简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Japanese Yen Soars on Rising Threat of a Full-Blown Currency War

Abstract:Japanese Yen Soars on Rising Threat of a Full-Blown Currency War

JPY Price Analysis and Talking Points:

Japanese Yen Soars as Chinese Yuan Breaks 7.00 Barrier

Japanese Yen and Gold to Benefit from a Currency War

See our quarterly JPY forecast to learn what will drive prices throughout Q3!

Japanese Yen Soars as Chinese Yuan Breaks 7.00 Barrier

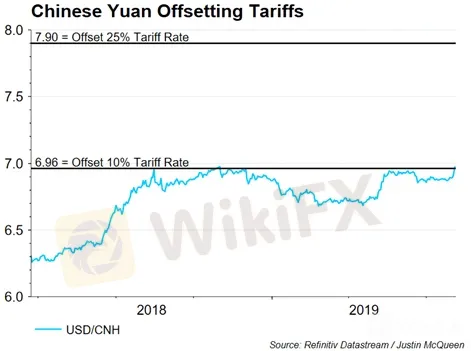

After President Trumps surprise decision to break the ceasefire and pledge to impose 10% of tariffs on $300bln worth of Chinese goods from September 1st. All eyes were on Beijing response, in which the PBoC had weakened the Chinese Yuan, prompting the currency post its biggest drop since 2015 and fall through the key 7.00 handle (down 11% since the beginning of the trade war). Subsequently, this had sparked safe-haven flows into the JPY as equities tumbled amid rising fears over a currency war. As we await the response from the White House, there is a potential that we are just one tweet away from a full-blown currency war.

Japanese Yen and Gold to Benefit from a Currency War

Those assets that are set to notably benefit from a currency war is the Japanese Yen and Gold. However, with regard to the JPY, there is a risk that Japanese Officials could potentially intervene in order to stem an aggressive bid in the currency. Therefore, gold may well indeed be the preferred option.

USDJPY Technical Outlook

Risks continue to remain titled to the downside for USDJPY with the pair making a break of trendline support from the 2016 low. A close below opens scope for a test of the 23.6% fib at 105.33, before the psychological 105.00 handle.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GEMFOREX Numbers Outlook – February 2023

these are the GEM numbers of the month for February:

Yen May Sink as US-China Restart Trade Talks, Can Crude Oil Rise?

The Japanese Yen may weaken as markets digest US-China restarting trade talks after the G20 Summit. Will this offset crude oil price declines as EU cooled Iran supply disruption fears?

Japanese Yen Soars, Mexican Peso Plummets, Crude Oil Prices Slammed - US Market Open

Japanese Yen Soars, Mexican Peso Plummets, Crude Oil Prices Slammed - US Market Open

Japanese Yen Flash Crash Warning on High Alert - Calm Before the Storm

Markets are on high alert for a potential flash crash to prompt a surge in volatility with Japanese markets closed for the longest period since World War 11.

WikiFX Broker

Latest News

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Italian Regulator Warns Against 5 Websites

SFC Freezes $91M in Client Accounts Amid Fraud Probe

Bybit Launches Gold & FX Treasure Hunt with Real Gold Rewards

Currency Calculator