简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

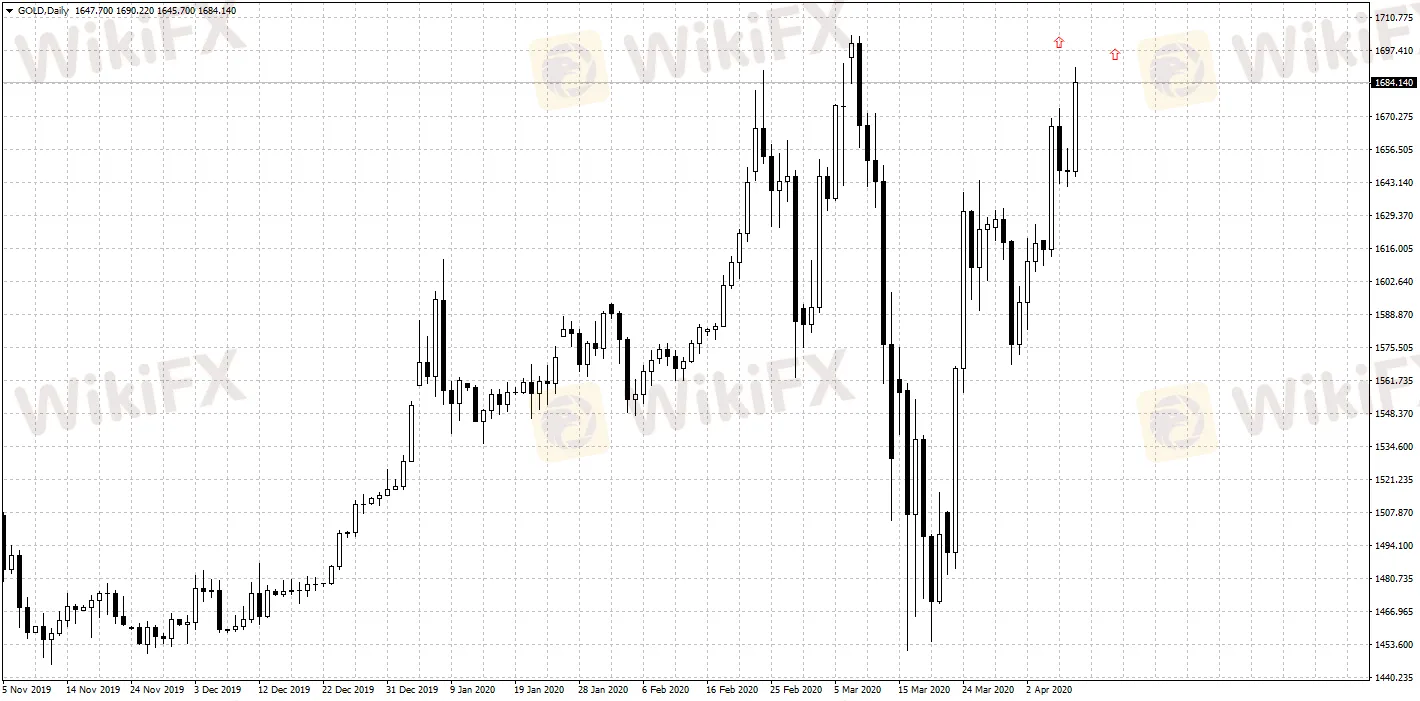

Gold May See Largest Gains in Q2

Abstract:Gold may see the largest increase in Q2 among all commodities, according to ING Group from the Netherlands.

Gold may see the largest increase in Q2 among all commodities, according to ING Group from the Netherlands.

ING Commodities Strategy Director Warren Patterson observed that the average gold price is at US$1,700 recently and may even test the record level of US$1,921.17, which was created in 2011, in the next 2-3 months.

Gold price has experienced more volatility in the past one month or so, and given the current level of market uncertainties, practically all central banks are easing monetary policies, which offered strong support for gold on the fundamental level.

Right now, positions of gold-backed ETF reached a record high, while the global wave of stimulus that aims to prop up economy,including unlimited QE of the US, also enhanced golds outlook.

According to the World Gold Council‘s April data, Global official gold reserve totaled 34,789.5 tonnes as of February, 2020. In February, global central banks’ net purchase of gold amounted 36 tonnes, up nearly a third from the previous month, suggesting that central banks are still actively acquiring this asset.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

Why Do You Feel Scared During Trade Execution?

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator