Score

Virtus Investment Partners

Japan|1-2 years|

Japan|1-2 years| https://www.vrtsjp.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Japan

JapanUsers who viewed Virtus Investment Partners also viewed..

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Making(MM)

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

vrtsjp.com

Server Location

United States

Website Domain Name

vrtsjp.com

Server IP

172.67.178.129

Company Summary

| Aspect | Information |

| Company Name | Virtus Investment Partners |

| Registered Country/Area | Japan |

| Founded Year | 2023 |

| Regulation | Unauthorized by NFA |

| Market Instruments | Mutual funds, ETFs, closed-end funds, variable insurance funds, UCITS, 529 plans, collective investment trusts |

| Account Types | Regular accounts, Individual Retirement Accounts (IRAs), systematic investment plans |

| Minimum Deposit | $100 |

| Trading Platforms | Online trading platform |

| Customer Support | Phone(1-800-243-1574) |

Overview of Virtus Investment Partners

Founded in 2023, Virtus Investment Partners is a Japanese-based company offering a array of trading assets, including mutual funds, ETFs, closed-end funds, variable insurance funds, UCITS, 529 plans, and collective investment trusts. Despite its relatively recent establishment, Virtus Investment Partners has quickly gained traction in the market. The company provides various account types, including regular accounts, Individual Retirement Accounts (IRAs), and systematic investment plans, with a low minimum deposit requirement of $100.

However, it's worth noting that Virtus Investment Partners is currently listed as unauthorized by the National Futures Association (NFA), raising regulatory issues among potential investors. Nevertheless, the company's online trading platform, supplemented by investor education resources on its website and accessible customer support, presents opportunities for investors to explore a wide range of investment options.

Is Virtus Investment Partners Legit or a Scam?

Virtus Investment Partners, Inc. currently operates without authorized regulation from the National Futures Association (NFA) or any other regulatory agencies. Despite lacking a regulated license, the company is listed as a licensed institution with the identifier VIRTUS INVESTMENT PARTNERS INC.

This unregulated status introduce uncertainties and risks for traders on the platform, as it implies a lack of oversight and accountability within the financial services provided.

Pros and Cons

| Pros | Cons |

| Diverse range of investment options | Unauthorized |

| Easy-to-use online trading platform | Some accounts may incur sales charges |

| Strong emphasis on investor education | |

| Competitive fees and expenses |

Pros:

Diverse Range of Investment Options: Virtus Investment Partners offers a wide variety of investment options, including mutual funds, ETFs, closed-end funds, and more. This allows investors to choose from different asset classes and investment strategies to suit their individual preferences and risk tolerance.

Easy-to-Use Online Trading Platform: The online trading platform provided by Virtus Investment Partners is user-friendly and intuitive, making it easy for investors to navigate and execute trades. This convenience enhances the overall investing experience for users, allowing them to manage their investments efficiently from anywhere with internet access.

Strong Emphasis on Investor Education: Virtus Investment Partners places a significant emphasis on investor education, providing resources and tools to help investors make informed decisions about their finances. This commitment to education empowers investors with knowledge and understanding, enabling them to navigate the complexities of the financial markets more effectively.

Competitive Fees and Expenses: Virtus Investment Partners offers competitive fees and expenses compared to other investment firms. This can lead to cost savings for investors, allowing them to keep more of their investment returns over time.

Cons:

Some Accounts Incur Sales Charges: While Virtus Investment Partners offers a range of investment options, some accounts incur sales charges or fees. These charges can vary depending on the type of account and investment vehicle chosen, potentially impacting the overall return on investment for investors.

NFA Unauthorized: Virtus Investment Partners is currently listed as unauthorized by the National Futures Association (NFA). This lack of regulatory oversight will raise issues for some investors about the level of protection and oversight provided for their investments. It's important for investors to carefully consider the regulatory status of any investment firm before committing funds.

Market Instruments

Virtus Investment Partners offers a range of trading assets to investors. Mutual Funds constitute a significant portion of their offerings, providing investors with professionally managed portfolios diversified across asset classes.

Additionally, Retail Separate Accounts offer customized investment strategies tailored to individual client needs. Closed-End Funds provide opportunities for investors seeking potential income and capital appreciation through a fixed number of shares.

Variable Insurance Funds offer tax-deferred investment options within insurance contracts, providing flexibility and diversification. Exchange-Traded Funds (ETFs) provide access to a wide range of markets and sectors, offering transparency and liquidity. UCITS (Undertakings for Collective Investment in Transferable Securities) provide European investors with regulated investment options across borders. CollegeAccess 529 plans facilitate tax-advantaged savings for education expenses, aiding families in planning for future educational costs.

Lastly, Collective Investment Trusts (CITs) offer institutional investors access to professionally managed investment portfolios. Overall, Virtus Investment Partners' array of trading assets serve a wide range of investors' needs and preferences, enabling them to construct well-rounded investment portfolios aligned with their financial goals.

Account Types

Virtus Investment Partners offers various account types tailored to accommodate different investor needs and preferences. One account option is the regular account, which typically requires a minimum initial investment of $2,500. This account type is suitable for individuals looking to invest in mutual funds or other securities without specific retirement or systematic investment requirements.

For investors focused on retirement planning, Virtus Investment Partners offers Individual Retirement Accounts (IRAs). These accounts require a lower minimum initial investment of $100 and are designed specifically for retirement savings. IRAs provide tax advantages and investment options tailored to retirement goals, making them suitable for individuals looking to build retirement wealth through investment in mutual funds or other securities.

Additionally, Virtus Investment Partners offers a Systematic Investment Plan, allowing investors to contribute a minimum of $100 through automatic monthly deductions from their checking or savings account. This plan is ideal for individuals seeking a disciplined approach to investing and looking to dollar-cost average into mutual funds over time.

How to Open an Account?

Research Account Options: Begin by researching the various types of accounts offered by Virtus Investment Partners to determine which best suits your investment goals and risk tolerance.

Gather Required Documents: Collect the necessary documentation for opening an account, which typically includes personal identification such as a driver's license or passport, Social Security number, and proof of address.

Complete Application: Fill out the account application form provided by Virtus Investment Partners. Ensure all information provided is accurate and up-to-date.

Choose Investment Strategy: Select your preferred investment strategy or specify any investment preferences during the application process. This may include choosing specific mutual funds, ETFs, or other investment vehicles offered by Virtus.

Fund Your Account: Once your application is approved, fund your account by transferring funds from your bank account or another investment account. Follow the instructions provided by Virtus for initiating the transfer.

Review and Confirm: Review all account details and confirm that your account is set up according to your preferences. Once everything is in order, you're ready to start investing with Virtus Investment Partners.

Spreads & Commissions

Virtus Investment Partners imposes various spreads and commissions depending on the type of account and fund chosen by investors.

For Class A shares, the Public Offering Price (POP) includes a maximum sales charge, which varies depending on the type of fund.

For equity, specialty, multi-asset, alternative, and international/global funds, as well as Virtus Convertible Fund, the sales charge stands at 5.50%. Certain fixed income funds incur lower sales charges, ranging from 3.75% for specific bond funds to as low as 2.25% for short-duration bond funds.

Additionally, Class A shares of certain funds, such as Virtus Seix U.S. Government Securities Ultra-Short Bond Fund and Virtus Seix Ultra-Short Bond Fund, have no sales charges.

Trading Platform

Virtus Investment Partners employs a Secure Socket Layer (SSL) server for its trading platform, ensuring a secure environment for online transactions. The use of SSL encryption guarantees that all communications between users and the server are encrypted, thus safeguarding sensitive information from interception by third parties.

Specifically, Virtus Investment Partners' server requires 128-bit encryption, enhancing the security measures in place. It's worth noting that while SSL encryption provides robust protection, some companies and Internet service providers (ISPs) restrict access to sites using SSL. In such cases, users will encounter difficulties accessing the platform and need to seek assistance from their ISP or a computer support professional to address any issues related to SSL compatibility.

Deposit & Withdrawal

The minimum deposit required varies depending on the type of account and investment method chosen with Virtus Investment Partners. For regular accounts, the minimum initial investment is $2,500. However, for Individual Retirement Accounts (IRAs) and accounts with systematic purchase or exchange, the minimum initial investment is lower, set at $100. Notably, there is no minimum initial or subsequent purchase amounts for defined contribution plans, asset-based fee programs, profit-sharing, or employee benefit plans.

Additionally, Virtus offers a Systematic Investment plan with a minimum initial investment of $100, enabling investors to invest in any Virtus Mutual Fund(s) through automatic monthly deductions from their checking or savings account. This lower threshold makes investing more accessible to a wider range of individuals, particularly those looking to start with smaller amounts or utilize systematic investment strategies.

Customer Support

Virtus Investment Partners offers various customer support with multiple contact options. Operating hours are Monday to Thursday from 8:30 am to 6:00 pm ET, and Friday from 8:30 am to 5:00 pm ET. For immediate assistance, there's a 24/7 Automated Fund Access line(1-800-243-1574). Retail Sales & Marketing, Closed-End Funds, and RIA Firms each have dedicated phone lines. CollegeAccess 529 also provides support during business hours.

Additionally, there's an FAQ page for quick reference, and customers can email inquiries, with responses promised within two business days. For media inquiries or website feedback, specific contact details are provided, ensuring efficient communication channels.

Educational Resources

Virtus Investment Partners' educational resources, as outlined in their literature library, offer a wide array of materials for both investors and financial professionals. This collection covers various aspects crucial to understanding and managing investments effectively.

Additionally, the availability of account forms and applications streamlines administrative processes, enhancing user experience. The inclusion of online account information ensures accessibility and convenience. Moreover, the library encompasses a wide range of fund documents, including those related to mutual funds, ETFs, and variable insurance funds, providing valuable insights into investment options and strategies.

Conclusion

In conclusion, Virtus Investment Partners presents a compelling option for investors seeking a range of investment opportunities and an easy-to-use online trading platform. The firm's strong emphasis on investor education is commendable, empowering investors with the knowledge needed to navigate the complexities of the financial markets effectively. Additionally, competitive fees and expenses contribute to the overall appeal of Virtus Investment Partners, potentially leading to cost savings for investors over time.

However, it's important to acknowledge the potential drawbacks associated with the firm, including the possibility of sales charges incurred by some accounts and the current unauthorized status with the National Futures Association (NFA). These factors may give investors pause and prompt careful consideration before committing funds. Despite these disadvantages, Virtus Investment Partners offers a compelling suite of investment options and resources, making it a noteworthy contender in the investment landscape.

FAQs

What types of accounts does Virtus Investment Partners offer?

Virtus Investment Partners offers regular accounts, Individual Retirement Accounts (IRAs), and systematic investment plans.

What is the minimum initial investment required for Virtus Investment Partners' regular account?

The minimum initial investment for a regular account is $2,500.

Are there any fees associated with Virtus Investment Partners' accounts?

Yes, some accounts incur sales charges, while others have competitive fees and expenses.

Can I access Virtus Investment Partners' trading platform online?

Yes, Virtus Investment Partners provides an easy-to-use online trading platform for investors.

Is Virtus Investment Partners regulated?

Virtus Investment Partners is currently listed as unauthorized by the National Futures Association (NFA).

Keywords

- 1-2 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 7

Content you want to comment

Please enter...

