简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

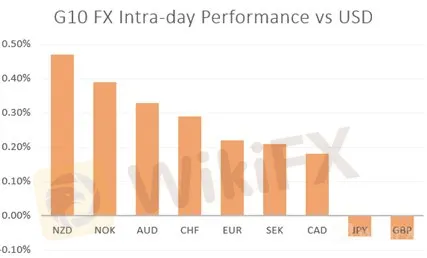

USD Soft on Rising Fed Rate Cut Bets, AUDUSD Eyes RBA Rate Cut - US Market Open

Abstract:USD Soft on Rising Fed Rate Cut Bets, AUDUSD Eyes RBA Rate Cut - US Market Open

AUD: Notable outperformance in high beta currencies despite the cautious market tone. The AUD is now hovering at 2-week highs against the USD, ahead of the likely RBA rate cut. However, given that markets remain very bearish on the currency, there is a risk of a short vulnerable if the RBA fail to live up to the aggressive dovish pricing. Of note, money markets are pricing in three RBA rate cuts by the year-end.

GBP: The Pound remains soft across the board with EURGBP edging back towards its recent peak (0.8870). Todays Mfg. PMI surprised to the downside with the headline figure dropping to the lowest level since July 2016 amid the unwind of Brexit related stockpiling. Going forward, the Pound is likely to take its cue from the Conservative Party leadership contest throughout the next few weeks.

Source: DailyFX, Thomson Reuters

IG Client Sentiment

How to use IG Client Sentiment to Improve Your Trading

WHATS DRIVING MARKETS TODAY

“Sterling (GBP) Week Ahead: Risk, Brexit, NFPs and Flashing Signals” by Nick Cawley, Market Analyst

“Crude Oil Bulls Exit, Copper and Silver Downtrend Persist - COT Report” by Justin McQueen, Market Analyst

“S&P 500 and Dow Jones Weakness Failing to Result In a VIX ‘Event’” by Paul Robinson, Currency Strategist

“Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

{13}

Follow Justin on Twitter @JMcQueenFX

{13}

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Key Economic Calendar Events for This Week (August 5-9, 2024)

This week's economic events include: Japan's Monetary Policy Minutes and U.S. Services PMI on Monday, impacting JPY and USD. Tuesday's RBA Interest Rate Decision affects AUD, with German Factory Orders influencing EUR. Wednesday sees German Industrial Production and U.S. Crude Inventories impacting EUR and USD. Thursday: RBA Governor speaks, with U.S. Jobless Claims. Friday: China's CPI and Canada's Unemployment Rate affect CNY and CAD.

Anticipating the Nonfarm Payroll Report

As we approach the Nonfarm Payroll (NFP) report on August 2, 2024, market participants are keenly observing the data for insights into the U.S. labor market. The report is expected to show an increase of 194,000 to 206,000 jobs for July, indicating modest growth. This suggests potential softening in the labor market. A weaker-than-expected report could prompt the Fed to consider rate cuts, influencing the USD. Major currency pairs and gold prices will likely see volatility around the NFP release

High Volatility Economic Events for This Week (GMT+8)

This week, key economic events expected to generate high volatility include China's Q2 GDP and retail sales data, impacting CNY. The US will release Core Retail Sales and Philadelphia Fed Manufacturing Index, affecting USD. The UK's CPI data will influence GBP, and the ECB Interest Rate Decision and Press Conference will impact EUR. These events will drive significant market movements due to their influence on monetary policy and economic outlooks.

Global Market Insights: Key Events and Economic Analysis Part 2

This week's global market analysis covers significant movements and events. Fed Chairman Powell's cautious stance on interest rates impacts the USD. TSMC benefits from Samsung's strike. Geopolitical tensions rise with Putin's diplomacy. PBOC plans bond sales to stabilize CNY. Key economic events include Core CPI, PPI, and Michigan Consumer Sentiment for the USA, and GDP data for the UK. These factors influence currency movements and market sentiment globally.

WikiFX Broker

Latest News

Ghana Trader Jailed for $300K Forex and Crypto Scam

US Dollar Surge Dominates Forex Market

Hong Kong Police Bust Deepfake Crypto Scam Syndicate Involving $34 Million

Is it a good time to buy Korean Won with the current depreciation?

Pepperstone Sponsored the "Aston Martin Aramco Formula One Team"

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Soegee Futures Review: Should You Trust This Broker?

Malaysian Pilot Loses RM1.36 Million in UVKXE Investment App Scam

Indonesia officially joins the BRICS countries

Attention! Goldman Sachs Cuts Gold Target to $2910

Currency Calculator