简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Philippine Bonds Lose Allure as Real Rates Turn Red

Abstract:Philippine government bonds, Asias best-performing local-currency debt this year, are losing their appeal as real interest rates turn negative.

LISTEN TO ARTICLE

1:40

SHARE THIS ARTICLE

Share

Tweet

Post

Photographer: SeongJoon Cho/Bloomberg

Photographer: SeongJoon Cho/Bloomberg

Philippine government bonds, Asias best-performing local-currency debt this year, are losing their appeal as real interest rates turn negative.

The quickening pace of consumer-price gains suggests the central bank will be increasingly reluctant to cut interest rates again after lowering its overnight borrowing rate by a combined 150 basis points from March to help counter the coronavirus pandemic. The successive rate cuts have seen Philippine sovereign debt return 17% this year, according to data compiled by Bloomberg.

“The massive bond rally is probably coming to an end,” said Emilio Neri, lead economist at Bank of the Philippine Islands in Manila. “With negative real rates already upon us, rate cuts are probably near the floor.”

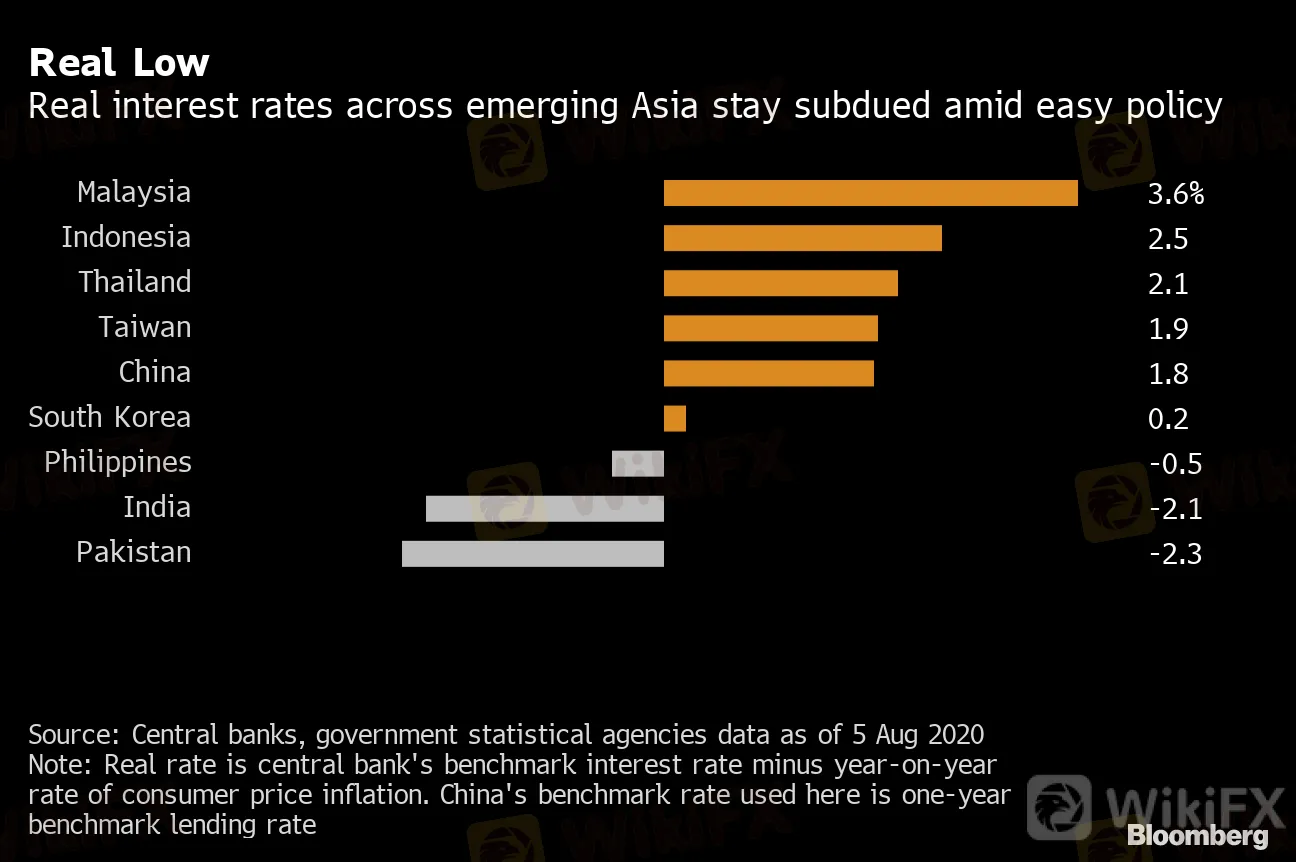

Real interest rates, which measure the central banks benchmark minus the level of inflation, are still positive in most emerging markets, with those for Malaysia, Indonesia and Thailand all above 2%. The negative rate for the Philippines puts it in the camp of developed economies such as the U.S., the U.K. and Canada, where the pace of inflation is above the central bank benchmarks.

Real Low

{18}

Real interest rates across emerging Asia stay subdued amid easy policy

{18}

Source: Central banks, government statistical agencies data as of 5 Aug 2020

{21}

Note: Real rate is central bank's benchmark interest rate minus year-on-year rate of consumer price inflation. China's benchmark rate used here is one-year benchmark lending rate

{21}

{777}

The current policy stance can hold for the next few quarters and foreign investment is likely to keep coming in, Philippine central bank Governor Benjamin Diokno said last week. Policy makers next meet to review interest rates on Aug. 20.

{777}

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Italian Regulator Warns Against 5 Websites

Currency Calculator