Overview of TJM Ivestments

Established in 1996, TJM Investments is a brokerage firm catering specifically to institutional clients, both large and small. With a combined experience of over 100 years across its entities – TJM Investments, LLC, TJM Institutional Services, LLC, and TJM Europe, LLP – TJM boasts a comprehensive suite of agency execution services. This allows institutions to seamlessly navigate global financial markets, trading in diverse instruments such as equities, futures, options, forex, and more.

TJM Investments positions itself as a seasoned player in institutional brokerage, yet its 'suspicious clone' warning from the U.S. NFA contradicts this image. Prospective clients should proceed with prudence.

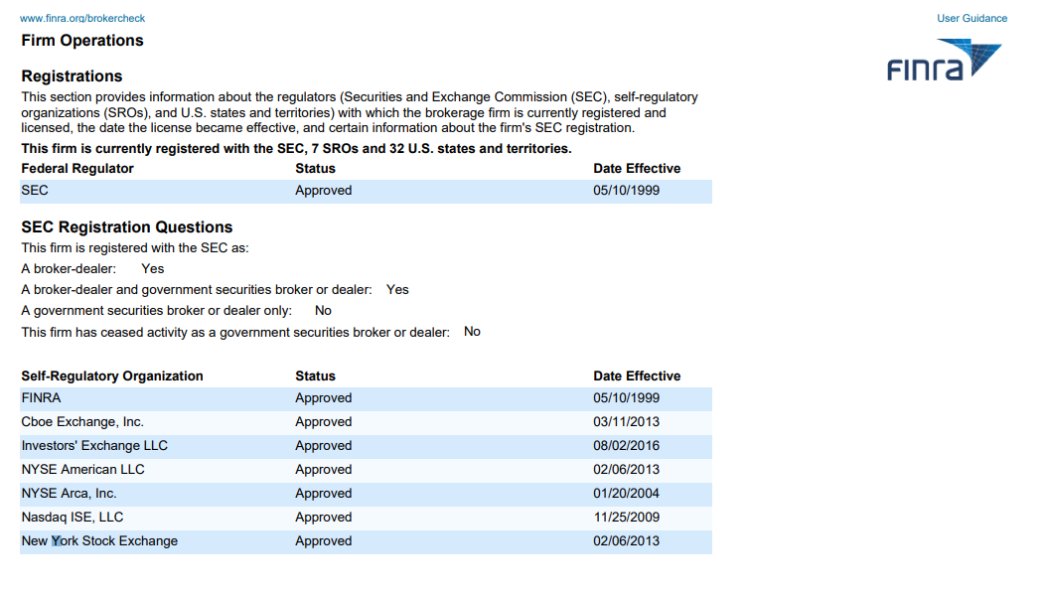

Regulatory Status

TJM Investments' regulatory status is a point of contention. Although it possesses a license from the U.S. National Futures Association (NFA), the license is under suspicion of being a clone. This red flag casts a shadow on the broker's legitimacy and trustworthiness.

Pros & Cons

TJM Investments stands out by offering a wide range of market instruments that cater to diverse investment strategies. Their portfolio includes equities, futures, options, forex, and more. Additionally, TJM Investments provides specialized institutional services such as clearing and capital introduction, designed to meet the specific needs of institutional traders. This suite of services is claimed to backed by an experienced team with over 100 years of combined experience in executing trades across multiple asset classes.

However, there are notable drawbacks to consider when evaluating TJM Investments. The broker's regulatory status is a significant issure, as their NFA license is flagged as a potential clone, raising questions about their legitimacy. Furthermore, customer support options are limited, with assistance available primarily via phone and email, and no live chat or 24/7 support. Additionally, there is a lack of transparency regarding commission.

Market Instruments

TJM Investments provides various market instruments, including equities, index options, futures, forex, cash treasuries, energy, and Treasury Relative Value.

Equities: TJM Investments provides customized services for trading equities and equity options, covering execution, clearing, and reconciliation.

Index Options: The broker's Index Options Group operates from the Chicago Board Options Exchange (CBOE) and executes trades on all major listed indices offered there.

Futures: TJM offers specialized services for trading futures and futures options, including execution, clearing, and reconciliation.

Forex: TJM enhances liquidity and streamlines the FX execution process for institutional clients.

Cash Treasuries: The Cash Treasuries Group provides execution services for trading on-the-run U.S. Treasury securities.

Energy: TJM's energy group covers oil, oil products, natural gas options, metals, and renewable energy.

Services

TJM Investments offers specialized institutional services, including clearing and capital introduction.

Clearing: TJM has established relationships with multiple FCMs and equity prime brokers to provide clearing, settlement, and trade reconciliation services.

Capital Introduction: TJM offers a global solution for sourcing capital, specializing in proprietary trading firms and emerging market hedge funds.

Additional Features and Services

TJM Investments also offers a suite of additional features and services designed to support institutional clients:

Research and Analysis: TJM provides detailed market research and analysis, helping clients make informed trading decisions.

Risk Management: TJM emphasizes risk management practices, providing clients with strategies and tools to manage and mitigate market risks effectively.

Global Market Access: With operations in key financial centers, TJM facilitates global market access, enabling clients to trade across various international markets seamlessly.

Customer Support

TJM Investments provides customer support primarily through phone, email and message box.

Phone: Clients can contact a TJM professional at 3124325100.

Email: Clients can also contact the customer support team via email. General customer support can be contacted at info@tjmbrokerage.com.

Message box: Additionally, clients can leave a message on the website using the message box.

Conclusion

TJM Investments presents a mixed bag for institutional traders. On one hand, it boasts a wide range of market instruments, specialized services, and an experienced team. However, the 'suspicious clone' status of its regulatory license calls into question. Potential clients must carefully weigh these factors and conduct meticulous research before choosing TJM Investments as their broker.

FAQs

Q: What types of market instruments does TJM Investments offer?

A: TJM Investments offers a wide range of market instruments, including equities, index options, futures, forex, cash treasuries, energy, and treasury relative value products.

Q: Does TJM Investments provide clearing services?

A: Yes, TJM Investments offers clearing services through its established relationships with multiple FCMs and equity prime brokers.

Q: How can I contact TJM Investments' customer support?

A: You can contact TJM Investments' customer support by phone at 312.432.5100 or by email at info@tjmbrokerage.com. They also have a message box on their website for inquiries.

Q: Is TJM Investments a regulated broker?

A: TJM Investments holds a license with the U.S. NFA but is flagged as a 'suspicious clone.' Potential clients should intently evaluate any potential engagement to make an informed choice..