Score

Ambit Capital

India|1-2 years|

India|1-2 years| https://ambitcap.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

India

IndiaUsers who viewed Ambit Capital also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Website

ambitcap.com

Server Location

United States

Website Domain Name

ambitcap.com

Server IP

172.67.204.109

Company Summary

| Aspect | Information |

| Company Name | Ambit Capital |

| Registered Country/Area | Switzerland |

| Founded Year | 2023 |

| Regulation | Unregulated |

| Market Instruments | Stocks, Cryptocurrencies, Commodities, Forex, Indices |

| Account Types | Basic, Silver, Gold, Platinum, VIP |

| Minimum Deposit | $1,500 |

| Maximum Leverage | Up to 1:200 |

| Spreads | N/A |

| Trading Platforms | Proprietary Platform, MetaTrader 4 |

| Customer Support | Phone: UK - 447441909375, CA - 14378879699, AU - 61285294491, SP - 34930410761, Email: support@ambitcap.com |

| Deposit & Withdrawal | Bank transfers, credit/debit cards, e-wallets, cryptocurrency deposits, mobile payment services |

| Educational Resources | FAQ, Investment Calculator, Economic Calendar, Download Center, Blog |

Overview of Ambit Capital

Ambit Capital, headquartered in Switzerland since 2023, offers a wide range of trading assets, including stocks, cryptocurrencies, commodities, forex, and indices.

With advantages such as multiple payment methods, access to proprietary and MetaTrader 4 platforms, and a mobile app for on-the-go trading, Ambit Capital accommodates traders seeking flexibility and convenience.

However, its unregulated status raises risks regarding investor protection and regulatory oversight. Despite this, Ambit Capital's comprehensive trading offerings and accessible platforms have attracted traders worldwide, establishing its presence in the competitive financial market landscape.

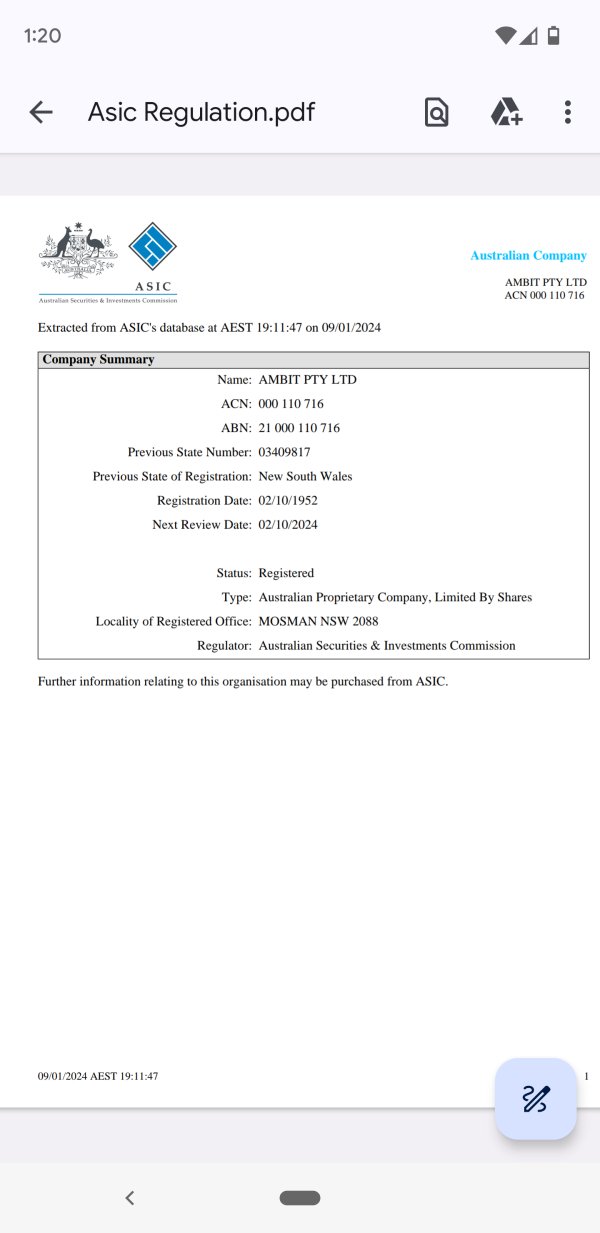

Regulatory Status

Ambit Capital operates without regulatory oversight.

This absence of supervision poses potential risks to investors. Without regulations, Ambit Capital's practices might lack transparency and accountability, potentially leading to fraudulent activities or misuse of funds.

Investors could face financial losses due to the lack of safeguards and protections typically provided by regulatory bodies. In unregulated environments, the likelihood of market manipulation and unfair practices increases, leaving investors vulnerable to exploitation.

Pros and Cons

| Pros | Cons |

| Wide range of trading assets including stocks, cryptocurrencies, commodities, forex, and indices | Unregulated |

| Multiple payment methods | High minimum deposit requirements ($1,500) |

| Access to proprietary platform | |

| Integration with MetaTrader 4 | |

| Mobile app for on-the-go trading | |

| Leverage up to 1:200 |

Pros:

Wide range of trading assets: Ambit Capital offers a wide array of trading assets, including stocks, cryptocurrencies, commodities, forex, and indices.

Multiple payment methods: Ambit Capital supports various payment methods, including bank transfers, credit/debit cards, e-wallets, cryptocurrency deposits, and mobile payment services.

Access to proprietary platform: Ambit Capital provides clients with access to its proprietary trading platform. This platform is specifically designed to meet the needs of traders, offering a user-friendly interface, advanced charting tools, and real-time market data, facilitating efficient trade execution and portfolio management.

Integration with MetaTrader 4: In addition to its proprietary platform, Ambit Capital integrates with MetaTrader 4 (MT4), a widely used trading platform known for its advanced features and customizable interface.

Mobile app for on-the-go trading: Ambit Capital offers a mobile app that enables clients to trade on-the-go using their smartphones or tablets. This mobile app provides access to real-time market data, trade execution capabilities, and account management tools.

Leverage up to 1:200: Ambit Capital offers leverage of up to 1:200, which can amplify potential profits.

Cons:

Unregulated: One significant drawback of Ambit Capital is its lack of regulatory oversight. Without regulation, clients may face increased risk, as there are no safeguards or protections in place to ensure fair and transparent trading practices.

High minimum deposit requirements ($1,500): Ambit Capital imposes relatively high minimum deposit requirements of $1,500 for opening an account. This may pose a barrier to entry for some traders, especially those who are new to trading or have limited capital to invest.

Market Instruments

Ambit Capital provides various trading assets including stocks, cryptocurrencies, commodities, forex, and indices.

Stocks: Ambit Capital provides access to stock trading, allowing investors to engage in the dynamic world of equities. Clients can invest in a wide range of leading companies across various industries, enabling them to build and diversify their investment portfolios according to their preferences and market trends.

Crypto: Ambit Capital offers cryptocurrency trading, allowing investors to participate in the burgeoning digital asset market. Clients can trade popular cryptocurrencies like Bitcoin and Ethereum, capitalizing on the potential for price movements and volatility in the crypto space.

Commodities: With Ambit Capital, clients can trade commodities, including precious metals, energy resources, and agricultural products. Commodities trading offers investors the opportunity to diversify their portfolios and hedge against inflation or geopolitical uncertainties.

Forex: Ambit Capital facilitates forex trading, enabling clients to trade currencies from around the world. Forex trading provides opportunities for investors to capitalize on fluctuations in exchange rates and geopolitical developments, potentially generating profits from currency movements.

Indices: Ambit Capital offers trading in indices, allowing investors to track the performance of broader market segments or specific sectors. Trading indices provides investors with exposure to diversified portfolios of stocks, enabling them to make informed investment decisions based on market trends and economic indicators.

