Score

FX Fair

Saint Vincent and the Grenadines|5-10 years|

Saint Vincent and the Grenadines|5-10 years| https://www.fxfair.com/

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

+84 969986491

Other ways of contact

Broker Information

More

Fair Group

FX Fair

Saint Vincent and the Grenadines

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:100 |

| Minimum Deposit | -- |

| Minimum Spread | 0.0 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | -- |

| Minimum Spread | 0.1 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:1111 |

| Minimum Deposit | -- |

| Minimum Spread | 1.5 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed FX Fair also viewed..

XM

VT Markets

ATFX

MiTRADE

FX Fair · Company Summary

| Aspect | Information |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 2-5 years |

| Company Name | FX Fair |

| Regulation | No Regulation |

| Minimum Deposit | $51 |

| Maximum Leverage | Up to 1:1111 |

| Spreads | Starts from 0.0 pips |

| Trading Platforms | MT4 (MetaTrader 4) |

| Tradable Assets | Forex, Energy, Precious Metals, Cryptocurrency, Stock Index, Stock |

| Account Types | STANDARD Account, ZERO SPREAD Account, PRO Account |

| Demo Account | Available |

| Islamic Account | Not mentioned |

| Customer Support | Phone: +84 969986491<br>Email: support@fxfair.com |

| Payment Methods | Credit/Debit Card, Bank Transfer, BitGo, Perfect Money |

| Educational Tools | Trade Analysis, Share Function, Trading Tendency, Detailed Trade Analysis, Calendar Function |

Overview of FX Fair

FX Fair is a broker that currently lacks valid regulation, which carries inherent risks. Traders should exercise caution and be aware of the potential hazards associated with engaging in financial activities with FX Fair. The broker offers a variety of market instruments for trading, including forex, energy commodities, precious metals, cryptocurrencies, stock indices, and individual stocks.

FX Fair provides multiple account types to cater to different trading needs. The STANDARD account offers general trading with a spread of at least 1.5 pips and a maximum leverage of 1111 times. The ZERO SPREAD account is designed for scalping strategies, offering ultra-narrow spreads starting from 0.1 pips and a maximum leverage of 500 times. The PRO account is an STP/ECN account with no trading or transaction fees, spreads from 0.0 pips, and a maximum leverage of 100 times.

To open an account with FX Fair, visit their website and choose between opening a demo account or a real account. Provide the required personal information, account opening information, select the account type and base currency, and agree to the legal documents. Finally, click on “Register” to submit your account opening application.

FX Fair offers leverage options of up to 1:1111, allowing traders to amplify potential profits or losses. The broker also provides a range of deposit and withdrawal methods, with a minimum deposit and withdrawal amount of $51. The processing time for deposits and withdrawals varies depending on the chosen method.

FX Fair primarily uses the widely recognized MT4 trading platform, which is available on various devices, including Windows PC, Mac, iPhone, iPad, Android, Tablet, and WebTrader. The platform offers features like one-click trading, automated trading with Expert Advisors, and comprehensive chart analysis tools.

Traders using FX Fair can access various trading tools, such as trade analysis, trading tendencies analysis, and a calendar function to track performance. Customer support is available via phone and email during weekdays, and inquiries can be submitted through an inquiry form on the website.

Pros and Cons

FX Fair is a broker that operates without valid regulation, which presents inherent risks for traders. It offers a variety of market instruments, including forex, energy commodities, precious metals, cryptocurrencies, stock indices, and individual stocks. With different account types, leverage options up to 1:1111, and the utilization of the popular MT4 trading platform, FX Fair aims to cater to the diverse needs of traders. However, it is important to consider the lack of regulation, potential risks, limited customer support, and other factors before engaging in financial activities with FX Fair. Here is a summary of the general pros and cons:

| Pros | Cons |

| Offers a range of market instruments | Lacks valid regulation |

| Provides different account types | Regulatory license is suspicious |

| Leverage options up to 1:1111 | Limited information on company background |

| Utilizes the popular MT4 trading platform | Limited customer support availability |

| Various deposit and withdrawal methods | Potentially higher risk in trading activities |

| Offers trading tools for analysis and sharing | Lack of transparency in regulatory oversight |

Is FX FairLegit?

FX Fair is a broker that, upon verification, has been found to lack valid regulation at present. It is important to note that operating without regulation carries inherent risks. Therefore, it is advisable to exercise caution and be fully aware of the potential hazards associated with engaging in financial activities with FX Fair.

Market Instruments

FX Fair offers a range of market instruments for trading. Here is a summary of the available instruments:

Forex: FX Fair provides over 50 currency pairs for trading. Traders have the option to choose from a variety of major and minor currency pairs, including EURUSD, USDJPY, EURJPY, GBPJPY, and etc.

Energy: FX Fair allows trading in energy commodities such as oil, OILUSD. Trading energy instruments can be an opportunity for those interested in speculating on the price movements of oil.

Precious Metals: FX Fair offers trading in precious metals like gold and silver, including XAUUSD and XAGUSD. Precious metals are considered a safe haven investment and can provide diversification options for traders.

Cryptocurrency: Traders can engage in cryptocurrency trading on FX Fair's platform. Popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP) are available for trading.

Stock Index: FX Fair provides trading opportunities in major stock indices including USA.30, NAS100, and JPN225. Traders can speculate on the performance of these stock indices and potentially benefit from their movements.

Stock: FX Fair offers trading in individual stocks. This enables traders to buy and sell shares of various companies listed on major stock exchanges.

| Pros | Cons |

| Wide range of currency pairs available for trading, including major and minor pairs. | Lack of regulation poses inherent risks in trading activities. |

| Opportunity to speculate on the price movements of energy commodities like oil. | Regulatory license is considered suspicious. |

| Trading in precious metals such as gold and silver, which are considered safe haven investments. | Limited information available on the company background. |

| Availability of popular cryptocurrencies like Bitcoin, Ethereum, Litecoin, and Ripple for trading. | Customer support availability may be limited. |

Account Types

FX Fair offers a range of account types to cater to the diverse needs of traders:

STANDARD Account:

The STANDARD account offered by FX Fair is designed for general trading purposes. It provides traders with a spread of at least 1.5 pips, indicating a slightly wider range compared to other account types. The account offers a maximum leverage of 1111 times, allowing traders to amplify their positions. FX Fair utilizes the popular MT4 platform, which is widely recognized in the industry. With one-click trading functionality and a unique trade analysis tool, traders can execute trades and analyze market trends. The account also boasts 24-hour speed for deposits and withdrawals. A minimum deposit of $51 is required to open a STANDARD account, and there are no account opening fees.

ZERO SPREAD Account:

The ZERO SPREAD account caters to traders who engage in scalping and similar trading strategies. This account type offers ultra-narrow spreads, starting from a minimum of 0.1 pips. The maximum leverage available for this account is 500 times. Like the STANDARD account, it operates on the MT4 platform, enabling users to enjoy its features and functionalities. The account offers one-click trading and a unique trade analysis tool for trading and market analysis. Deposits and withdrawals are processed quickly, with 24-hour availability. The minimum deposit requirement for opening a ZERO SPREAD account is $51, and there are no account opening fees. It's worth noting that the external fee deducted from this account is equivalent to the spread charged on the STANDARD account.

PRO Account:

The PRO account provided by FX Fair is an STP/ECN account tailored for professional traders. Notably, this account type does not charge any trading fees or transaction fees. It offers a spread starting from a minimum of 0.0 pips. The maximum leverage available for PRO account holders is 100 times. The MT4 platform is adopted for this account as well. Traders can benefit from one-click trading functionality and an original trade analysis tool. The PRO account guarantees 24-hour speed for deposits and withdrawals, allowing traders to access their funds promptly. A minimum deposit of $51 is required to open a PRO account, and there are no account opening fees.

Additionally, FX Fair provides a demo account option for users to practice trading strategies before engaging in real trades.

| Pros | Cons |

| Offers a range of account types | Lacks transparency in regulatory information |

| Wide range of leverage options | Limited information on company background |

| Utilizes the popular MT4 platform | Customer support availability may be limited |

| 24-hour speed for deposits and withdrawals | Lack of valid regulation carries inherent risks |

| No account opening fees | Potential higher risk in trading activities |

| Demo account option for practice |

How to Open an Account?

To open an account with FX Fair, follow these steps:

Visit the FX Fair website.

Click on “Open a demo account” or “Open a real account.”

3. Provide your email, password, and confirm them.

4. Proceed to the next step.

5. Fill in your personal information, including country, name, phone number, date of birth, gender, and address.

6. Complete the account opening information, such as planned investment amount, total annual income, estimated net worth, and employment form.

7. Select the account type and base currency.

8. Read and agree to the legal documents, including terms of service, order execution policy, risk disclosure, conflicts of interest policy, privacy policy, and IB terms.

9. Click on “Register” to submit your account opening application.

Leverage

FX Fair offers leverage options of up to 1:1111. Leverage, in the context of financial trading, refers to the practice of borrowing funds to amplify potential profits or losses.

Spreads

FX Fair offers a spread range that starts from 0.0 pips. The spread refers to the difference between the bid and ask prices of a financial instrument. It is important to note that spreads can vary across different brokers and trading platforms.

Deposit & Withdrawal

Deposit:

There are various options to choose from, including credit/debit card, bank transfer, BitGo, and Perfect Money. The minimum deposit amount for all methods is $51, with a maximum deposit limit of $100,000 for bank transfers and Perfect Money. Credit/debit card deposits can be made using VISA or Mastercard. It's important to note that fees are not applicable for deposits below $2,000, except for specific fees imposed by certain WEB money companies. The reflection time for deposits ranges from immediate processing to a maximum of two business days.

Withdrawal:

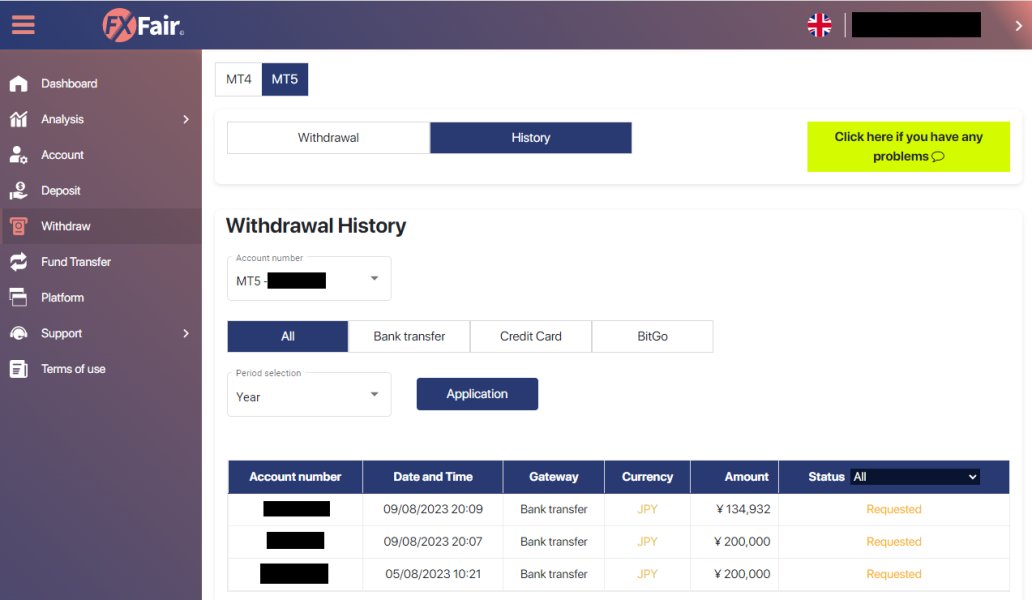

FX Fair offers multiple withdrawal methods, available 24 hours a day on weekdays. The withdrawal options include bank transfer, BitGo, and Perfect Money. The minimum withdrawal amount for all methods is $51, with a maximum withdrawal limit of $100,000. Similar to deposits, fees are waived for withdrawal amounts below $2,000, except for fees imposed by certain WEB money companies. The reflection time for withdrawals varies, with bank transfers taking 1-5 business days and BitGo and Perfect Money withdrawals being processed immediately or within two business days.

| Pros | Cons |

| Various deposit options | Possible fees for deposits above $2,000 |

| Immediate processing of deposits | Withdrawal fees for amounts above $2,000 |

| Multiple withdrawal methods | Bank transfers may take 1-5 business days for reflection |

| 24/7 weekday withdrawals | BitGo and Perfect Money withdrawals may take up to 2 business days |

| No minimum deposit above $51 | - |

Trading Platforms

FX Fair offers a range of trading platforms that cater to various devices including iPhone, iPad, Android, Tablet, Windows PC, and Mac PC. Among these platforms, FX Fair utilizes the widely acclaimed MT4 (MetaTrader 4) trading platform, which has gained recognition as a leading platform in the industry.

MT4 is renowned for its popularity, with a focus on providing traders with exceptional operability and a wide array of features. The platform allows for automated trading using Expert Advisors (EA), enabling continuous trading activities around the clock, 24 hours a day, 365 days a year.

The MT4 platform is available for free on smartphones, facilitating trading on-the-go. It supports one-click trading and provides a simulated trading environment through demo accounts. Traders can also leverage the platform's capability to incorporate indicators and automatic trading software. The availability of comprehensive chart analysis tools allows users to analyze market trends on an hourly basis. Additionally, MT4 enables the management of multiple accounts in a centralized manner.

FX Fair provides easy access to MT4 across different devices. Whether it's a Windows PC, Mac, iPhone, iPad, Android, Tablet, or WebTrader, the MT4 platform is accessible and supported.

FX Fair emphasizes user-friendliness, particularly catering to beginners. The MT4 platform features a beginner-friendly design, and FX Fair offers a manual that guides users from the MT4 download process to the initiation of trading. This resource aims to make beginners feel comfortable and confident in their trading endeavors.

It is important to note that FX Fair supports MT4 specifically for Windows compatibility, Mac, iPhone/iPad, Android/Tablet, and WebTrader, enabling users on various devices to access the platform without restriction.

| Pros | Cons |

| Offers a range of trading platforms for various devices | Limited information on platform features |

| Utilizes the widely acclaimed MT4 trading platform | Lack of alternative trading platform options |

| Provides automated trading using Expert Advisors (EA) | Potential learning curve for beginners |

| Supports one-click trading and incorporates indicators | Limited customization options |

| Offers comprehensive chart analysis tools | Lack of information on platform security measures |

| Facilitates trading on-the-go with mobile platform support | Limited information on platform reliability |

| Provides a simulated trading environment through demo accounts | |

| Allows management of multiple accounts in a centralized manner |

Trading Tools

FX Fair offers a range of trading tools to assist users in their trading activities. One such tool is the Trade Analysis feature, which allows traders to assess their own margin transition over a specified period. This tool enables users to have a clear overview of their margin performance.

Another tool provided by FX Fair is the Share function, which enables traders to share their trading results on platforms such as Twitter. This feature promotes interaction among traders, allowing them to exchange advice and insights.

The Trading Tendency tool allows users to analyze their selling and buying trends as well as their preferred trading styles. By examining their trading tendencies, traders can adjust their strategies and assess their progress towards their goals. Furthermore, traders have the option to share their trading results on social media platforms, fostering a sense of competition and collaboration among fellow traders.

FX Fair also offers a detailed trade analysis feature that provides insights under various conditions, such as specific time periods, currency pairs, and transaction types (Buy/Sell). Traders can analyze factors such as the number of pips earned, average profit/loss, win/loss ratios, and position holding time. Understanding these trade analytics can be beneficial for future trading decisions.

Additionally, FX Fair provides a calendar function that presents the transition of account balance, total income and expenditure, and gross profit margin in a calendar format. This feature allows traders to easily track and assess their performance on a daily basis.

Traders using FX Fair can also share their trade analysis results through Twitter integration. This enables them to showcase their analysis findings, compete with other traders, and provide updates on their daily trading activities.

Customer Support

FX Fair provides customer support through an inquiry form that allows clients to submit their questions or concerns. The company, registered as FXFair Ltd. under registration number 21238 IBC 2013, is located at Beachmont Business Centre, 358, Kingstown, St. Vincent and the Grenadines. Additionally, FX Fair has a Vietnam office situated at CAPITAL PLACE, No. 29 Lieu Giai, Ba Dinh District, Ha Noi, Vietnam.

To contact customer support, clients can reach out to FX Fair via phone at +84 969986491 or through email at support@fxfair.com. The support team is available on weekdays, providing assistance round the clock.

When using the inquiry form, customers are required to fill in relevant details such as their MT4 Account Number, country, name, email address, phone number, and inquiry details. The customer support team strives to address inquiries promptly within the specified business hours of 24 hours on weekdays.

Conclusion

FX Fair is a broker that currently lacks valid regulation, which poses inherent risks for traders. While the broker offers a variety of market instruments, including forex, energy commodities, precious metals, cryptocurrencies, stock indices, and individual stocks, it is crucial to exercise caution when engaging in financial activities with FX Fair due to the absence of regulation. The broker provides different account types, such as STANDARD, ZERO SPREAD, and PRO accounts, each with its own characteristics and leverage options. FX Fair utilizes the popular MT4 trading platform, which is accessible on various devices. However, it is important to note that the absence of regulation and associated risks should be carefully considered. Customers can contact FX Fair's customer support through phone or email during weekdays for assistance.

FAQs

Q: Is FX Fair regulated?

A: FX Fair currently lacks valid regulation, posing inherent risks. Caution is advised when engaging in financial activities with FX Fair.

Q: What market instruments does FX Fair offer?

A: FX Fair offers trading in forex, energy commodities, precious metals, cryptocurrencies, stock indices, and individual stocks.

Q: What are the account types available at FX Fair?

A: FX Fair offers STANDARD, ZERO SPREAD, and PRO accounts, each with its own features and minimum deposit requirements.

Q: How do I open an account with FX Fair?

A: To open an account with FX Fair, visit their website, choose between a demo or real account, provide personal information, select the account type and base currency, agree to the legal documents, and submit the registration.

Q: What leverage does FX Fair offer?

A: FX Fair offers leverage options of up to 1:1111, allowing traders to amplify their positions.

Q: What are the deposit and withdrawal options at FX Fair?

A: FX Fair accepts various deposit methods such as credit/debit card, bank transfer, BitGo, and Perfect Money. Withdrawals can be made through bank transfer, BitGo, and Perfect Money.

Q: Which trading platform does FX Fair use?

A: FX Fair utilizes the popular MT4 (MetaTrader 4) trading platform, available on multiple devices including Windows PC, Mac, iPhone/iPad, Android/Tablet, and WebTrader.

Q: What trading tools are provided by FX Fair?

A: FX Fair offers trade analysis tools, sharing capabilities, trading tendency analysis, and a calendar function to track performance.

Q: How can I contact FX Fair's customer support?

A: You can reach FX Fair's customer support through phone, email, or by submitting an inquiry form on their website. They aim to provide assistance during weekdays.

News

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now