简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

UK Holds Benchmark Interest Rate at 0.1%

Abstract:Bank of England recently announced the latest interest rate decision as the 9 members of Monetary Policy Committee(MPC) agreed unanimously to hold benchmark interest rate at 0.1%.

Bank of England recently announced the latest interest rate decision as the 9 members of Monetary Policy Committee(MPC) agreed unanimously to hold benchmark interest rate at 0.1%.

MPC also voted by a majority of 7:2 to keep bond purchase volume at 6,450 pounds, which was in line with market expectation.The 2 policymakers proposed to add another 100 billion pounds to the current bond purchase scheme.

BOC noted that buying bond with the present speed will make the government reach the upper-limit of the purchase scheme by July.

It’s estimated that the pandemic will cause a swift decline of British economy which is expected to be temporary, and the economy will slowly revive afterwards.BOC expected Britain’s GDP to shrink 25% in 2020’s second quarter, but up by 15% in the whole year of 2021.

Bank of England’s Governor Bailey expects that the impact of the epidemic on economic demand will continue for about a year after lifting the lockdown restrictions. From previous experience,increasing QE is a negative factor for the pound, because issuing more pounds will lead to depreciation of the currency.

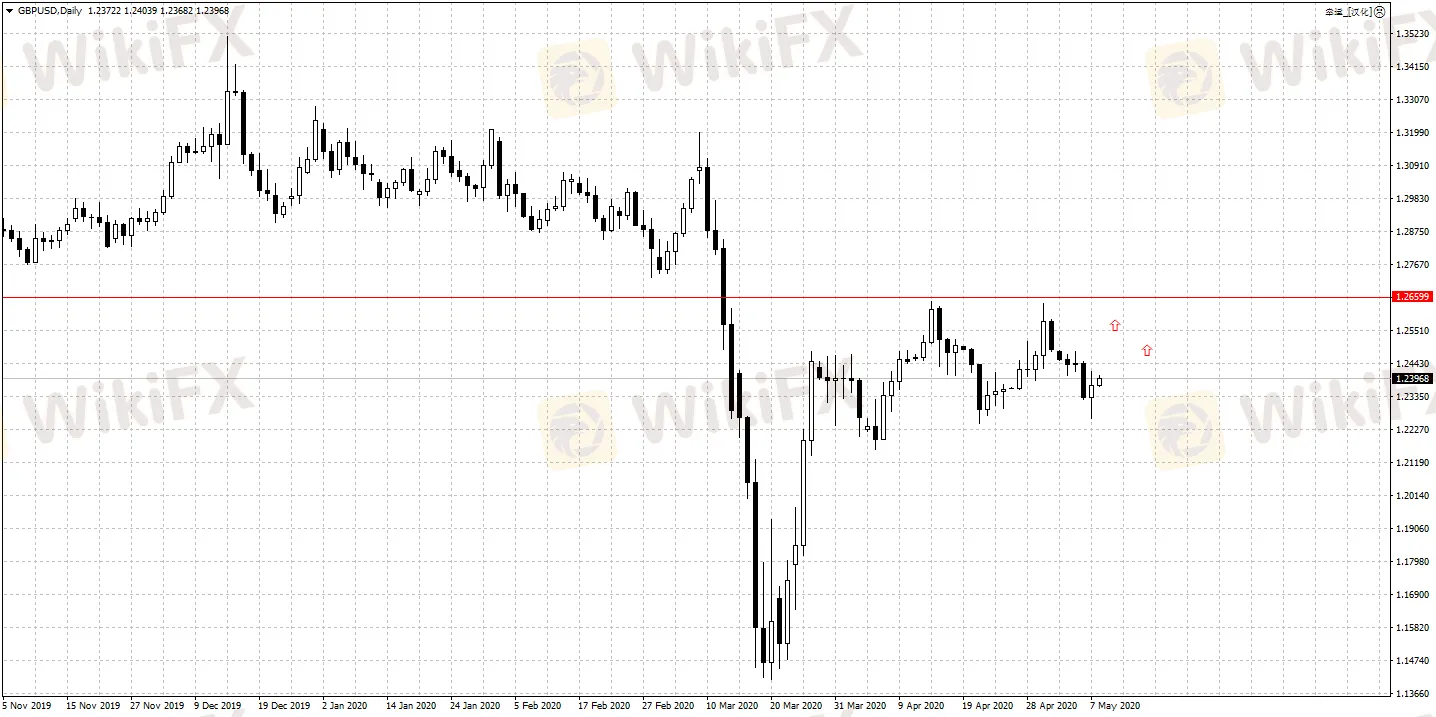

GBP/USD daily pivot points: 1.2342-1.2362

S1: 1.2286 R1: 1.2439

S2: 1.2200 R2: 1.2505

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

WikiEXPO Global Expert Interview: Advanced Practices and Insights in Financial Regulation

Justin Sun Invests $30M in Trump-Backed World Liberty Financial

Kraken Closes NFT Marketplace Amid New Product Focus

Robinhood Launches Ethereum Staking with 100% Rewards Match

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Currency Calculator