简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Three Reasons to Sell the US Dollar

Abstract:The US currency will seriously suffer from the redistribution of the world

The US currency will seriously suffer from the redistribution of the world

For decades, the entire financial world has been looking after the United States. The American economy is the strongest; the stock market is the largest; the dollar is the most needed. Unfortunately, the unipolar world does not accelerate development, but slows it down. The interesting thing is that the pandemic helped to trigger the mechanism of its destruction. China will surely overtake the US, European stocks and bonds will outdo their American counterparts, and the share of greenback in gold and currency reserves, international settlements and conversion operations will decrease. All this makes the long-term outlook for EUR/USD “bullish”.

According to USB, China's economy will grow by 2.5% in 2020. Taking into account the sinking of the American GDP this year and the slower recovery in 2021-2022, China will be able to overtake the United States in the second half of the 20s. This is a very good news for the export-oriented eurozone. Of course, Washington doesn't like this and is organizing a commercial battle, shutting the Chinese consulate in Houston, in addition to the breakup of diplomatic relations, but the process cannot be stopped!

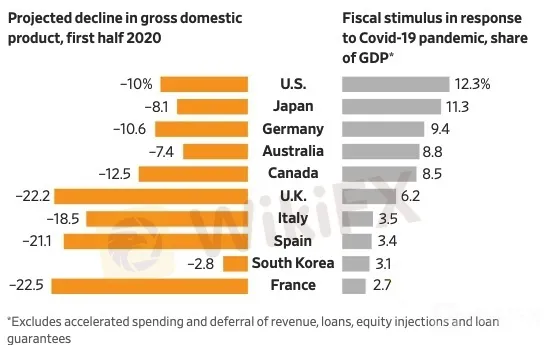

The American economy now resembles a steroid-pumped athlete. All this strong data on retail sales and other indicators against the backdrop of the labor market disaster is a direct result of fiscal and monetary stimulus, which is much greater than that in other developed countries. But there is a fierce debate over the new aid package between Republicans and Democrats, and when the bunch of money from the Fed starts looking for places to apply, the US dollar feels extremely bad.

GDP Forecasts and Scope of Stimulus

The S&P 500 stocks have a P/E ratio at their highest level since the dot-com crisis. The bubble burst lately, and who can guarantee that this wont happen again? US Treasury yields are hovering near record lows, and the market is clearly overbought. But once rates rise, the Fed will face financial repression. For a long time, investors had no alternatives, but after the EU approved the Franco-German proposal, they appeared.

The project is not in vain called a milestone in European history and is compared with the proposal of the American Treasury Secretary Alexander Hamilton, who proposed the idea of buying state debts at the end of the 18th century. European Commission bonds are an obligation of the EU itself, and not of its members. The bonds can be acquired by the ECB, which practically eliminates the risk of default. The market has received a reliable asset competitive with Treasuries. In addition, it received a very attractive asset in the form of bonds of the peripheral countries of the euro zone, which is competitive with the debt obligations of developing countries. These countries have reduced their loan costs by 5,510 bps since the beginning of 2019, which makes their bonds less attractive.

The dynamics of the loan costs

In my opinion, the redistribution of the world, the flow of capital from the New to the Old World and the fall of the role of US dollars in international settlements, gold and currency reserves and conversion operations will contribute to the growth of EUR/USD to 1.18 and 1.22 in 6 and 12 months.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

What's happening with the US Dollar? Why do countries ditch USD?

As several nations focus on enhancing their currencies, the dominance of the US dollar in the global monetary system is declining. Nouriel Roubini, also known as “Doctor Doom” for accurately forecasting the 2008 global financial crisis, recently warned that the dollar’s position as the primary reserve currency in the world is at risk. This warning is proving accurate, as the world’s major emerging economies have agreed to ditch USD for trade!

What's happening with the US Dollar? Is it losing its dominance?

As several nations focus on enhancing their currencies, the dominance of the US dollar in the global monetary system is declining. Nouriel Roubini, also known as “Doctor Doom” for accurately forecasting the 2008 global financial crisis, recently warned that the dollar’s position as the primary reserve currency in the world is at risk. This warning is proving accurate, as the world's major emerging economies have agreed to ditch US dollar for trade!

GemForex - weekly analysis

The week ahead: US Dollar struggles to find demand

US Dollar Outlook: USD Upside Stalling, Risk of Larger Setback

USD Losing its Appeal Temporarily Eyes on August and March Peaks for Support

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

UK FCA Fines Barclays £40 Million Over 2008 Deal

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Pros & Cons of Automated Forex Trading

Currency Calculator