Review 7

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

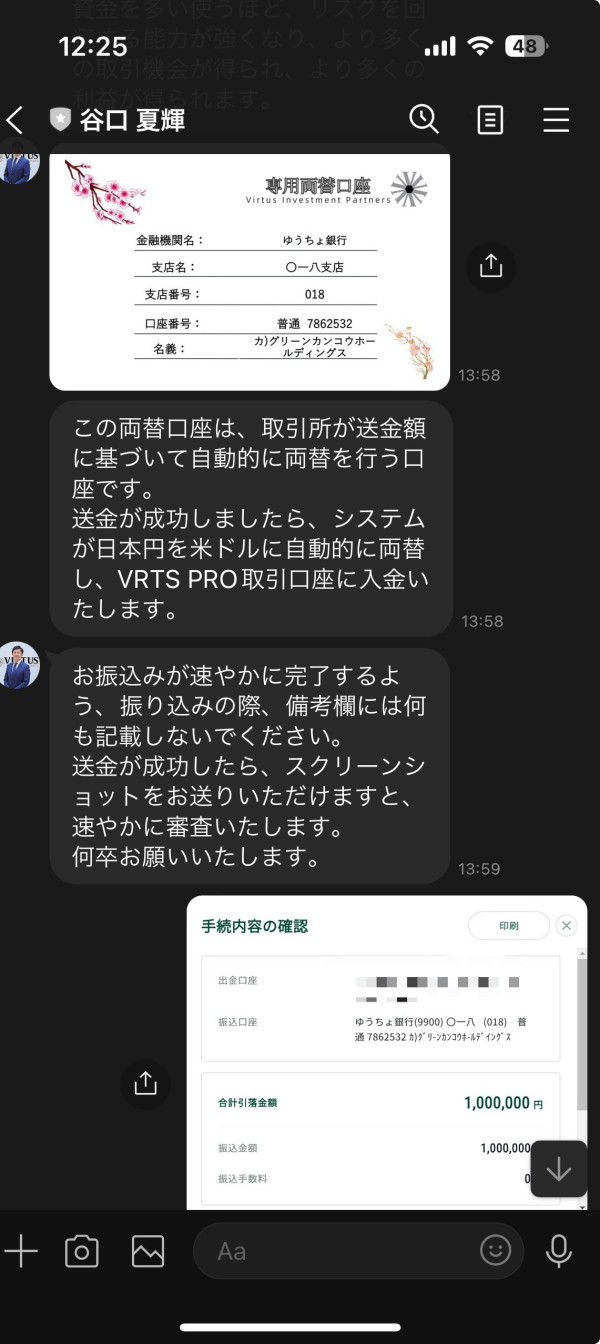

FX4385181272

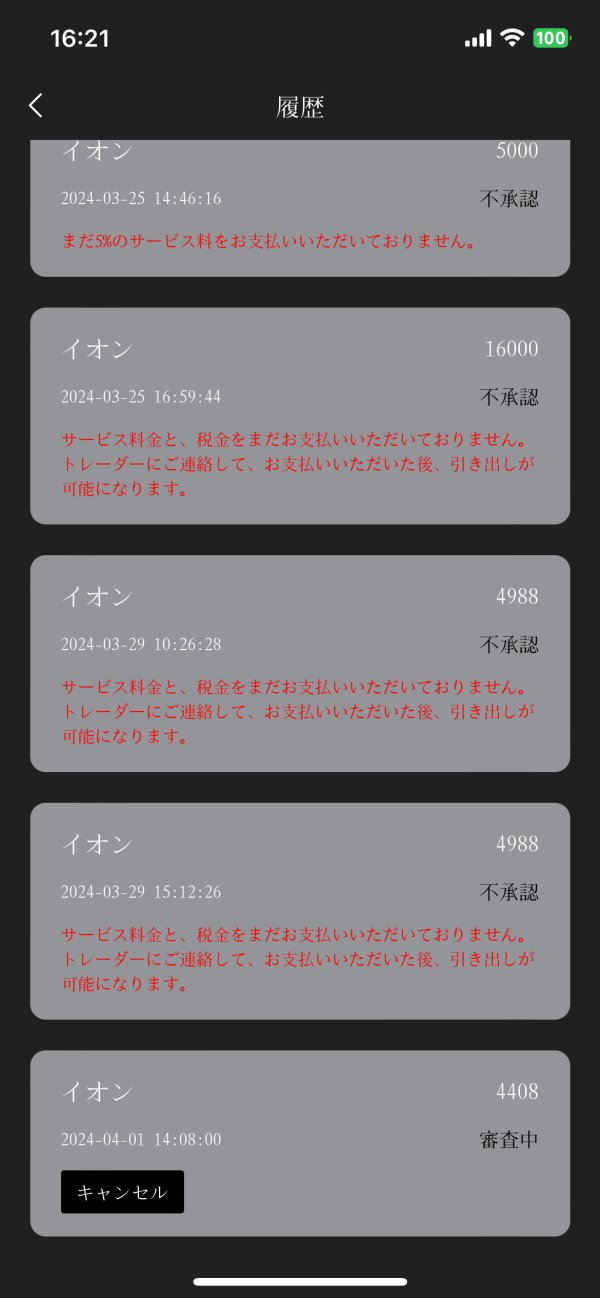

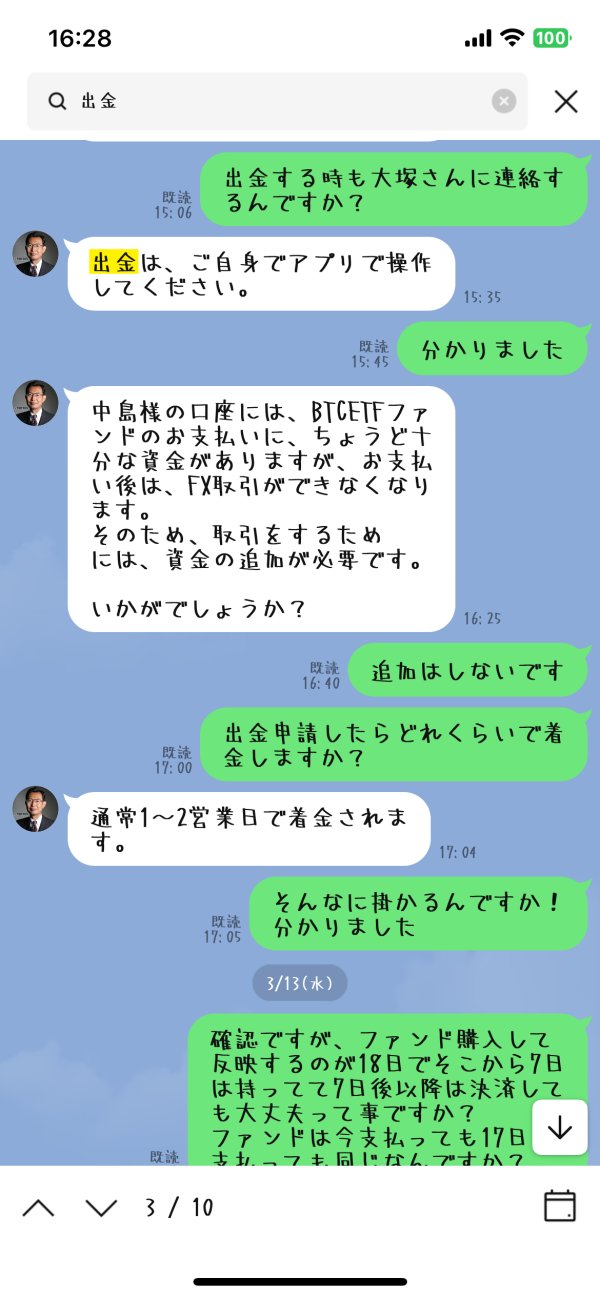

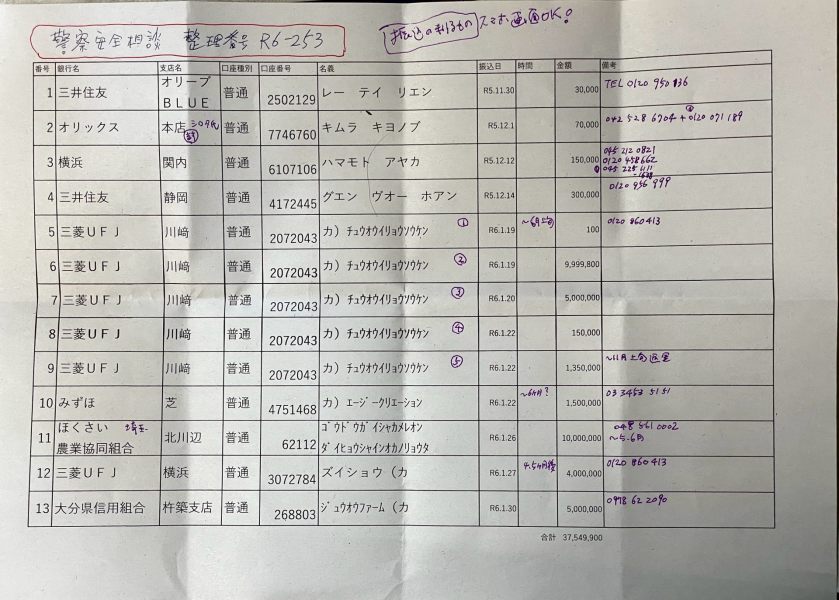

Japan

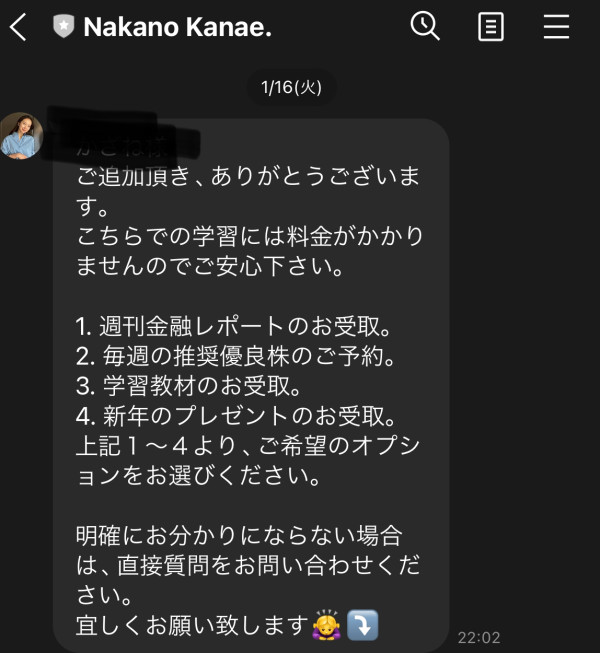

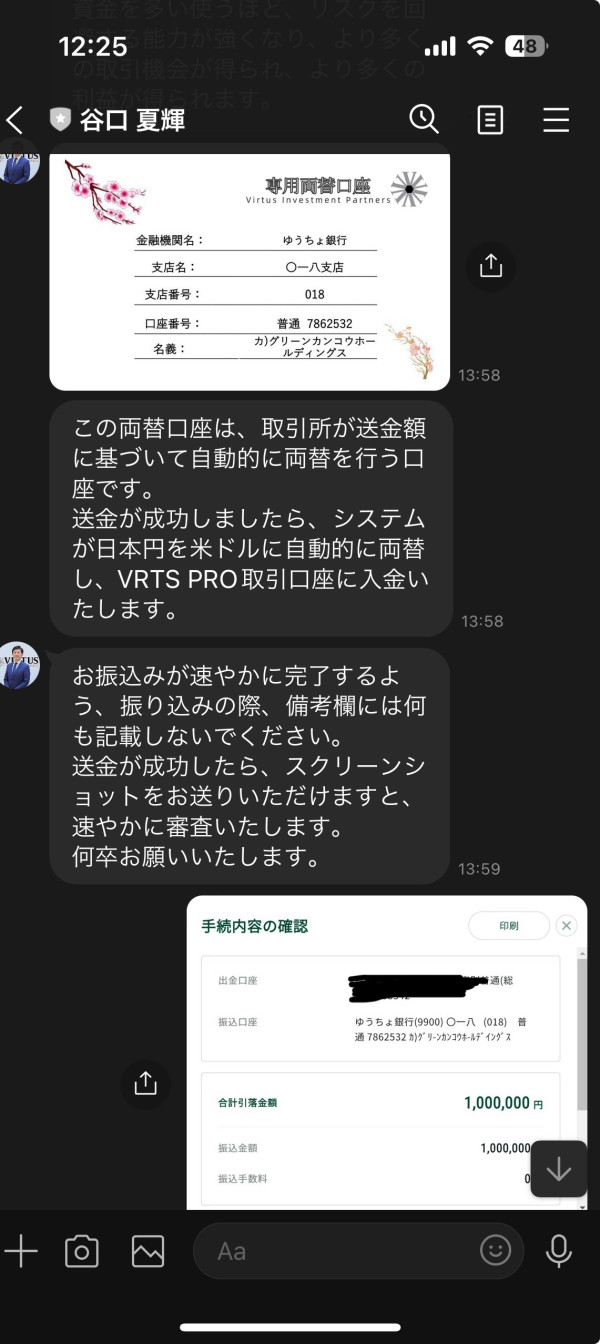

A man who calls himself Kazuma Otsuka often speaks strange Japanese. Anyway, I'm worried about when the money will be transferred. Even though I applied for a withdrawal, I wonder if they're manipulating it. I can't withdraw the money. He's suddenly asked to pay taxes by a group of scammers. April. Apply for withdrawal in one day. Still under review. Completely ignored when I inquired, thought to be a scammer.

Exposure

2024-04-07

oono

Japan

The company does not exist at the registered address. Don't let them withdraw money for any reason.

Exposure

2024-03-13

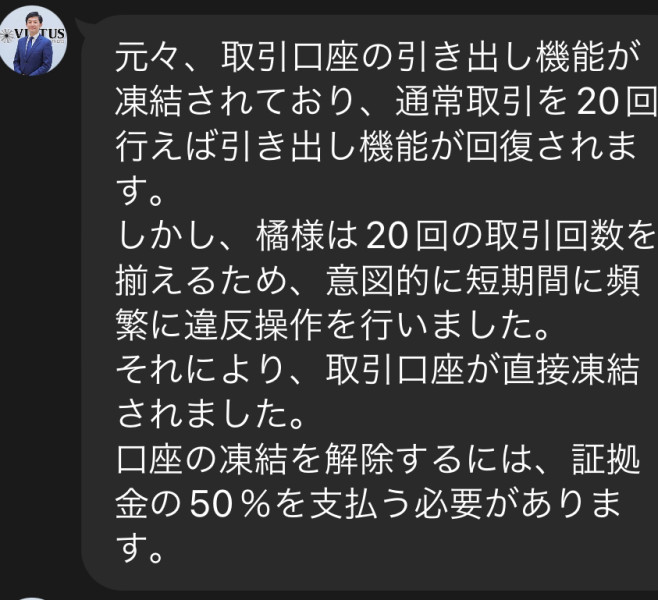

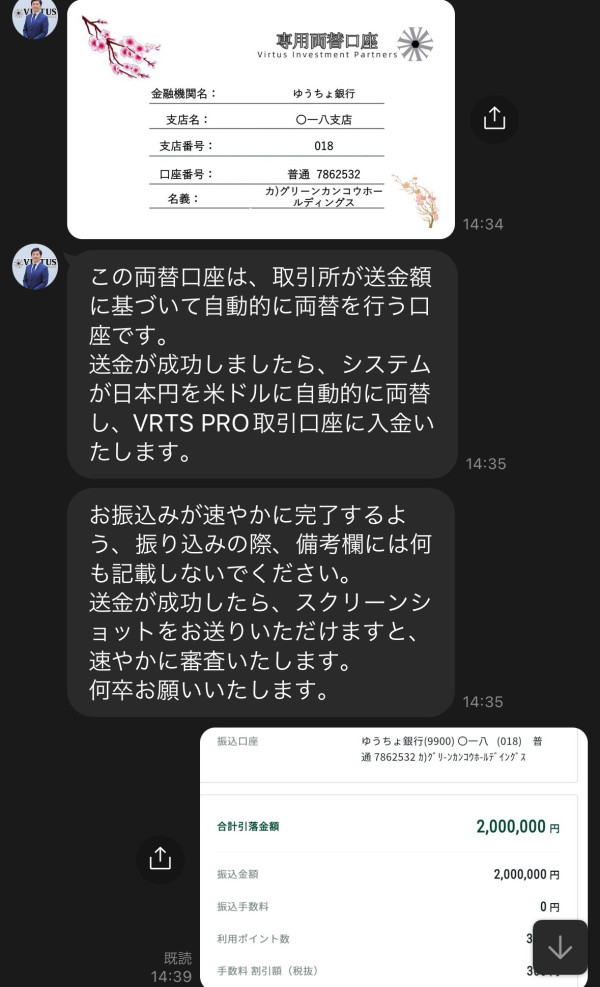

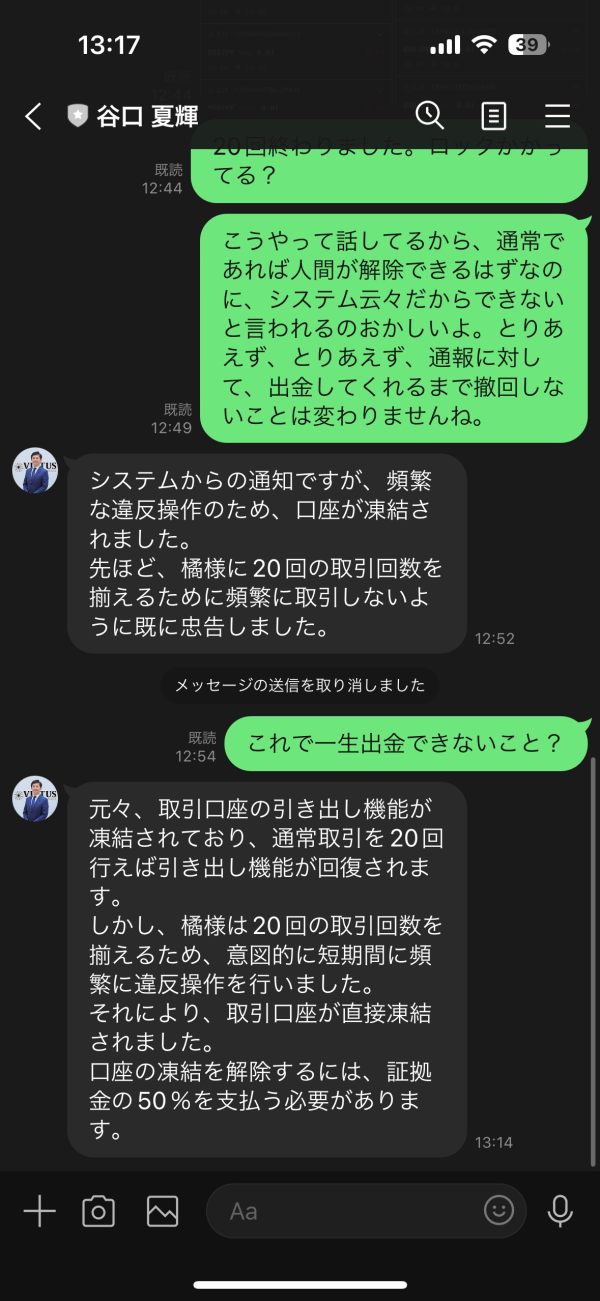

oono

Japan

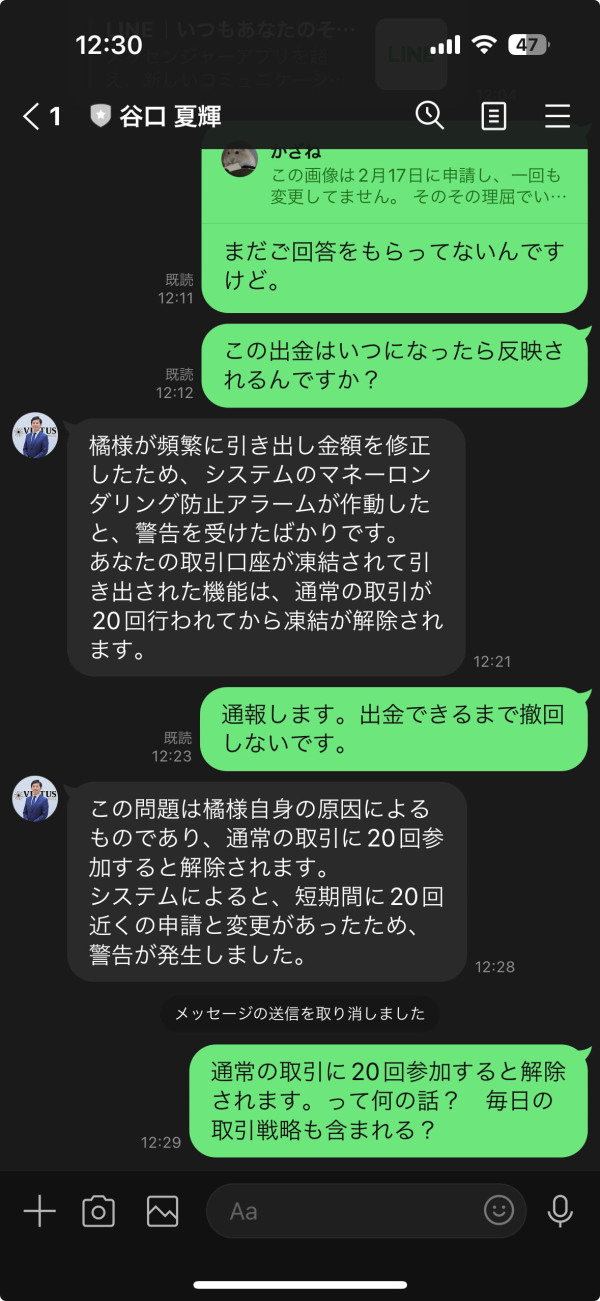

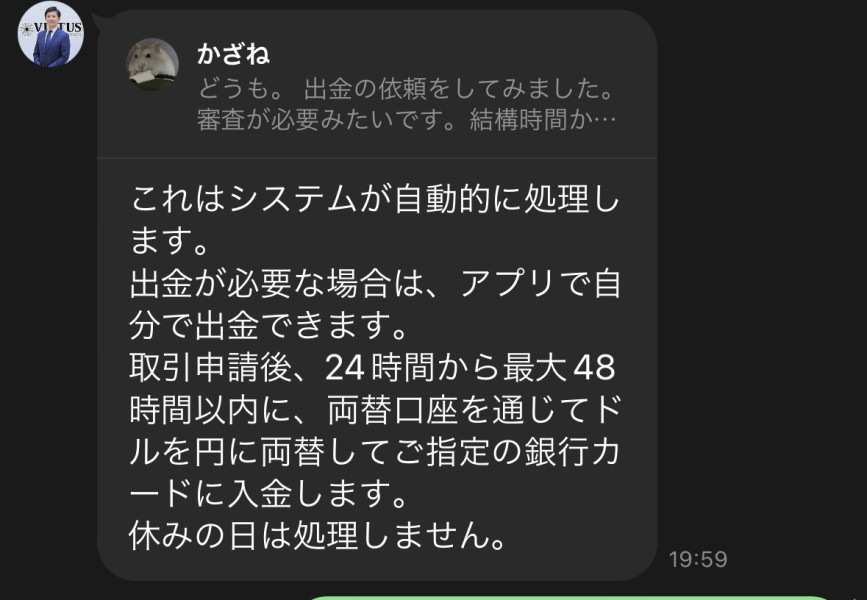

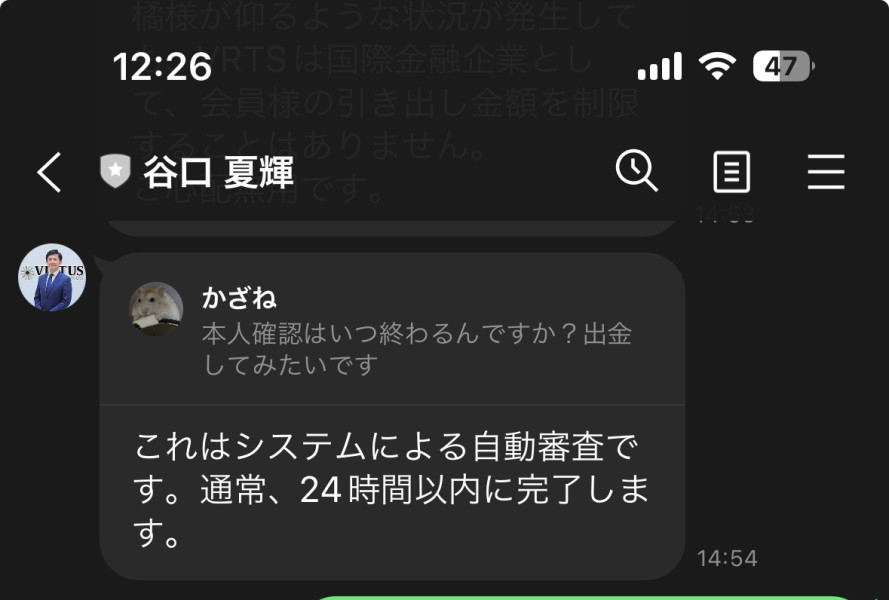

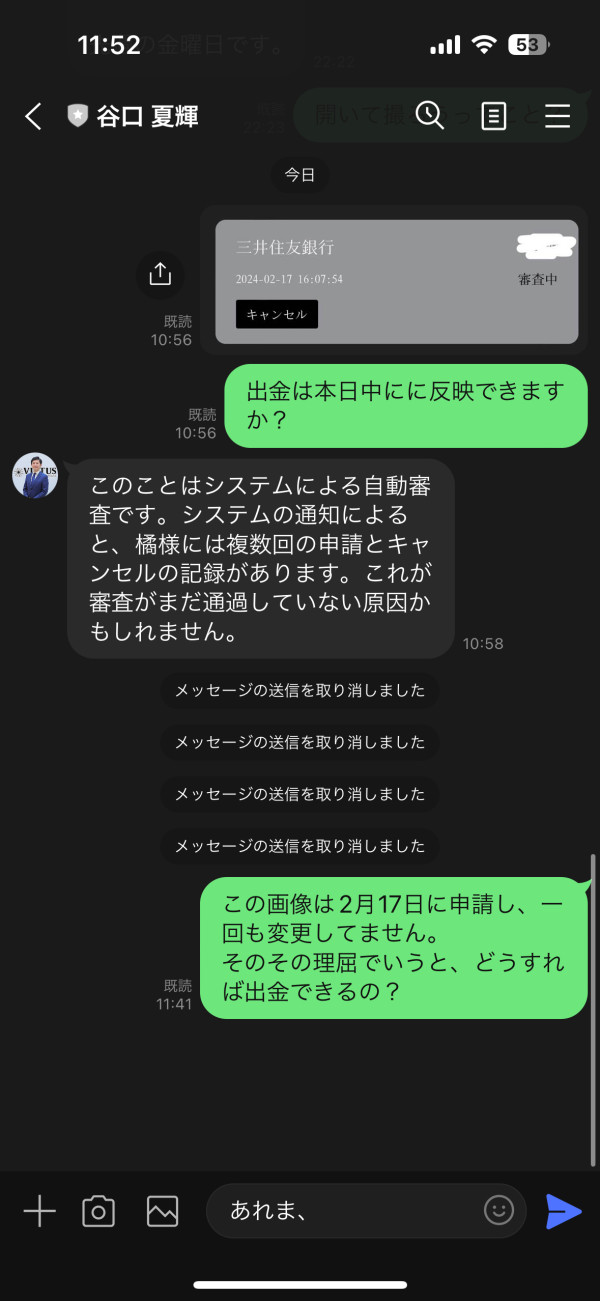

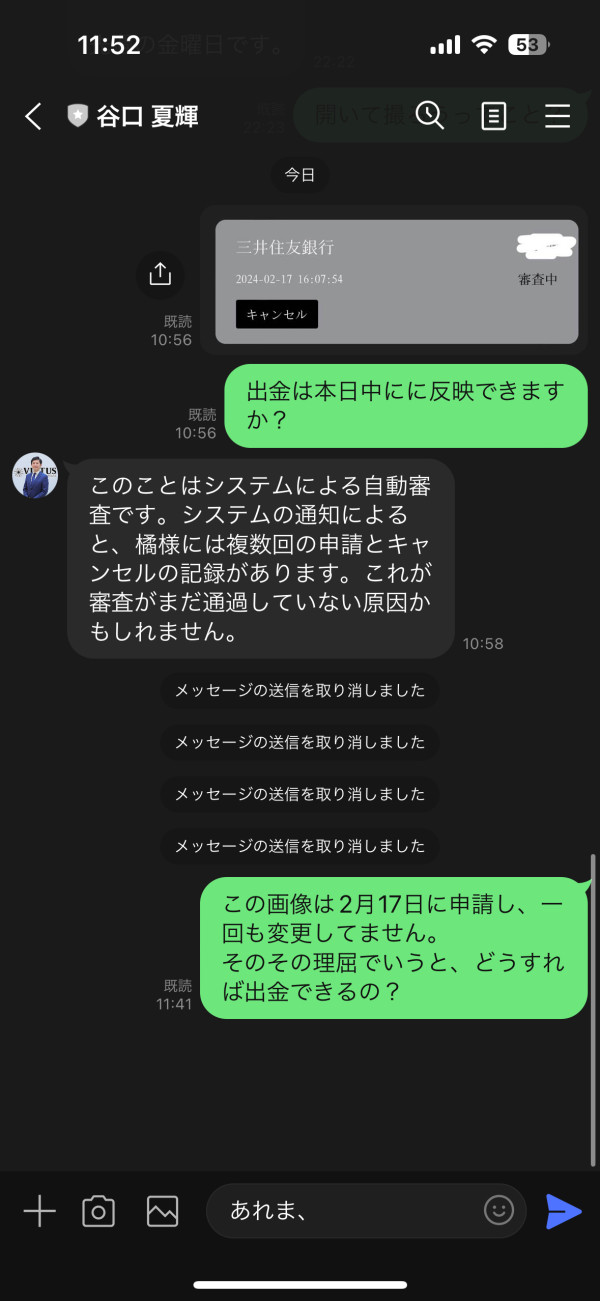

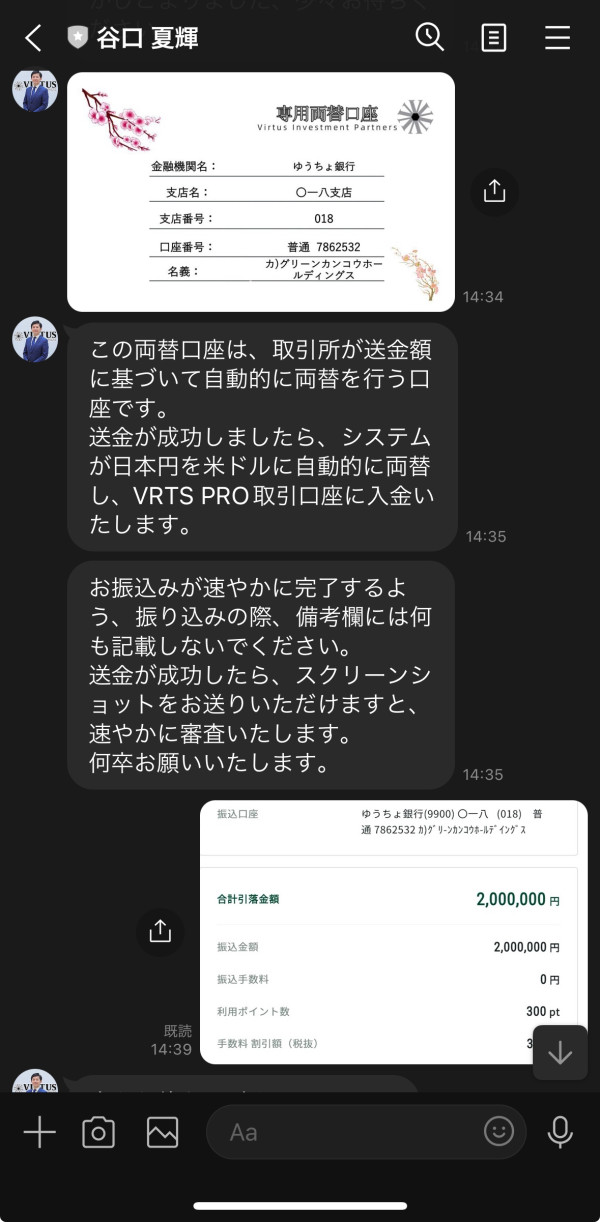

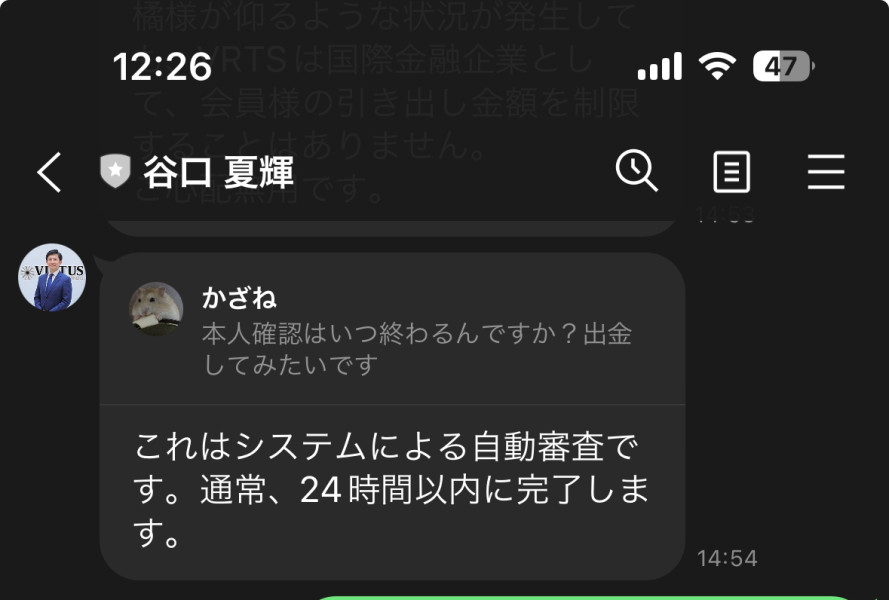

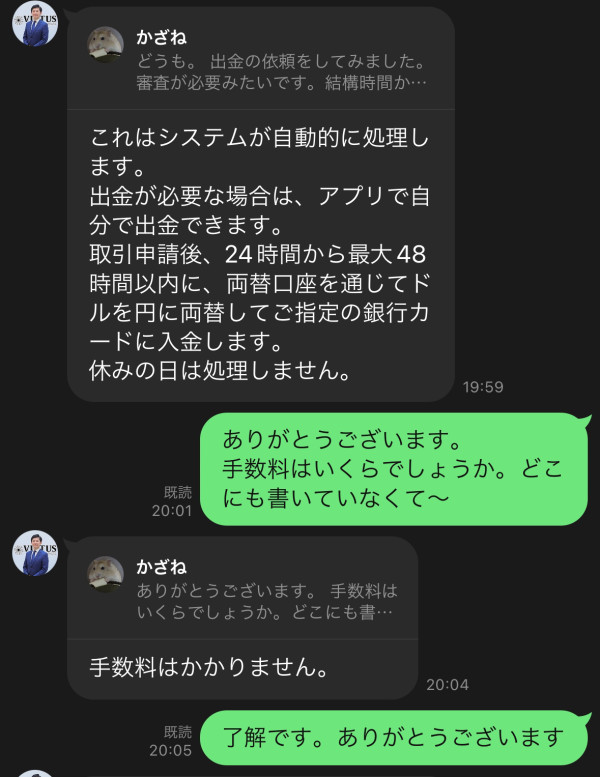

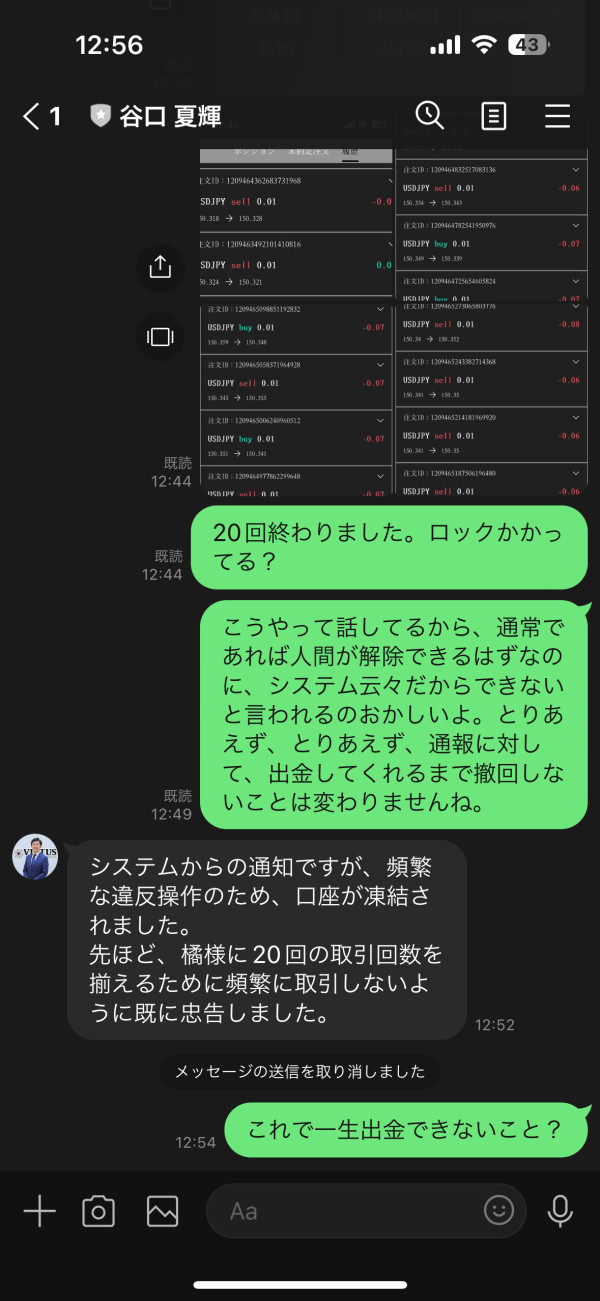

- There was no prior explanation regarding the conditions for forced suspension of the withdrawal function and freezing of the account. - I was notified for the first time after my account was actually frozen - I was told that I would have to pay 50% of the funds separately in order to unlock my frozen account, and there was no prior explanation about this either. - The withdrawal rules have changed from "within 24 hours" to "up to 48 hours", and the explanation has changed later. -Currently, the account has been frozen and the funds of 3,050,000 yen cannot be withdrawn.

Exposure

2024-02-26

oono

Japan

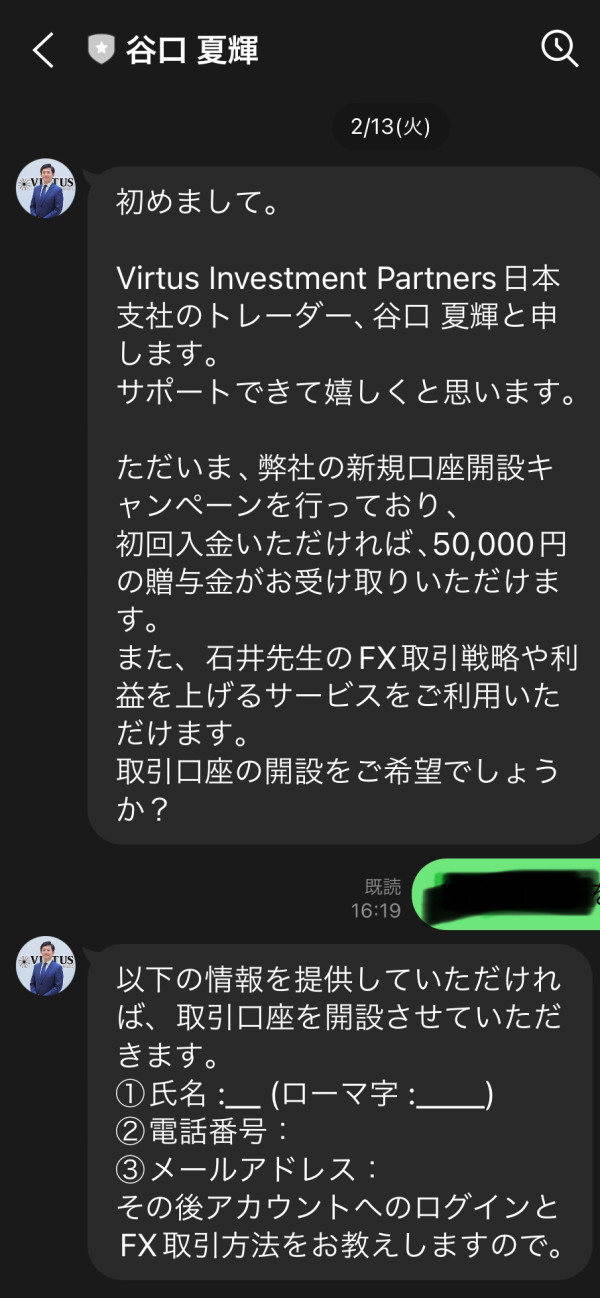

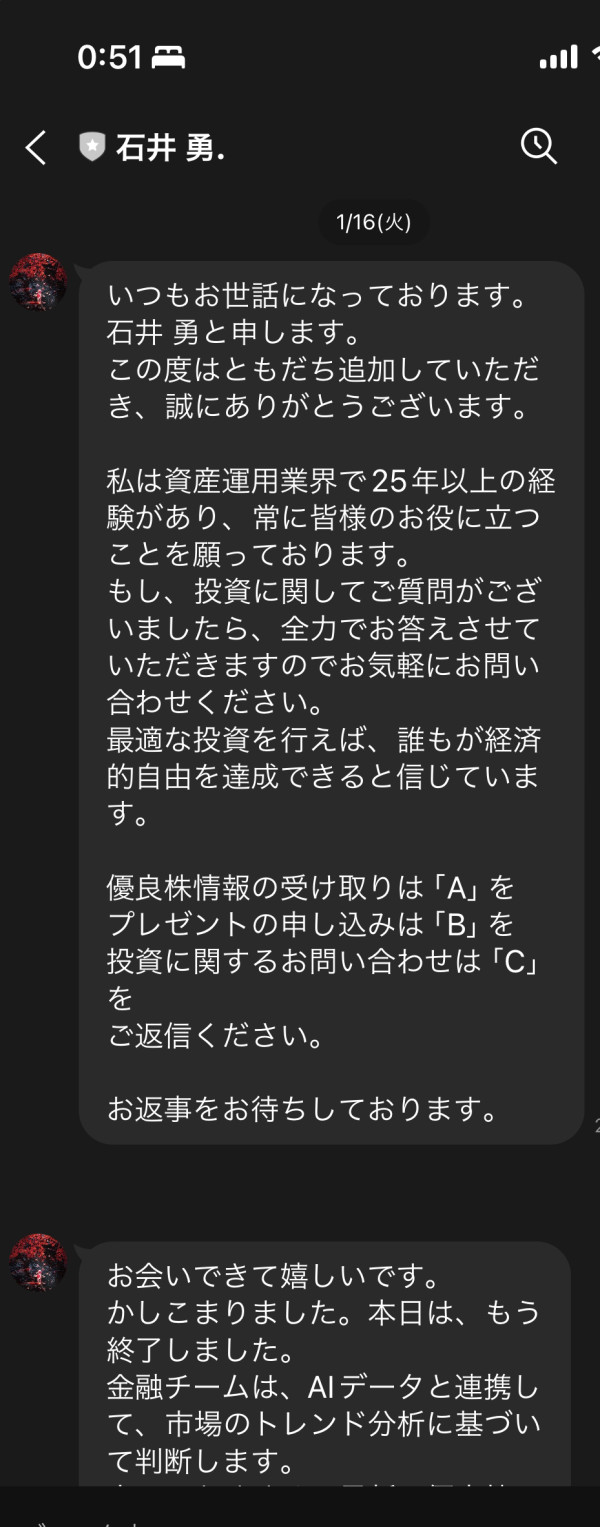

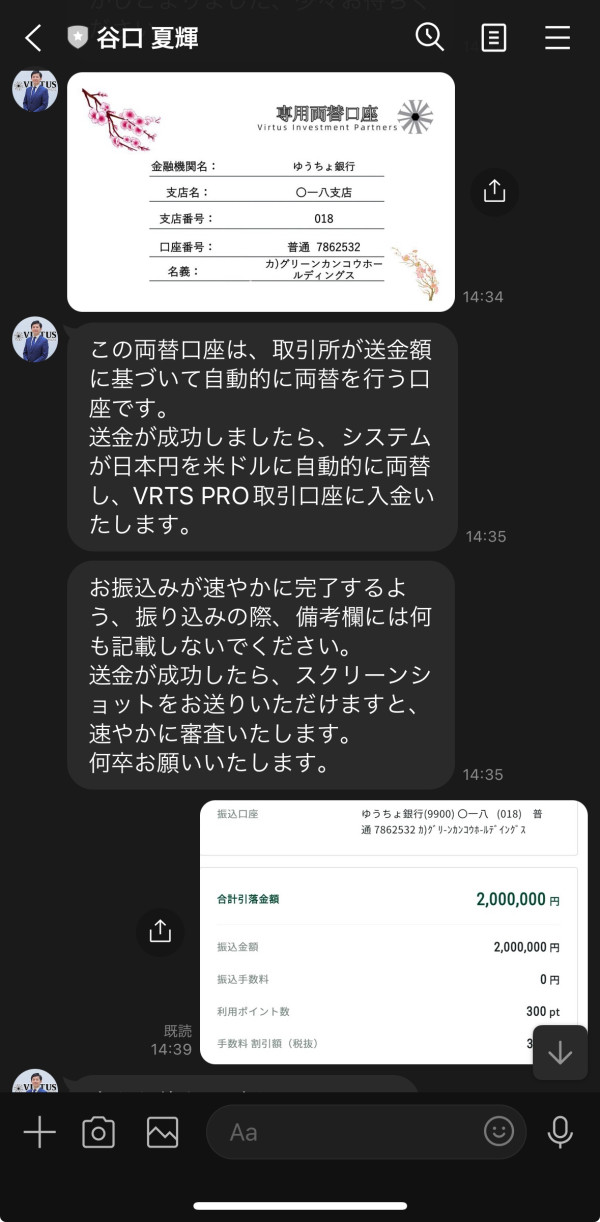

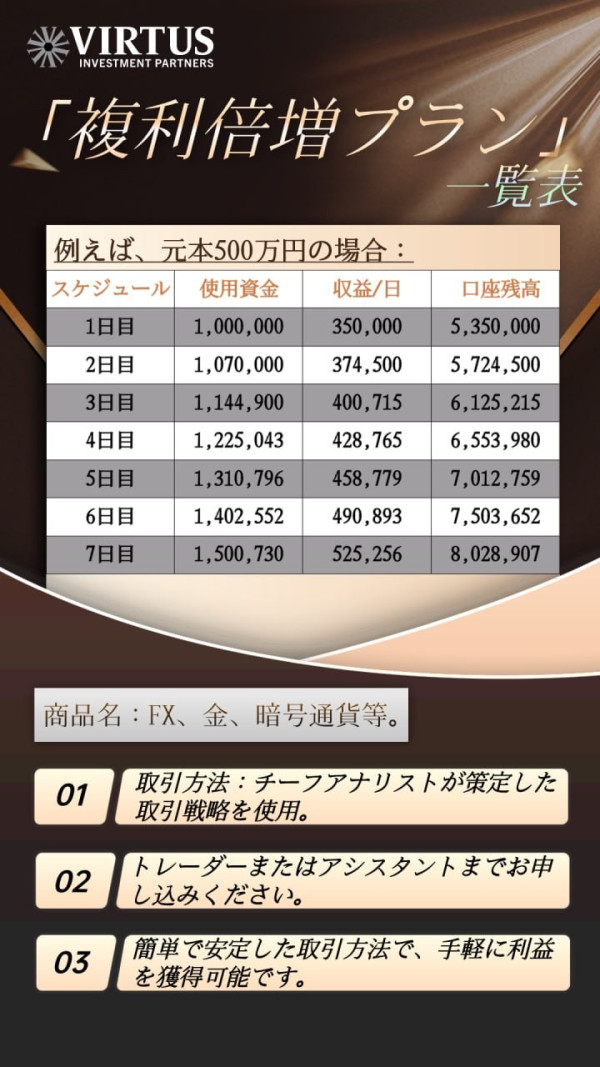

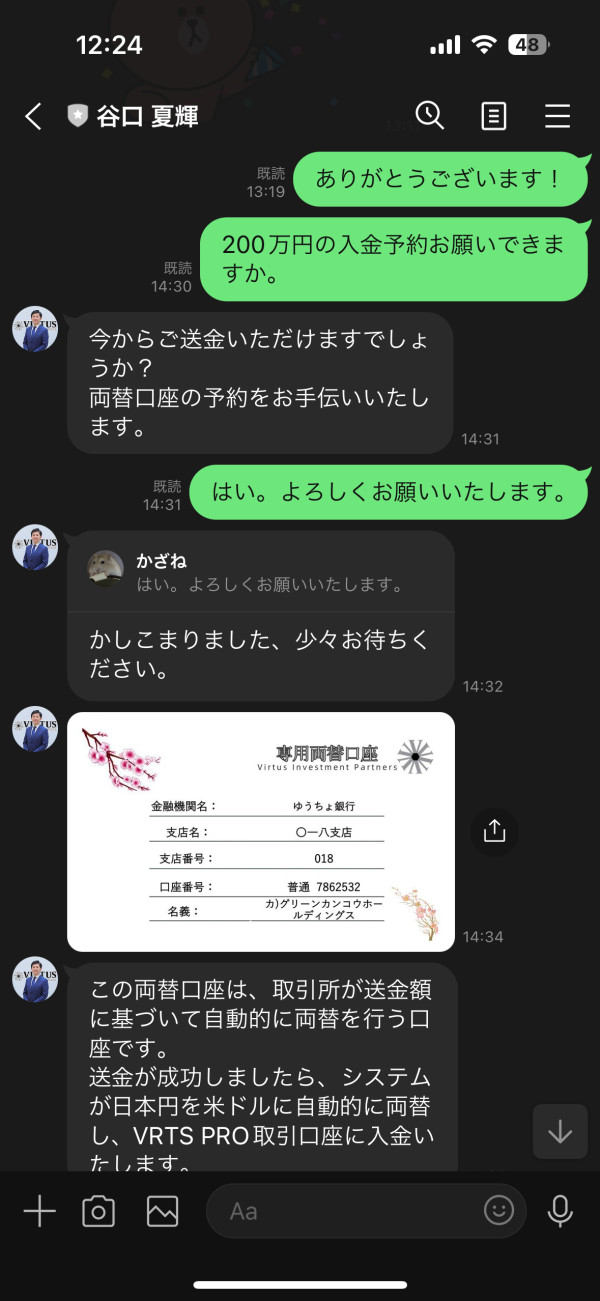

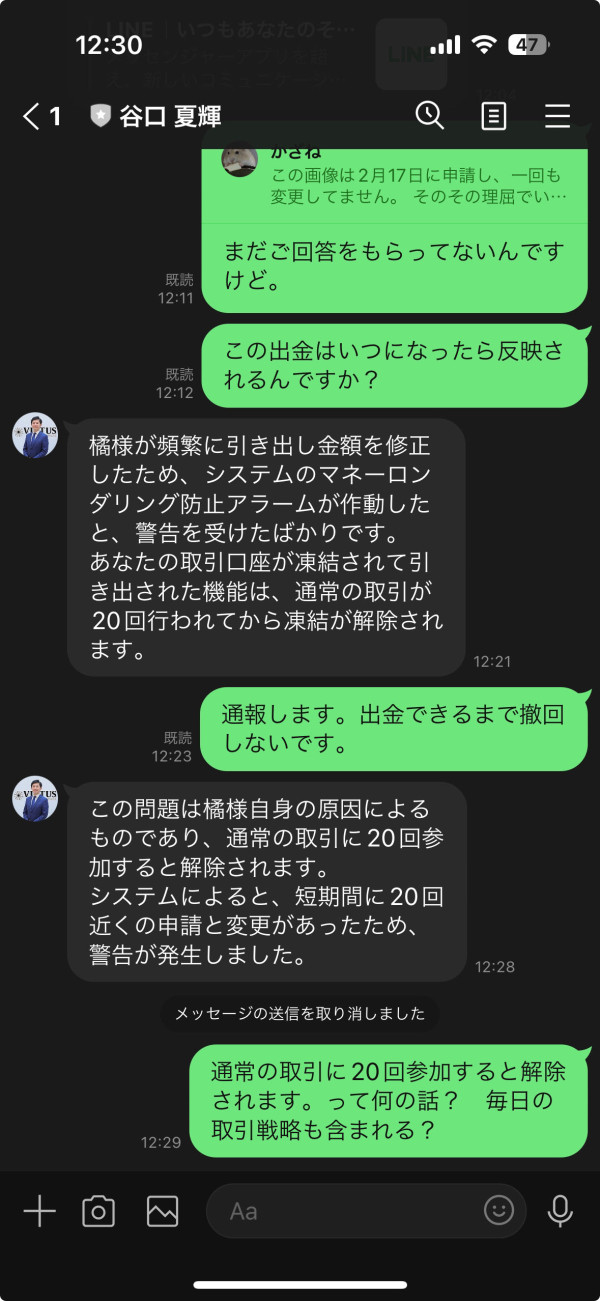

Around February 6, 2024, we released an FX exchange app called VRTS PRO, had Line group members open accounts and make deposits, and taught them FX trading strategies every weekday for about a week, achieving a 100% win rate. I deposited 3 million, but the account is not VirtusInv.ed tmentPartners, but a completely unrelated corporation. When I tried to withdraw money for funding, I received a message that said, ``Due to the large number of withdrawal cancellations, the system was locked, so the account was locked after 20 transactions.'' (If you make many changes to the withdrawal amount, there will be no advance notice of course). Moreover, they just said it is not good to do it frequently, without saying that "it will be frozen", and clicked here. I tried to induce the account to be frozen, and now I have 3 million yen in it and can't withdraw it. I can't even log in. I will leave this report until the withdrawal issue is resolved.

