简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EURUSD Rate Consolidates Ahead of ECB Amid Failure to Test April-Low

Abstract:EUR/USD fails to test the May-low (1.1107) ahead of the ECB meeting on June 6, with the exchange rate snapping the series of lower highs and lows from the previous week.

EUR/USD Rate Talking Points

EUR/USD fails to test the May-low (1.1107) ahead of the European Central Bank (ECB) meeting on June 6, with the exchange rate snapping the series of lower highs and lows from the previous week.

EURUSD Rate Consolidates Ahead of ECB Amid Failure to Test April-Low

EUR/USD appears to be catching a bid as the ECB is widely expected to retain the current policy, and more of the same from the Governing Council may keep the exchange rate afloat as the central bank remains confident in achieving its one and only mandate for price stability.

In fact, the ECB may largely endorse a wait-and-see approach as President Mario Draghi & Co. prepare to launch another round of Targeted Long-Term Refinance Operations (TLTRO), and EUR/USD may continue to consolidate throughout the first full week of June as the Governing Council appears to be in no rush to alter the forward-guidance for monetary policy.

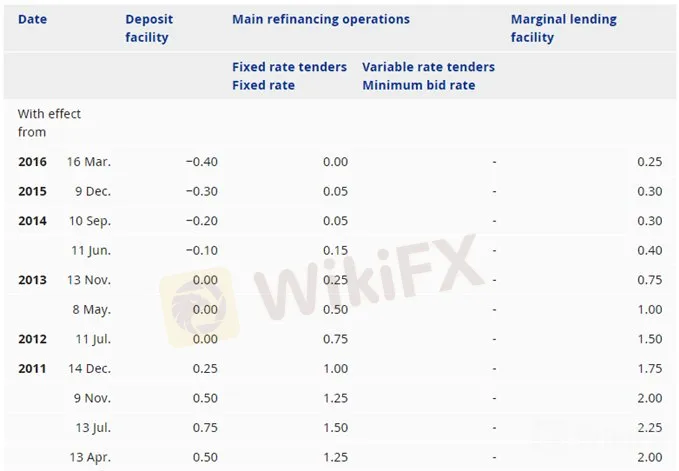

With that, it seems as though the ECB will be on autopilot ahead of President Draghis departure at the end of October, but the central bank may come under increased pressure to further insulate the monetary union amid the weakening outlook for the global economy. As a result, the Governing Council may continue to rely on non-standard measures, with the Euro stands at risk of facing a more bearish fate over the coming days if Governing Council shows a greater willingness to implement a negative interest rate policy (NIRP).

Until then, EUR/USD may continue to consolidate amid the failed attempt to test the May-low (1.1107), with recent price action raising the risk for a larger rebound as the exchange rate snaps the series of lower highs and lows from the previous week.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups surrounding foreign exchange markets.

EUR/USD Rate Daily Chart

Keep in mind, the broader outlook for EUR/USD remains tilted to the downside as both price and the Relative Strength Index (RSI) continue to track the bearish formations from earlier this year, with the near-term outlook mired by the failed attempt to push back above the Fibonacci overlap around 1.1270 (50% expansion) to 1.1290 (61.8% expansion).

With that said, the 1.1100 (78.6% expansion) handle remains on the radar, but lack of momentum to test the May-low (1.1107) raises the risk for range-bound conditions.

Next downside area of interest comes in around 1.1040 (61.8% expansion) followed by the Fibonacci overlap around 1.0950 (100% expansion) to 1.0980 (78.6% retracement).

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Crude Oil Prices at Risk if US Economic Data Cool Fed Rate Cut Bets

Crude oil prices may fall if upbeat US retail sales and consumer confidence data cool Fed rate cut bets and sour risk appetite across financial markets.

EURUSD Fails to Test 2019 Low, RSI Flashes Bullish Signal After ECB

EURUSD fails to test the 2019-low (1.0926) following the ECB meeting, with the Relative Strength Index (RSI) breaking out of the bearish formation carried over from June.

Gold, Crude Oil Prices at Risk if ECB, US CPI Cool Stimulus Hopes

Gold and crude oil prices may be pressured if the ECB underwhelms investors dovish hopes while higher US core inflation cools Fed rate cut expectations.

EURUSD Rate Rebound Unravels as Attention Turns to ECB Meeting

EURUSD gives back the rebound from earlier this month, with the Euro at risk of exhibiting a more bearish behavior as the ECB is expected to deliver a rate cut.

WikiFX Broker

Latest News

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

Breaking News! Federal Reserve Slows Down Interest Rate Cuts

Beware: Pig Butchering Scam Targeting Vulnerable Individuals

This Economic Indicator Sparks Speculation of a Japan Rate Hike!

Currency Calculator