简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

New York Senate passes bills related to Trump taxes, pardon power

Abstract:One bill makes it easier for Congress to get Trump's state taxes, and the other curbs the effect of his pardon power in New York.

The New York State Senate passed two bills on Wednesday that could dramatically curb the effect of President Donald Trump's pardon power and facilitate the release of his most sensitive financial information.One bill makes it easier for certain congressional committees to obtain his state tax returns as they investigate his business dealings, many of which are tethered to New York.The second bill closes the double-jeopardy loophole that grants immunity to people who have been pardoned from being prosecuted for the same crimes on a state level.The bills will go to the Democratic-controlled State Assembly and New York Gov. Andrew Cuomo, both of whom have signaled support for the measures.Visit BusinessInsider.com for more stories.New York state lawmakers passed two bills on Wednesday that make it easier for Congress to obtain President Donald Trump's tax returns and weaken the effect of presidential pardons in the state.The New York State Senate, which is controlled by Democrats, passed both bills as the House of Representatives ramps up its scrutiny of Trump's business dealings and financial ties to foreign powers.One bill authorizes the commissioner of the New York Department of Taxation and Finance to release any state tax return requested by one of three congressional committees for any “specified and legitimate legislative purpose.”The other bill closes the “double-jeopardy loophole” that grants immunity to individuals who have been pardoned from being prosecuted for the same crimes by New York state prosecutors.Next, the two measures will go to the Democratic-controlled State Assembly, where they're expected to pass as well. New York Gov. Andrew Cuomo has said he will sign both bills into law.Read more: Repeated leaks and revelations are chipping away at Trump's attempts to keep his tax records secret from the American publicThe bills' passage comes as state authorities launch sprawling investigations of the president's financial records.In March, the New York State Department of Financial Services subpoenaed records from Aon, Trump's longtime insurance company. The move came after Trump's former lawyer, Michael Cohen, testified to Congress that the president routinely falsified his financial health for tax and insurance purposes.The New York state attorney general's office has also subpoenaed Deutsche Bank, which Cohen said received financial statements from Trump that misrepresented his assets.Trump's net worth has perhaps been the biggest question mark looming over his real-estate career.The president's financial dealings also invited further scrutiny following the publication of several years of Trump's tax information.Read more: Trump said investigating his finances would be a 'red line.' New York prosecutors are about to cross it.The latest leak came on Tuesday, when The New York Times published details of the president's 1985 to 1994 tax records, which expose losses of more than $1 billion over the course of nine years by Trump's hotel and casino businesses.According to The Times, Trump lost more money during part of that time period than almost any other individual US taxpayer.In October 2016, before Trump won the US election, The Times obtained 1995 tax documents that showed he claimed $916 million in losses that year. The records suggested he may not have paid any federal income taxes for two decades.Perhaps the most damaging revelation came last year, when The Times reported that Trump engaged in a complicated tax scheme to shield a $400 million inheritance from his father from the Internal Revenue Service (IRS).New York may pose a particularly stark threat to the president because it serves as the linchpin to Trump's businesses.The Trump campaign, moreover, is headquartered at Trump Tower in Manhattan, New York, and state investigators have cited that as a key reason they want to obtain a full, unredacted copy of Mueller's report in the Russia investigation.Read more: Trump just invoked executive privilege to stonewall Congress from seeing any new material related to the Mueller probeSpecifically, they believe the document could contain evidence of criminal wrongdoing that could be subject to state charges against Trump or people in his orbit, such as his children and other family members.New York authorities, as well as the state's law, are also known to be tough on financial crime.“Fraud cases are the linchpin of what most attorneys general do, and the laws are particularly strong in New York,” Paul Nolette, a political-science professor at Marquette University who studies attorneys general, told FiveThirtyEight in January.“The Mueller investigation is the shiny object everyone is watching,” Berit Berger, a former federal prosecutor and the executive director of Columbia Law School's Center for the Advancement of Public Integrity, told the outlet. “But under everyone's nose are what look like much more straightforward violations of state law, including some pretty flagrant tax fraud. Depending on what happens with Mueller, that could be what actually sinks the big ship.”It's not just Trump who could face legal jeopardy in his home state.People who are convicted of state crimes cannot be pardoned, and Trump's children, other family members, and campaign associates may also see trouble ahead, as Paul Manafort, Trump's former campaign manager, found out earlier this year.Just minutes after Manafort was sentenced to 7 1/2 years in federal prison as a result of the Mueller probe, state prosecutors in New York slapped him with a 16-count indictment accusing him of engaging in a yearlong fraud scheme to falsify business records and illegally obtain millions of dollars in loans.Tom Porter contributed reporting.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Trump retweets call to fire Fauci who said US response will cost lives - Business Insider

It's not clear whether it's more than a vague threat, but Trump has fired several prominent public servants over the last few weeks.

The typical price of a home in every state in the US - Business Insider

With help from Zillow, we found out the median home value in each of the 50 states (plus Washington, DC).

Bad news for Trump — 60% of Americans say the surging stock market doesn't affect them - Business Insider

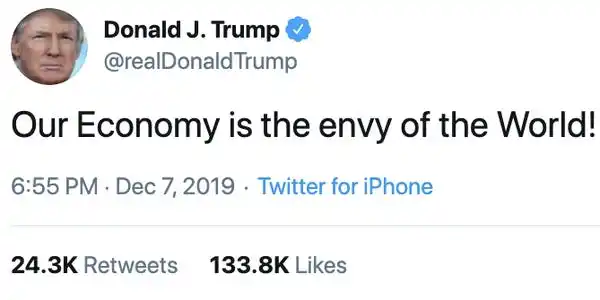

Only 40% of respondents in the Financial Times poll said that the stock market had gone up this year. The S&P 500 has soared about 26% in 2019.

Who supports impeachment? Major Democrats who want to impeach Trump

So far, 139 currently-serving House Democrats and other notable Dems that have openly come out in favor of impeaching Trump.

WikiFX Broker

Latest News

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

Breaking News! Federal Reserve Slows Down Interest Rate Cuts

Beware: Pig Butchering Scam Targeting Vulnerable Individuals

This Economic Indicator Sparks Speculation of a Japan Rate Hike!

Currency Calculator