简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USDCAD Rebound Unravels Ahead of Fed Symposium Amid Sticky Canada CPI

Abstract:USDCAD pullbacks ahead of the Fed Economic Symposium as Canadas Consumer Price Index (CPI) comes in stronger-than-expected in July.

Canadian Dollar Talking Points

USDCAD consolidates ahead of the Kansas City Fed Economic Symposium in Jackson Hole, Wyoming, and the advance from the August-low (1.3178) may continue to unravel as the Federal Open Market Committee (FOMC) comes under pressure to implement a rate easing cycle.

USDCAD Rebound Unravels Ahead of Fed Symposium Amid Sticky Canada CPI

USDCAD pullbacks from a fresh monthly-high (1.3346) as Canadas Consumer Price Index (CPI) comes in stronger-than-expected in July, with the headline reading for inflation holding steady at 2.0% for the second consecutive month.

Signs of sticky price growth should keep the Bank of Canada (BoC) on the sidelines as “growth in the second quarter appears to be stronger than predicted,” and Governor Stephen Poloz and Co. may continue to endorse a wait-and-see approach at the next meeting on September 4 as “recent data show the Canadian economy is returning to potential growth.”

In contrast, the FOMC is likely to face a different fate as President Donald Trump tweets that “the only problem we have is Jay Powell and the Fed,” and the central bank may come under increased pressure to reverse the four rate hikes from 2018 as the shift in trade policy clouds the outlook for the US economy.

In turn, the Federal Reserve may continue to alter the forward guidance for monetary policy, but it remains to be seen if Chairman Jerome Powell will make a major announcementahead of the next interest rate decision on September 18 as the central bank head is scheduled to deliver a speech at the economic symposium.

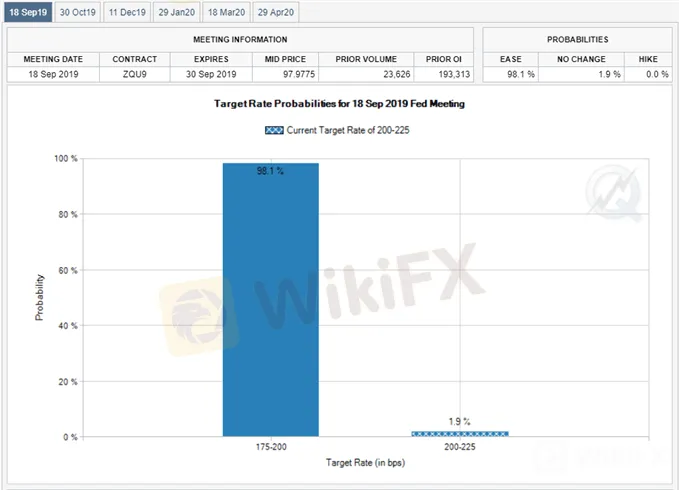

With that said, a batch of dovish comments is likely to produce headwinds for the US Dollar, with USDCAD at risk of exhibiting a more bearish behavior over the remainder of the month as Fed Fund futures still reflect overwhelming expectations for another 25bp rate cut in September.

However, recent comments from Boston Fed President Eric Rosengren, a 2019-voting member on the FOMC, suggest theres a rift within the central bank, and a growing number of Fed officials may resist calls to implement a rate easing cycle as the US economy shows little evidence of a looming recession.

With that said, remarks coming out of the Fed symposium may sway the near-term outlook for USDCAD, but the advance from the August-low (1.3178) may continue to unravel amid the diverging paths for monetary policy.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

USD/CAD Rate Daily Chart

Source: Trading View

Keep in mind, the broader outlook for USDCAD is no longer constructive as the exchange rate clears the February-low (1.3068), with the break of trendline support raising the risk for a further decline in the exchange rate.

At the same time, the rebound from the 2019-low (1.3016) remains capped by the 1.3280 (23.6% expansion) to 1.3330 (38.2% retracement) region, with the string of failed attempt to close above the Fibonacci overlap raising the risk for a further decline in the exchange rate.

Need a break/close below 1.3220 (50% retracement) to bring the downside targets back on the radar, with the first area of interest coming in around 1.3120 (61.8% retracement) to 1.3130 (61.0% retracement).

Will keep a close eye on the Relative Strength Index (RSI) as the indicator still tracks the upward trend from July, but the failed attempt to push into overbought territory may send the oscillator towards trendline support, with a break of the formation offering a bearish signal.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

US Stocks Fall as Inflation Holds Pace

Dow Jones Drops 173 Points, S&P 500 Sheds 27 Points, Nasdaq 100 Closes Lower by 57 Points

Safe-haven yen, Swiss franc rise on Omicron fears, Fed policy uncertainty

The dollar ticked higher on Friday amid a broadly calmer tone in markets as fears over Omicron’s impact eased, but currency moves were muted ahead of a key U.S. payrolls report that could clear the path to earlier Federal Reserve interest rate hikes.

Safe-haven yen, Swiss franc rise on Omicron fears, Fed policy uncertainty

The dollar ticked higher on Friday amid a broadly calmer tone in markets as fears over Omicron’s impact eased, but currency moves were muted ahead of a key U.S. payrolls report that could clear the path to earlier Federal Reserve interest rate hikes.

Dollar stands tall as Fed heads toward taper

The dollar held within striking distance of the year's peaks on the euro and yen on Wednesday, as investors looked for the Federal Reserve to begin unwinding pandemic-era policy support faster than central banks in Europe and Japan.

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

MTrading’s 2025 "Welcome Bonus" is Here

Doo Financial Obtains Licenses in BVI and Cayman Islands

CFI’s New Initiative Aims to Promote Transparency in Trading

Currency Calculator