简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Revolut and N26 are bringing premium accounts to new markets - Business Insider

Abstract:Revolut and N26 both launched premium products in new markets, which could help them get closer to profitability.

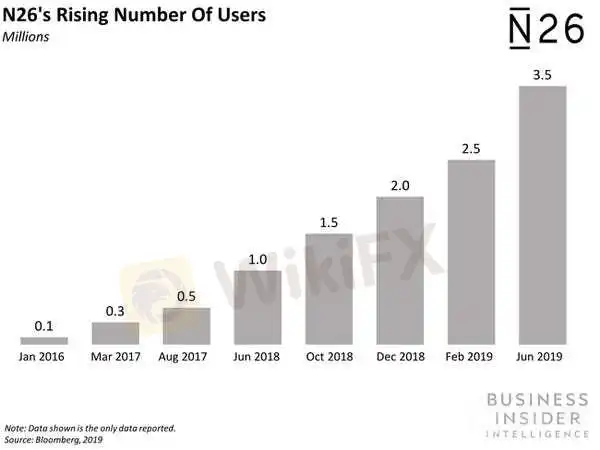

This story was delivered to Business Insider Intelligence Banking subscribers earlier this morning.To get this story plus others to your inbox each day, hours before they're published on Business Insider, click here.Neobanks Revolut and N26, which are based in the UK and Germany respectively, have both launched premium products in new markets.

Business Insider Intelligence

N26 and Revolut are among the mature European neobanks expected to collectively triple their global customer base next year to 35 million — and these expansions could accelerate that effort. Revolut rolled out a premium version of its travel card in Singapore, per Vulcan Post. Upon launching in Singapore in October, the neobank offered a free multicurrency travel debit card that supported the Singapore dollar and 13 other currencies, with plans to add more currencies. It has now launched a premium version of that card — made of steel — called Revolut Metal. The account comes with a monthly subscription fee of S$19.99 ($15) or an annual subscription fee of S$199 ($147). The card supports 28 currencies, offers 1% cash back on international spending, free international ATM withdrawals up to S$1,050 ($775) monthly, free airport lounge access, and a ticket booking concierge service. Revolut counts 8 million users and is adding between 800,000 and 900,000 new users monthly. It could further accelerate that trajectory as it continues to scale and add more features, such as commission-free stock trading, which it offers in Europe and plans on adding in Singapore.N26 launched several tiered accounts — N26 You, Metal, and Business You — in Greece, per Crowdfund Insider.N26 You is a premium bank account that comes with travel insurance, N26 Metal offers a stainless steel debit card, and N26 Business You is a free bank account for freelancers that comes with 0.1% cash back on all purchases and free international spending. International expansion is becoming central to N26's growth strategy: It recently launched in Switzerland and the US, surpassed 1 million users in France, and is preparing for a 2020 Brazil launch. The neobank has seen rapid growth since launching in 2015: It now counts 5 million users and is valued at $3.5 billion. Expanding the geographic presence of its tiered and premium accounts that are tailored for certain types of consumers could help N26 reach its eventual goal of 30 million to 70 million users. Reaching profitability is a universal challenge for neobanks — and they're navigating different routes to get there. Most neobanks generate interchange revenue through a debit card, but that places them at the whim of their customers' swiping habits, squeezing neobanks' revenue if their customers don't use the card on a consistent basis.They are instead working to reach primary account status among consumers in order to become profitable, and while there's no universal path to primary account status and profitability, a few strategies are emerging.Some neobanks operate a “freemium” pricing strategy, offering their product for free but charging for additional features. Others, like N26 and Revolut, offer multitier subscriptions with levels of premium accounts.Offering tiered and premium accounts while simultaneously expanding geographically could allow N26 and Revolut to get closer to profitability by not only widening their user bases, but getting more value out of their existing customers by upselling them to premium accounts. Want to read more stories like this one? Here's how to get access: Sign up for Banking Pro, Business Insider Intelligence's expert product suite tailored for today's (and tomorrow's) decision-makers in the financial services industry, delivered to your inbox 6x a week. /> /> Get StartedJoin thousands of top companies worldwide who trust Business Insider Intelligence for their competitive research needs. /> /> Inquire About Our Enterprise MembershipsExplore related topics in more depth. /> /> Visit Our Report StoreCurrent subscribers can log in to read the briefing here.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

US personal savings rate increases due to lowered spending amid social distancing - Business Insider

The US personal savings rate increased from 8% in February to 13.1% in March due to lowered spending from social distancing.

Barclays Q1 earnings beat forecasts as markets income surges 77% - Business Insider

The British banking giant took a $2.6 billion impairment charge to reflect the impact of the coronavirus pandemic.

US Banking Digital Trust Study from Business Insider - Business Insider

The US banks with the highest levels of digital trust in 2020 are PNC, Chase, and Citibank, according to our inaugural Banking Digital Trust study.

Goldman Sachs sees higher loan deferral opt-ins than competitors - Business Insider

Goldman Sachs has seen between 10% and 20% of its consumer loan customers request payment deferrals across its Marcus and Apple Card products.

WikiFX Broker

Latest News

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Why is there so much exposure against PrimeX Capital?

Two Californians Indicted for $22 Million Crypto and NFT Fraud

RM62k Lost Investment Scam After Joining XRP Community Malaysia on Telegram

Victims of Financial Fraud in France Suffer Annual Losses of at Least €500 Million

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

What Impact Does Japan’s Positive Output Gap Have on the Yen?

Macro Markets: Is It Worth Your Investment?

SEC Warns on Advance Fee Loan Scams in the Philippines

Currency Calculator