简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Stock Market Update: DIS Earnings Impress, Market Awaits Trade Data

Abstract:US stocks closed mostly in the red following a volatile day of trading. Traders will now look to Thursdays trade balance data for insight into the US-China trade war.

Stock Market Update Talking Points:

Disney released strong financial findings for their second quarter, which will likely offer buoyancy for the Dow Jones in Thursday trading

Stock traders will look to Thursday‘s US trade balance data to garner the impact the US-China trade war has had ahead of Friday’s deadline

With trade talks on the fritz and the month of May progressing, will the stock market crash and fulfill the “sell in May and go away” phenomenon?

Stock Market Update: DIS Earnings Impress, Market Awaits Trade Data

Amid a tumultuous trading session, Disney (DIS) was one of the few stocks on the Dow Jones to close in the green. Anticipation for their quarterly report saw DIS shares climb 1.21% in Wednesday trading – only to climb another 1.63% in the after-hours session as the results were released. A strong quarterly performance from one of the Dow Jones hottest stocks should inject optimism back into the Average on Thursday. Upon the earnings release, DIS remained within the implied price range and above the sizable price gap.

View our Economic Calendar for upcoming data releases.

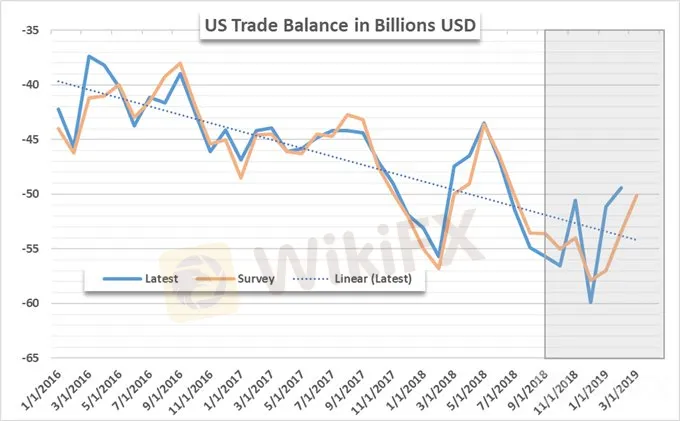

While meaningful, Disney earnings pale in comparison to the larger issues plaguing the stock market. As trade war talks hit a rough patch, markets have sold off and the VIX has spiked. With all eyes on Friday‘s deadline, insight into the effects of the economic bout will be offered Thursday with the release of US trade balance data from March. A deficit of -$51.1 billion is expected, climbing from February’s deficit of -$49.4 billion.

US Trade Deficit Mounts

Source: Bloomberg

Since the US-China trade war began back in June 2018, markets have been offered 8 months of trade data. Because the data trails by two months, the shaded area above highlights data released from September to February – along with tomorrows expected balance. Although many economists have debated the exact impact of higher tariffs, the longer-term implications are unclear.

Similarly, the takeaways that can be garnered from the balance between the United States and China alone is also opaque. In February 2018, the United States imported $39.07 billion in goods from China while exporting $9.8 billion – resulting in a deficit of roughly -$29.26 billion. In 2019, imports in the month of February totaled $33.19 billion, accompanied by exports of $8.43 billion – resulting in a deficit of -$24.76 billion.

Source: Bloomberg

While the US-China trade deficit shrank in comparable time periods, the data is too noisy to draw a firm conclusion. One thing that is clear however, is the overall widening trade deficit of the United States. Despite the smaller deficit with China, the total balance continues to fall deeper into the red.

Over the last 9 years, the monthly average deficit has climbed to -$52.10 billion from -$32.49 billion. In tomorrow‘s report, traders and investors will scour the data for any indication a trend has developed from the trade war. To that end, specific sectors like agriculture (soybeans) and larger goods like airplanes and machinery will be important areas to watch. The data will assist investors in forecasting the ramifications of a potential change in levy rates on Friday. Check back at DailyFX.com for a breakdown and analysis of tomorrow’s trade data.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

In the stock market, it’s become Apple, Microsoft and Alphabet vs everyone else

KEY POINTS Does a relative shortage of stocks combined with somewhat mechanical sources of buying explain the Dow rising to 29,000? What’s truly scarce are big, reliable cash flows that investors believe will endure economic wobbles and constant technological disruption. This has created a vastly bifurcated market, and an unusually wide spread between the valuation of the most expensive stocks and the cheapest ones. In aggregate Apple-Microsoft-Alphabet trades at 26-times this year’s profits, with no debt and enormous capacity to invest, buy back stock or fund future dividends. The broad market is below 19-times earnings.

Stocks Sink After President Trump Announces New Tariffs on China

Amidst a recovery rally from Wednesdays selloff, President Trump announced an additional round of tariffs on goods coming into the United States from China as stocks dived.

Stock Market Outlook: Top 3 Themes to Watch in AAPL Earnings

Stock traders eagerly await Apple (AAPL) earnings due Tuesday afternoon. Past hiccups from the company have spurred equity turmoil and currency flash crashes, here are the top 3 themes to watch.

Stock Market Fund Flows Suggest S&P 500 Sentiment Remains Bullish

The S&P 500 looks to end Fridays session in a range that previously offered considerable resistance in a week where the SPY, IVV and VOO ETFs recorded $6.4 billion in inflows.

WikiFX Broker

Latest News

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

FXCL Lucky Winter Festival Begins

Warning Against MarketsVox

Is the stronger dollar a threat to oil prices?

Currency Calculator