简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Will Indian Economy Go Short?

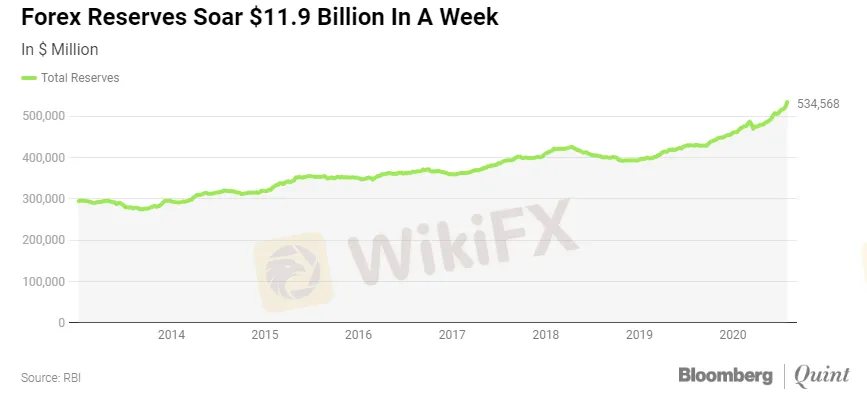

Abstract:According to the latest data of the Reserve Bank of India (RBI), the country's forex reserves have surged $11,938 million to a fresh all-time high of $534,568 million for the week ended July 31.

According to the latest data of the Reserve Bank of India (RBI), the country's forex reserves have surged $11,938 million to a fresh all-time high of $534,568 million for the week ended July 31. Its forex reserves have seen sharp rise over the past few months as overseas investors pumped money into Indias stock markets.

Data source: RBI

However, the country‘s external debt shows an opposite scenario, dropping away from its forex reserves. As of March, its external debt has grown to $558.5 billion from the $474.4 billion five years ago. The ratio of external debt to forex reserves goes as high as 111.7%. By the end of 2019, India’s public debt has reached up to $1,170 billion, accounting for 250% of forex reserves.

Data source: tradingeconomics.com

Over the past decade, India‘s equity markets have been booming along with the strong momentum in economic growth. But the excessively heavy debt may put economic burden on enterprises and the government because India has a large population as a major developing country. The inverted trend mentioned above implies that India’s forex reserves seem to be very vulnerable.

Indias economy has been highly dependent on dollar liabilities for several years. Once the greenback disengages from India massively, the economy may suffer from near-term hit and surrender its wealth to the dollar capital at any time since global financial giants are going short. Investors should be alert to “black swan” events.

As a leading media in forex industry, WikiFX App has included profiles of more than 19,000 forex brokers around the world, while providing 7*24 latest market news, interpreting massive forex information, warning against investment risks, and protecting investors fund safety in forex trading.

Please download the WikiFX App for detailed financial information at any time: https://bit.ly/wikifxIN

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

AUS GLOBAL partners with the United Nations to promote Global Sustainable Development

We are honored to share that AUS GLOBAL, as an invited guest of the United Nations forum on Science, Technology and Innovation (UNSTI), successfully completed the important mission of this event on June 20, 2024 at the Palais des Nations in Geneva, Switzerland.The forum brought together dignitaries and renowned business people from around the world to discuss important topics such as global fintech development and environmental protection.

2021 World Economic Outlook

The IMF projects that the global economy will shrink by 4.4% in 2020, followed by a 5.2% rebound in 2021, supporting a V-shaped recovery.

Fed survey: The poorest Americans are being hit hardest by job loss - Business Insider

"This reversal of economic fortune has caused a level of pain that is hard to capture in words," said Fed Chair Jerome Powell.

US jobless claims preview: Economists expect another week of decline - Business Insider

"If the current rate of decline continues, claims will dip below 1M in the second or—more likely—third week of June," said economist Ian Shepherdson.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

Why Do You Feel Scared During Trade Execution?

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator