简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Japanese Yen Flash Crash Warning on High Alert - Calm Before the Storm

Abstract:Markets are on high alert for a potential flash crash to prompt a surge in volatility with Japanese markets closed for the longest period since World War 11.

Flash Crash Analysis and Talking Points

Flash崩溃分析和谈话要点

Japanese Golden Week: Is Another Flash Crash on the way?

日本黄金周:是否会发生另一次闪电崩溃方式?

Recent Flash Crash Events Have Typically Taken Place in Asian Hours

最近的Flash崩溃事件通常发生在亚洲时段

See a longer list of major bubbles, bear markets and flash crashes in our ‘Brief History’ article

在我们的“简史”文章中查看更长的主要泡沫,熊市和闪电崩溃列表

Japanese Golden Week: Is Another Flash Crash on the way?

日本黄金周:是另一个闪电崩溃的途中?

Japanese markets will be closed from 27th April to 6th May, which will be the longest market closure since World War II. Consequently, this has seen fears mount that there is the possibility of a flash event and volatile market movements, given that Asian hour liquidity conditions will be lower than average, this thin liquidity consequently raises the risk of a surge in market volatility. The Japanese FX Chief added to these concerns having stated that they cannot rule out the chance of a flash crash in the market.

日本市场将于4月27日至5月6日关闭,这将是自二战以来最长的市场关闭。因此,由于亚洲时段的流动性状况将低于平均水平,这种稀薄的流动性因此增加了市场波动激增的风险,因此市场担心会出现闪电事件和市场波动的可能性。日本外汇主管对这些担忧表示,他们不能排除市场发生闪电崩盘的可能性。

{7}

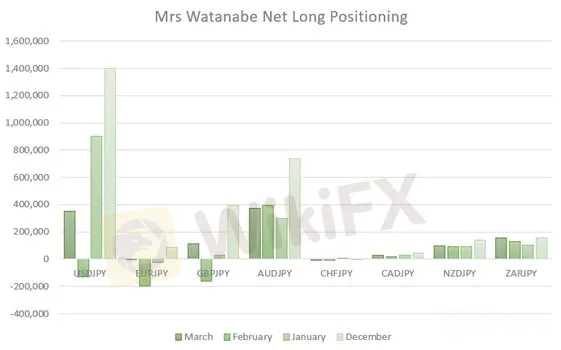

Latest Japanese Retail FX Net Positioning

{7}

What is a Flash Crash?

什么是Flash崩溃?

A “flash crash” is typically characterised as an event in which a large and sudden move in the price of an asset appears to be excessive relative to the fundamental environment, often with no obvious catalyst, which is then followed by a rather swift recovery.

“闪电崩溃”通常被描述为一个大而突然的移动的事件相对于基本环境而言,资产的价格似乎过高,通常没有明显的催化剂,然后是相当迅速的复苏。

RECENT FLASH CRASH EVENTS

最近的闪存崩溃事件 p>

US Equity Market Flash Crash (May 6th, 2010) | -6% in 40-Minutes

美国股票市场Flash崩溃(2010年5月6日)| 40分钟-6%

On May 6th, 2010 a London-based trader manipulate S&P 500 E-mini futures through “spoofing”. This had involved an algorithm constantly placing large “fake” sell orders just above the best offer, which artificially drove down the price of the index before cancelling those sell orders so that no sell orders were executed. Consequently, as E-mini and equity prices dropped sharply, liquidity had deteriorated, providing further distortions in prices. In the timespan of roughly 40-minutes the S&P 500 dropped sharply by over 6% in the first 20-minutes before retracing.

2010年5月6日,一位伦敦交易员通过“欺骗”操纵标普500电子迷你期货。这涉及一种算法不断地在最佳报价之上放置大量“假”卖单,在取消这些卖单之前人为地降低了指数的价格,以便没有执行卖单。因此,随着E-mini和股票价格大幅下跌,流动性ty已经恶化,价格进一步扭曲。在大约40分钟的时间内,标准普尔500指数在回溯前的前20分钟内大幅下跌超过6%。

Pound Flash Crash (October 7th, 2016) | -6% in 3-minutes

Pound Flash Crash(10月7日) ,2016)| 3分钟-6%

Early in the Asian trading session, the Pound had depreciated near over 6% in a matter of minutes before quickly retracing much of the losses. While there were a lack of clear catalysts to drive such price action among the major factors that had played a role in the move was the time of day, which is typically asscosicated with lower market volume, making for illiquid trading conditions. Another factor that seemed to have had exacerbated the decline was the surge in demand to sell the Pound in order to hedge options positions, while a GBP negative media report had also added a marginal weight, however, this had not been new information. Consequently, these factors had contributed to a brief halt in futures trading.

在亚洲交易时段早些时候,英镑在几分钟内贬值近6%,然后迅速回落大部分跌幅。虽然在这一行动中发挥作用的主要因素之间缺乏明确的催化剂来推动此类价格行动,但时间通常与市场交易量较低相关,导致非流动性交易条件。另一个似乎加剧下跌的因素是出售英镑以对冲期权头寸的需求激增,而英镑负面媒体报道也增加了边际权重,但这并不是新的信息。因此,这些因素导致期货交易暂停。

VIX Blowout (February 5th, 2018) | +80% in 2-hours

VIX Blowout(2018年2月5日)| 2小时+ 80%

On February 5th, 2018, the S&P 500 had plunged over 4%, marking the largest daily drop in the index since August 2011. This had coincided with VIX rising by 20 points, which had been the largest rise since 1987. Typically, a fall in equity markets is associated with a rise in the VIX and VIX futures.

2018年2月5日,标准普尔500指数跌幅超过4%,是自2011年8月以来该指数中跌幅最大的一次。随着VIX上涨20点,这是自1987年以来的最大涨幅。通常情况下,股票市场的下跌与VIX和VIX期货的上涨有关。

Among the main factors behind the surge in the VIX and VIX futures had been related to issues of volatility exchange trade products (ETPs), which allows an investor to trade volatility for hedging and speculators reasons. Issuers of leveraged volatility ETPs can take long positions on VIX futures in order to increase their returns relative to the VIX. Inverse volatility ETPs are investors to take short positions in VIX futures meaning that they are able to bet on lower volatility. In order for investors to maintain their target exposures, investors tend rebalance their portfolios on a daily basis via trading VIX related derivatives in the last hour of the trading day.

VIX和VIX期货飙升背后的主要因素与波动性交易所交易产品(ETPs)问题有关,该交易所允许投资者以对冲和投机者的原因交易波动性。杠杆波动性发行人ETP可以持多头头寸oVIX期货以相对于VIX增加其回报。反向波动率ETP是投资者在VIX期货中持有空头头寸意味着他们能够在较低的波动率下注。为了让投资者维持目标敞口,投资者通常在交易日的最后一小时通过交易VIX相关衍生品来重新平衡他们的投资组合。

On February 5th, the surge in the VIX had created a feedback loop whereby long volatility ETPs had to buy more VIX futures in order to maintain their exposure, while inverse volatility ETPs had to buy VIX futures in order to cover their losses, which had ultimately dropped over 80%, leading to the termination of the product. Consequently, this had driven the overall levels of volatility and thus exacerbating the declines on the S&P 500. In the 2-hour period, the VIX had jumped over 80%.

2月5日, VIX的激增创造了一个反馈回路,长期波动性ETP必须购买更多VIX期货以维持其风险,而反向波动ETP必须购买VIX期货以弥补其损失,最终跌幅超过80% ,导致产品终止。因此,这推动了整体波动水平,从而加剧了标准普尔500指数的下跌。在2小时内,波动率已超过80%。

Japanese Yen Flash Crash (January 3rd, 2019) | -3% in 5-Minutes

日元闪电崩溃(2019年1月3日)| 5分钟-3%

On January 3rd, 2019 during the early hours of the Asian trading session, the Japanese Yen had surged by over 3% against the US Dollar in a matter of minutes. Much like prior flash events the direct catalyst behind them are somewhat uncertain. Given the time at which the event had occurred, market liquidity would have been a factor that contributed to the move given the time of day (between US close and Asia open), while liquidity would have been reduced further, since Japanese participants had been away for a public holiday.

2019年1月3日亚洲交易时段早些时候,日元兑美元飙升3%以上分钟问题。就像先前的闪光事件一样,它们背后的直接催化剂有些不确定。鉴于事件发生的时间,市场流动性将成为推动一天中的时间(美国收盘和亚洲开盘之间)的因素,而流动性将进一步减少,因为日本参与者已离开公共假期。

Another factor that added to the gains in the Japanese Yen had been the liquidation of carry trades, which in turn saw JPY rise substantially against higher yielding currencies such as the Australian Dollar (AUDJPY dropped 8%) and Turkish Lira (TRYJPY dropped 10%). Prior to the event, Japanese retail positioning had been notably short the Japanese Yen.

另一个增加日元涨幅的因素是套利交易清算,随后日元升值实际上反对高收益货币,如澳元(澳元兑日元下跌8%)和土耳其里拉(TRYJPY下跌10%)。在此次活动之前,日本的零售定位明显偏短日元。

Sources: BIS, Bloomberg, Thomson Reuters, Tokyo Financial Exchange

资料来源:BIS,Bloomberg,汤森路透,东京金融交易所

--- Written by Justin McQueen, Market Analyst

---由市场分析师Justin McQueen撰写

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Global Market Volatility and Strategic Moves by Major Economies and Companies

Global markets face volatility with significant declines in US and Asian stocks due to central bank rate decisions and economic uncertainties. JPMorgan's recession forecast, and Cathie Wood's tech stock acquisitions. Additionally, geopolitical tensions, market shifts in New York and Thailand, and rising energy prices in Europe highlight the diverse factors influencing the global financial landscape.

Japanese Yen Eases on BoJ Dovish Statement

The Japanese Yen eased on Wednesday morning after the BoJ Deputy Governor indicated that the Japanese central bank would not raise interest rates if global markets remained unstable. This statement has calmed the market and unwound concerns about Yen carry trades. Meanwhile, the dollar has regained strength, with the dollar index (DXY) climbing above the $103 mark.

Dovish Fed’s Statement Hammers Dollar

The highly anticipated Fed’s interest rate decision was disclosed yesterday, hammering the dollar’s strength lower as Fed Chief Jerome Powell explicitly signalled that a September rate cut is possible. The U.S. central bank is balancing both inflation and recession risks, with interest rates adjusted to curb inflation while maintaining a solid labour market.

Powell’s Dovish Tone Hammers Dollar

Federal Reserve Chair Jerome Powell indicated that recent U.S. economic data suggest inflation is returning to a downward trajectory. However, he emphasised the need for more evidence before the Fed considers shifting its current monetary policy. Consequently, the dollar eased from its recent highs, while U.S. equity markets, buoyed by the dovish tone, saw the Nasdaq and S&P 500 reaching all-time highs.

WikiFX Broker

Latest News

RM62k Lost Investment Scam After Joining XRP Community Malaysia on Telegram

Victims of Financial Fraud in France Suffer Annual Losses of at Least €500 Million

What Impact Does Japan’s Positive Output Gap Have on the Yen?

Macro Markets: Is It Worth Your Investment?

Trading is an Endless Journey

SEC Warns on Advance Fee Loan Scams in the Philippines

Russia Turns to Bitcoin for International Trade Amid Sanctions

Rs. 20 Crore Cash, Hawala Network, Income Tax Raid in India

Hong Kong Stablecoins Bill Boosts Crypto Investments

BEWARE! Scammers are not afraid to impersonate the authorities- France’s AMF said

Currency Calculator