Score

XFlow Markets

Saint Lucia|2-5 years|

Saint Lucia|2-5 years| https://www.xflowmarkets.com/

Website

Rating Index

Influence

Influence

C

Influence index NO.1

Brazil 5.84

Brazil 5.84Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Saint Lucia

Saint LuciaAccount Information

Users who viewed XFlow Markets also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

BlackBull

- 5-10 years |

- Regulated in New Zealand |

- Market Making(MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Making(MM)

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

xflowmarkets.io

Server Location

India

Website Domain Name

xflowmarkets.io

Server IP

217.21.90.90

xflowmarkets.com

Server Location

United States

Website Domain Name

xflowmarkets.com

Server IP

68.183.146.28

Company Summary

Risk Warning

Forex and leveraged trading carry a high level of risk, and it is not suitable for all investors. Please note that the information contained in this article is for general information purposes only.

| Feature | Information |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | unregulated |

| Market Instrument | FX, cryptocurrencies, stocks, precious metals, and indices |

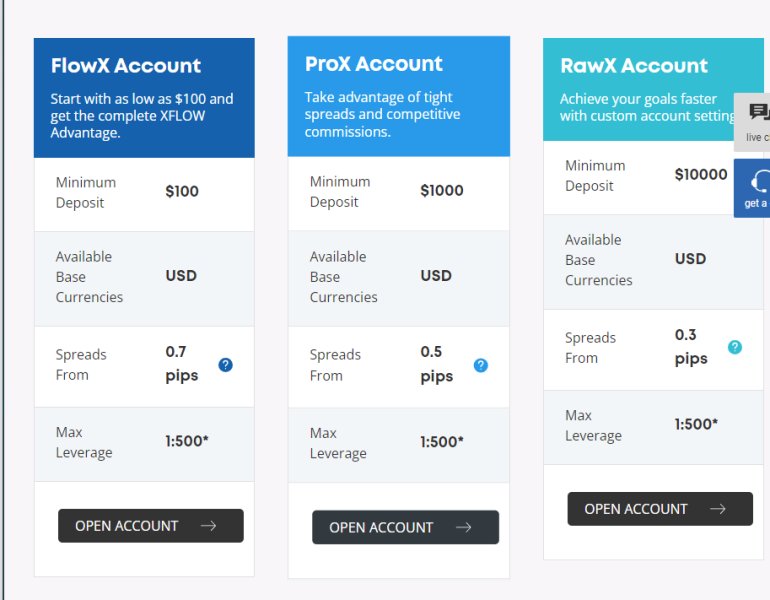

| Account Type | FlowX, ProX and RawX |

| Demo Account | yes |

| Maximum Leverage | 1:500 |

| Spread | Vary on the account type |

| Commission | no |

| Trading Platform | MetaTrader4, MT4 WebTrader, MT4 for iPhone, Android, and iPad/Tablet, XFlow WebTrader, XFM Tab, XFM Mobile, XFM API |

| Minimum Deposit | $100 |

| Deposit & Withdrawal Method | VISA, MasterCard, Local Transfers, PaySera, Alipay, Skrill, Neteller, PayPal, UnionPay, SEPA, Bitcoin, Bank Transfers |

General Information

XFlow Markets, a trading name of XFlow Markets LLC, is a forex brokerage registered in Saint Vincent and the Grenadines, allegedly offering its clients access to over 200 trading instruments, variable spreads from 0.3 pips, leverage up to 1:500, as well as 24/5 customer support service.

The company provides different account types, such as the FlowX Account, ProX Account, and RawX Account, catering to different trading needs and preferences. Each account type has its own minimum deposit requirement and offers access to a range of financial instruments with varying trading conditions.

XFlow Markets offers a range of trading platforms, including MetaTrader 4 (MT4) and their own proprietary platforms like XFlow, xTab, xMobile, and xAPI. These platforms provide traders with various features, such as charting tools, real-time data, and automated trading options.

While XFlow Markets offers a diverse range of market instruments and trading opportunities, potential clients should exercise caution due to the lack of regulatory oversight. It is advisable to carefully consider the risks involved before engaging in any financial transactions or investments with XFlow Markets.

Here is the home page of this brokers official site:

Pros and Cons

XFlow Markets is a broker that operates without valid regulation, which poses potential risks to clients. Engaging with an unregulated entity like XFlow Markets lacks investor protection and exposes individuals to the uncertainties of trading unregulated instruments. Despite this, XFlow Markets provides a diverse range of market instruments, including forex, cryptocurrencies, stocks, precious metals, and indices. Clients have the opportunity to trade major currency pairs, popular cryptocurrencies, global stock indices, and various commodities. The availability of different account types caters to different trading needs, although higher minimum deposit requirements and limited information on account features may be considered as drawbacks. XFlow Markets offers multiple trading platforms, including MetaTrader 4 and their proprietary platforms, providing secure trading and extensive charting capabilities. However, mobile platforms may have limitations due to screen space. The broker also offers various trading tools such as technical analysis, daily and weekly market outlooks, an economic calendar, a rollover table, and a margin calculator. While these tools provide valuable insights, there may be limited information or customization options. XFlow Markets provides educational resources, including an FAQ section and a glossary, to enhance traders' understanding of Forex trading. However, it's important to exercise caution and thoroughly assess the potential risks associated with trading with an unregulated broker like XFlow Markets.

| Pros | Cons |

| Diverse range of market instruments | Lack of regulatory oversight |

| Market calendar, news, and macro data | Potential risks associated with trading unregulated instruments |

| Availability of popular cryptocurrencies | Lack of investor protection |

| Empowerment for robots, algorithms, and trading apps | Limited information transparency |

| Wide range of payment options available | Higher minimum deposit requirements for ProX and RawX accounts |

| Real-time data export (MT4 platform) | Lack of specific details about account features |

| Margin calculator helps manage risk | Limited information on trading conditions |

Is XFlow Markets safe to trade with?

XFlow Markets is just an offshore forex broker and it has been verified that this broker is not authorized or regulated by any regulatory authorities. On WikiFX, the regulatory status of XFlow Markets is marked as “No License” and it got a very low score of 1.36/10. So, please be aware of the risk.

Note: The screenshot date is February 9, 2023. WikiFX gives dynamic scores, which will update in real-time based on the broker's dynamics. So the scores taken at the current time do not represent past and future scores.

Market Instruments

With the XFlow Markets platform, traders can get access to 200+ trading instruments, such as FX, cryptocurrencies, stocks, precious metals, and indices.

Forex:

XFlow Markets provides access to the forex market, allowing traders to participate in currency trading. This includes major currency pairs such as EUR/USD, GBP/USD, and USD/JPY, among others. Forex trading offers opportunities to profit from fluctuations in exchange rates.

Commodities:

Traders can also engage in the trading of various commodities through XFlow Markets. This includes popular commodities like oil, natural gas, precious metals such as gold, silver, and platinum, as well as agricultural products like cocoa, soybeans, cotton, sugar, corn, and wheat. Additionally, industrial metals like copper, zinc, nickel, and aluminum are available for trading.

Indices:

XFlow Markets offers trading opportunities in major stock indices from around the world. Traders can access and trade popular indices like the S&P 500, NASDAQ, FTSE 100, DAX 30, and many others. Trading indices allows investors to speculate on the performance of a basket of stocks representing a particular market or sector.

Cryptocurrencies:

XFlow Markets provides access to a range of cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP), among others. Crypto trading allows traders to take advantage of price movements in digital currencies and potentially profit from their volatility.

Stocks:

Through XFlow Markets, traders can also engage in stock trading. This includes well-known stocks from companies like Amazon, Facebook, Microsoft, Netflix, Google, Alibaba, Apple, and IBM, among others. Stock trading offers investors the opportunity to buy and sell shares in publicly listed companies.

| Pros | Cons |

| Diverse range of market instruments | Lack of regulatory oversight |

| Access to major forex currency pairs | Potential risks associated with |

| Availability of popular cryptocurrencies | trading unregulated instruments |

| Opportunity to trade global stock indices | Lack of investor protection |

| Trading opportunities in commodities | Limited information transparency |

Account Types

Three trading accounts are available with the XFlow Markets platform: FlwX account, ProX account, and RawX account. The FlwX account is suitable for all types of trading accounts and only asks for an acceptable initial capital of $100. The ProX account is designed for professional traders, requiring a minimum initial deposit of $1,000. The RawX account, the most expensive one, requires a minimum initial deposit of 10,000 USD, ideal for traders with large volumes.

FlowX Account:

The FlowX Account is designed for individuals who are looking to start trading with a low initial deposit of $100. It offers the complete XFLOW Advantage, providing traders with access to a range of financial instruments, including FX, cryptocurrencies, stocks, precious metals, and indices. The account is denominated in USD and offers a maximum leverage of 1:500. The spreads start from 0.7 pips.

ProX Account:

To open a ProX Account, a minimum deposit of $1000 is required. Like the FlowX Account, it supports various base currencies, with USD being one of them. The maximum leverage available is 1:500, and the spreads start from 0.5 pips.

RawX Account:

For traders who prefer a more customizable trading experience, the RawX Account offers custom account settings. It requires a minimum deposit of $10,000 and supports USD as the base currency. The RawX Account provides spreads, starting from 0.3 pips, and offers a maximum leverage of 1:500.

| Pros | Cons |

| Access to a wide range of financial instruments | Higher minimum deposit requirements for ProX and RawX accounts |

| Lower entry barrier with the FlowX Account | Lack of specific details about account features |

| Low spreads and commissions with ProX Account | Limited information on trading conditions |

| Customizable settings with the RawX Account | Lack of clarity on additional fees or charges |

| Maximum leverage of 1:500 | Potential risk associated with unregulated broker |

Aside from live accounts, XFlow Markets also offers demo accounts for clients to test the trading environment in the brokerage platform and enhance their trading skills.

How to Open an Account?

To open an account with XFlow Markets, follow these steps:

Visit the XFlow Markets website and locate the “Open your XFLOW ACCOUNT” button. Click on it to initiate the account opening process.

2. Personal Information: Provide your full name, gender, email address, and confirm the email address by entering it again. Enter a phone number including the country code. Enter your date of birth.

3. Address: Fill in your address details. Specify your country, state, city, and zip code. Enter your complete address.

4. Secure Your Account: Create a secure password for your XFlow Markets account. The password should be at least six characters long. Enter your chosen password and confirm it by entering it again.

After completing these steps, review the information you have provided to ensure accuracy. Once you are satisfied, click on the confirmation button to submit your account application to XFlow Markets.

Leverage

XFlow Markets provides traders with a maximum trading leverage of up to 1:500. This level of leverage is considered high in the industry. It is crucial for traders to understand the implications of high leverage and exercise caution when utilizing it. While high leverage can potentially lead to significant profits, it also carries an increased risk of substantial losses. Traders should carefully assess their risk tolerance and select an appropriate leverage level that aligns with their comfort and trading strategy. It is advisable to seek proper education and understanding of leverage before engaging in trading activities with XFlow Markets or any other brokerage firm.

Spreads & Commissions

XFlow Markets offers different spreads based on the trading account type. With the FlwX account, traders can access spreads starting from 0.7 pips, while the ProX account provides spreads from 0.5 pips. The RawX account offers spreads, starting from 0.3 pips. Importantly, XFlow Markets does not charge any commissions for trades across all account types.

Trading Platform

XFlow Markets has enhanced the MT4 platform to support No Dealing Desk Forex execution. This means there are no third-party bridges or auto account syncs involved. The key features of MT4 include a Market Watch Window, Navigator Window, multiple order types, 85 pre-installed indicators, analysis tools, multiple chart setups, automated trading, and order execution capabilities. Clients can enjoy real-time data export via DDE protocol, first-class charting with an unlimited quantity of charts, and access to a free MT4 download and demo account.

MT4 WebTrader:

The MT4 WebTrader is a browser-based version of the MT4 platform, designed for a user-friendly interface. It offers 24 analytical instruments, updates on financial market news, collaborative symbol charts, trade history, and the ability to trade from anywhere in the world, 24/5. Traders have complete control over their trading accounts through this web-based platform.

MT4 for Android:

The MetaTrader 4 Android OS App is a comprehensive trading platform for Android mobile devices. It provides a wide range of features, including 24 analytical instruments, financial market news updates, collaborative symbol charts, trade history, and the ability to trade from anywhere in the world, 24/5. Traders can have complete control over their trading accounts using this app.

MT4 for iPad:

MetaTrader 4 for iPad/iPhone is known as the world's most efficient platform for iOS-powered devices. It offers a vast selection of brokers and servers to trade from. The platform includes 24 analytical instruments, financial market news updates, collaborative symbol charts, trade history, and the ability to trade from anywhere in the world, 24/5. Traders can also enjoy chat options, audio notifications, and push notifications.

XFlow, xTab, xMobile, and xAPI:

XFlow Markets introduces its own trading platforms, namely XFlow, xTab, xMobile, and xAPI. XFlow is an ultra-fast web-based trading platform that supports over 300 tradable assets, including forex pairs, indices, commodities, cryptocurrencies, and global stocks. It offers advanced chart trading, market calendar, news, and macro data, and various customization options.

xTab is designed for trading on the move from iPad or Android tablets, offering advanced charting, fast performance, market calendar, news, and macro data.

xMobile provides trading capabilities on Android and iOS phones, featuring advanced charting, fast performance, and access to market calendar, news, and macro data.

xAPI empowers traders with the ability to operate robots, algorithms, and trading apps. It supports coding in any language, ultra-fast execution, and the development of various trading applications without restrictions.

| Pros | Cons |

| Market calendar, news, and macro data (XFlow, xTab, xMobile) | Limited to MT4 features (MT4 platform) |

| Real-time data export (MT4 platform) | Limited features compared to desktop platforms (MT4 WebTrader) |

| Extensive charting (MT4 platform) | Limited screen space on mobile devices (MT4 for Android and iPad) |

| User-friendly interface (MT4 WebTrader) | Limited screen space on mobile devices (MT4 for Android and iPad) |

| Accessible from any browser (MT4 WebTrader) | |

| Empowerment for robots, algorithms, and trading apps (xAPI) | |

| Advanced charting (XFlow, xTab, xMobile) |

Trading Tools

XFlow Markets offers a range of trading tools to assist users in their trading activities. These tools include Technical Analysis, Daily Outlook, Weekly Outlook, Economic Calendar, Rollover Table, and Margin Calculator.

Technical Analysis:

The Technical Analysis tool provides insights into the market trends and price movements of various commodities, such as coffee and copper. It includes graph images and analysis conducted by the research team. Users can stay updated with the latest information on commodity prices and make informed trading decisions.

Daily Outlook:

The Daily Outlook tool offers a comprehensive overview of the market for specific currency pairs, such as USD/CAD, USD/JPY, and other assets like oil and indices. It provides graph images, analysis, and commentary on the recent performance and factors influencing the market. Traders can gain valuable insights to guide their daily trading strategies.

Weekly Outlook:

The Weekly Outlook tool focuses on providing a broader perspective of the market. It offers detailed analysis and graph images for assets like XAUUSD (Gold). Traders can access information on recent market trends, upcoming events, and potential trading opportunities to plan their strategies for the week.

Economic Calendar:

The Economic Calendar tool helps traders keep track of important economic events and announcements that can impact the financial markets. It provides a schedule of key economic indicators, central bank meetings, and other significant events. By staying informed about these events, traders can anticipate potential market volatility and adjust their trading positions accordingly.

Rollover Table:

The Rollover Table tool displays information related to the rollover dates for various trading instruments. It allows traders to see the months in which rollover occurs for different instruments, such as AUS200, BRAIND, BUND, CHNCOMP, and COCOA. This information is useful for traders who wish to manage their positions and adjust their trading strategies based on rollover dates.

Margin Calculator:

The Margin Calculator tool helps traders calculate the required margin for their trades based on the leverage and position size. By entering the necessary parameters, traders can quickly determine the margin requirements for their trades, enabling them to manage their risk.

| Pros | Cons |

| Provides technical analysis for various assets | Limited information on trading indicators |

| Offers daily and weekly market outlooks | Lack of customization options |

| Includes an economic calendar for event tracking | Limited depth of analysis in outlooks |

| Rollover table helps manage trading positions | Margin calculator may lack advanced features |

Deposit & Withdrawal

The minimum deposit amount is $100. XFlow Markets allows its clients to make a deposit and withdrawal through an array of payment options, which include: VISA, MasterCard, Local Transfers, PaySera, Alipay, Skrill, Neteller, PayPal, UnionPay, SEPA, Bitcoin, Bank Transfers.

Educational Resources

In the Forex (Fx) education section, XFlow Markets provides a range of resources to help customers gain a better understanding of the basics and utilize their services. One of the key offerings is a comprehensive FAQ section that addresses numerous commonly asked questions about their services and Forex trading in general. This resource aims to provide customers with easy-to-understand knowledge and clarify any doubts they may have.

XFlow Markets also offers a glossary page specifically designed to familiarize traders with the terminology and concepts used in Forex trading. This feature is particularly useful for beginners who are looking to enhance their understanding and gradually improve their trading skills. Through this glossary, customers can access expert knowledge and insights to elevate their trading level from novice to expert.

For those who prefer visual learning, XFlow Markets provides trading videos and live webinars. These videos cover various aspects of Forex trading and offer valuable insights and strategies from experts in the field. By watching these resources, customers can gain a better understanding of the concepts and techniques employed in successful Forex trading.

Additionally, XFlow Markets offers a free ebook on the Forex market, providing in-depth knowledge for those who seek a comprehensive understanding of the subject. This ebook serves as a valuable resource for traders looking to expand their knowledge and enhance their trading skills.

| Pros | Cons |

| Comprehensive FAQ section | Limited information about the depth of educational content |

| Range of webinars covering various trading concepts | Lack of information about the frequency of webinars |

| Trader's glossary for learning trading terminologies | No information on the availability of live support |

| Trading videos created by industry experts | Limited information on the e-book's content and length |

| Free e-book providing in-depth forex market knowledge | Limited information on the seminar topics and schedule |

Customer Support

XFlow Markets offers various channels for traders to reach out for customer support regarding inquiries and trading-related issues. The available options include:

Telephone: Traders can contact XFlow Markets' customer support team by dialing +44 20 3835 5241.

Email: Another way to get in touch with customer support is through email at support@xflowmarkets.com. Traders can send their queries or concerns to this email address for assistance.

Contact Form: XFlow Markets provides a contact form on their website, allowing traders to submit their messages or questions directly through the form.

Social Networks: XFlow Markets can also be followed on various social networks such as Twitter, Facebook, Instagram, YouTube, and LinkedIn. Traders can connect with the broker through these platforms for additional support or updates.

Additionally, XFlow Markets emphasizes its customer support, maintaining a multi-lingual team available 24/5. Traders can expect assistance in their preferred language. The customer support team is available to help resolve trading queries via email, phone call, live chat, or even request a call-back for more personalized assistance.

For those who prefer traditional mail communication, XFlow Markets provides its company address as follows: 1st Floor, First St. Vincent Bank Ltd Building, James Street, Kingstown, St. Vincent and the Grenadines.

Conclusion

XFlow Markets is an online forex and CFD broker that offers a range of trading services to its clients. It provides access to various financial instruments, including currencies, commodities, and indices, allowing traders to speculate on price movements. One advantage of XFlow Markets is its user-friendly trading platform, which offers a range of tools and features to assist traders in making informed decisions. However, the broker has faced criticism for its customer support, with some users reporting slow response times and unhelpful assistance. Additionally, XFlow Markets has been accused of lacking transparency in its pricing structure, leading to concerns about hidden fees and potential conflicts of interest.

Frequently Asked Questions (FAQs)

| Q 1: | Is XFlow Markets regulated? |

| A 1: | No. It has been verified that XFlow Markets currently has no valid regulation. |

| Q 2: | At XFlow Markets, are there any regional restrictions for traders? |

| A 2: | Yes. XFlow Markets does not offer CFDs to residents of certain jurisdictions including Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries. |

| Q 3: | Does XFlow Markets offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does XFlow Markets offer the industry-standard MT4 & MT5? |

| A 4: | Yes. XFlow Markets supports MetaTrader4, MT4 WebTrader, MT4 for iPhone, Android and iPad/Tablet, XFlow WebTrader, XFM Tab, XFM Mobile, and XFM API. |

| Q 5: | What is the minimum deposit for XFlow Markets? |

| A 5: | The minimum initial deposit to open an account is $100. |

| Q 6: | Is XFlow Markets a good broker for beginners? |

| A 6: | No. XFlow Markets is not a good choice for beginners. Though it advertises very well, dont forget that it is an unregulated broker. |

Keywords

- 2-5 years

- Suspicious Regulatory License

- High potential risk

Review 13

Content you want to comment

Please enter...

Review 13

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

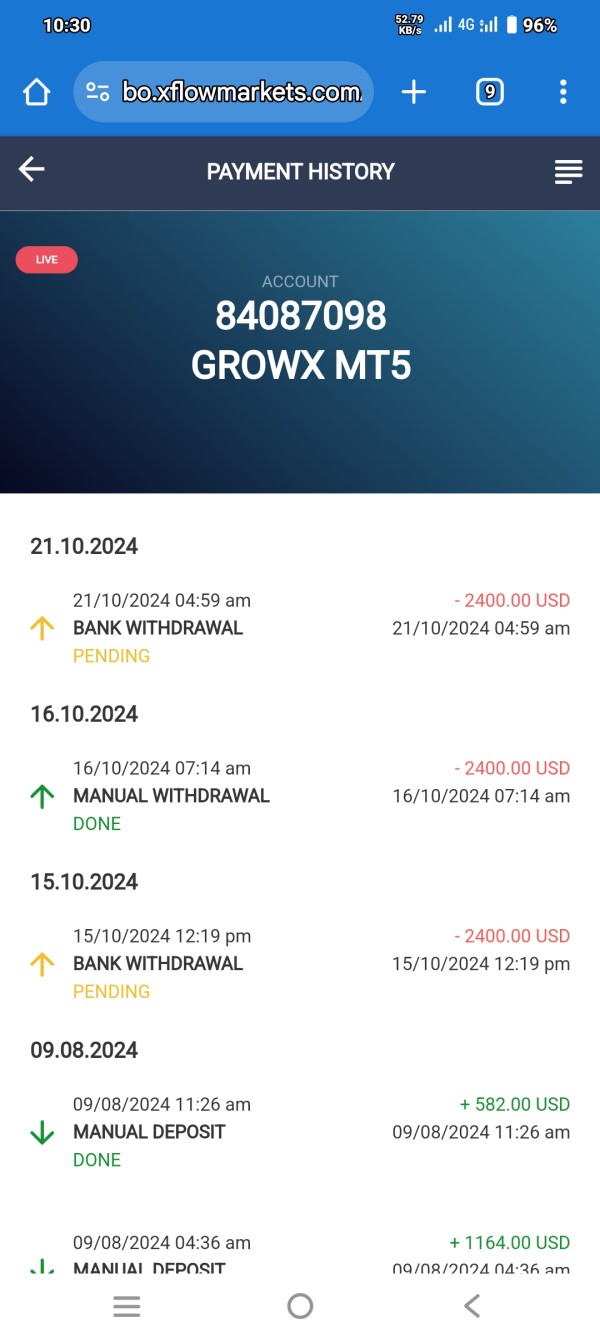

Pankaj933

India

is a xflow market froud not withdrawal $. is a 7dey proses accept is waiting is froad web series is not money back 😭😭😭🔙🔙

Exposure

2024-10-22

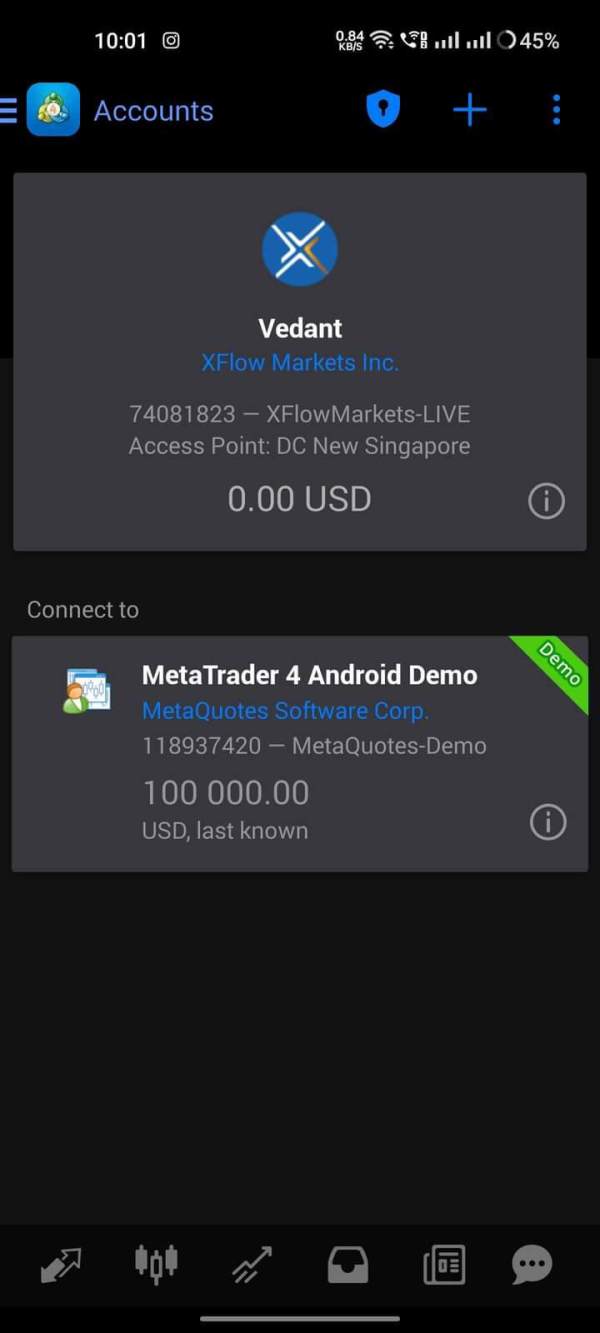

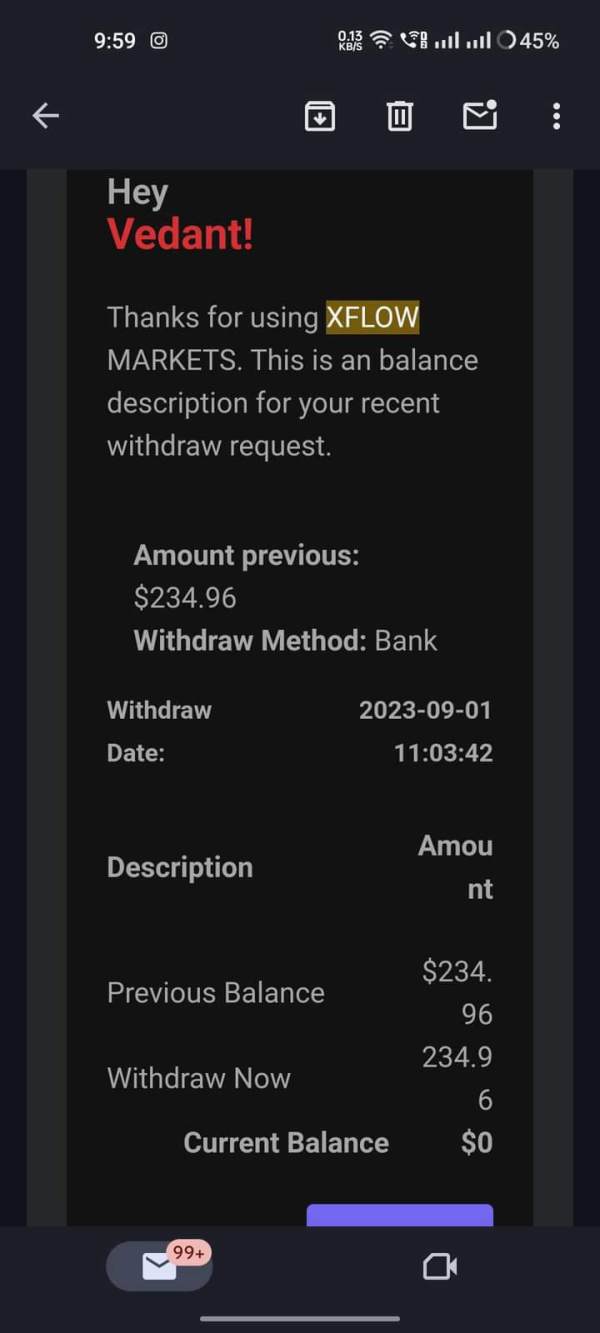

Vedant

India

I started trading on Xflow markets in September and just in few days I requested for withdrawal of the amount given in the photo which was $238 I also uploaded all the bank details on the site but didn't receive any payment till now I also raised ticket on their site, mailed them, wrote a review on trustpilot but didn't get any response anywhere and now I also can't access my account on their site so the issue has been worsen more and more and I don't feel any broker safe because of this and have stopped forex trading and as I am from India I feel brokers like this scam us more.

Exposure

2024-03-22

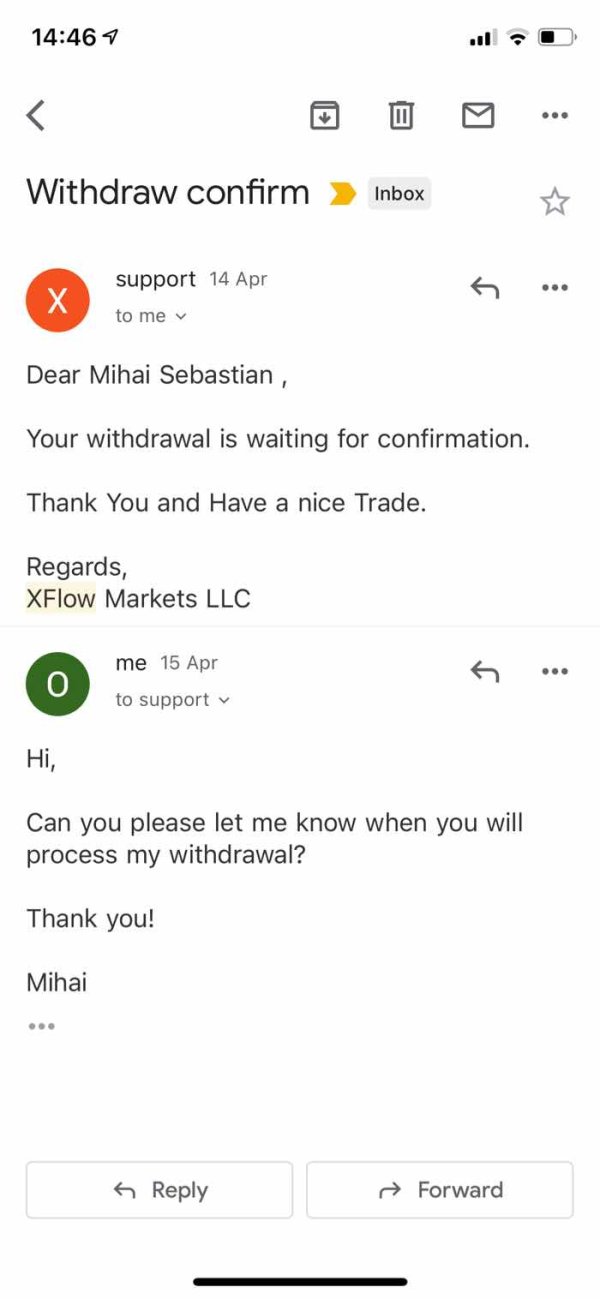

Onocan Mihai

Romania

Hi, Please stay away because this broker is a big fraud, the stole my profits and also my deposit, as you can see in the picture, i have made the withdrawal in april, and since then , they stop replying me and also disabled my account. Stay away!

Exposure

2021-07-21

FX8514463952

India

This is a very good platform and they guided me very well thankyou xflomarket.

Neutral

2024-04-15

Contter

United States

I checked out three kinds of accounts in total, and the RawX account really caught my eye. Or, maybe I could start with a virtual account first just to get my feet wet. It left a really good impression on me!

Positive

2024-07-26

bala874

India

XflowMarket borker provides risk management tools such as stop-loss orders and take-profit levels to help traders manage their positions effectively. support team very friendly and helpful it's good for investor and trader

Positive

2024-06-07

FX1916272973

India

ONE OF THE BEST APPS TO TRADE THE FOREX MARKETS OUT HERE. SPREADS AND COMMISITION ARE GREAT.IMMEDIATE WITHDRAWALS AND DEPOSITE. FAST EXECUTION OF ORDERS.XFLOW MARKETS IS THE FIRST PLATFORM I STARTED TO TRADE NEVER CHANGED OR HAD A NEED TO CHANGE.

Positive

2024-06-07

FX4550910320

India

one of the best borker xflow markat good broker time to time withdrawal servive and clint persnol support

Positive

2024-06-07

VINAY2959

India

xflow markets is the best broker in india you can trust this broker ,very help full staff and suppport team , deposit and withdrwal comfortable all method , its best for clients ,investor and IB

Positive

2024-06-07

Jitendra20

India

Very Good Broker. Fast withdrawal. on time trade execution. over all good services and reliable. No issues so far. Top-notch service. Fast response and amazing support team. Thanks for their professional service and excellent work.

Positive

2023-03-24

胡叔

Hong Kong

I am very happy I found XFlow Markets. No issues so far. Top-notch service. Fast response and amazing support team. Thanks for their professional service and excellent work.

Positive

2023-02-21

Daksh

India

The entire team at Xflowmarkets is beyond fantastic. I have been with them since 2017 and honestly, I have gotten nothing but exceptional service from them always. Payments are credited on time and sometimes even before the stipulated date. They are courteous and respectful. I cannot praise them enough.

Positive

2023-01-05

石振

United States

Excellent broker with a 5-star support team! A friend persuaded me to try XFlow Markets and I am so grateful I listened! A fast, reliable broker with decent spreads and a wide range of assets on offer.

Positive

2022-12-16