简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Australian Dollar Outlook Grim on Yield Curve as Jobs Data Looms

Abstract:The Australian Dollar outlook is grim on rising fears of a US recession, yield curve inversion. AUD/USD may shrug off rosy jobs data ahead on fears of slowing global growth.

Asia Pacific Market Open Talking Points

Australian Dollar at risk as sentiment sours on rising US recession worries

Aussie gains on jobs report could dwindle as global growth prospects fade

AUD/USD downside momentum fading but positioning offers bearish bias

Find out what the #1 mistake that traders make is and how you can fix it!

Australian Dollar at Risk as US Yield Curve Inversion Sinks Sentiment

The sentiment-linked Australian and New Zealand Dollars underperformed over the past 24 hours as rising fears of a US recession roiled financial markets. The Dow Jones Industrial dropped over 3 percent in its worst day on Wall Street this year as the S&P 500 fell by almost as much. Meanwhile, the anti-risk Japanese Yen and similarly-behaving Swiss Franc soared.

The source of panic likely stemmed from the inversion of the spread between US 10-year and 2-year government bond yields. The higher premium for near-term Treasuries compared to those maturing at a later date is historically seen as an acute signal of a looming recession. The more closely watched 10-year and 3-month spread has already been inverted since the end of May.

Thursdays Asia Pacific Trading Session

Ahead, this leaves the sentiment-linked Australian Dollar at risk as it awaits an upcoming local employment report. Australia is anticipated to add 14.0k jobs in July and it may very well beat estimates. Relative to economists expectations, data has been tending to surprise to the upside in Australia as of late. While this may bode well for AUD/USD in the near-term, down the road it may fall flat on its face if global risk aversion escalates.

Join me as I cover AUD/USD and the Australian jobs report beginning at 1:15 GMT as I discuss the Aussie outlook

Taking a look at S&P 500 futures, they are pointing notably lower heading into Thursdays Asia Pacific trading session. This may lead local benchmark stock indexes, such as the Nikkei 225 and ASX 200, to the downside. As such, this poses a threat to the Aussie while potentially benefiting the anti-risk Japanese Yen if the turmoil in markets continues.

AUD/USD Technical Analysis

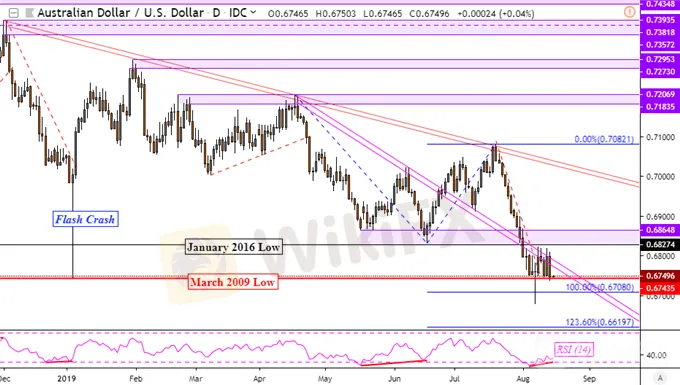

Positive RSI divergence in AUD/USD does warn of ebbing momentum to the downside, offering bears a sign of caution. This may precede a turn higher or translate into further consolidation. The latter has been more of the case as of late as prices hover above March 2009 lows. Near-term resistance appears to be well-solidified as a range between 0.6827 and 0.6865. These are the former 2019 lows.

AUD/USD Daily Chart

Chart Created in TradingView

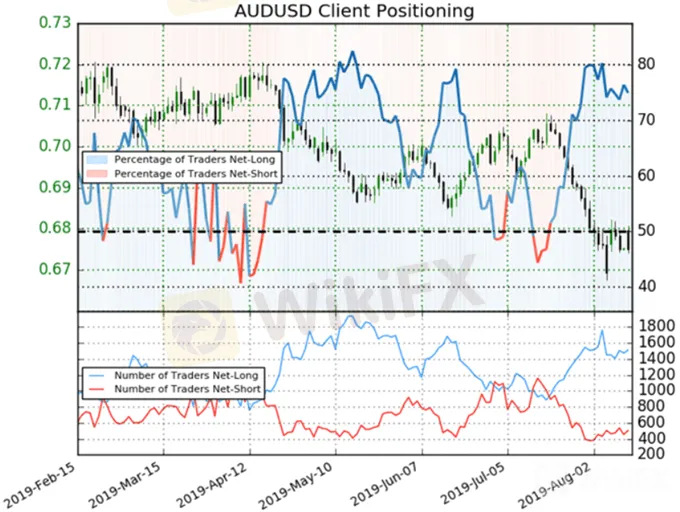

AUD/USD IG Client Sentiment

Meanwhile, IG Client Positioning is offering a stronger AUD/USD bearish contrarian trading bias. The number of net-short Aussie trading is unwinding quicker than net-long positioning. If this continues, we may see the downtrend in the Australian Dollar pick up pace. If you would like to learn more about using this tool in your trading strategy, join me every week on Wednesdays at 00:00 GMT to see how!

FX Trading Resources

See how the S&P 500 is viewed by the trading community at the DailyFX Sentiment Page

See our free guide to learn what are the long-term forces driving Crude Oil prices

See our study on the history of trade wars to learn how it might influence financial markets!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Australian Dollar Eyes Chinese Economic Data, Will AUD/USD React

Australian Dollar is in focus with Chinese economic data on tap to kick off APAC trading. Japan’s Q3 GDP crossed the wires at -3.0% q/q, missing analysts’ expectations of -0.7%. AUD/USD looks to move higher after a Bullish Engulfing candlestick pattern forms

Australian Dollar Battered Amid Market Turmoil Faces RBA and GDP

The Australian Dollar has got two huge economic data points on the schedule this week, but they may have to stray far from expectations to loosen overall risk appetites grip.

FX Week Ahead – Top 5 Events: September RBA Meeting & AUD/USD Rate Forecast

The Australian Dollar will likely be in focus to kick off the trading week as forex traders turn to the September RBA meeting for clues on where the Aussie might head next.

US Dollar Shrugs off Treasury Intervention Comment, AUD May Rise

The US Dollar shrugged off news that the Treasury Department is holding off on USD intervention “for now”. Ahead, downside AUD/USD progress may be impeded by local private Capex data.

WikiFX Broker

Latest News

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Bitcoin Nears $100,000: A Triumph of Optimism or a Warning Sign?

Malaysian Man Loses RM113,000 in Foreign Currency Investment Scam

Mastercard Partners with JPMorgan for B2B Cross-Border Payments

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

Coinbase Under Scrutiny Amid Wrapped Bitcoin Delisting Controversy

Currency Calculator