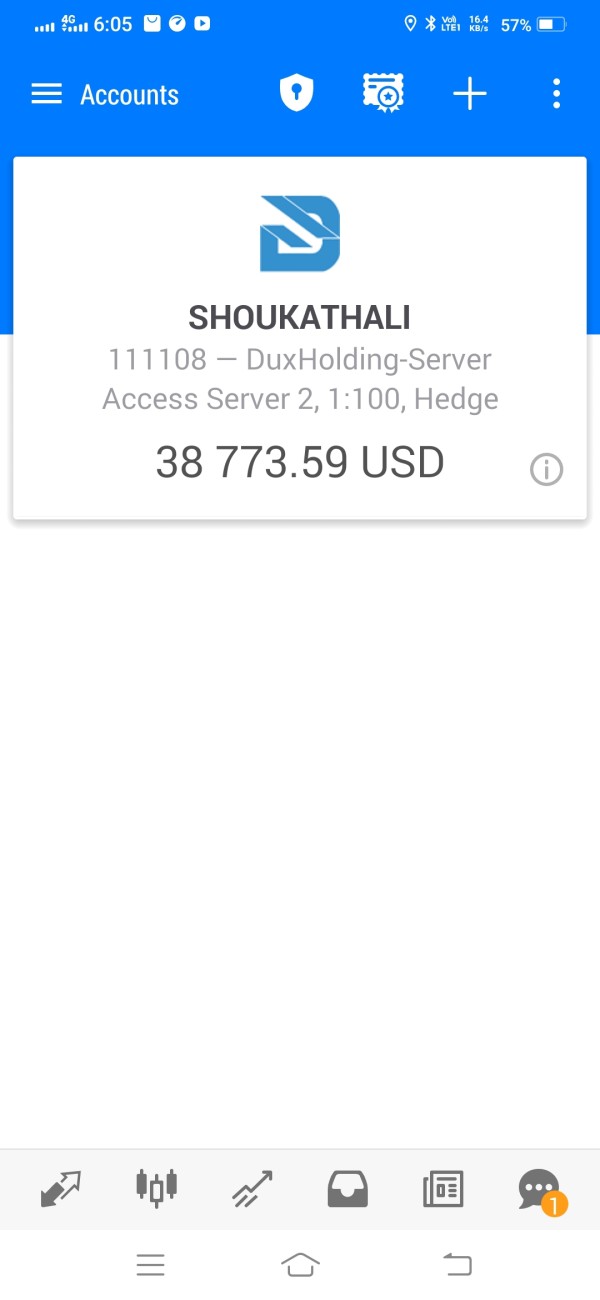

| Company Name | Dux Holding |

| Registered Country/Area | Hong Kong |

| Founded year | 2022 |

| Regulation | Unregulated |

| Minimum Deposit | $100 |

| Maximum Leverage | Up to 1:400 |

| Spreads | Starting from 1.6 pips for major forex pairs, 0.8 pips for gold, 0.5 pips for major indices. |

| Trading Platforms | Proprietary trading platform for desktop and mobile devices |

| Tradable assets | Forex pairs, commodities, indices, individual stocks, cryptocurrencies, volatility indices, and options |

| Account Types | Standard Account, Pro Account, VIP Account |

| Customer Support | Email (info@besintmt.com), Contact number: +852 22222222 |

| Deposit & Withdrawal | Various options including credit/debit cards, bank transfers, and e-wallets. |

| Educational Resources | Lacking educational resources, website inaccessible |

Overview of Dux Holding

Dux Holding, established in Hong Kong in 2022, offers a trading platform with a range of assets, including forex, commodities, indices, and cryptocurrencies. While providing traders with options for diverse accounts, advantageous features such as a proprietary platform and personal trading manager are available for VIP account holders.

However, Dux Holding's unregulated status raises concerns about transparency and user protection. Traders should exercise caution due to limited regulatory oversight. As a relatively new entrant, the platform's advantages and disadvantages warrant careful consideration to ensure a secure and satisfactory trading experience.

Is Dux Holding legit or a scam?

Dux Holding operates without regulatory oversight, posing potential risks for traders. The absence of regulatory scrutiny leaves users without protection and accountability, exposing them to potential fraudulent activities or malpractices. Traders should exercise caution when engaging with unregulated platforms like Dux Holding, as the absence of regulatory checks increases vulnerability to financial risks and inadequate dispute resolution mechanisms. Opting for a regulated trading platform is crucial for a more secure and transparent trading environment, where regulatory authorities provide oversight to safeguard the interests of investors.

Pros and Cons

| Pros | Cons |

| Diverse Trading Tools | Unregulated Status |

| Multiple Account Types | Inaccessible Website |

| User-Friendly Platform | Limited Transparency |

| Various Payment Methods | Limited Customer Support Channels |

| Competitive Spreads | Limited Educational Resources |

Pros:

Diverse Trading Tools:

Dux Holding offers a variety of trading tools, providing users with options to diversify their trading strategies. This diversity can be beneficial for traders with different preferences and trading styles.

2. Multiple Account Types:

The platform provides various account types, catering to different levels of traders and their specific needs. This flexibility allows traders to choose an account type that aligns with their experience and trading goals.

