简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USDCAD Eyes 2019 Lows, GBPUSD Rises on Short Squeeze - US Market Open

Abstract:USDCAD Eyes 2019 Lows, GBPUSD Rises on Short Squeeze - US Market Open

MARKET DEVELOPMENT –USDCAD Eyes 2019 Lows, GBPUSD Rises on Short Squeeze

市场发展 - 美国商业交易市场关注2019年低点,英镑兑美元短暂上涨

DailyFX 2019 FX Trading Forecasts

DailyFX 2019外汇交易预测

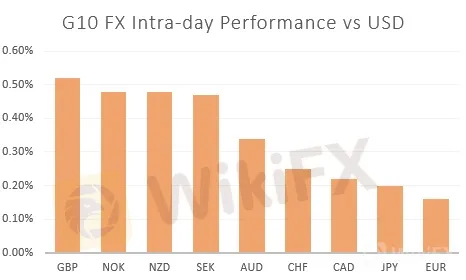

USD: Fed‘s Powell signal that interest rates will be cut at the upcoming meeting (July 31st) has continued to put the greenback on the back-foot against its major counterparts, while US indices extend on its record highs. While Powell is due to speak for a second day at Capital Hill, it is likely to be a reiteration from yesterday’s commentary. That said, with a July rate cut cemented, the focus now is whether the central bank expects further rate reductions going forward. Although with the latest CPI showing an upward surprise in the core figures, questions may be raised as the whether the Fed signals further easing is needed, thus the USD has seen a marginal bounce since the CPI report.

美元:美联储鲍威尔表示利率将在即将召开的会议上(7月31日),美元指数继续创下历史新高。虽然鲍威尔将在Capital Hill发言第二天,但很可能是昨天评论的重申。也就是说,随着7月降息的巩固,现在关注的焦点是央行是否预期未来会进一步降息。虽然最新的CPI显示核心数据意外上升,但可能会提出问题,因为美联储是否需要进一步宽松政策,因此美元自CPI报告以来已出现小幅反弹。

{5}

GBP: In recent sessions, the sentiment in the Pound has deteriorated and rightly so, given that recent data has softened, while BoE officials have grown more cautious. However, with the market increasingly bearish on GBPUSD (reminder, CFTC data shows speculators are the most bearish on GBP in the G10), yesterdays drop in the USD looks to have sparked a short squeeze in the pair, which trades above 1.2550. Topside resistance situated at 1.26.

{5}

CAD: Firmer oil prices and a central bank that is willing to sit on the side-lines relative to its dovish counterparts, has seen the Loonie continue to outperform with USDCAD once again edging towards its 2019 lows of 1.3037.

加元:油价较高且央行愿意坐在与其鸽派相对应的边线上,已经看到Loonie继续表现优于美元兑加元再次逼近2019年的低点1.3037。

EUR: The latest ECB minutes provided little in the way of fresh news given Draghis Sintra speech. Consequently, the Euro was relatively unchanged following the release with focus now on the upcoming data ahead of the July 25th monetary policy meeting.

欧元:最新的欧洲央行会议纪要在Draghis Sintra讲话中几乎没有提供新消息。因此,欧元在发布后相对不变,现在关注7月25日货币政策会议之前即将公布的数据。

Source: DailyFX, Thomson Reuters

来源:DailyFX,汤森路透

{9}

IG Client Sentiment

{9}

How to use IG Client Sentiment to Improve Your Trading

如何使用IG客户端情绪来改善交易

WHATS DRIVING MARKETS TODAY

今天的推动市场

“GBPUSD Outlook: From a Contrarian Perspective, a Sterling Rally is Due” by Martin Essex, MSTA , Analyst and Editor

“英镑兑美元展望:从反向角度来看,英镑拉力赛即将到期”由Martin Essex,MSTA,分析师和编辑

“Crude Oil Price Analysis: Oil Prices Jump on Hurricane and Supply Risks” by Justin McQueen, Market Analyst

“原油价格分析:油价因飓风和供应风险而上涨”,市场分析师Justin McQueen

“USD/CHF, EUR/CHF Price Forecast: Potential Comeback for the Sellers” byMahmoud Alkudsi , Market Analyst

“美元/瑞士法郎,欧元/瑞士法郎价格预测:卖家的潜在回升”,作者:市场分析师马哈茂德·阿尔库斯,

“Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

“使用外汇有效交易IG的全球市场主题”作者:Tyler Yell,CMT,外汇交易指导员

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Key Economic Calendar Events for This Week (August 5-9, 2024)

This week's economic events include: Japan's Monetary Policy Minutes and U.S. Services PMI on Monday, impacting JPY and USD. Tuesday's RBA Interest Rate Decision affects AUD, with German Factory Orders influencing EUR. Wednesday sees German Industrial Production and U.S. Crude Inventories impacting EUR and USD. Thursday: RBA Governor speaks, with U.S. Jobless Claims. Friday: China's CPI and Canada's Unemployment Rate affect CNY and CAD.

Anticipating the Nonfarm Payroll Report

As we approach the Nonfarm Payroll (NFP) report on August 2, 2024, market participants are keenly observing the data for insights into the U.S. labor market. The report is expected to show an increase of 194,000 to 206,000 jobs for July, indicating modest growth. This suggests potential softening in the labor market. A weaker-than-expected report could prompt the Fed to consider rate cuts, influencing the USD. Major currency pairs and gold prices will likely see volatility around the NFP release

High Volatility Economic Events for This Week (GMT+8)

This week, key economic events expected to generate high volatility include China's Q2 GDP and retail sales data, impacting CNY. The US will release Core Retail Sales and Philadelphia Fed Manufacturing Index, affecting USD. The UK's CPI data will influence GBP, and the ECB Interest Rate Decision and Press Conference will impact EUR. These events will drive significant market movements due to their influence on monetary policy and economic outlooks.

Global Market Insights: Key Events and Economic Analysis Part 2

This week's global market analysis covers significant movements and events. Fed Chairman Powell's cautious stance on interest rates impacts the USD. TSMC benefits from Samsung's strike. Geopolitical tensions rise with Putin's diplomacy. PBOC plans bond sales to stabilize CNY. Key economic events include Core CPI, PPI, and Michigan Consumer Sentiment for the USA, and GDP data for the UK. These factors influence currency movements and market sentiment globally.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator