Score

MIA

Australia|5-10 years|

Australia|5-10 years| https://www.mia491.com/#

Website

Rating Index

Contact

Licenses

Single Core

1G

40G

Disclosure

More

Danger

Warning

Contact number

Other ways of contact

Broker Information

More

My Group Fintech Co Pty Ltd.

MIA

Australia

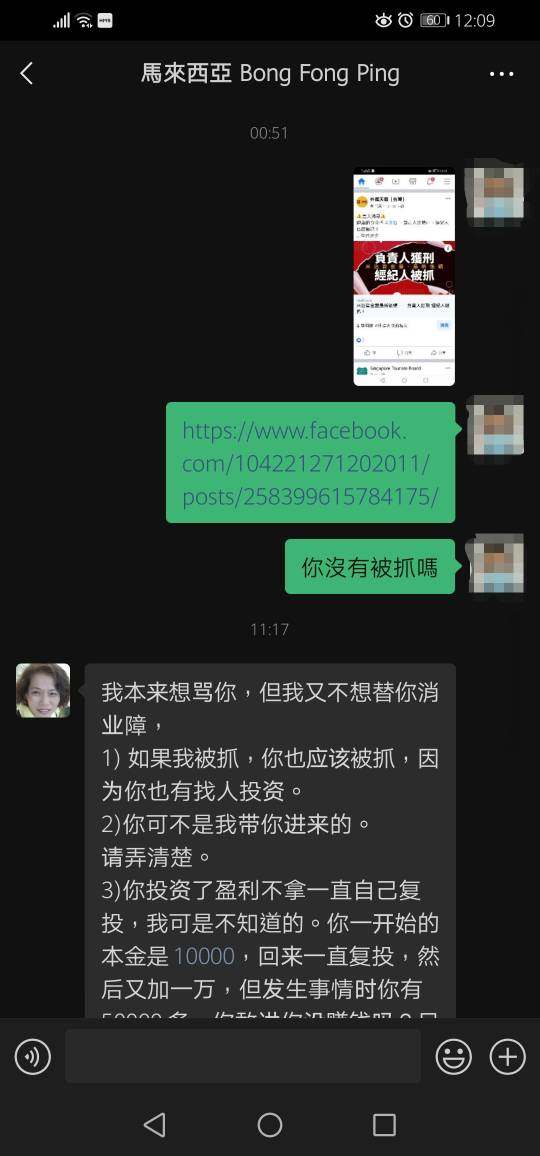

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- This broker has been verified to be illegal and all of its licences have expired, and it has been listed in WikiFX's Scam Brokers list. Please be aware of the risk!

- The platform is a Ponzi Scheme, which refers to the use of "principle of value multiplication". In the form of rolling or static fund circulation, it uses the money of next member to pay to the present one, which is essentially a pyramid scheme with the distinction of hidden, deceptive and socially harmful. By calling common person's desire for money, fraudsters in the platform begin raising funds underground. Since this kind of platform mostly will abscond after 1 or 2 years, the fund-raising mode just can exist less than 3 years.

- The number of the complaints received by WikiFX have reached 14 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

- The AustraliaASIC regulation (license number: 224022) claimed by this broker is suspected to be clone. Please be aware of the risk!

WikiFX Verification

Users who viewed MIA also viewed..

XM

Decode Global

MultiBank Group

FP Markets

MIA · Company Summary

| Aspect | Information |

| Registered Country/Area | Australia |

| Founded Year | Not provided |

| Company Name | My Group Fintech Co Pty Ltd |

| Regulation | Suspicious regulatory license |

| Minimum Deposit | Not provided |

| Spreads | Spread information not available |

| Trading Platforms | No trading software mentioned |

| Tradable Assets | Forex, Precious metals, Indices, Crude oil, other financial trading products (specific range may vary) |

| Account Types | Regular, Manager, Agency Manager, Regional Manager |

| Compensation Plans | Regular, Manager, Agency Manager, Regional Manager |

| Customer Support | Not provided |

Overview of MIA

MIA is an online trading platform based in Australia that claims to offer investment services in various financial instruments, including foreign exchange, precious metals, indices, crude oil, and other trading products. However, based on the available information, there are several red flags and suspicions surrounding MIA's legitimacy. The company names mentioned, such as Money Cat Group Pty Ltd and My Group Fintech Co Pty Ltd, are suspected to be suspicious clones with dubious regulatory licenses.

