简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Top 5 Events: May RBA Meeting & AUDUSD Price Forecast

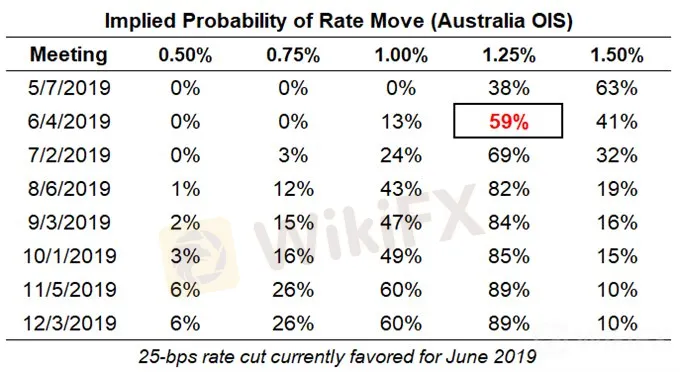

Abstract:The Reserve Bank of Australia meets on Tuesday, May 7 at 03:30 GMT; rates markets are pricing in a 38% chance of a 25-bps rate cut.

Talking Points:

- The Reserve Bank of Australia meets on Tuesday, May 7 at 03:30 GMT; rates markets are pricing in a 38% chance of a 25-bps rate cut.

- AUDUSD technical analysis studies suggest that the 2019 low may be tested once again, opening the door for a move to the September 2015 swing low.

- Retail traders are currently net-long AUDUSD, and have remained net-long since April 15; during that timeframe, AUDUSD fell by -2.2%.

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

05/07 TUESDAY | 03:30 GMT | AUD RESERVE BANK OF AUSTRALIA RATE DECISION

Not much has changed for the positive in the weeks since the last time the Reserve Bank of Australia met. The Q119 Australia inflation report showed that price pressures were weaker than expected, coming in at 1.3% versus 1.5% (y/y). March Australia retail sales were weaker as well, coming in at 0.2% from 0.8% (m/m). On balance, the Citi Economic Surprise Index for Australia, a gauge of economic data momentum, fell from 45.6 to 37.3 since the April RBA meeting.

In the interim period since the last RBA meeting in April, rates markets have steadily pulled forward expectations of a 25-bps rate cut into the first half of 2019. Currently, there is a 38% chance of a cut at the May meeting.

But prior to the April RBA meeting, overnight index swaps were pricing in a 30% chance of a cut by June; ahead of the May RBA meeting, odds of a 25-bps cut in June have risen to 59%. Considering these developments, it seems very likely that the RBA will use its May meeting to clarify the timing of when the first expansionary monetary policy move will be made.

Pairs to Watch: AUDJPY, AUDNZD, AUDUSD

AUDUSD Technical Analysis: Daily Timeframe (October 2018 to May 2019) (Chart 1)

Technical analysis studies show that AUDUSD price action has weakened considerably in recent weeks. By the end of the week, AUDUSD had fallen back towards its closing low for 2019, set on January 2 ahead of the Japanese Yen flash crash. With price below its daily 8-, 13-, and 21-EMA, and both daily MACD and Slow Stochastics trending lower in bearish territory, momentum is firmly to the downside.

A break of the 2019 low at 0.6982 would open the door for a move back towards the September 2015 swing low around 0.6907 in the near-term. Otherwise, only if AUDUSD were to return above the daily 13-EMA, which coincides with lows established in late-March and early-April (0.7057), would the short-term bearish price forecast be no longer appropriate.

IG Client Sentiment Index: AUDUSD Price Forecast (May 3, 2019) (Chart 2)

AUDUSD: Retail trader data shows 77.7% of traders are net-long with the ratio of traders long to short at 3.49 to 1. In fact, traders have remained net-long since April 18 when AUDUSD traded near 0.71738; price has moved 2.2% lower since then. The percentage of traders net-long is now its highest since Apr 25 when AUDUSD traded near 0.70185. The number of traders net-long is 9.5% higher than yesterday and 7.7% higher from last week, while the number of traders net-short is 16.8% lower than yesterday and 4.8% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUDUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUDUSD-bearish contrarian trading bias.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

AUD/USD Eyes Upside on Potential Loan Prime Rate Cut in China

Australian Dollar eyes China’s monthly 1- and 5-year Loan Prime Rate fixing. Traders await news over US/China oil inventory releases and Biden’s Fed pick. AUD/USD downside may continue as bearish SMA crossover nears.

EUR/USD, EUR/JPY Rates Rebound Off Lows after September ECB Meeting

Euro rates have seen volatility around the September ECB meeting as outgoing President Draghi's alter ego “Super Mario” made an appearance.

FX Week Ahead - Top 5 Events: August RBA Meeting Minutes & AUD/USD Rate Forecast

The August RBA meeting minutes are due to be on Tuesday, August 20 at 01:30 GMT, and the tone is likely to come in on the dovish side.

Gold Price Rise May Extend But Signs of Exhaustion Are Emerging

Gold prices may continue inching upward but technical cues pointing to ebbing momentum are warning of a possible pullback before the broader rise resumes.

WikiFX Broker

Latest News

Wolf Capital Exposed: The $9.4M Crypto Ponzi Scheme that Lured Thousands with False Promises

Confirmed! US December non-farm payroll exceeded expectations

Spain plans 100% tax for homes bought by non-EU residents

90 Days, Rs.1800 Cr. Saved! MHA Reveals

The Yuan’s Struggle: How China Plans to Protect Its Economy

LiteForex Celebrates Its 20th Anniversary with a $1,000,000 Challenge

Misleading Bond Sales Practices: BMO Capital Markets Fined Again by SEC

Italy’s Largest Bank Intesa Sanpaolo Enters Cryptocurrency Market

400 Foreign Nationals Arrested in Crypto Scam Raid in Manila

Singapore Blocks Polymarket Access, Following U.S. and France

Currency Calculator