简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US jobless claims preview: Economists see record UI beginning to slow - Business Insider

Abstract:The surge in claims "should push the unemployment rate up to 17% in the April data, a new post-World War II high," wrote Brett Ryan of Deutsche Bank.

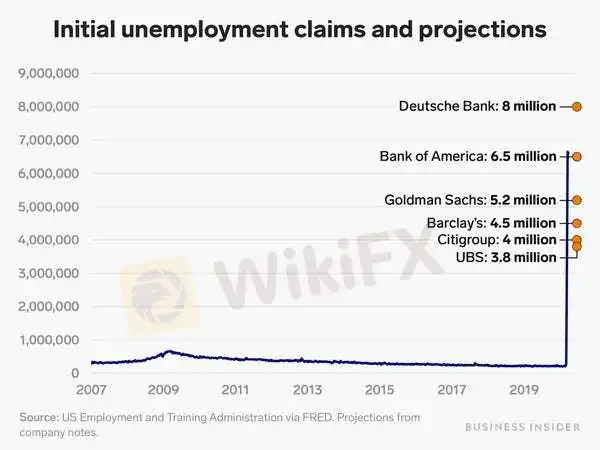

On Thursday, the Labor Department will release US weekly jobless claims for the week ending April 11. The median consensus estimate from economists is 5.46 million claims, according to Bloomberg data.In the last three weeks, nearly 17 million Americans have filed for unemployment insurance as coronavirus-induced layoffs persist. If Thursday's report meets or exceeds the consensus estimate, it will show the US has wiped out all jobs created since the Great Recession in just a matter of weeks.Visit Business Insider's homepage for more stories.

Economists expect that a report due to be released Thursday from the Labor Department will show that the US has wiped out all jobs created since the Great Recession in just a matter of weeks as the coronavirus pandemic continues to slam the economy. The median consensus estimate from economists is that US weekly jobless claims will be 5.46 million for the week ending April 11, according to Bloomberg data. That would be a slight decrease from the 6.6 million claims filed in the week ending April 4, the first week that record unemployment filings have declined since coronavirus layoffs began. Still, the consensus estimate would bring total filings for unemployment insurance to more than 22 million over the course of four weeks. That means in about one month, the US economy will have erased all of the jobs created since the 2008-2009 recession.

Andy Kiersz/ Business Insider

Read more: MORGAN STANLEY: Investors have a rare opportunity to make low-risk profits in 2020. Here's a 3-part strategy for pulling it off.“If our forecast is close to the mark, it would push the four-week total to almost 25 million, over 10 times the prior worst four-week period in the last 50-plus years,” Brett Ryan, senior economist at Deutsche Bank, wrote in a Friday note. His forecast for the week ending April 11 is 8 million claims, one of the highest estimates.

He continued: “This record surge in claims should push the unemployment rate up to 17% in the April data, a new post-World War II high.” Going forward, economists will watch to see any trend that claims are declining as the coronavirus outbreak continues. “We think the numbers will come down from here,” Michael Gapen, chief US economist at Barclays, told Business Insider.Yet it's likely that claims will remain much higher from pre-coronavirus reports. States are continuing to work through major backlogs of claims, and with the passage of the CARES Act, more people have become eligible for unemployment insurance. That's likely to keep claims elevated, according to economists from Bank of America.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

AUS GLOBAL partners with the United Nations to promote Global Sustainable Development

We are honored to share that AUS GLOBAL, as an invited guest of the United Nations forum on Science, Technology and Innovation (UNSTI), successfully completed the important mission of this event on June 20, 2024 at the Palais des Nations in Geneva, Switzerland.The forum brought together dignitaries and renowned business people from around the world to discuss important topics such as global fintech development and environmental protection.

2021 World Economic Outlook

The IMF projects that the global economy will shrink by 4.4% in 2020, followed by a 5.2% rebound in 2021, supporting a V-shaped recovery.

Will Indian Economy Go Short?

According to the latest data of the Reserve Bank of India (RBI), the country's forex reserves have surged $11,938 million to a fresh all-time high of $534,568 million for the week ended July 31.

Fed survey: The poorest Americans are being hit hardest by job loss - Business Insider

"This reversal of economic fortune has caused a level of pain that is hard to capture in words," said Fed Chair Jerome Powell.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator