Score

SuperTrader

Hong Kong|5-10 years|

Hong Kong|5-10 years| https://www.supertraderlimit.com

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Hong Kong

Hong KongUsers who viewed SuperTrader also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

Website

supertraderlimit.com

Server Location

United States

Website Domain Name

supertraderlimit.com

Server IP

50.63.202.50

Company Summary

| Aspect | Information |

| Registered Country/Area | Hong Kong |

| Company Name | Star Trader PTE LTD |

| Regulation | Unregulated |

| Minimum Deposit | Not specified |

| Maximum Leverage | Claimed up to 1:200, up to 1:1000 in demo MT5 |

| Spreads | Not specified |

| Trading Platforms | MT5 (MetaTrader 5) |

| Tradable Assets | Commodities, Forex pairs, Indices, Stocks, Precious Metals |

| Account Types | Lack of transparency on account types |

| Demo Account | Available, with reportedly high leverage |

| Customer Support | Limited contact information, slow response times, lack of support channels |

| Payment Methods | Deposit methods not specified, reported issues with deposits |

| Educational Tools | No educational resources provided |

Overview

SuperTrader, operating out of Hong Kong, presents a concerning picture for potential traders. As an unregulated entity, it operates without oversight, exposing traders to significant risks. The lack of transparency is evident in various aspects of the broker's services.

Notably, information regarding minimum deposits and spreads remains undisclosed, making it challenging for traders to assess costs accurately. The broker's claim of offering high leverage up to 1:200 (with even riskier options in the demo MT5 account) should be approached with extreme caution due to the elevated risk of losses.

Furthermore, Star Trader's lack of transparency extends to its account types, leaving traders in the dark about critical features. Reported issues with deposit processes and slow customer support response times add to the growing list of concerns.

To exacerbate the situation, the absence of educational resources leaves traders without valuable tools for improving their skills and knowledge. Most concerning is the reported downtime of Star Trader's website, coupled with reports labeling it as a scam. These red flags should serve as a strong warning to potential investors, urging them to explore more reputable alternatives in the trading industry.

Regulation

SuperTrader is an unregulated broker, which means it operates without oversight or regulation from any financial authorities or regulatory bodies. This lack of oversight can expose traders and investors to significant risks, as there are no safeguards in place to protect their interests. Unregulated brokers often operate in a less transparent manner, potentially leading to fraudulent or unethical practices. To safeguard your investments, it's generally advisable to choose a broker that is regulated by a reputable financial authority.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

Star Trader presents a mix of advantages and disadvantages for traders. On the positive side, it offers a diverse range of trading instruments and high leverage options. The availability of the MT5 trading platform can be appealing to some traders.

However, significant concerns arise due to its lack of regulation, which exposes traders to risks. Transparency issues regarding account types and features raise questions about the broker's operations. Reported problems with deposit and withdrawal processes, slow customer support, and the absence of educational resources further contribute to a less favorable trading environment. Traders should exercise caution when considering Star Trader as their broker of choice and explore alternatives with stronger regulatory oversight and better services.

Market Instruments

Based on the information provided, the broker offers a variety of trading instruments that encompass a range of asset classes. These instruments include commodities like oil, popular currency pairs in the Forex market, indices representing various stock market benchmarks, and specific stocks themselves. Additionally, precious metals like gold and silver are also available for trading.

Here is a detailed table summarizing the market instruments offered by the broker:

| Asset Class | Specific Instruments |

| Commodities | Oil |

| Forex | Various currency pairs |

| Indices | A selection of stock indices |

| Stocks | Individual company stocks |

| Precious Metals | Gold and Silver |

The broker appears to provide a diverse range of trading options, allowing investors to access different markets and asset types. However, it's important to exercise caution when dealing with unregulated brokers to ensure the safety of your investments and to conduct thorough research before choosing to trade with them. Additionally, verify the accuracy of the offered instruments directly on the broker's platform, as availability may change over time.

Account Types

Based on the information provided, it appears that Star Trader's platform lacks transparency regarding its account types and features, which can be a significant concern for potential users. The absence of clear information on account types, minimum deposit requirements, and other account features can make it difficult for traders to make informed decisions about their investments.

It's essential for any reputable trading platform to provide detailed and easily accessible information about the various account types they offer. This typically includes clear descriptions of the account features, minimum deposit requirements, leverage options, spreads, and any other relevant details that can help traders choose the most suitable account type for their needs.

Additionally, the mention of account managers pressuring users to give control of their accounts raises red flags. In some cases, such practices can be indicative of potential fraudulent activities or unethical behavior on the part of the broker.

Before considering any trading platform, it is advisable for individuals to thoroughly research the platform's reputation, ensure regulatory compliance, and carefully read all available information on account types and features. If a platform lacks transparency or raises concerns, it's often best to explore other options to protect your investments and financial security.

Leverage

Star Trader provides traders with the advantage of high leverage. According to information available on their website, they claim to offer leverage of up to 1:200. Furthermore, in their MT5 demo accounts, traders can access even higher levels of leverage, reaching up to 1:1000. This range of leverage options can cater to a wide spectrum of traders with varying risk tolerance and trading strategies.

It's important to note, however, that while high leverage can magnify potential profits, it also comes with an increased risk of losses. The higher the leverage, the smaller the margin required to open and maintain a trade, which means that traders can potentially lose more than their initial investment if the market moves against them. Therefore, it's essential for investors to exercise caution when using higher leverage ratios and to implement effective risk management strategies to mitigate potential losses.

Spreads and Commissions

The available information regarding spreads and commissions for trading with Star Trader is somewhat limited, as there are no specific details provided about these financial aspects. It's mentioned that spreads and commissions may vary depending on the type of trading accounts offered by the broker. This lack of detailed information can make it challenging for potential traders to assess the cost structure associated with trading on the platform. Typically, traders rely on transparent and clearly outlined spreads and commissions to make informed decisions about their trading activities. Therefore, individuals interested in trading with Star Trader should seek comprehensive information about these financial aspects directly from the broker to understand their trading costs fully.

Deposit & Withdrawal

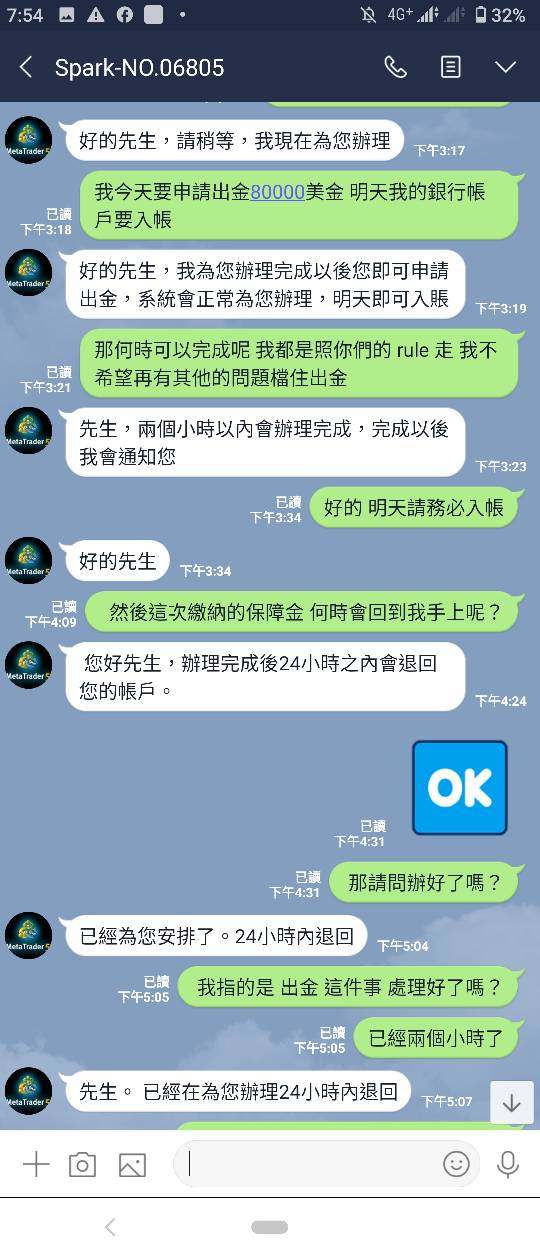

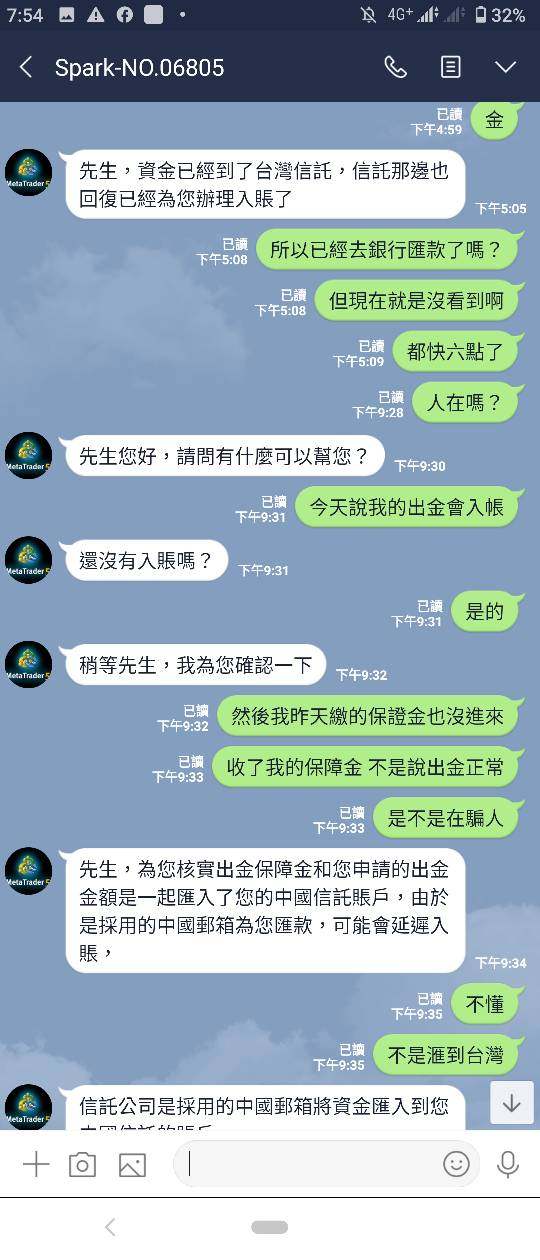

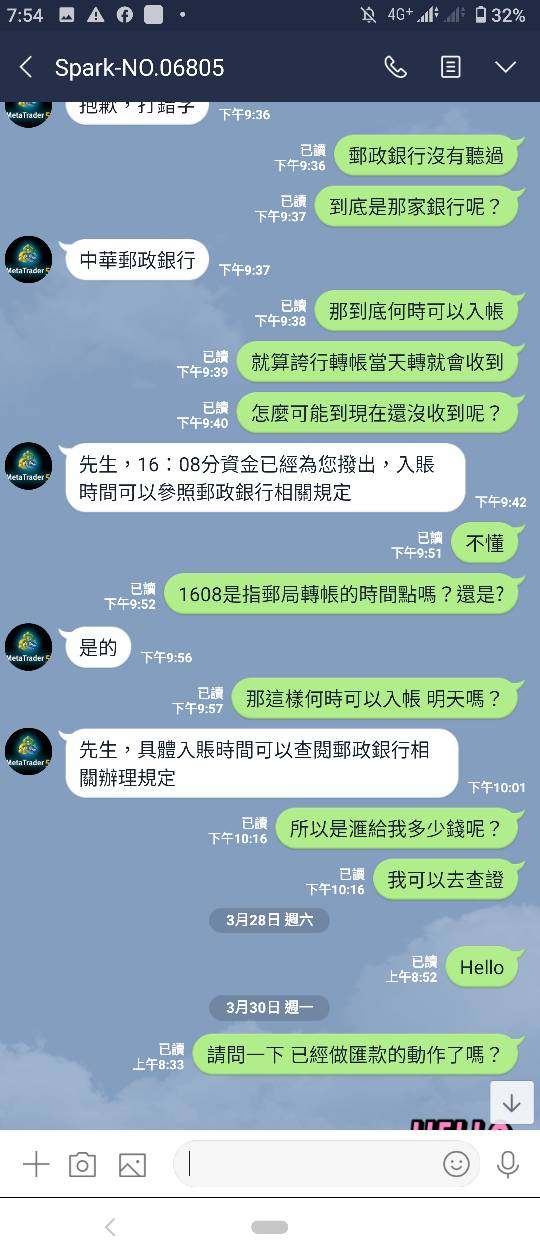

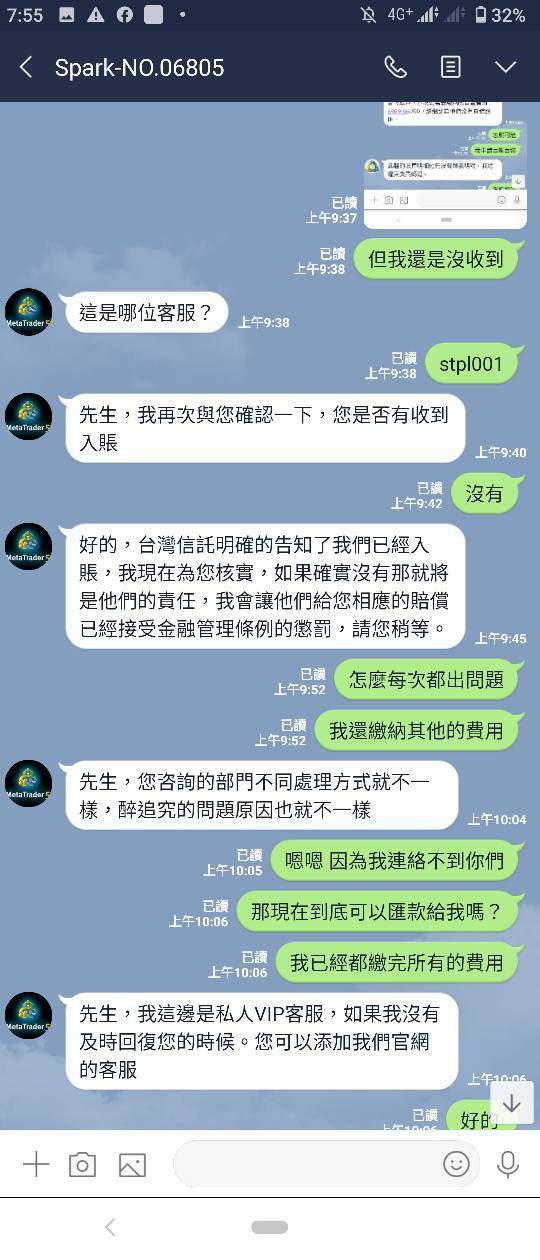

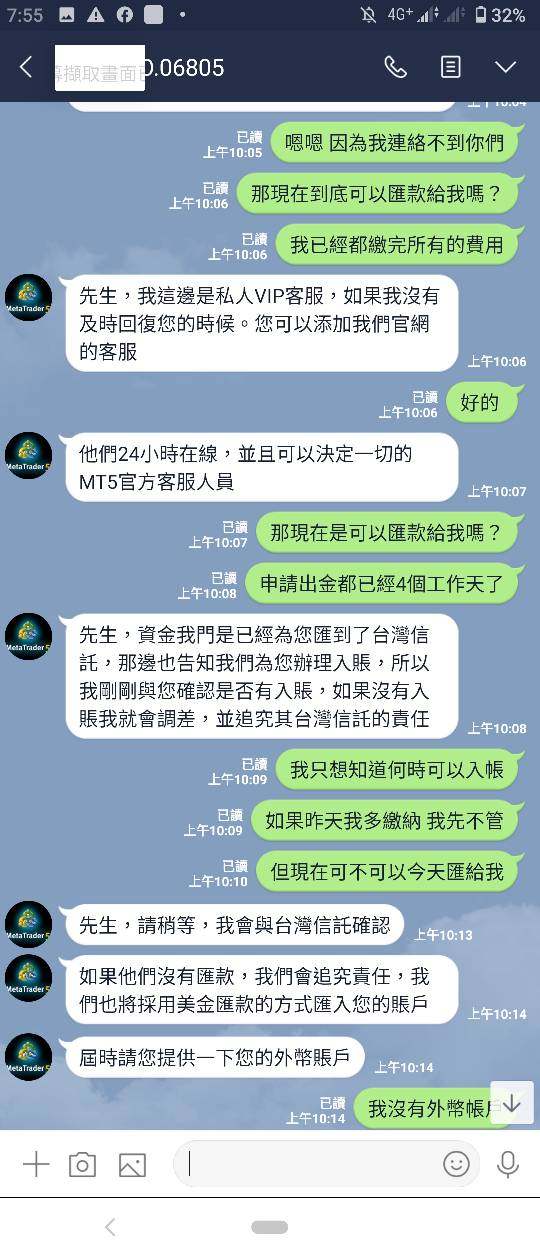

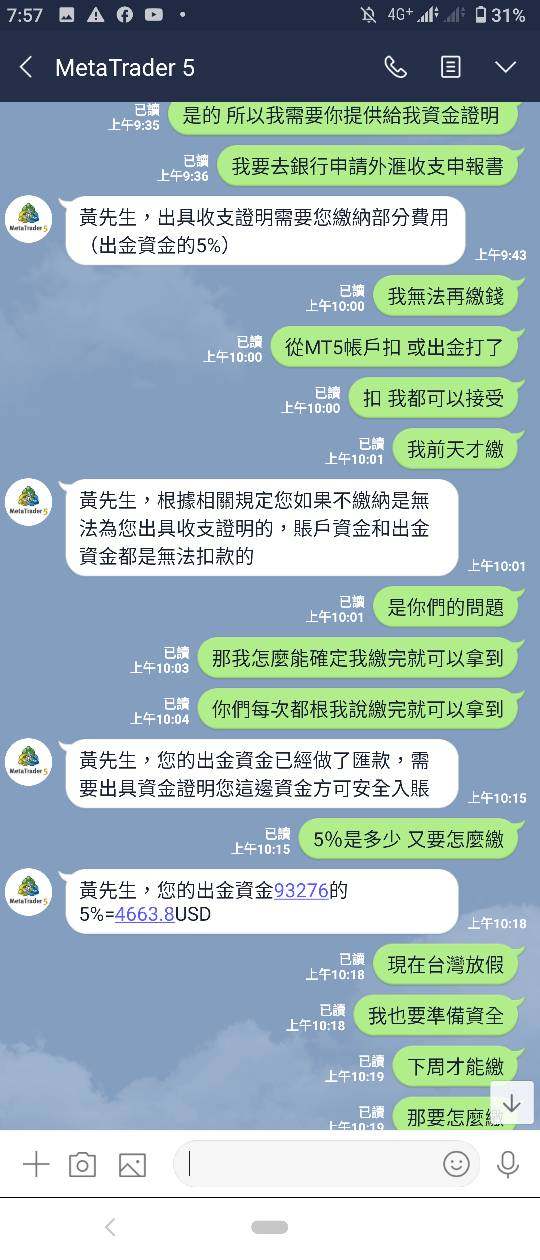

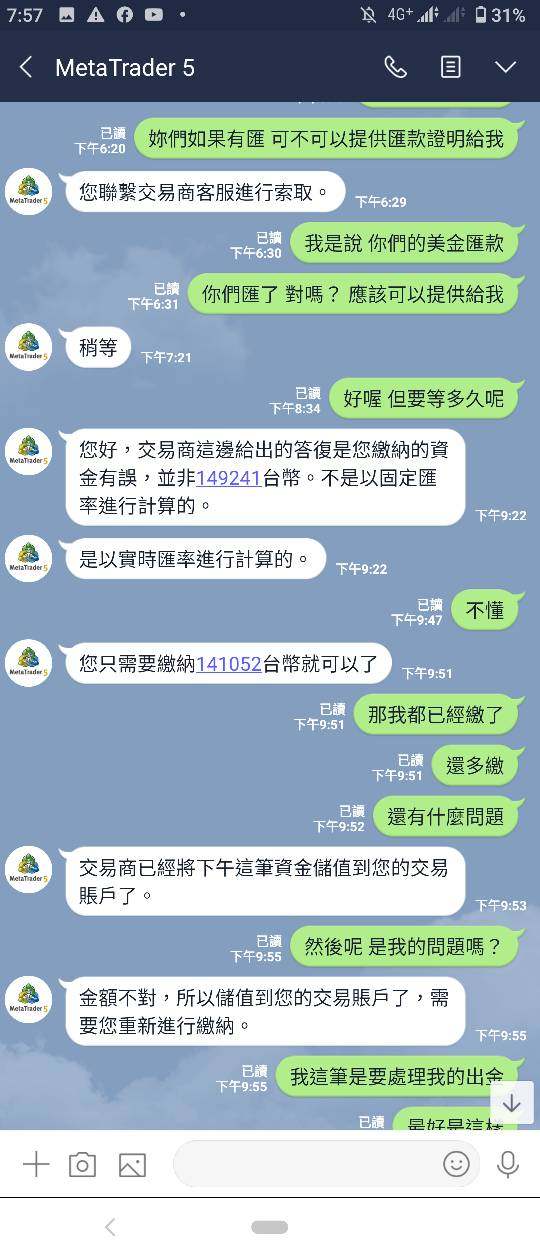

Based on the information we know, there are significant concerns related to the deposit and withdrawal processes with Star Trader:

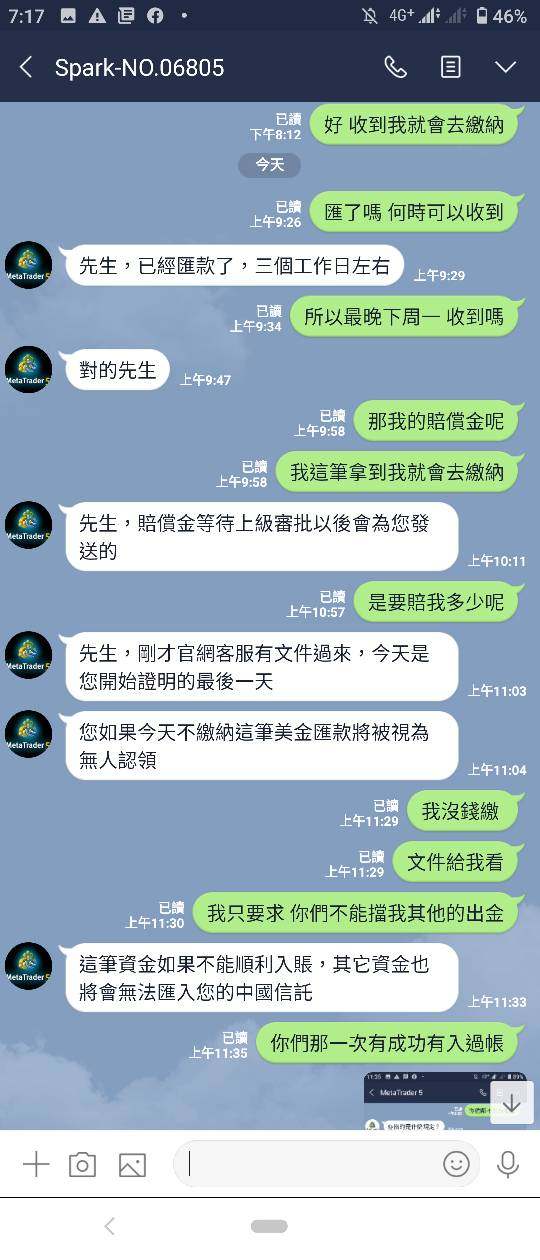

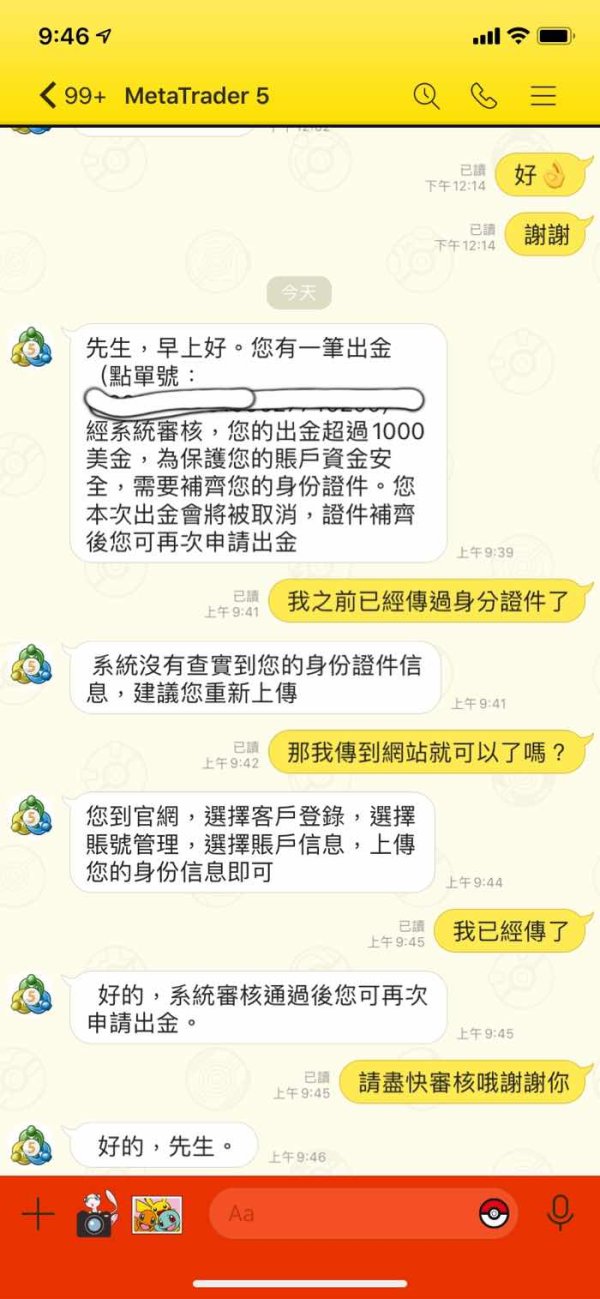

Lack of Deposit Information: Star Trader is criticized for not providing clear information about their deposit methods on their homepage or website. This lack of transparency can make it difficult for potential traders to understand how to fund their accounts.

Unfulfilled Deposit Promises: The article suggests that members have experienced issues with deposits not reflecting in their trading accounts as promised. This situation can be highly frustrating and potentially indicative of operational issues or fraudulent practices.

Difficulty with Chargebacks: Victims who have encountered problems with Star Trader's deposit process have reportedly faced challenges when attempting to file chargebacks with their banks. This suggests that retrieving deposited funds could be a complicated and time-consuming process.

In summary, the information provided raises concerns about the transparency and reliability of Star Trader's deposit and withdrawal processes. Potential investors should exercise caution and thoroughly research the broker's deposit and withdrawal methods, as well as the associated terms and conditions, before considering any financial transactions with the platform. Additionally, it's advisable to choose brokers with a solid reputation and transparent financial operations to minimize such risks.

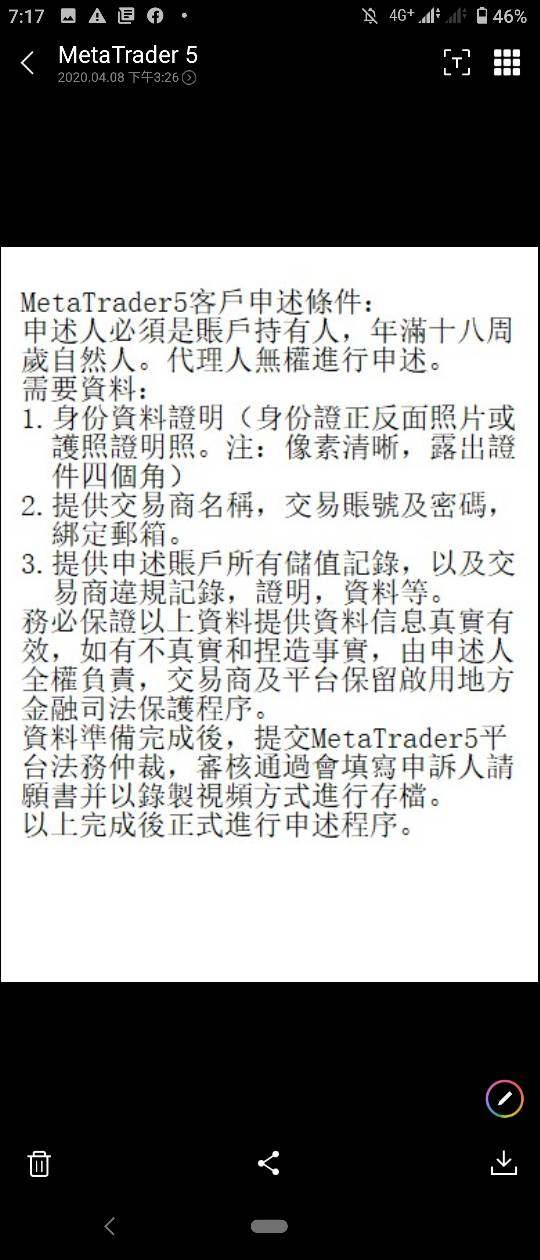

Trading Platforms

Star Trader appears to offer trading services through the use of the MT5 (MetaTrader 5) trading platform. While their website claims to provide leverage of up to 1:200, demo traders on the MT5 platform are reportedly offered access to even higher leverage levels, reaching up to 1:1000.

It's important to note that the MT5 platform is a widely recognized and popular trading platform known for its advanced features, user-friendly interface, and support for various financial instruments. However, it's crucial for traders to verify the platform's actual features and functionality directly on the broker's website.

Traders should exercise caution and perform due diligence when choosing a trading platform and broker, ensuring that the platform aligns with their trading preferences and requirements. Additionally, the availability of high leverage, as mentioned, should be approached with caution due to the associated increased risk of losses. Effective risk management is essential when using high leverage ratios.

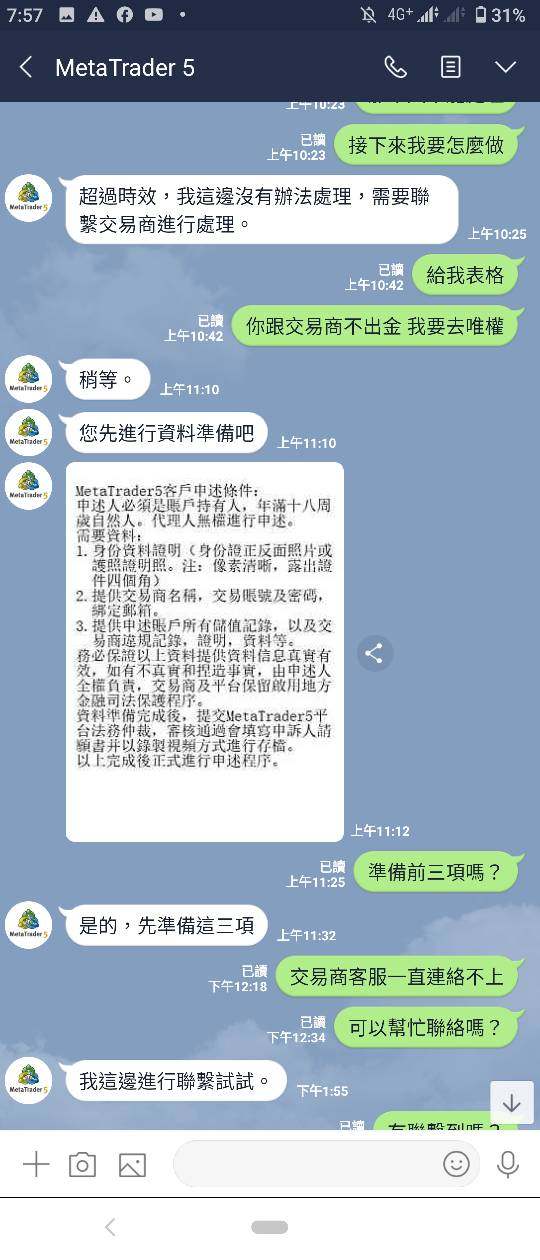

Customer Support

The customer support provided by Star Trader, as described in the information, appears to be lacking in transparency and reliability:

Limited Contact Information: The only provided contact information is a phone number with a Hong Kong prefix and an email address. There are no details about physical addresses or other means of communication, which can raise concerns about the broker's legitimacy and accessibility.

Slow Response Times: The article mentions complaints from members regarding sluggish response times to emails. Slow customer support response times can be frustrating and can potentially hinder effective communication between the broker and its clients.

Lack of Support Channels: There is no mention of additional customer support channels such as live chat or dedicated customer service representatives. The absence of multiple communication options can limit traders' ability to seek assistance promptly.

In summary, based on the available information, Star Trader's customer support does not appear to be robust or user-friendly. The limited contact information and reported issues with response times may contribute to a negative experience for traders seeking assistance or clarification from the broker. Traders should consider the level of customer support as an essential factor when evaluating a broker's services.

Educational Resources

Star Trader does not offer educational resources for its traders. This means that the broker may not provide learning materials, tutorials, webinars, or other educational content to help traders improve their knowledge and skills in trading.

The absence of educational resources can be a drawback for traders, especially those who are new to the financial markets or wish to expand their understanding of trading strategies and techniques. Having access to educational materials can be beneficial for traders looking to make informed decisions and enhance their trading abilities.

Traders should consider their own level of experience and the importance of educational resources when choosing a broker, as the availability of such resources can vary widely among different brokers in the industry.

Summary

Star Trader, an unregulated broker, has raised significant concerns across multiple aspects of its services. The lack of regulation exposes traders to substantial risks, as there are no safeguards in place. The broker's website lacks transparency in critical areas, including account types, deposit methods, and customer support. Traders have reported unfulfilled promises, slow response times, and difficulties with deposit-related chargebacks. Furthermore, the absence of educational resources hampers traders' ability to enhance their skills and knowledge. The recent reports of its website being down and being labeled as a scam further underscore the negative reputation associated with Star Trader. Investors are strongly advised to exercise extreme caution and explore more reputable alternatives in the trading industry.

FAQs

Q1: Is Star Trader a regulated broker?

A1: No, Star Trader is an unregulated broker, operating without oversight from financial authorities, which can pose significant risks to traders.

Q2: What trading instruments are offered by Star Trader?

A2: Star Trader provides a variety of trading instruments, including commodities like oil, currency pairs, indices, stocks, and precious metals such as gold and silver.

Q3: Does Star Trader offer educational resources?

A3: No, Star Trader does not provide educational resources, which may be a limitation for traders seeking learning materials and tutorials.

Q4: What is the maximum leverage offered by Star Trader?

A4: Star Trader claims to offer leverage of up to 1:200, with even higher leverage available in their MT5 demo accounts, reaching up to 1:1000.

Q5: Is there reliable customer support at Star Trader?

A5: The customer support at Star Trader has been criticized for limited contact information, slow response times, and lack of multiple support channels, potentially leading to a negative customer experience.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 10

Content you want to comment

Please enter...

Review 10

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

蔡耀龍

Taiwan

The platform will ask for varied tax with every reason.

Exposure

2020-05-12

黃智盈

Taiwan

Super Trader and SPTL would inveigle you to deposit fund and then give no access to your fund with grinding reasons, keeping asking you to pay varied fees. The most victims come form Taiwan.

Exposure

2020-04-29

黃智盈

Taiwan

The platform will find every mean including asking for fee or giving wrong news to escape the withdrawal. It will hoard all your fund. The majority victims come from Taiwan. Take heed on it.

Exposure

2020-04-09

le81977

Taiwan

I was asked to submit certification again before withdrawing fund. Have anyone encountered with the same situation?

Exposure

2020-04-09

黃智盈

Taiwan

Although I have paid all asked fees, the withdrawal is unavailable. I deposited 100 thousand RMB while I even couldn’t withdraw 1000 RMB.

Exposure

2020-04-07

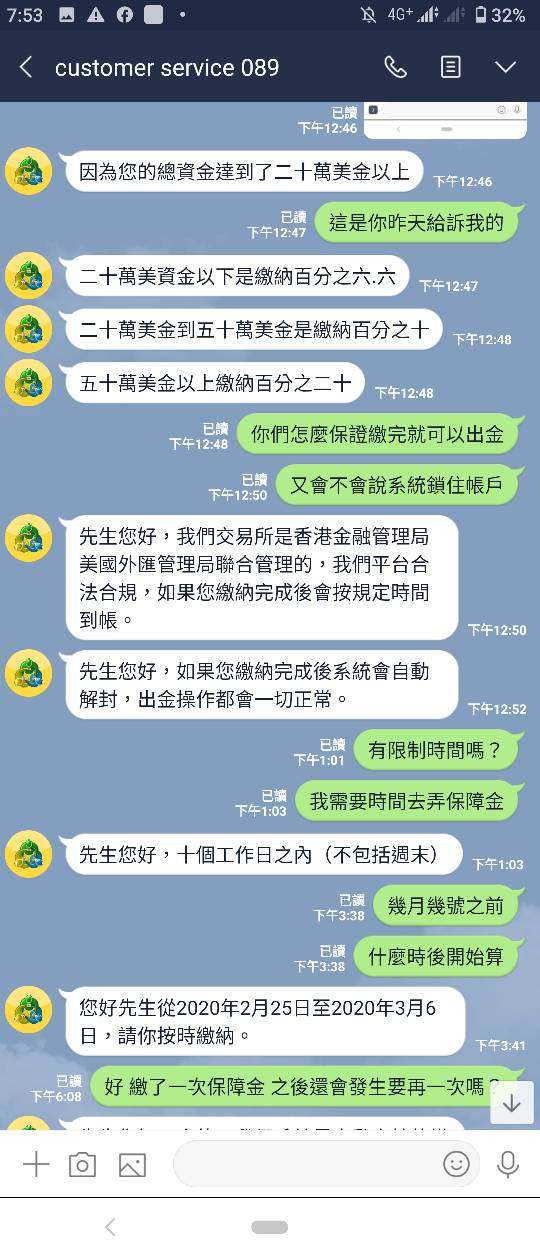

FX3964322135

Taiwan

I was asked to pay margin before making withdrawal. The platform even threatened me to delete the exposure. Otherwise, it won’t give the fund and will lock my account. Don’t be scammed.

Exposure

2020-03-25

FX3964322135

Taiwan

Please take heed on this scam platform. I deposited 30000 RMB, and the platform refused my request for withdrawing $15000 with the reason of illegal trading. I was asked to pay $10000 for certifying. Pay attention.

Exposure

2020-02-14

FX2764434839

Taiwan

1.The platform is unregulated by NFA(even its information couldn’t be found) 2. The deposit won’t be approved by the nonlocal(You will be told that your account was suspected of money-laundering when making a withdrawal). 3. The customer service didn’t tell anything with the reason of trade secret. 4. Client should pay 30% as a margin to unfreeze the account. 5. The platform will induce you to deposit by high interests(The monthly interest for 50000 RMB could reach 3.2% to 3.6%, which is calculated by the total asset). 6. With the excuse of one-to-one service, the customer service didn’t responded to my question. 7. The platform is recommended by the remitter who could obtain my information easily.

Exposure

2019-12-30

FX2764434839

Taiwan

The platform froze my account, saying that my account was suspected of money-laundering since someone deposited fund into my account.

Exposure

2019-12-30

Rohit Kumar

New Zealand

The website of this terrible company SuperTrader is down, I read on wikifx that many people have been scammed. Can wikifx help them recover their funds?

Neutral

2022-12-12