Score

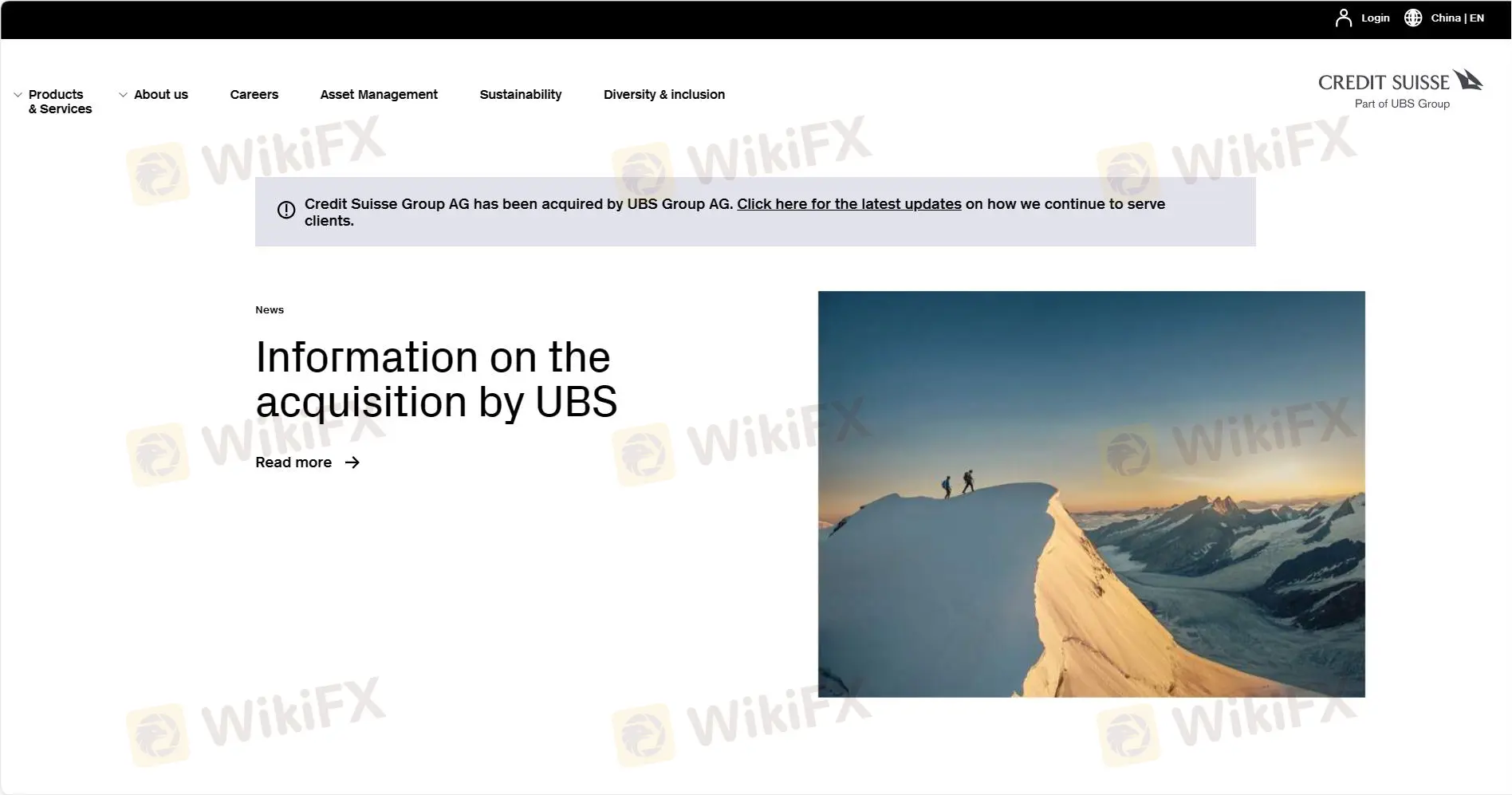

CREDIT SUISSE

Hong Kong|2-5 years|

Hong Kong|2-5 years| https://www.credit-suisse.com/hk/en/

Website

Rating Index

Influence

Influence

AA

Influence index NO.1

Switzerland 9.22

Switzerland 9.22Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Hong Kong

Hong KongUsers who viewed CREDIT SUISSE also viewed..

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Making(MM)

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

Most visited countries/areas

Switzerland

Hong Kong

Singapore

credit-suisse.com

Server Location

United Kingdom

Most visited countries/areas

France

Website Domain Name

credit-suisse.com

Website

WHOIS.COREHUB.NET

Company

CORE-164 (GLOBAL IP ACTION AG)

Domain Effective Date

1996-12-06

Server IP

162.13.54.220

Company Summary

| Aspect | Information |

| Company Name | Credit Suisse(Part of UBS Group) |

| Registered Country/Area | Hong Kong |

| Founded Year | 2015 |

| Regulation | Unregulated |

| Products & Services | Entrepreneurs,Private wealth management,Corporates & Institutional investores |

| Demo Account | Available |

| Customer Support | Phone:+41 44 333 11 11,+1 212 325 2000,+44 20 7888 8888;Online message system,Social media(Twitter:https://twitter.com/creditsuisse/) |

| Educational Resources | Media & News,Reports & Research,Events,Articles & Stories |

Overview of Credit Suisse

Credit Suisse, now part of the UBS Group, is a financial services company registered in Hong Kong since 2015. Despite being unregulated, it offers a variety of specialized services aimed at entrepreneurs, private wealth management, and corporate and institutional investors.

Credit Suisse provides a demo account, allowing potential clients to familiarize themselves with the platform without financial risk. The company is committed to customer engagement, accessible via multiple phone lines across different regions, an online messaging system, and social media platforms, notably Twitter.

Additionally, Credit Suisse enriches its clients' financial knowledge through a diverse range of educational resources, including media and news updates, research reports, various events, and insightful articles and stories, making it a comprehensive hub for its clients financial needs.

Regulatory Status

Credit Suisse remains unregulated. This status means that the company does not adhere to the oversight typically enforced by financial regulatory authorities.

This lack of regulation can affect the legal recourse available to clients in the event of disputes or financial misconduct.

Pros and Cons

| Pros | Cons |

| Diverse Financial Services | Unregulated Status |

| Global Accessibility | Complexity for Smaller Investors |

| Demo Account Feature | Potential Overreliance on Digital Platforms |

| Rich Educational Resources | Geographic Limitations |

| Reputation and Network | Risk of Information Overload |

Pros of Credit Suisse

Diverse Financial Services: Credit Suisse offers specialized services for different client segments including entrepreneurs, private wealth management, and corporate and institutional investors, addressing a wide range of financial needs.

Global Accessibility: With contact numbers in major regions like Europe and North America, plus an online messaging system and active social media presence, Credit Suisse ensures clients worldwide can easily reach out for support.

Demo Account Feature: The availability of a demo account allows potential and new clients to practice trading and investment strategies in a risk-free environment before committing real funds.

Rich Educational Resources: Clients have access to a wealth of knowledge through Credit Suisse's media and news updates, reports and research, events, and articles and stories, fostering informed decision-making.

Reputation and Network: Being part of the renowned UBS Group enhances Credit Suisse's credibility and provides clients with a vast network of financial expertise and resources.

Cons of Credit Suisse

Unregulated Status: Operating without regulatory oversight could pose significant risks for clients, as they lack protections usually offered by regulated entities.

Complexity for Smaller Investors: The focus on entrepreneurs and institutional investors will make the services less accessible or relevant for smaller or retail investors.

Potential Overreliance on Digital Platforms: While offering various digital contact methods enhances accessibility, it could also lead to challenges for clients who prefer traditional, in-person financial advisory services.

Geographic Limitations: Despite its global presence, being registered only in Hong Kong will limit the company's ability to offer services tailored to the regulatory and economic conditions of other countries.

Risk of Information Overload: The vast array of educational materials and updates will overwhelm clients who are new to finance or prefer a more streamlined information flow.

Products & Services

Credit Suisse, as part of the UBS Group, offers a tailored range of services attracting distinct client groups: entrepreneurs, private wealth management clients, and corporate and institutional investors. Heres an overview of each service category:

Services for Entrepreneurs

Credit Suisse provides comprehensive advisory services and innovative financial solutions specifically designed for entrepreneurs. This includes assisting through all phases of business development—from inception and growth to expansion and succession planning.

The bank integrates its wealth management expertise to ensure that both the personal and business financial needs of entrepreneurs are met, helping them to optimize their financial strategies in alignment with their business goals.

Private Wealth Management

Tailored to individuals and families, Credit Suisse's private wealth management service offers holistic financial planning and asset management. This includes asset diversification, holistic wealth planning, next-generation training, succession planning, and advisory on philanthropy.

The service is designed to manage, grow, and secure clients wealth across generations, providing personalized solutions that reflect the unique circumstances and aspirations of each client.

Services for Corporates & Institutional Investors

Credit Suisse provides a robust suite of services tailored to the needs of corporations and institutional investors. This includes capital market access, sales and trading solutions, investment banking, asset management, and specialized financial research.

The bank offers strategic advice and tailored solutions to help these clients optimize their asset portfolios, manage financial risks, and achieve their investment objectives.

How to Open an Account?

Opening an account with Credit Suisse involves a straightforward process designed to ensure a easy and secure experience for potential clients. Heres how you can start:

Contact Credit Suisse: Begin by reaching out to Credit Suisse to express your interest in becoming a client. You can do this through their website, by contacting them via the provided phone numbers, or through their online message system.

Consultation Meeting: Arrange a meeting with a Credit Suisse representative. This can be done in person or virtually, depending on your location and preference. During this meeting, you will discuss your financial goals, investment needs, and other pertinent details that will help the bank understand how best to serve you.

Documentation and Verification: You will need to provide necessary personal and financial documents for identity verification and regulatory compliance. This may include your passport, proof of address, and financial statements. Credit Suisse will guide you through the required documents and their secure submission process.

Account Setup and Funding: Once your documents are verified and your account application is approved, you will be able to set up your account specifics, such as choosing the type of account and the services you need.

Customer Support

Credit Suisse offers a robust customer support system to ensure that clients have access to assistance whenever needed.

Clients can reach out through multiple channels, including dedicated phone lines available in various regions (+41 44 333 11 11, +1 212 325 2000, +44 20 7888 8888), an online messaging system, and social media platforms such as Twitte:https://twitter.com/creditsuisse/.

This multi-faceted approach allows for versatile communication, meeting different preferences and ensuring that whether clients need immediate assistance, have a query, or require detailed support, Credit Suisse is readily accessible to address their needs efficiently and effectively.

Educational Resources

Credit Suisse offers a comprehensive array of educational resources designed to provide clients and the broader public with valuable financial insights and knowledge. Heres an overview of each category:

Media & News: Credit Suisses media center is an essential resource for the latest updates and information. It includes media releases, up-to-date news coverage, and ad hoc announcements that keep readers informed about the bank's operations, financial results, and strategic decisions.

Reports & Research: This section offers in-depth analysis and forecasts on various financial and economic topics, including trends and developments across different sectors. The Credit Suisse Research Institute, a part of this resource, combines the knowledge of external experts with the expertise of Credit Suisse analysts to analyze fundamental global trends.

Events: Credit Suisse provides detailed information about major financial events and conferences it hosts or participates in. This includes annual general meetings, investment conferences, and webinars which often feature presentations, replays, and other downloadable content.

Articles & Stories: This section features a range of articles on topical issues and narratives that delve into economic and financial themes. It serves as a platform for thought leadership and insight into how global financial trends are evolving and how Credit Suisse is actively engaged in shaping the future of finance.

Conclusion

Credit Suisse, now part of the UBS Group, offers an extensive suite of financial services and a wealth of educational resources. These resources are designed to keep clients well-informed and engaged with the latest financial trends and corporate activities.

The variety of tools available, from detailed reports and research to dynamic events and insightful articles, positions Credit Suisse as a leader in financial education and client engagement.

FAQs

Question: How can I access Credit Suisse's financial reports?

Answer: Financial reports, including annual and interim reports, can be accessed through the Credit Suisse website under the Reports & Research section.

Question: What types of educational resources does Credit Suisse offer?

Answer: Credit Suisse offers a range of educational resources including media and news updates, in-depth reports and research, coverage of financial events, and a collection of articles and stories.

Question: Can I attend Credit Suisse events online?

Answer: Yes, Credit Suisse offers online access to many of its events, including webinars and conference presentations, which can be found in the Events section of their website.

Question: How can I contact Credit Suisse?

Answer: You can find the appropriate regional:+41 44 333 11 11, +1 212 325 2000, +44 20 7888 8888 and call Credit Suisse.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Global Business

- High potential risk

Disclosure

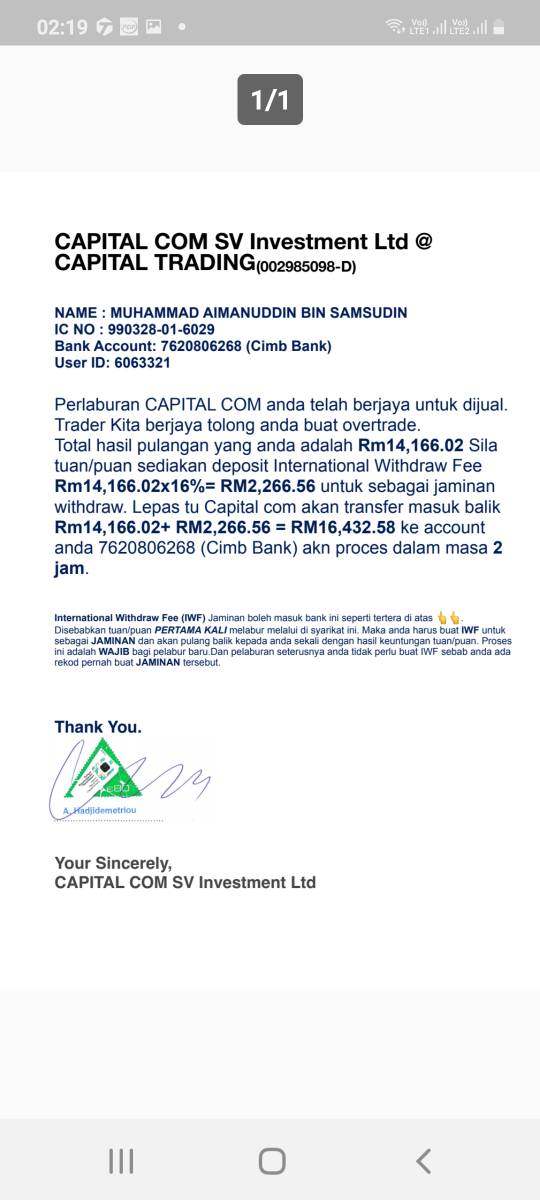

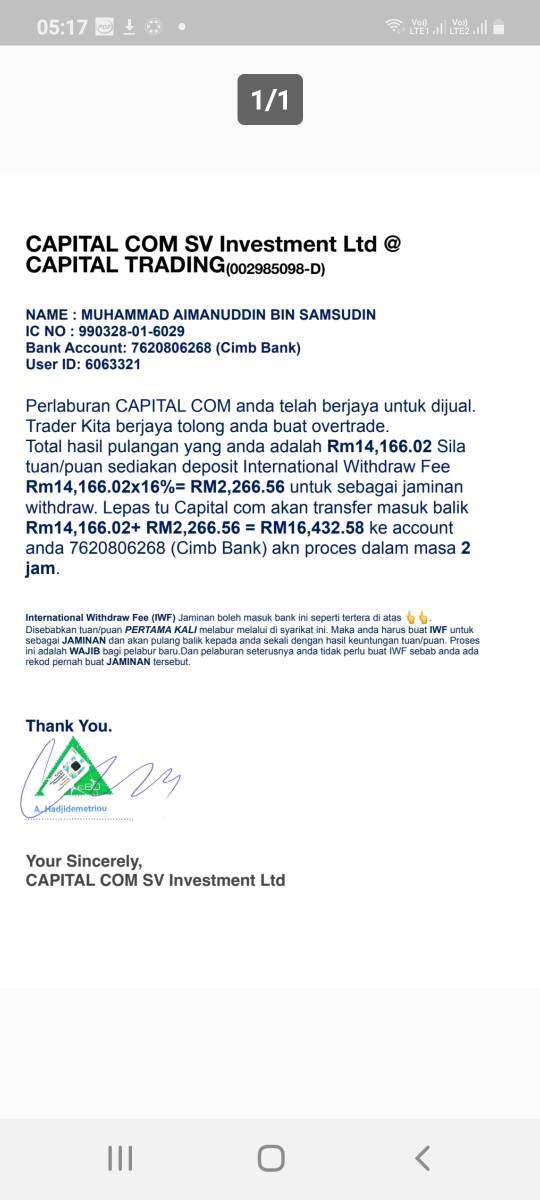

Regarding Administrative Actions against Credit Suisse Securities Co., Ltd.

Country/Region

JP FSA

Disclosure time

2016-04-25

Disclose broker

Financial Conduct Authority fines Credit Suisse and Yorkshire Building Society for financial promotions failures

Country/Region

UK FCA

Disclosure time

2014-06-16

Disclose broker

Content you want to comment

Please enter...

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now