简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Angel Broking Charged Unjustified Trading Commissions

Abstract:Investors may be quite immune to lame marketing scripts such as“Invest US$300 and get US$3,000 of returns in 24 hours”.

Investors may be quite immune to lame marketing scripts such as“Invest US$300 and get US$3,000 of returns in 24 hours”. But when the scam broker claims to offer high returns for low brokerage rates, investors may not realize its a trap.

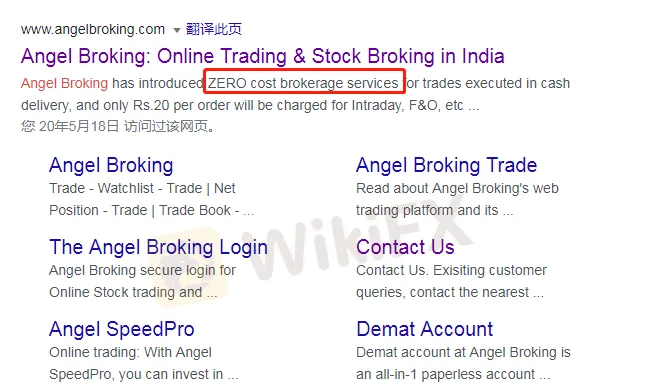

Recently, an Indian investor complained against the broker Angel Broking for unjustified deduction from his trading account, hoping to bring the broker to justice. The complainant told WikiFX that he was attracted to Angel Broking for its so-called zero cost brokerage.

Angel Broking claims to offer zero-cost brokerage

Angel Brokings advertisement on moneycontrol, an established Indian financial media

But not long after he made his deposits, investor received several confirmation text messages of account deduction generated by the broker, each time for 800 rupees.

Indian investor got account deduction texts from Angel Broking

Through observation, the investor found that every transaction from his trading account will generate an automatic deduction of account balance which goes to the broker. He complained that Angel Broking‘s advertisements about “zero commission” is an outright lie as they make unreasonable deduction of investor’s account and exploit investors trust.

Investor exposed Angel Brokings illegal practices

We may conclude that Angel Broking is an illegal broker which tries to lure investors to its trap with the bait of so-called “zero commission”. Per checking WikiFX App, Angel Broking is rated at only 1.20 and is currently unregulated, so please stay away!

Angel Broking has a poor rating of 1.2 on WikiFX

In India‘s forex market, there are still many brokers like Angel Broking that try to scam investors by claiming to charge attractively low commissions. Major discount brokers in India like upstox and Zerodha are also being heavily complained recently for withdrawal failure, trading server lag and causing unjustified losses. Indian investors should definitely be more aware, as many investors choose a broker solely base on its commission, yet seldom pay attention to the broker’s compliance. Even some brokers on the regulatory list of SEBI are not necessarily reliable and worth-choosing. Stay tuned as WikiFX continues to present you latest exposures of Indian forex brokers.

So far, WikiFX App has included profiles of over 18,000 forex brokers around the world, while integrating broker information query, exposure, news feed and other functions, offering investors 24/7 services.

To report illegal traders, please contact WikiFX official customer service at wikifx@wikifx.com.

You may also download WikiFX App and sign up as VIP member for more information and services.https://bit.ly/3ajawKO

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Webull Canada Expands Options Trading to TFSAs and RRSPs

CySEC Launches Redesigned Website Packed with New Features

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiFX Review: Is PU Prime a decent broker?

Currency Calculator