Exposure

2024-02-20

teru777n

Japan

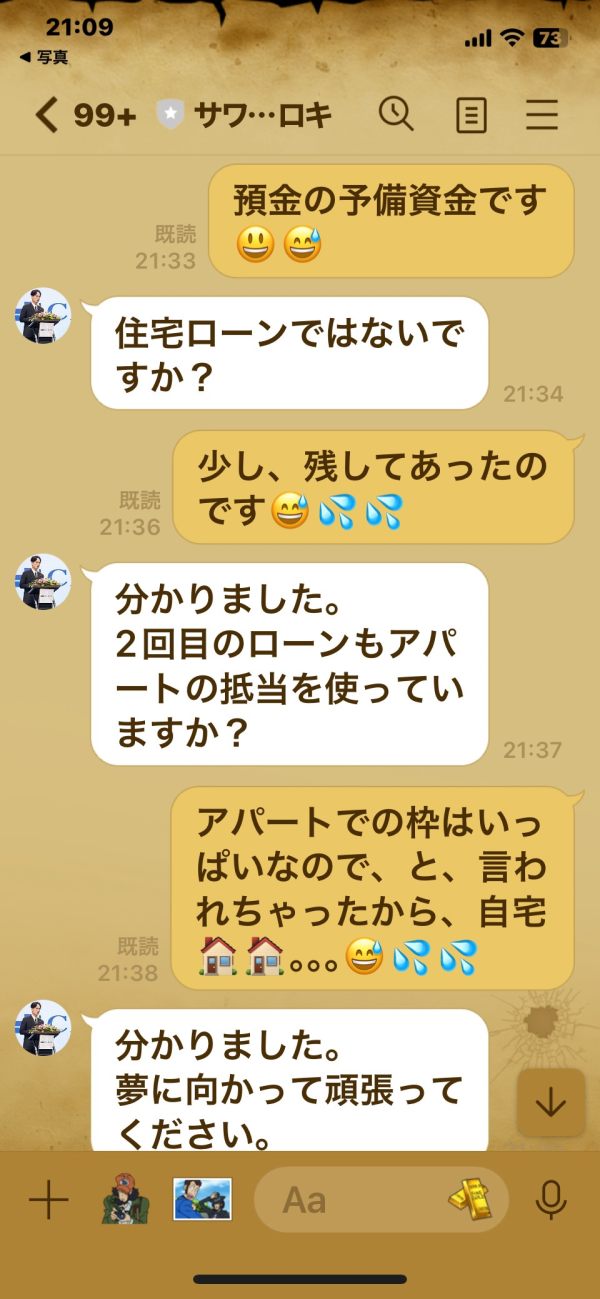

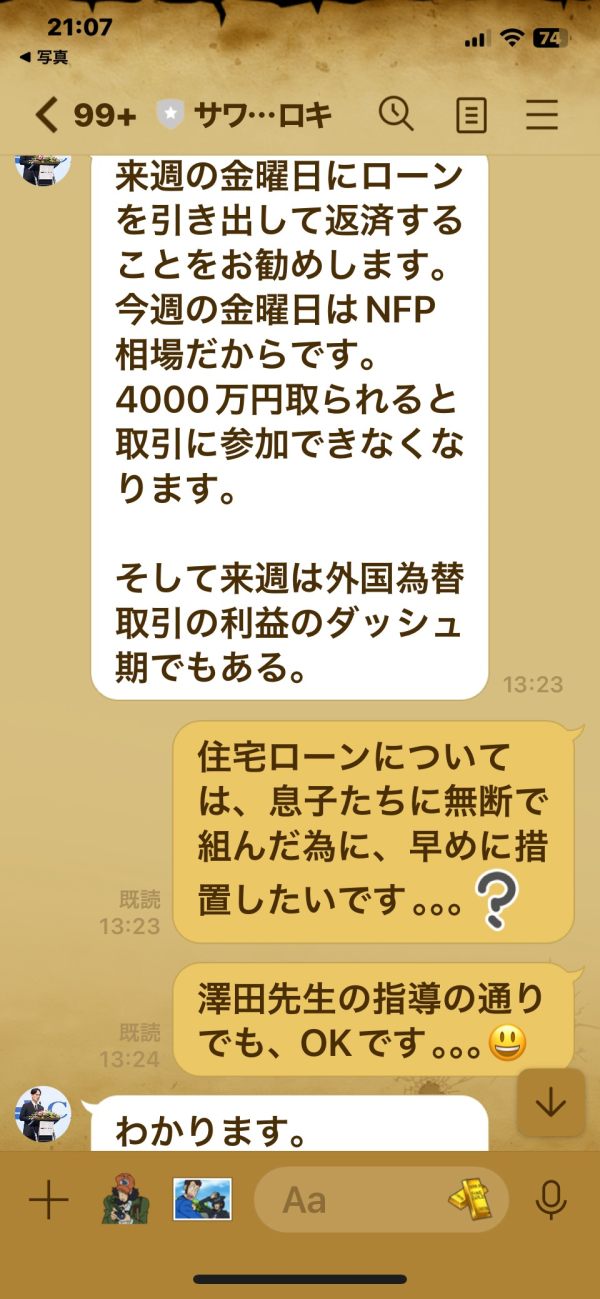

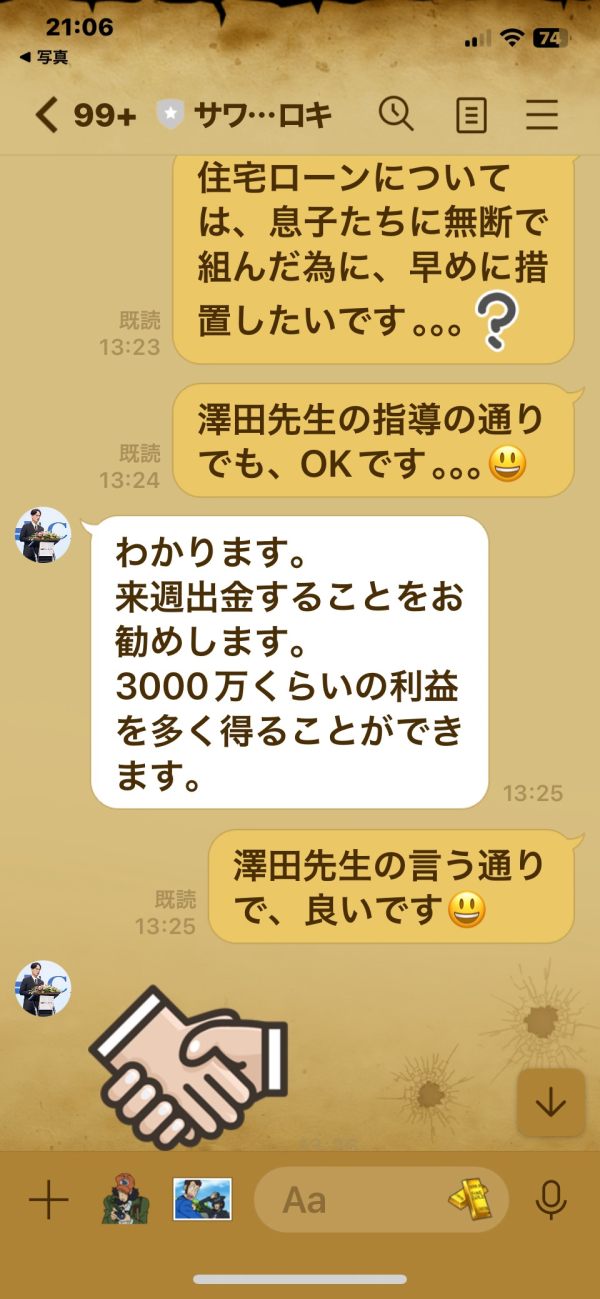

MetaTrader5 investment scam on LINE 🥵💦🥵💦 Dr. Sawada investment scam 🥵🥵💦💦.

Exposure

2024-02-16

82346

Japan

Trading with this broker has been okay so far. I like the variety of assets and the MT4 platform. But honestly, their lack of regulation makes me nervous about putting in more money. They do respond when I reach out, but I'm playing it safe for now.

Neutral

2024-06-27

Wildery

United Kingdom

Virtus Investment Partners has offered me a diverse trading experience. The myriad of trading assets including mutual funds and 529 plans has been intriguing. I like the flexibility of account types and the low minimum deposit of $100. So far so good!

Positive

2024-05-15