简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EURUSD Rebound in Focus Amid Dismal ISM Survey, Mixed Fed Rhetoric

Abstract:EURUSD may stage a larger rebound over the coming days as signs of a slowing economy puts pressure on the Federal Reserve to reverse the four rate hikes from 2018.

EUR/USD Rate Talking Points

EURUSD bounces back from a fresh yearly-low (1.0926) as the US ISM Manufacturing survey sinks to its lowest level since 2016, and the exchange rate may stage a larger rebound over the coming days as signs of a slowing economy puts pressure on the Federal Reserve to reverse the four rate hikes from 2018.

EURUSD Rebound in Focus Amid Dismal ISM Survey, Mixed Fed Rhetoric

EURUSD attempts to pare the decline from the end of August as the ISM Manufacturing survey slips to 49.1 from 51.2 in July, with a reading below 50 indicative of a contraction for the sector.

A deeper look at the report showed the employment component also narrowing to 47.4 from 51.7 during the same period, and the update raises the risk of seeing a below-forecast print for Non-Farm Payrolls (NFP) as the shift in US trade policy appears to be hitting business confidence.

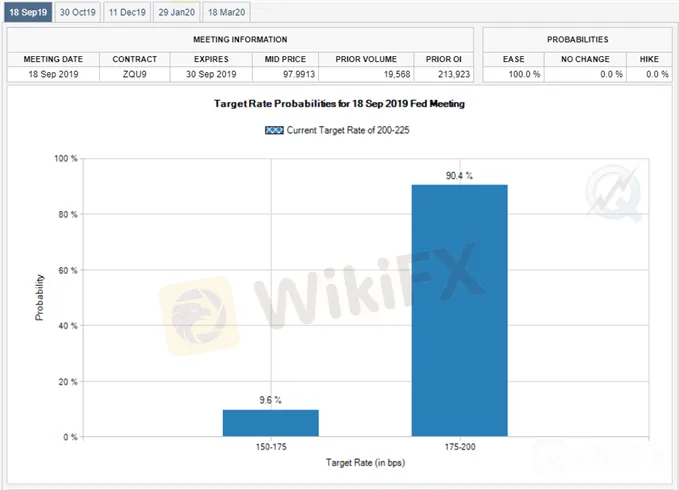

In response, St. Louis Fed President James Bullard, a 2019-voting member on the Federal Open Market Committee (FOMC), insists that the central bank “should have a robust debate about moving 50 basis points” at its quarterly meeting scheduled for later this month, with the official going onto that say that the board should “respect the market signal” as Fed Fund futures continue to show overwhelming expectations for a 25bp reduction on September 18.

In fact, Fed Fund futures are now showing renewed expectations for a 50bp rate cut later this month, but there appears to be a growing dissent with the central bank as Boston Fed President Eric Rosengren, another 2019-voting member, argues that “if the consumer continues to spend, and global conditions do not deteriorate further, the economy is likely to continue to grow around 2%.”

It remains to been if the FOMC will deliver back-to-back rate cuts as the Atlanta Fed GDPNow model projects the US economy to expand 2.3% in the third quarter of 2019 compared to 2.2% on August 16, and the FOMC may find it difficult to justify a rate easing cycle amid little indications of a looming recession.

With that said, the mixed language coming out of the Federal Reserve may dampen the appeal of the US dollar as it raises the risk of a policy error, and EURUSD may stage a larger rebound over the coming days as the Relative Strength Index (RSI) appears to be bouncing back from oversold territory.

EUR/USD Rate Daily Chart

Source: Trading View

The broader outlook for EURUSD is becoming more bearish as the exchange rate clears the May-low (1.1107) following the Federal Reserve rate cut in July, with the 1.1100 (78.6% expansion) handle no longer offering support.

Will keep a close eye on the Relative Strength Index (RSI) as the oscillator continues to track the bearish formation from June, but recent developments suggest the bearish momentum is starting to sputter as the oscillator bounces back from oversold territory.

In turn, failure to close below the Fibonacci overlap around 1.0950 (100% expansion) to 1.0980 (78.6% retracement) may generate a larger rebound in EURUSD as the exchange rate struggles to extend the series of lower highs and lows from the previous week.

In turn, the first area of interest comes in around 1.1040 (61.8% expansion) followed by the 1.1100 (78.6% expansion) handle

lack of momentum to extend the series of lower highs and lows from the previous week may generate a short-term rebound in EURUSD,

comes up against trendline support, with a break of the bearish structure raising the risk a larger rebound in EURUSD.

The failed attempt to test the August-low (1.1027) has pushed EURUSD back above the 1.1140 (78.6% expansion) pivot, with the Fibonacci overlap around 1.1190 (38.2% retracement) to 1.1220 (78.6% retracement) now on the radar.

Next area of interest comes in around 1.1270 (50% expansion) to 1.1290 (61.8% expansion) followed by the 1.1340 (38.2% expansion) region.

For more in-depth analysis, check out the3Q 2019 Forecast for Euro

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Dollar stands tall as Fed heads toward taper

The dollar held within striking distance of the year's peaks on the euro and yen on Wednesday, as investors looked for the Federal Reserve to begin unwinding pandemic-era policy support faster than central banks in Europe and Japan.

Gold Price, Silver Price Jump After Saudi Arabia Oil Field Attacks

Gold and silver turned sharply higher after the weekend‘s drone attacks on Saudi oil fields saw tensions in the area ratchet higher with US President Donald Trump warning Iran that he is ’locked and loaded.

EURUSD Fails to Test 2019 Low, RSI Flashes Bullish Signal After ECB

EURUSD fails to test the 2019-low (1.0926) following the ECB meeting, with the Relative Strength Index (RSI) breaking out of the bearish formation carried over from June.

USDCAD Rebound to Benefit from Sticky US Consumer Price Index (CPI)

Updates to the US Consumer Price Index (CPI) may keep USDCAD afloat as the figures are anticipated to highlight sticky inflation.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

YAMARKETS' Jingle Bells Christmas Offer!

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Currency Calculator