简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Groomed by Stiglitz, Argentinas Debt Chief Takes on Wall Street

Abstract:He‘s never taken the bait, rarely even raised his voice. The bondholders he’s up against, used to throwing their weight around, boast that they‘ll be there long after he’s gone. When BlackRock Inc.s Laurence Fink insisted on talking to his boss, he made it a three-way call.

He‘s never taken the bait, rarely even raised his voice. The bondholders he’s up against, used to throwing their weight around, boast that they‘ll be there long after he’s gone. When BlackRock Inc.s Laurence Fink insisted on talking to his boss, he made it a three-way call.

But make no mistake. Martin Guzman, Argentinas 37-year-old economy minister, an academic leftist with zero experience in billion-dollar-credit talks, is in charge of historic debt negotiations. He will either persuade creditors to write down the value of their bonds by almost half -- establishing a blueprint for scores of developing nations seeking pandemic debt relief -- or trigger a redux of the grueling legal battle that plagued the country after its 2001 default.

Some who admire Guzman and know Argentina -- now in its ninth painful default -- say he‘s taken on a task many would have turned down. His longtime friend, economist Pablo Gluzmann, says, “If I had his skills, I never would’ve accepted being economy minister in this moment, even without Covid-19.”

Guzmans mentor, Nobel laureate Joseph Stiglitz of Columbia University, thinks this is precisely the moment to stand up to men like Fink. He and scores of other economists signed a letter in May calling on the bondholders to “trim the revenue stream” and accept that the pandemic is straining national economies.

In an interview, Stiglitz said, “The creditors feel like they have to show that theyre tough to set the stage for a whole series of debt negotiations.” However, the pandemic requires what he called “a sense of humanity,” adding, “If this is not a time where the financial markets show a heart, when will it ever be?”

Appealing to the hearts of Wall Street creditors hasnt generally been held up as a winning strategy. But perhaps it will work for Guzman, a soft-spoken, hard-driven, studious, unmarried athlete who spurns the high society of Buenos Aires for family gatherings (he has four brothers), tennis and soccer in his hometown of La Plata about an hour away.

Guzman has already conceded a lot of ground. He‘s revised his offer several times, bumping up the proposed repayment price to almost 54 cents on the dollar from an initial 40 cents. Creditors have until Aug. 4 to accept, but the bonds wouldn’t be swapped until a month later. The gap between deadline and execution dates could suggest the government will use the extra weeks to sweeten the deal and get more reluctant creditors on board.

New Setback

Creditors dealt Guzman a new setback Monday, rejecting his offer and saying they‘ll submit a counteroffer. The top three creditor groups joined forces to turn down the latest proposal -- something they hadn’t done before -- but said, “We are confident that a consensual resolution is in sight.”

Guzman says his country‘s crises have partly defined who he’s become. “Argentinas reality shaped my personal interests,” Guzman told Bloomberg News, responding to written questions. In the catastrophic 2001 default, “the recession affected millions of people, including part of the community that surrounded me.”

Economy minister since December, when President Alberto Fernandez brought him home from being a research associate at Columbias business school, Guzman led the decision to default -- yet again -- in May as he seeks to restructure $65 billion in overseas debt in the midst of the pandemic and economic free fall.

It‘s a task that mixes number crunching with theatrics in which he’s constantly saying that this is his “last offer.”

No surprise that his is a job with limited longevity. The average tenure for an economy minister in Argentina since 1983 is a year and a half. The previous government had three ministers in four years.

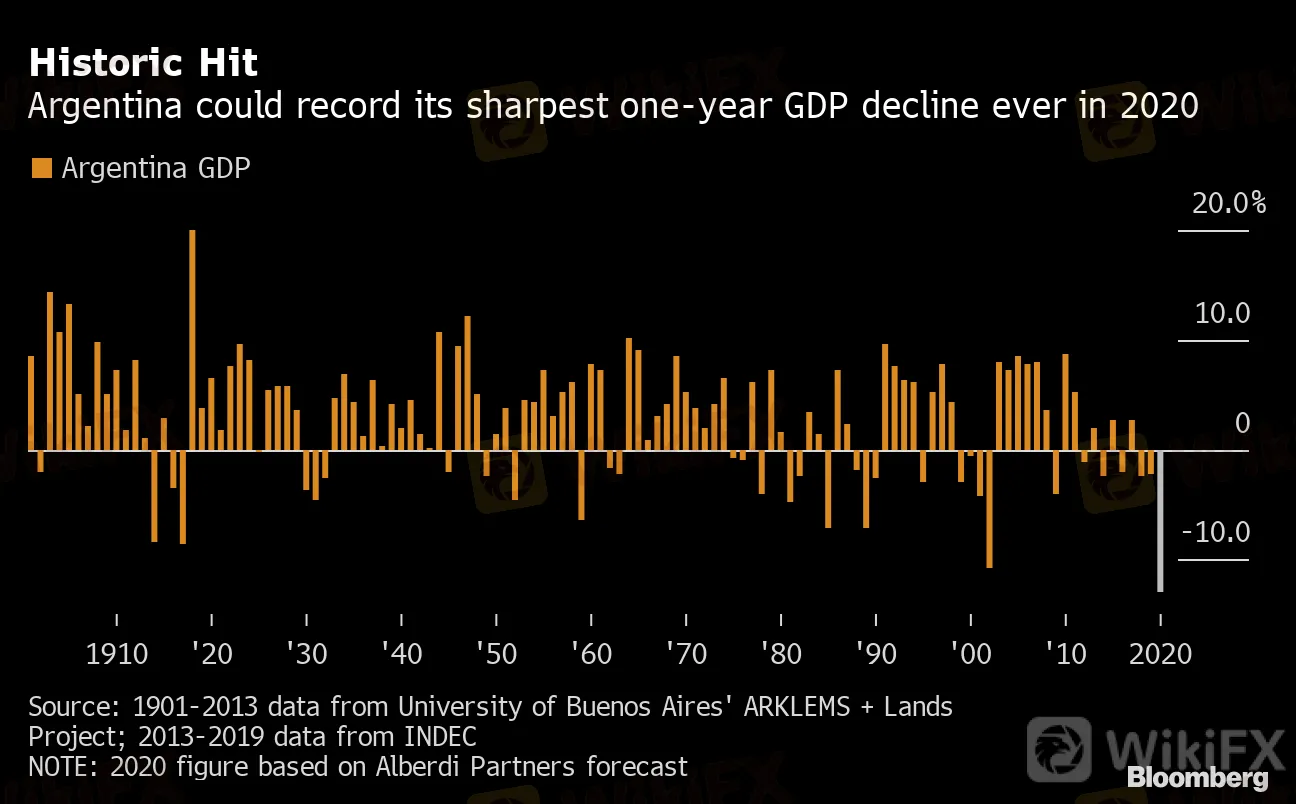

The situation is as bad as it‘s ever been. Argentina’s economy is heading for a third straight year of recession with inflation near 50%, rising double-digit unemployment and an electorate losing patience with a four-month coronavirus lockdown. It will likely post its worst GDP contraction ever this year.

Historic Hit

Argentina could record its sharpest one-year GDP decline ever in 2020

Source: 1901-2013 data from University of Buenos Aires' ARKLEMS + Lands Project; 2013-2019 data from INDEC

NOTE: 2020 figure based on Alberdi Partners forecast

Guzmans job involves more than debt talks, of course, although he tends to leave the rest to others. On his watch, fiscal spending has soared and government revenues have tanked as the Peronist-infused government has instituted a range of policies partly in response to the virus. These include universal income for the poor, billions of pesos in emergency loans and increasing unemployment insurance.

Hes won his share of enemies. Walter Stoeppelwerth, chief investment officer at Portfolio Personal Inversiones in Buenos Aires, says Guzman deserves credit for some decisions, such as “disarming a time bomb,” of local currency debt. But he and others have widely criticized his negotiation tactics, labeling him rigid and inexperienced, costing Argentina time and money as talks drag on from their original March deadline.

Negative Feedback

“All of the feedback that I hear is negative,” said Stoeppelwerth, citing conversations with creditors. “Guzman was handling the negotiation in an excessively heavy-handed and inflexible way, and I think thats come back to hurt him.”

Guzman is chasing two words: Sustainable debt. His research focused partly on an alarming trend dubbed “too little, too late.” More than half of the countries that restructured debt since 1973 had to do so again within five years because the deal didnt provide enough relief or relied on unrealistic assumptions about growth and reforms.

Guzmans career took a pivotal turn after getting a doctorate at Brown University. His thesis adviser, economist Peter Howitt, recommended him to Stiglitz for a post-doctoral program. A close connection quickly blossomed with the left-leaning Stiglitz, who had warm relations with former president Cristina Fernandez de Kirchner, now the vice president.

Guzman notched a victory in his latest offer, winning support from Luis Caputo, the former governments finance minister who issued some of the bonds now being restructured. Some creditors got on board too, like Fintech Advisory Inc and Gramercy Funds Management. And other opposition leaders backed the deal as well in a rare moment of political unity for a deeply divided nation. Now he just has to persuade the heavyweight creditors.

Guzmans friends say he has a history of taking on painful challenges where victory comes with high costs. Martin Fiszbein, an economist at Boston University who studied with Guzman at Brown, recalls a soccer match there. Guzman scored a goal and then his foot exploded in pain.

Fiszbein urged Guzman to request a substitute. It was just intramurals. Guzman scoffed and kept playing, his side prevailing 2-1.

The result? Fiszbein: “Double bone fracture. Surgery.”

— With assistance by Ben Bartenstein

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

Why Do You Feel Scared During Trade Execution?

Currency Calculator