简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Stock Market Fund Flows Suggest S&P 500 Sentiment Remains Bullish

Abstract:The S&P 500 looks to end Fridays session in a range that previously offered considerable resistance in a week where the SPY, IVV and VOO ETFs recorded $6.4 billion in inflows.

Stock Market Fund Flows Talking Points:

Broad-market ETFs SPY, IVV and VOO notched $6.4 billion in outflows in an eventful week for US monetary policy

The flows suggest bullish sentiment even as US indices look to end Friday notably lower

Interested in equities and ETF fund flows? Sign up for the weekly webinar - Stock Market Catalysts for the Week Ahead

Stock Market Fund Flows Suggest S&P 500 Sentiment Remains Bullish

The S&P 500 is headed for a painful Friday close, retracing the bullish reaction to Wednesday‘s dovish FOMC meeting. At the time of this article’s publication, the index traded narrowly above 2,800 and slightly below prior resistance at 2,815, but considerable inflows into some of the market‘s largest exchange traded funds suggest investors are still confident in the index’s ability to run.

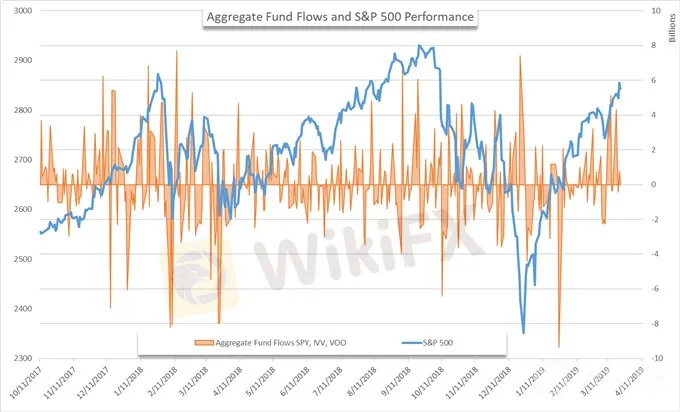

Aggregate Fund Flows for Broad Market ETFs versus S&P 500 (Chart 1)

The aggregate fund flows of SPY, IVV and VOO totaled $6.4 billion this week, with an intraday inflow of $4.3 billion on Monday alone. Investors were similarly confident on Tuesday, adding $1.8 billion in exposure to the three funds. After minor outflows on Wednesday, bullishness returned Thursday with an inflow of $782 million.

{9}

Compare how ETF investors are positioned to IG Clients using IG Client Sentiment Data.

{9}

For the year to date, net aggregate fund flows total $113 million, displaying investor indecision despite a corresponding 12% gain in the S&P 500. Profit-taking could partially explain the virtually deadlocked fund flows for the year, while capital rotation into more-specific sectors may explain it further.

{11}

HYG ETF Fund Flows versus S&P 500 (Chart 2)

{11}

The high-yield corporate debt ETF – HYG - posted a string of inflows this week. In total, $687 million in fresh capital entered the fund, a sign investors were confident the S&P 500 was aimed higher. Consequently, the ETF has seen over $2 billion in fresh capital for its coffers in the year to date. As general market theory would suggest, T-Bills have seen relatively consistent outflows.

BIL ETF Fund Flows versus S&P 500 (Chart 3)

The BIL ETF which grants exposure to 1-3-month T-Bills managed a weekly net inflow of $64 million, even as the dovish policy from the Federal Reserve weighs on yields. In the year to date, the fund has seen $765 million exit the fund, contrasting the consistent demand for more high-yielding debt like HYG. Still, BIL may be one important fund to watch in times of equity turbulence. If the broader equity markets were to fall under pressure, the relatively safe ETF would benefit and see greater demand.

S&P 500 Price Chart: 4 – Hour Time Frame (October 2018 – March 2019) (Chart 4)

Learn tips and tricks to day trading the S&P 500

As for the immediate outlook, the S&P 500 has multiple technical levels to negotiate. The index now trades within the band that previously offered resistance from 2,786 to 2,815, bolstered by the 78.6% Fibonacci level at 2,814. Beyond that, a tentative support trendline from December lies slightly below. Follow @PeterHanksFX on Twitter for deeper stock market and equity insights.

That said, the trendline has not been solidified as it only has two points of contact. If the trend is to gain technical respect, a close above the line early next week is paramount. With the S&P 500 trending higher since late December, a decidedly dovish Fed and consistent ETF inflows, the index has a plethora of reasons to trade higher next week.

View our Economic Calendar for important events and data releases next week.

On the other hand, domestic and global growth remain headwinds. Next Thursday will offer meaningful insight on the US economy with the release of first quarter GDP. For trend continuation purposes, the data will need to impress. ETF flows leading up to the datas release next week may shed light on investor sentiment regarding the release.

{21}

Read more: Will the Stock Market Crash in 2019?

{21}

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

{24}

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you‘re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

{24}

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Commodity prices Surge as Geopolitical Tension Rise

he market saw muted activity as both the U.S. and the U.K. observed public holidays in yesterday's session. The dollar index (DXY) edged lower, failing to hold above the 104.50 level. This decline comes as the market anticipates signs of cooling U.S. inflation ahead of the PCE reading due on Friday. Meanwhile, the U.S. Securities and Exchange Commission (SEC) announced a reduction in Wall Street settlement times, aiming to complete transactions in a single day.

eWarrant Japan Securities K.K. offers clients Nikkei and Dow Jones indices trading with MetaTrader 5

Warrant Japan Securities K.K. launched its new services eWarrant Direct, allowing its clients to trade covered warrants via a dedicated platform.

eWarrant Japan Securities K.K. offers clients Nikkei and Dow Jones indices trading with MetaTrader 5

eWarrant Japan Securities K.K. launched its new services eWarrant Direct, allowing its clients to trade covered warrants via a dedicated platform.

In the stock market, it’s become Apple, Microsoft and Alphabet vs everyone else

KEY POINTS Does a relative shortage of stocks combined with somewhat mechanical sources of buying explain the Dow rising to 29,000? What’s truly scarce are big, reliable cash flows that investors believe will endure economic wobbles and constant technological disruption. This has created a vastly bifurcated market, and an unusually wide spread between the valuation of the most expensive stocks and the cheapest ones. In aggregate Apple-Microsoft-Alphabet trades at 26-times this year’s profits, with no debt and enormous capacity to invest, buy back stock or fund future dividends. The broad market is below 19-times earnings.

WikiFX Broker

Latest News

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

Breaking News! Federal Reserve Slows Down Interest Rate Cuts

Beware: Pig Butchering Scam Targeting Vulnerable Individuals

This Economic Indicator Sparks Speculation of a Japan Rate Hike!

Currency Calculator