简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

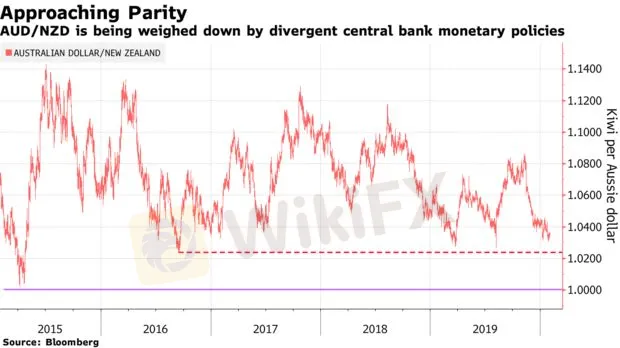

AUD/NZD Shows a Tendency to Approach 1.01

Abstract:The exchange rate of AUD against NZD fell 5% after reaching the highest point in last November. And whether the tendency this week is strengthened or not, which draws close attentions from investors.

The exchange rate of AUD against NZD fell 5% after reaching the highest point in last November. And whether the tendency this week is strengthened or not, which draws close attentions from investors.

Although the inflation and unemployment rate is well improved, it is estimated that the Reserve Bank of Australia will at least cut interest rates once, and even twice according to the prediction from some banks. By comparison, it is surprising that the Reserve Bank of New Zealand has kept interest rate on hold since last November, which weakens the prediction that RBNZ will ease monetary policy further. The latest market expectation suggests that there is a possibility of 62% that RBZN may cut interest rate this year.

Per price trend, monetary policy has a significant impact on AUD/NZD. The possibility of RBNZ‘s further interest rates cut in February is reduced expectedly. If New Zealand Treasury worries about the novel coronavirus’ pressure on the economy in New Zealand, the possibility of rate cut will be increased. And the views can be proved by some new trends this week. RBAs Chairman Philip Lowe gave a speech at Sydney on Wednesday, and will make the half-year statement to Congress on Friday.

AUD/NZD recently hovers above the support level of 1.0238, the lowest point since September 14, 2016. And any breakthrough in this level will help increase the tendency above.

We expect the RBA will reduce the cash rate to 0.5% in April, while RBNZ will stabilize the rate at 1.0% in the first half of 2020, and AUD/NZD is expected to be close to 1.01 by June.

AUD/NZD Daily Pivot Point: 1.0355

S1: 1.0340 R1: 1.0370

S2: 1.0325 R2: 1.0385

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Keep Silence to FX Scams? NO! EXPOSE Them on WikiFX!

Keep Silence to FX Scams? NO! EXPOSE Them on WikiFX!

Watch out! PlatformsFx Robbed Me of US$76,878

A few months ago, a person from the trading solution provider company “PlatformsFx” contacted the victim for forex trading. According to the victim, the scammer and his so-called well-known gold trading platform took US$76,878 from her and put it into a presumably real forex account.

How to choose the best leverage level

Archimendes said: “Give me a fulcrum, I can lift the whole earth”. This is the earliest appearance of the concept of leverage. The word leverage dates from 1724 and was originally used to describe the action of a lever. By 1824, by which time the Industrial Revolution was fully underway, the scope of the word had expanded to include the power of a lever and therefore the obtaining of a mechanical advantage. It is simple to say that if you want to invest $10,000 in the forex market, you can to it by leverage with small investment. Leverage is a financial tool, which can magnify the result of your investment, including gain or loss at a fixed ratio.

Oil Prices Hit Fresh High on Uncertain Outlook

WikiFX News (6 Aug) - WTI crude oil embraced a steep rise in prices, up 4.5% to the high level of $43.68, compared to its low level of $41.76. It has recorded a fresh five-month high since March 6. Nevertheless, the outlook of oil remains uncertain because of the insufficient upward momentum in future oil prices resulted from the sluggish job growth in the United States.

WikiFX Broker

Latest News

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

Volkswagen agrees deal to avoid Germany plant closures

Geopolitical Events: What They Are & Their Impact?

Webull Canada Expands Options Trading to TFSAs and RRSPs

CySEC Launches Redesigned Website Packed with New Features

WikiFX Review: Is PU Prime a decent broker?

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

Currency Calculator