简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

AUDUSD Rate Capped by 200-Day SMA Ahead of Australia Inflation Report

Abstract:AUDUSD stands at risk for a further decline ahead of Australias CPI report as the rebound from the June-low (0.6832) stalls ahead of the 200-Day SMA (0.7087).

Australian Dollar Talking Points

AUDUSD extends the decline from earlier this week as Reserve Bank of Australia (RBA) Governor Philip Lowe strikes a dovish tone, and recent price action raises the risk for a further decline as the rebound from the June-low (0.6832) stalls ahead of the 200-Day SMA (0.7087).

AUDUSD Rate Capped by 200-Day SMA Ahead of Australia Inflation Report

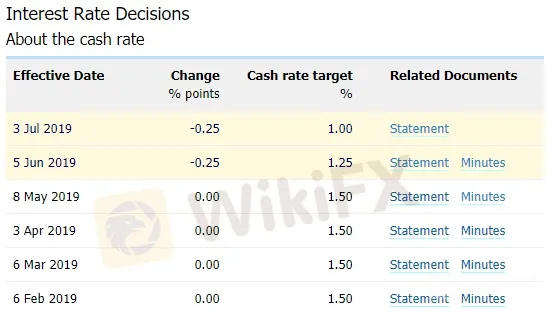

A recent speech by Governor Lowe has weighed on the Australian dollar as the central bank head states that “if demand growth is not sufficient, the Board is prepared to provide additional support by easing monetary policy further.”

With that said, updates to Australias Consumer Price Index (CPI) may curb the recent decline in AUDUSD as the headline reading is anticipated to widen to 1.5% from 1.3% annum during the first quarter of 2019. However, a slowdown in the core rate of inflation may produce a mixed reaction, with the Australian dollar at risk of facing headwinds as below-target price growth puts pressure on the RBA to further embark on its rate easing cycle.

In turn, AUDUSD stands at risk of facing a further decline ahead of the Federal Reserve interest rate decision on July 31, and the advance from the June-low (0.6832) may continue to unravel as the exchange rate remains capped by the 200-Day SMA (0.7087).

Keep in mind, the AUDUSD rebound following the currency market flash-crash has been capped by the 200-Day SMA (0.7087), with the exchange rate marking another failed attempt to break/close above the moving average in July.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

AUD/USD Rate Daily Chart

The broader outlook for AUDUSD remains tilted to the downside, with the exchange rate still at risk of giving back the rebound from the 2019-low (0.6745) as both price and the Relative Strength Index (RSI) continue to track the bearish formations from late last year.

Moreover, the advance from the June-low (0.6832) has sputtered ahead of the Fibonacci overlap around 0.7080 (61.8% retracement) to 0.7110 (78.6% retracement), which lines up with the 200-Day SMA (0.7090), with AUDUSD carving a fresh series of lower highs and lows.

In turn, a close below the 0.6950 (61.8% expansion) to 0.6960 (38.2% retracement) region raises the risk for a run at the monthly-low (0.6911), with the next area of interest coming in around 0.6850 (78.6% expansion) to 0.6880 (23.6% retracement).

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

US Stocks Fall as Inflation Holds Pace

Dow Jones Drops 173 Points, S&P 500 Sheds 27 Points, Nasdaq 100 Closes Lower by 57 Points

USDCAD Rebound to Benefit from Sticky US Consumer Price Index (CPI)

Updates to the US Consumer Price Index (CPI) may keep USDCAD afloat as the figures are anticipated to highlight sticky inflation.

AUDUSD Range Vulnerable to Dovish RBA Forward Guidance

AUDUSD may face a more bearish fate over the coming days if the Reserve Bank of Australian (RBA) prepares Australian household and businesses for lower interest rates.

USDCAD Rebound Unravels Ahead of Fed Symposium Amid Sticky Canada CPI

USDCAD pullbacks ahead of the Fed Economic Symposium as Canadas Consumer Price Index (CPI) comes in stronger-than-expected in July.

WikiFX Broker

Latest News

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

JUST Finance and UBX Launch Multi-Currency Stablecoin Exchange

XM Revamps Website with Sleek Design and App Focus

TradingView & Mexico’s Uni. Partnership, to Enhance Financial Education

Something You Need to Know About SogoTrade

Global Shift in Cryptocurrency Taxation: Italy and Denmark Chart New Paths

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

eToro Launches Global-Edge Smart Portfolio: A Balanced Approach to Growth and Stability

Currency Calculator