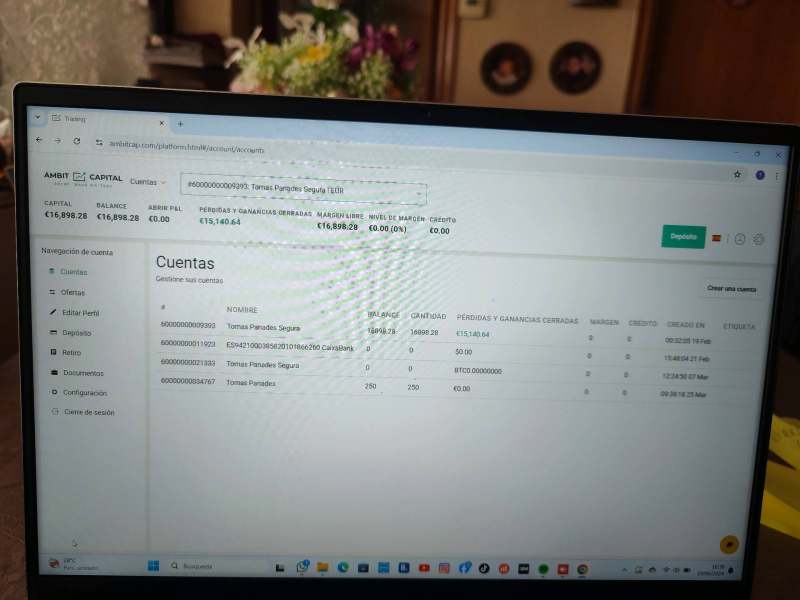

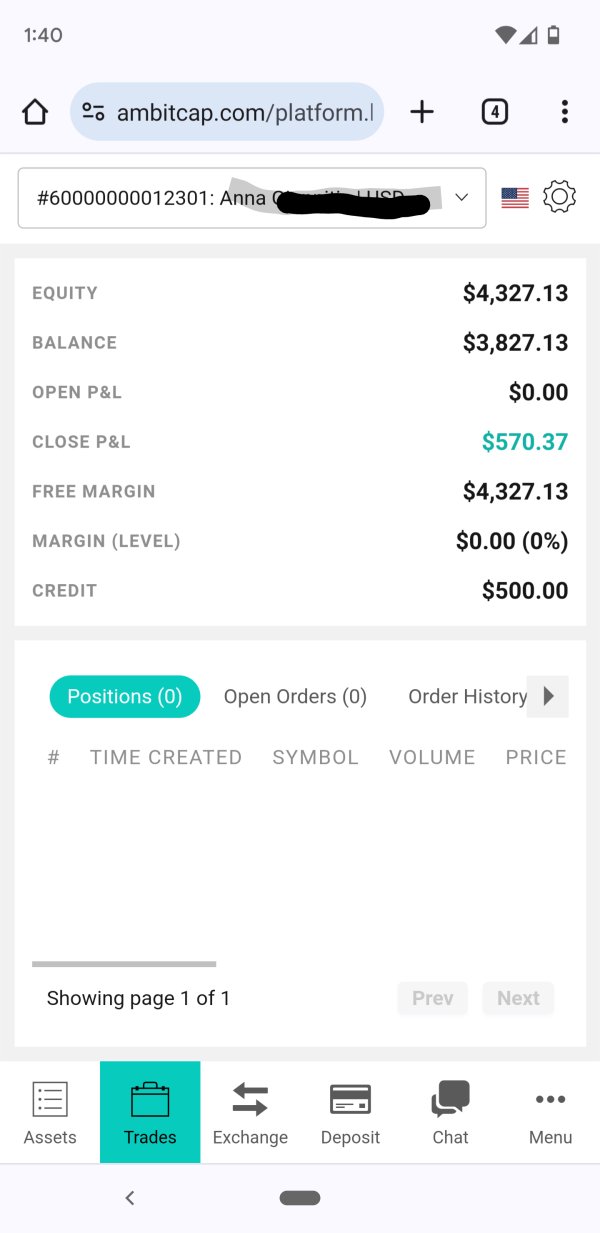

Account Types

Ambit Capital provides various account types for users.

The Basic account requires a minimum deposit of $1,500 and offers 24/7 customer service. It provides a 7-day trial of the managed account and leverage of 1:25. While it lacks some personalized features like a personal analyst or introduction session, it serves as an entry-level option for those looking to explore trading with limited initial investment and basic support.

Moving up, the Silver account demands a higher deposit of $25,000 but maintains 24/7 customer service. It extends the trial period to 30 days and offers leverage of 1:25. With the inclusion of a personal analyst and introduction session, it serves traders seeking more personalized guidance and support.