3. User-Friendly Platform:

Dux Holding's trading platform is user-friendly, offering real-time quotes, charting tools, and order execution. While not overly complex, it provides essential features for placing trades and monitoring positions, making it suitable for traders of varying experience levels.

4. Various Payment Methods:

The platform supports various payment methods, including credit/debit cards, bank transfers, and e-wallets. This variety of payment options enhances convenience for users, allowing them to choose the method that best suits their preferences.

5. Competitive Spreads:

Dux Holding offers competitive spreads on its trading instruments, particularly in forex. Competitive spreads can contribute to cost-effective trading, potentially maximizing profits for traders.

Cons:

Unregulated Status:

Dux Holding operates without regulatory oversight, raising concerns about user protection and transparency. The absence of regulatory checks may expose traders to potential risks and fraudulent activities, emphasizing the need for caution.

2. Inaccessible Website:

The platform's website is inaccessible, making it challenging for users to access information or utilize online services. This lack of accessibility can hinder the overall user experience and limit users' ability to gather essential information.

3. Limited Transparency:

Dux Holding exhibits limited transparency in terms of its operations and regulatory compliance. Users may face challenges in understanding the platform's practices and policies, which can be crucial for informed decision-making.

4. Limited Customer Support Channels:

Dux Holding provides customer support primarily through email and a contact number. However, the absence of more immediate channels like live chat may slow down issue resolution and hinder efficient communication, potentially leading to frustration for users.

5. Limited Educational Resources:

The platform lacks educational resources, depriving users of essential materials for learning about trading strategies, market analysis, and risk management. This absence may impact the skill development and informed decision-making of users, especially those seeking educational support.

Market Instruments

Dux Holding offers a range of trading assets, catering to various trading styles and risk appetites.

Forex: With major, minor, and exotic pairs, Dux Holding covers the forex spectrum. EUR/USD, GBP/USD, and USD/JPY are well-represented, alongside less-traded options like NZD/JPY and TRY/MXN. Spreads and liquidity vary depending on the pair.

Commodities: Gold, silver, oil, and natural gas are the staples, providing exposure to traditional markets. Dux Holding also includes agricultural commodities like coffee and wheat, offering diversification.

Indices: Major global indices like the S&P 500, Dow Jones Industrial Average, and Euro Stoxx 50 are available, alongside regional benchmarks like the Nikkei 225. This allows traders to tap into broad market trends.

Dux Holding ventures into CFDs on individual stocks, indices, and even cryptocurrencies. This caters to traders seeking specific assets or alternative asset classes. However, CFDs involve complex risk management.

While not exclusive, Dux Holding offers volatility indices and options, attracting experienced traders comfortable with these instruments.

Dux Holding's asset selection is diverse, but not the most extensive compared to some competitors. It covers popular choices across asset classes, with some ventures into less-traded instruments. This caters to a broad range of traders, but those seeking highly specialized assets might need to look elsewhere.

Account Types

Dux Holding offers a variety of account types, each with its own set of features and benefits. The account types include:

Standard Account:

The Standard Account with Dux Holding offers a maximum leverage of up to 1:200. Traders can access the market with a minimum deposit of $100. The spread for this account type starts at 1.6 pips, and while a demo account is available for practice, the trading tools are provided through Dux Holding's proprietary platform.

Pro Account:

For traders seeking more advanced features, the Pro Account offers increased leverage of up to 1:400. With a higher minimum deposit of $1,000, users benefit from a tighter spread starting at 1.2 pips. Similar to the Standard Account, a demo account is available, and trading tools are accessible through the proprietary platform.

VIP Account:

The VIP Account caters to high-tier traders with a maximum leverage of up to 1:400. To unlock VIP privileges, a substantial minimum deposit of $5,000 is required. Traders with a VIP Account enjoy the tightest spread starting at 1 pip. Notably, the VIP experience is enhanced with access to Dux Holding's proprietary platform and a personal trading manager, providing a more personalized and potentially strategic trading approach.

| Feature | Standard Account | Pro Account | VIP Account |

| Leverage | Up to 1:200 | Up to 1:400 | Up to 1:400 |

| Spread | Starts at 1.6 pips | Starts at 1.2 pips | Starts at 1 pip |

| Commission | Varies by instrument | Varies by instrument | Negotiable |

| Minimum Deposit | $100 | $1,000 | $5,000 |

| Demo Account | Available | Available | Available |

| Trading Tool | Proprietary platform | Proprietary platform | Proprietary platform + personal trading manager |

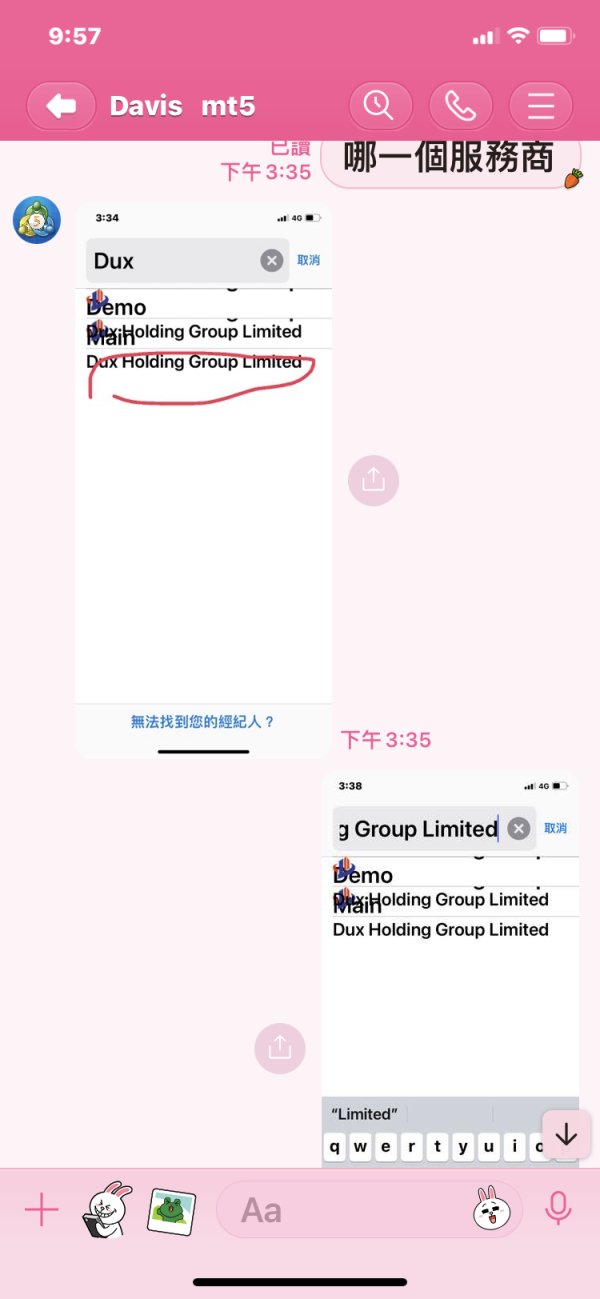

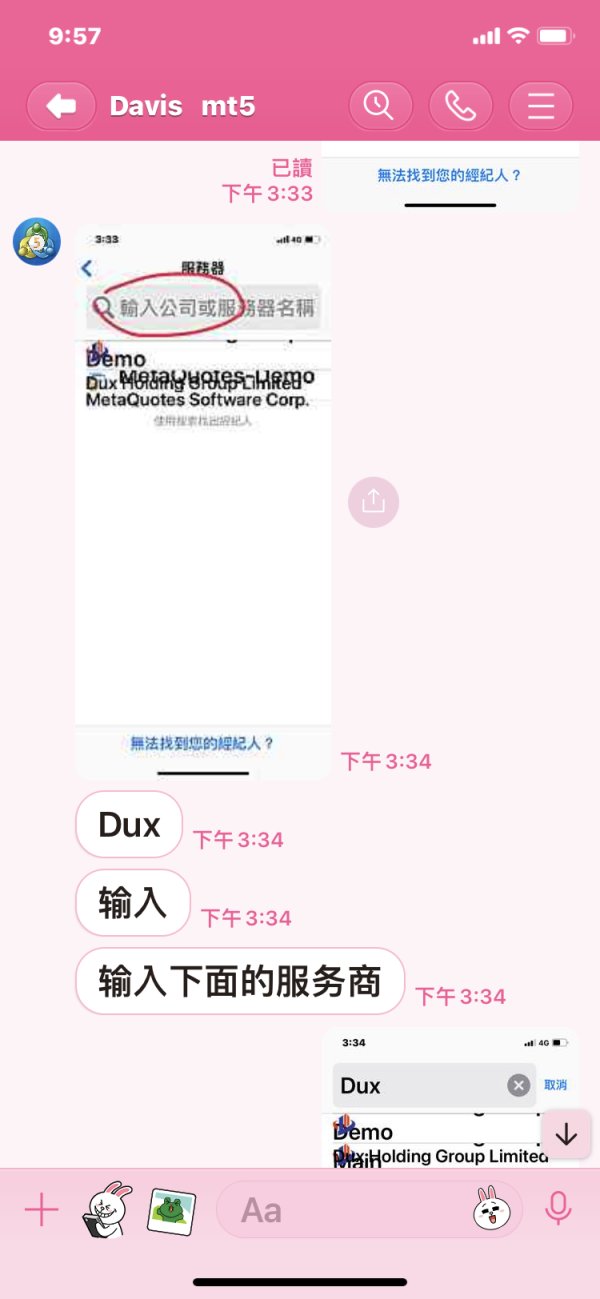

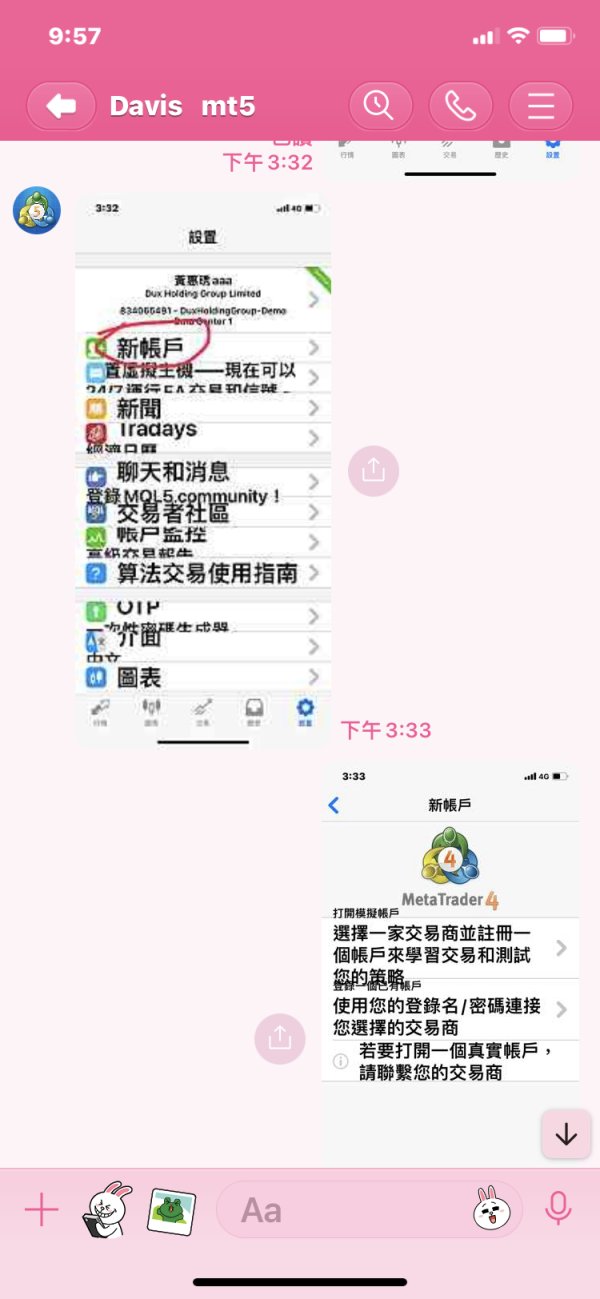

How to Open an Account?

Here's a step-by-step guide on how to open an account with Dux Holding:

Visit Dux Holding's Website:

Open your web browser and go to the official website of Dux Holding.

2. Click on “Open Account”:

Look for a prominent “Open Account” button on the homepage and click on it.

3. Provide Personal Information:

Fill in the registration form with accurate personal details. This typically includes your full name, email address, phone number, and any other required information.

4. Verify Your Identity:

Follow the instructions to verify your identity. This may involve submitting scanned copies of identification documents, such as a passport or driver's license, and proof of address.

5. Deposit Funds:

After identity verification, fund your trading account. Dux Holding usually has a minimum deposit requirement, so ensure you deposit the specified amount using the available payment methods.

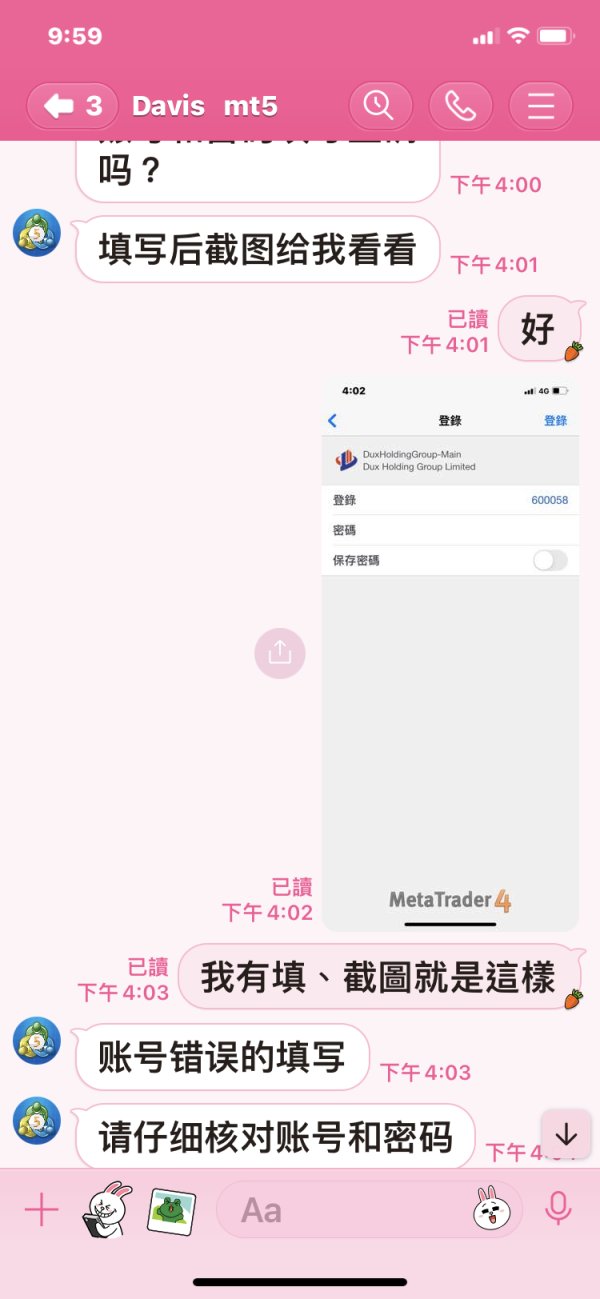

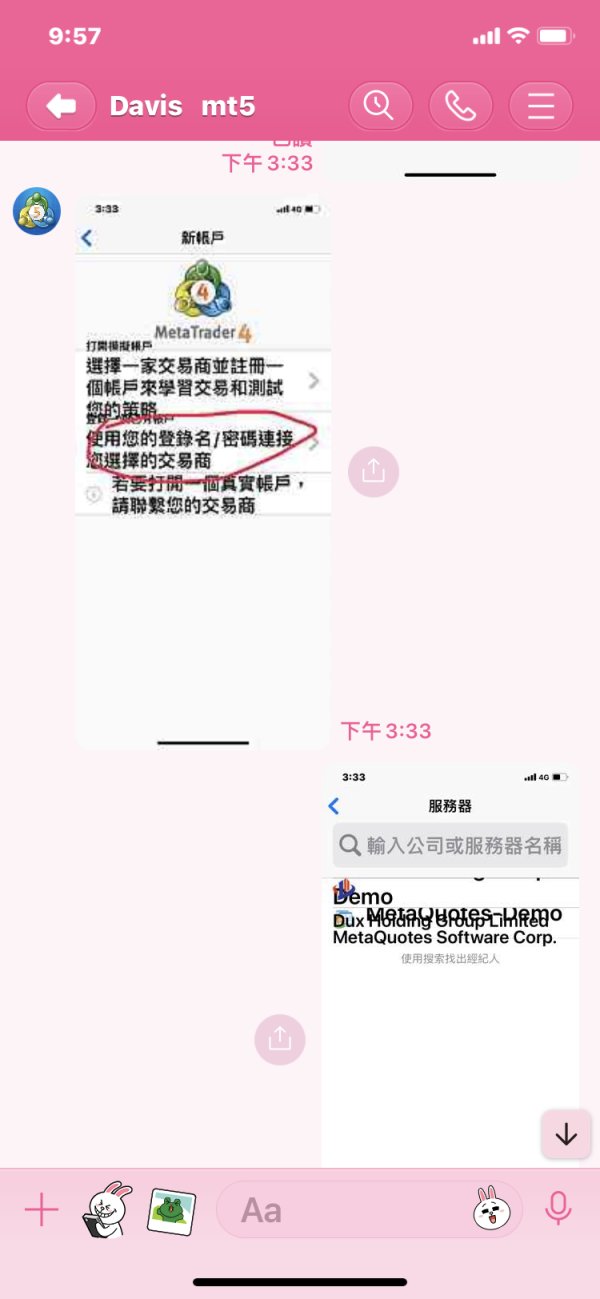

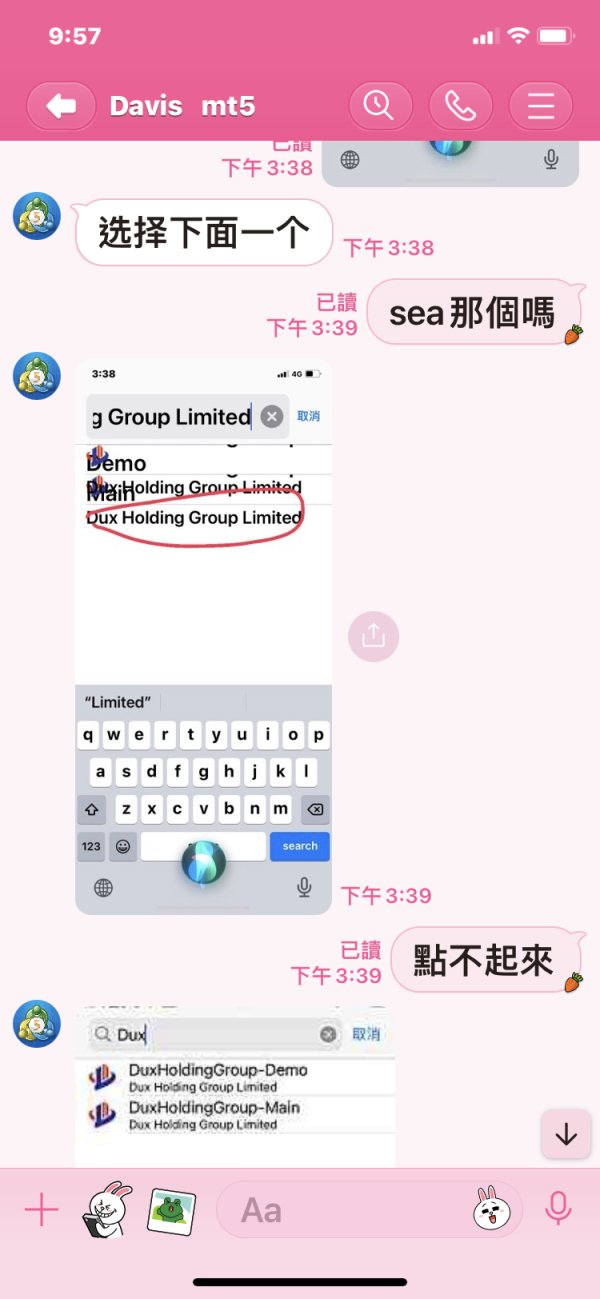

6. Download and Set Up Trading Platform:

Download the recommended trading platform provided by Dux Holding. Install the software on your device, log in with your account credentials, and you're ready to start trading.

Remember to carefully read and understand the terms and conditions during the account creation process. If you encounter any issues, Dux Holding's customer support, available through various channels, can provide assistance.

Leverage

Dux Holding offers varying maximum leverage levels based on the type of trading account:

Standard Account: Up to 1:200 maximum leverage.

Pro Account: Up to 1:400 maximum leverage.

VIP Account: Up to 1:400 maximum leverage.

Traders should carefully consider the implications of leverage on their trades and risk management strategies, as higher leverage allows for larger positions but also involves increased risk. It's crucial for traders to align their chosen leverage with their risk tolerance and trading objectives.

Spreads & Commissions

Dux Holding's spreads can be a bit of a labyrinth.

Forex:

Major pairs: Start at 1.6 pips, but can widen to 3 pips during volatile periods.

Minor pairs: Start around 1.8 pips, with potential jumps to 4 pips.

Exotic pairs: Start at 2.5 pips and can climb to 5 pips or more.

Commodities:

Precious metals: Start at 0.8 pips for gold and 1.2 pips for silver, but can reach 2 pips and 3 pips, respectively, in turbulent markets.

Energy commodities: Start at 1 pip for oil and 2 pips for natural gas, with potential increases to 3 pips and 4 pips, respectively.

Agricultural commodities: Start around 1.5 pips for coffee and 2 pips for wheat, with potential hikes to 3 pips and 4 pips, respectively.

Indices:

Major indices: Start at 0.5 pips for the S&P 500 and Euro Stoxx 50, and 1 pip for the Nikkei 225. Volatility can push them to 1 pip, 1.5 pips, and 2 pips, respectively.

Trading Platform

Dux Holding offers its own proprietary trading platform, which is available for both desktop and mobile devices. It's user-friendly, offering real-time quotes, charting tools, and order execution. However, some features might leave seasoned chefs wanting more:

Functionality: You'll find standard technical indicators, order types, and risk management tools. No fancy bells and whistles, just the essentials for placing trades and monitoring positions.

Customization: Limited compared to industry leaders. While you can adjust layouts and charts, deeper customization options are missing.

Multi-asset support: Handles forex, commodities, and indices, but CFDs on individual stocks or complex options might require additional software.

Mobile access: Available on iOS and Android, allowing you to manage your portfolio on the go. A plus for on-the-move traders.

Overall, Dux Holding's platform is a decent workhorse for basic trading. It's stable and reliable, but lacks the advanced features and customization that might entice seasoned traders or those seeking a more sophisticated experience.

Deposit & Withdrawal

Dux Holding offers a range of convenient options for funding your account and accessing your funds. These include:

Credit/Debit cards: Major cards like Visa and Mastercard are accepted, with instant deposits and potentially faster withdrawals compared to other methods.

Bank Transfers: A reliable option for larger transfers, but processing times can be 2-5 business days.

E-wallets: Popular options like Skrill and Neteller provide instant deposits and fast withdrawals (within 24 hours).

The minimum deposit amount varies based on your chosen account type:

Standard Account: The most accessible option, requiring a minimum deposit of $100.

Pro Account: For more experienced traders, the minimum deposit jumps to $1,000.

VIP Account: Tailored for high-volume traders, the VIP account demands a hefty minimum deposit of $5,000.

Dux Holding strives for swift processing times for both deposits and withdrawals:

Deposits: Most methods, like credit cards and e-wallets, reflect instantly in your account. Bank transfers might take 2-5 business days.

Withdrawals: Standard processing times range from 24-48 hours, depending on the method. VIP account holders enjoy priority processing within 24 hours.

Customer Support

Dux Holding's customer support raises concerns with a notably slow response time. Despite providing a contact number (+852 22222222) and email (info@besintmt.com), the absence of more immediate channels, such as live chat, hampers users seeking timely assistance.

The limited transparency on support options reflects negatively on the platform's commitment to efficient communication and problem resolution. Traders relying on Dux Holding may find the lack of accessible and prompt customer support inconvenient, potentially leading to prolonged issue resolution and a less satisfactory overall trading experience.

Educational Resources

Dux Holding's educational resources are notably lacking, compounded by the inaccessibility of their website. With no available content and the platform being unreachable, users are deprived of essential educational materials, including information on trading strategies, market analysis, and risk management. This absence of educational resources signifies a significant drawback for traders, especially those seeking to enhance their skills and understanding of the financial markets.

The unavailability of educational content coupled with an inaccessible website poses a substantial challenge for users, limiting their ability to acquire crucial knowledge and insights needed for informed decision-making in the realm of online trading.

Conclusion

In conclusion, Dux Holding, established in 2022 in Hong Kong, presents a trading platform with a diverse range of tools and account types, accommodating traders with varying preferences.

However, significant drawbacks pose challenges to its overall appeal. The platform's unregulated status raises concerns about user protection and transparency, demanding caution from traders. The inaccessible website and limited transparency further hinder the user experience, limiting access to critical information. Additionally, the absence of immediate customer support channels, coupled with a dearth of educational resources, may impede issue resolution and hinder users seeking to enhance their trading skills.

While Dux Holding provides some advantageous features, the highlighted disadvantages underscore the importance of careful consideration and scrutiny before engaging with this platform.

FAQs

Q: Is Dux Holding a regulated platform?

A: No, Dux Holding operates without regulatory oversight.

Q: What is the minimum deposit required for a Standard Account?

A: The minimum deposit for a Standard Account with Dux Holding is $100.

Q: Are there demo accounts available for practice?

A: Yes, Dux Holding offers demo accounts for users to practice trading.

Q: How can I contact Dux Holding's customer support?

A: You can reach Dux Holding's customer support via email at info@besintmt.com or by calling +852 22222222.

Q: What trading tools are available for VIP account holders?

A: VIP account holders at Dux Holding have access to the proprietary trading platform and a personal trading manager.

Q: Does Dux Holding provide educational resources?

A: No, Dux Holding lacks educational resources, and its website is currently inaccessible.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 4

Content you want to comment

Please enter...

Review 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

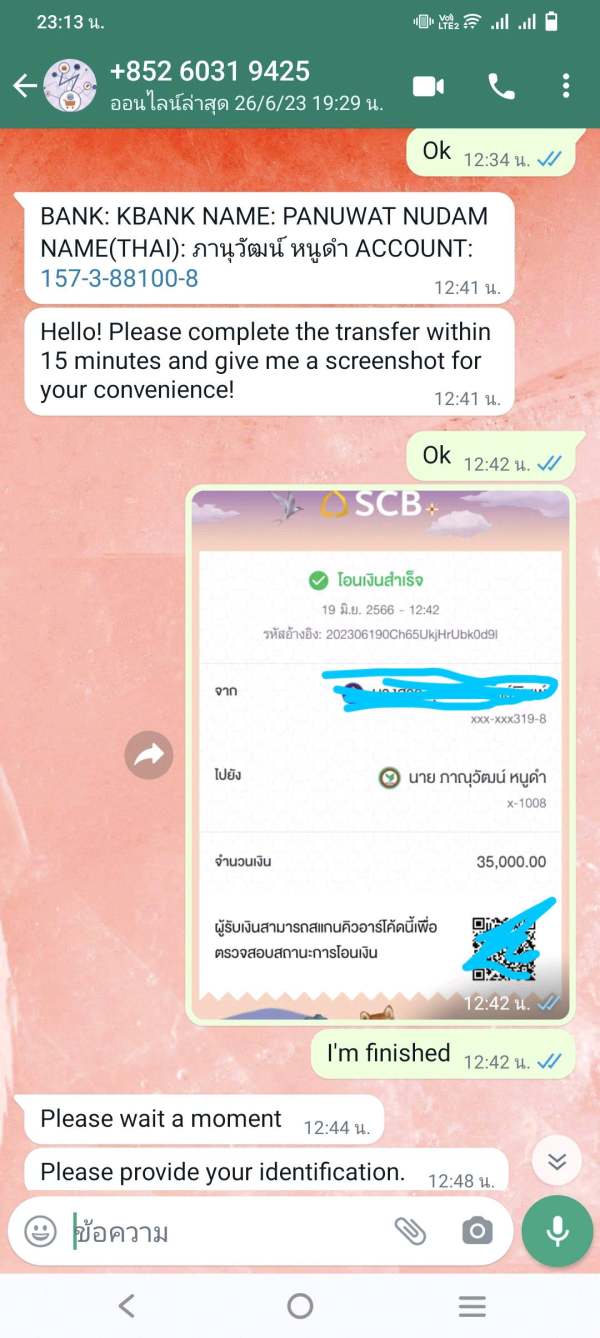

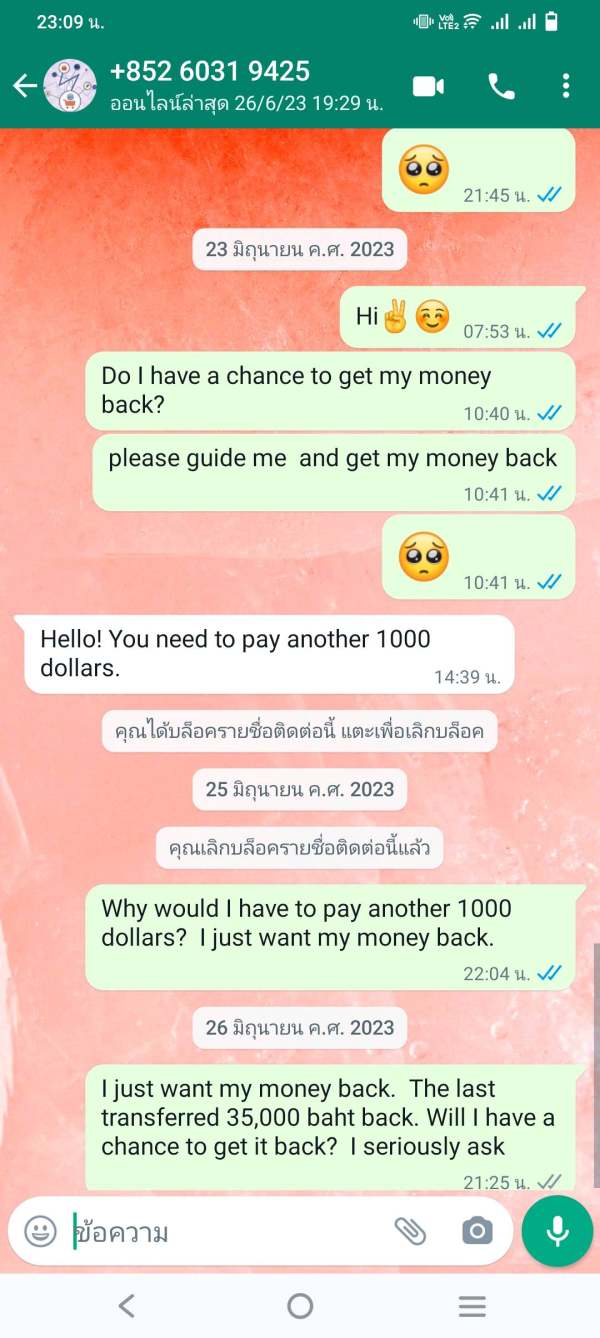

ployployzz

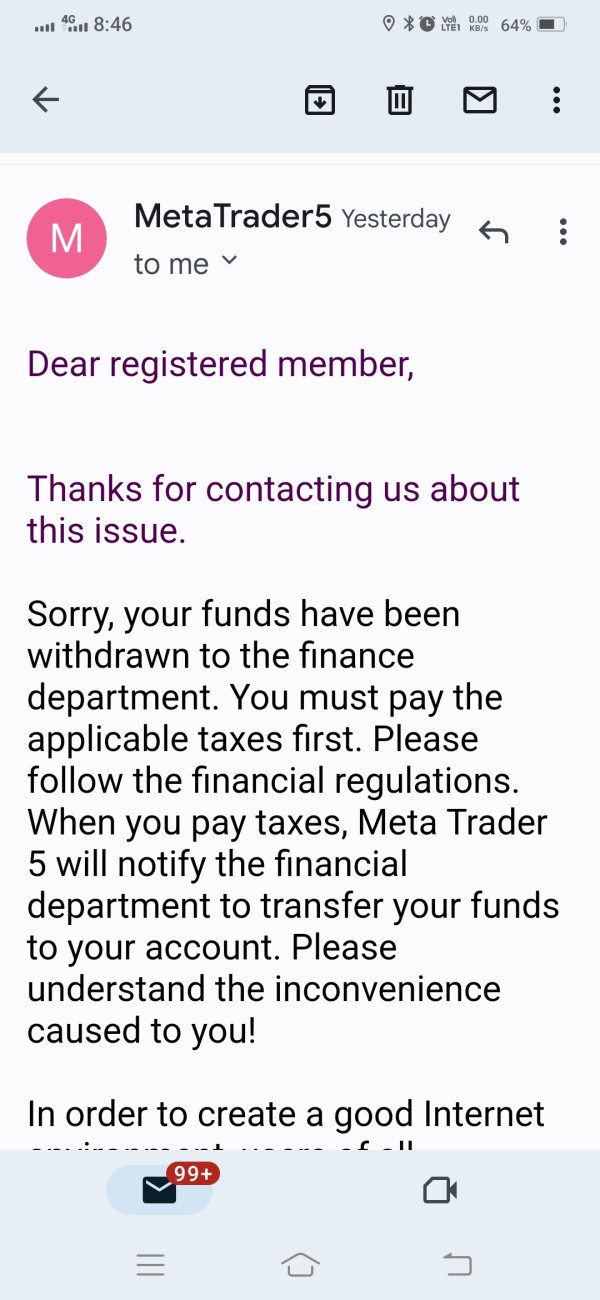

Thailand

I made a deposit but can't continue trading on this platform and money doesn't enter system when asked back if there is a chance to get a refund, it still comes to pay another 1000usd and there is still no money left to be withdrawn.

Exposure

2023-07-05

FX3308363627

Taiwan

In mid-October last year, all the taxes that should be paid were collected, and the money for changing the line was also collected. This year, I was asked to use virtual currency to remit the money to withdraw the money, but the result was still unable to withdraw the money for various reasons. I cheated me of my hard earned money. money, really disgusting

Exposure

2023-03-11

babu4955

Saudi Arabia

asking tax 10k tax for releasing fund

Exposure

2023-02-05

墙纸

Netherlands

The trading signals provided by the platform were not accurate, resulting in losses for my trades. The platform also had high spreads which increased the overall cost of trading. Additionally, I was repeatedly pressured to deposit more funds into my account, which made me uncomfortable. I suggest that traders be cautious before investing with Dux Holding and thoroughly research any platform before depositing their funds.

Neutral

2023-03-22