简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US weekly jobless claims preview: another week of millions unemployed - Business Insider

Abstract:There is "probably no single metric you can look at" to better get a broad sense of how the economy is doing than unemployment, said Jason Thomas.

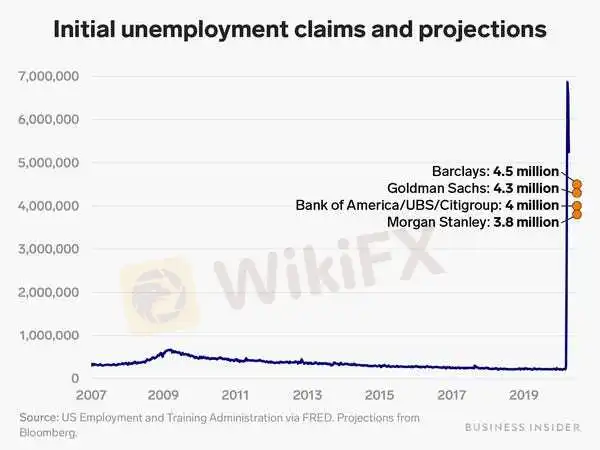

The median economist estimate for US jobless claims in the week ending April 11 is 4.5 million, according to Bloomberg data. The report will be released Thursday by the Labor Department. The estimate is below the 5.2 million Americans that filed for claims in the previous week, signaling a downward trend in unemployment claims. Still, another week of millions of Americans filing for benefits shows the damage that the coronavirus pandemic and lockdowns to curb the spread of the disease has had on the US economy. Visit Business Insider's homepage for more stories.

Economists are anticipating that a Thursday report from the Labor Department will once again show that millions of Americans filed for unemployment claims in the week ending April 18, as coronavirus layoffs persist. The median consensus estimate for weekly unemployment insurance claims is 4.5 million, according to Bloomberg data. The estimate is again below the 5.2 million Americans who filed for unemployment benefits in the previous week, marking the third report in a row to show a decline in claims.

Andy Kiersz/ Business Insider

Even if there is a declining trend in the reports, 4.5 million filing for unemployment in one week is a staggering number that shows just how widespread the economic fallout is from the coronavirus-induced lockdown in the US.

Loading

Something is loading.

“It's been humbling to try to predict unemployment claims,” Jason Thomas, chief economist at AssetMark, told Business Insider. Still, there is “probably no single metric you can look at” to better get a broad sense of how the economy is doing than unemployment, he said.The consensus estimate for this week's report would bring total claims filed during the coronavirus pandemic, which started in mid-March, to about 26 billion. That means that in just five weeks, the US will have erased millions more jobs than were created from the trough of unemployment in the Great Recession through the longest-ever economic recovery.

Read more: Meet the 20-year-old day-trading phenom who turned $20,000 into $3 million. He details his precise strategy — and shares how he made $11,400 in 2 minutes this week.Going forward, economists expect that the April unemployment rate will skyrocket when data is released in May. The jump in claims through April 11 would raise the unemployment rate to 15.7%, according to the Economic Policy Institute. But that figure accounts for everything else staying the same, which is not the case, said Heidi Shierholz, senior economist at EPI, in a statement. One reason for this is that not all workers who have filed for unemployment insurance benefits will be counted as unemployed — for example, furloughed workers or any others not actively seeking employment will be left out of the count.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Recession Concerns Ease: Can the U.S. Sustain Its Momentum?

The U.S. Conference Board Consumer Confidence Index rose to 100.3 in July 2024, up from a revised 97.8 in June. For Q2 2024, the U.S. GDP grew at an annualized rate of 2.8% in a preliminary reading, a notable increase from the 1.4% growth in Q1 2024. The Eurozone's annual Consumer Price Index (CPI) rose to 2.6% in July 2024, up from 2.5% in June. This slight increase was driven mainly by a jump in energy prices, which rose by 1.3% compared to 0.2% in the previous month. The US Core PCE which...

AUS GLOBAL partners with the United Nations to promote Global Sustainable Development

We are honored to share that AUS GLOBAL, as an invited guest of the United Nations forum on Science, Technology and Innovation (UNSTI), successfully completed the important mission of this event on June 20, 2024 at the Palais des Nations in Geneva, Switzerland.The forum brought together dignitaries and renowned business people from around the world to discuss important topics such as global fintech development and environmental protection.

What is Recession and How it would Impact Our Daily Lives?

An updated report by Ned Davis reveals some sobering historical context, showing that a global recession is 98% likely. The harsh reality is that every single person will suffer from the effects of a recession, and you can already feel the inflationary pressure as interest rates and consumer prices rise globally. Here's what a recession means for your wallet and what you can do to prepare!

What is Recession and How it would Impact Our Daily Lives?

The global economy is teetering on a cliff’s edge, as market indicators are flashing warning signals that we are heading toward a recession sooner than expected. An updated report by Ned Davis reveals some sobering historical context, showing that a global recession is 98% likely. The harsh reality is that every single person will suffer from the effects of a recession, and you can already feel the inflationary pressure as interest rates and consumer prices rise globally.

WikiFX Broker

Latest News

Will Gold Break $2,625 Amid Fed Caution and Geopolitical Risks?

ECB Targets 2% Inflation as Medium-Term Goal

New Year, New Surge: Will Oil Prices Keep Rising?

PH SEC Issues Crypto Guidelines for Crypto-Asset Service Providers

FTX Chapter 11 Restructuring Plan Activated: $16 Billion to Be Distributed

Think Before You Click: Malaysian Loses RM240,000 to Investment Scam

Bithumb CEO Jailed and Fined Over Bribery Scheme in Token Listing Process

WikiFX Review: Something You Need to Know About Saxo

Is PGM Broker Reliable? Full Review

Terraform Labs Co-founder Do Kwon Extradited to the U.S. to Face Fraud Charges

Currency Calculator