The Gold account requires a minimum deposit of $50,000 and offers similar features to the Silver account but enhances the frequency of sessions with the analyst to weekly. Additionally, it allows for one free withdrawal per week and provides the option for bonuses of up to 50%. This tier suits traders who desire more frequent interactions with their analyst and occasional withdrawal flexibility.

The Platinum account targets high-net-worth individuals with a minimum deposit of $150,000. It offers all the features of the Gold account but significantly increases the leverage to 1:100. Moreover, it introduces access to the Platinum Market for faster execution and grants a higher bonus potential of up to 75%. With a dedicated dealing department available via WhatsApp and enhanced privileges, this tier is suitable for experienced traders seeking advanced tools and benefits.

Finally, the VIP account, although lacking a specific minimum deposit requirement, is a fully managed account offering comprehensive support and services. With 24/7 customer support and WhatsApp communication with analysts, it ensures continuous assistance. The VIP tier is suitable for traders who prefer hands-off management and seek exclusive perks without the constraints of minimum deposit requirements.

| Aspects | Basic | Silver | Gold | Platinum | VIP |

| Minimum Deposit | $1,500 | $25,000 | $50,000 | $150,000 | N/A |

| Customer Service | 24/7 | 24/7 | 24/7 | 24/7 | Fully Managed |

| Managed Account Trial | 7 days | 30 days | 30 days | 30 days | |

| Leverage | 1:25 | 1:25 | 1:25 | 1:100 | 1:200 |

| Personal Analyst | ✓ | ✓ | ✓ | ✓ | |

| Introduction Session | ✓ | ✓ | ✓ |

How to Open an Account?

Opening an account with Ambit Capital is a straightforward process, typically consisting of four simple steps:

Registration: Visit the Ambit Capital website and navigate to the registration page. Fill out the online registration form with accurate personal information, including your full name, email address, contact number, and residential address. Ensure that all details provided are correct and up to date to expedite the account opening process.

Verification: After completing the registration form, you will be required to verify your identity and residency. Ambit Capital may request documents such as a government-issued ID (passport, driver's license), proof of address (utility bill, bank statement), and any other documents deemed necessary for verification purposes. Submit clear and legible copies of these documents through the designated verification channel provided by Ambit Capital.

Account Selection: Once your identity and residency have been successfully verified, you can proceed to select the type of account that best suits your trading needs and financial goals. Choose from the available account options offered by Ambit Capital, considering factors such as minimum deposit requirements, trading assets, and account features.

Funding Your Account: After selecting your preferred account type, it's time to fund your trading account. Ambit Capital supports various deposit methods, including bank transfers, credit/debit cards, e-wallets, cryptocurrency deposits, and mobile payment services. Choose the most convenient payment method and follow the instructions provided to transfer funds into your trading account.

Leverage

Ambit Capital offers varying levels of leverage across its account types. The Basic, Silver, and Gold accounts provide a maximum leverage of 1:25, enabling traders to amplify their positions up to 25 times their initial investment.

In contrast, the Platinum account offers a higher leverage of 1:100, allowing for greater position control. The VIP account offers the highest leverage of 1:200.

Trading Platform

Ambit Capital offers a selection of trading platforms for the various needs of its clients.

Firstly, clients have access to Ambit Capital's proprietary trading platform, designed to provide a user-friendly interface and essential trading tools for executing trades and managing portfolios efficiently. For traders on the go, Ambit Capital offers a mobile app, enabling clients to access real-time market data, execute trades, and manage their portfolios directly from their smartphones or tablets.

The mobile app provides convenience and flexibility, allowing traders to stay connected to the markets and react to market movements promptly, regardless of their location.

Additionally, Ambit Capital supports MetaTrader 4 (MT4), a widely used third-party platform known for its advanced charting features, technical analysis tools, and customizable interface.

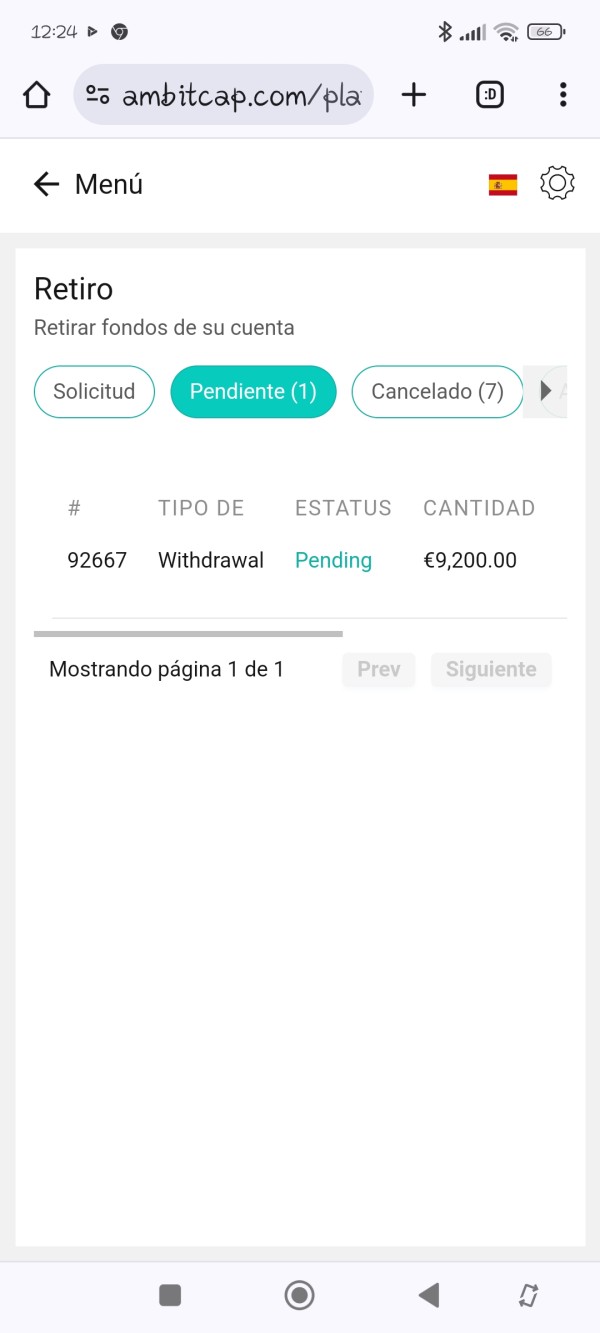

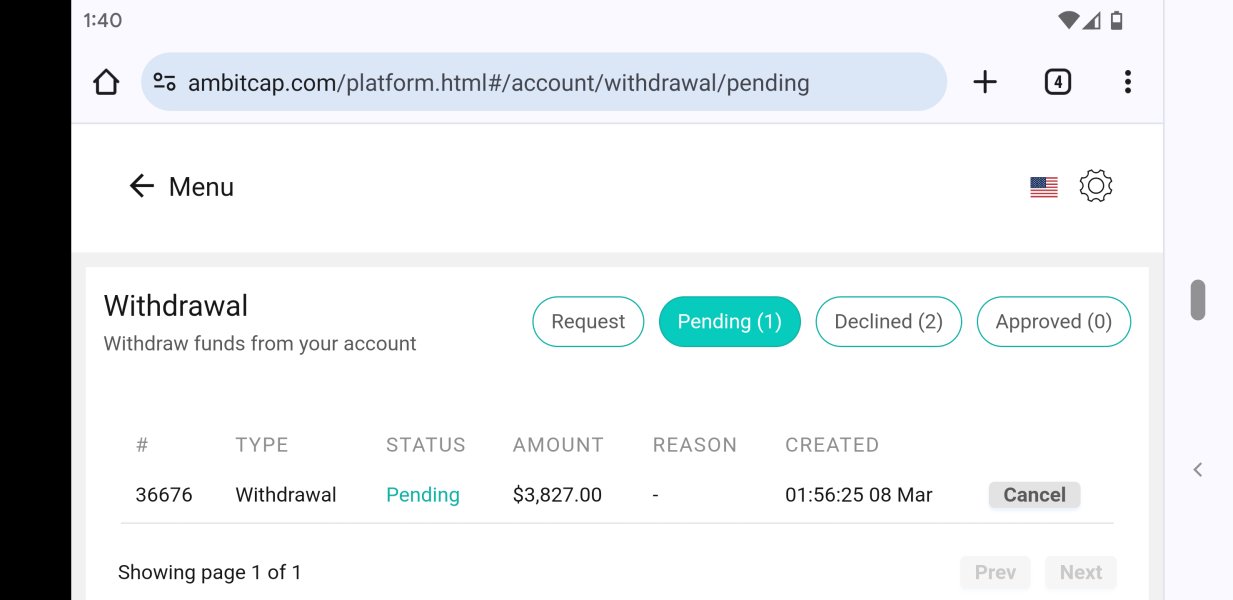

Deposit & Withdrawal

Ambit Capital offers a variety of payment methods for convenient deposits into trading accounts, accommodating clients worldwide with traditional bank transfers, credit/debit cards, e-wallets, cryptocurrency deposits, and mobile payment services.

With a minimum deposit requirement starting from $1,500 for the Basic account, clients can access these payment options to fund their trading activities securely and efficiently.

Withdrawals are processed promptly via various methods, including bank transfers, e-wallets, cryptocurrency, or wire transfers, ensuring clients can access their profits with ease.

Customer Support

Ambit Capital provides customer support via multiple channels, including phone and email.

Clients can reach out to the dedicated support team during working hours, from 7 AM to 7 PM (GMT+1), Monday to Friday.

The support team assists clients with inquiries, account-related issues, and technical assistance. For direct contact, clients can use the provided phone numbers for different regions, including the UK, Canada, Australia, and Spain.

Additionally, clients can email support@ambitcap.comfor further assistance. The support team provides prompt and efficient service to address clients' needs and ensure a positive trading experience.

Educational Resources

Ambit Capital offers a variety of educational resources to support traders at every level of experience.

From a comprehensive FAQ section covering common queries to an investment calculator aiding in strategic decision-making, the platform empowers users with essential tools and knowledge.

Additionally, the economic calendar provides insights into market-moving events, while the download center offers access to essential documents and resources.

The inclusion of a blog further enhances the learning experience, offering in-depth analysis, market insights, and trading strategies.

Conclusion

In conclusion, Ambit Capital, established in Switzerland in 2023, presents a robust trading platform with a wide array of market instruments and account types.

Its unregulated status and high minimum deposit requirements may deter some traders, while the lack of regulatory oversight raises risks about investor protection.

However, the platform offers advantages such as multiple payment methods, access to proprietary and MetaTrader 4 platforms, and a mobile app for convenient trading. Despite its drawbacks, Ambit Capital's comprehensive trading offerings and accessible platforms have garnered popularity among traders, positioning it as a contender in the competitive financial market landscape.

FAQs

Question: What trading instruments are available on Ambit Capital?

Answer: Ambit Capital offers a wide range of trading instruments, including stocks, cryptocurrencies, commodities, forex, and indices.

Question: What are the minimum deposit requirements for opening an account?

Answer: Minimum deposit requirements vary depending on the account type, starting from $1,500 for the Basic account.

Question: What platforms can I use to trade on Ambit Capital?

Answer: You can trade using our proprietary platform or MetaTrader 4 (MT4), providing you with flexibility and choice in your trading experience.

Question: How can I contact customer support?

Answer: You can reach our customer support team via phone or email during working hours, from 7 AM to 7 PM (GMT+1) Monday to Friday.

Question: Are my funds secure with Ambit Capital?

Answer: While Ambit Capital is unregulated, we employ stringent security measures to safeguard client funds and ensure a secure trading environment.

Keywords

- 1-2 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

News

Exposure CANADA CSA Warned Against Six Scam Brokers

The Canadian Securities Administrators (CSA) recently issued a warning to investors about six fraudulent brokers operating in Canada. The names of the scam brokers are :

2024-07-12 16:57

Exposure Ambit Capital: A Tale of Deception and Financial Betrayal

Ambit Capital's deceptive practices have devastated investors, as promises of substantial returns turn into financial nightmares.

2024-03-21 17:48

Review 2

Content you want to comment

Please enter...

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now