The regulatory licenses claimed by MIA, including the Australia Securities & Investment Commission (ASIC) and the National Futures Association (NFA), lack supporting details such as license type, website, address, or phone number of the licensed institutions. This raises concerns about the authenticity of the licenses mentioned. Moreover, MIA is listed as a potential scam broker on WikiFX's Scam Brokers list, with multiple complaints filed against it in recent months.

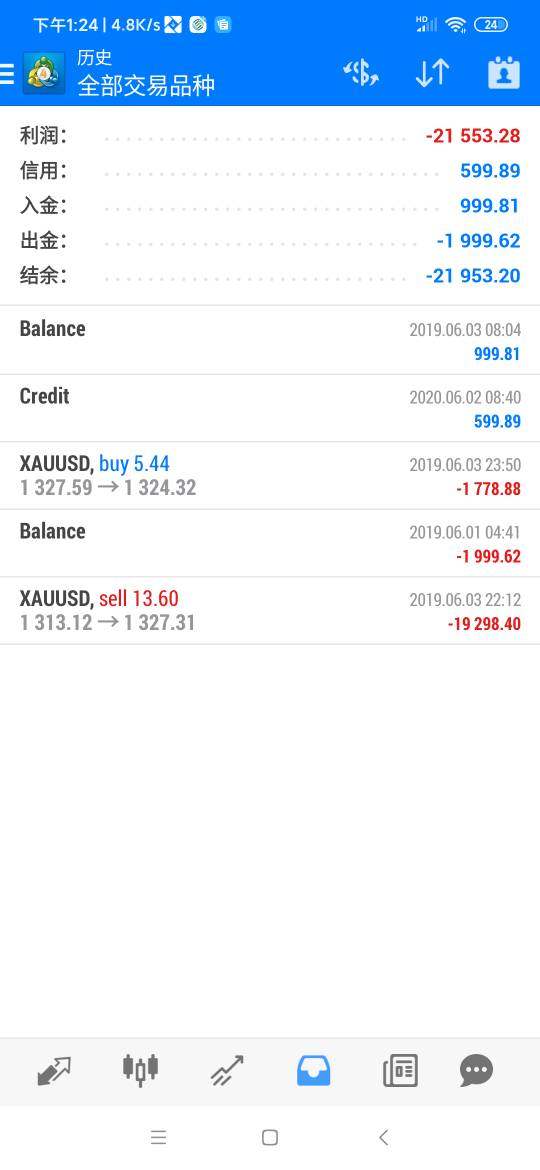

Furthermore, negative reviews and experiences shared by users highlight various issues, including substantial financial losses, fraudulent practices, and difficulties in withdrawing funds. These reviews contribute to the overall lack of trust and raise significant doubts about the integrity of MIA as a reliable and legitimate trading platform.

In conclusion, based on the available information and the numerous suspicions and red flags surrounding MIA, it is strongly advised to exercise caution and avoid engaging with this platform. The potential risks and concerns associated with MIA's operations, along with the lack of transparency and negative user experiences, indicate a high likelihood of fraudulent activities and financial harm for investors.

Pros and Cons

MIA, an online trading platform, has a number of pros and cons to consider. On the positive side, MIA offers foreign exchange trading, enabling investors to participate in the global currency markets. It also allows for trading of precious metals, access to various stock indices, and trading of crude oil. Furthermore, MIA provides a range of financial trading products and utilizes the Mirror Trade System for account management. However, there are several concerns regarding MIA. The regulatory licenses claimed by the platform are suspicious, raising doubts about its legitimacy. It has also been listed as a potential scam broker, with multiple complaints and negative reviews. The lack of disclosed spreads and transparency is another drawback. Additionally, there have been reports of fraudulent activities associated with MIA, and the compensation plans offered are unclear.

| Pros | Cons |

| Offers foreign exchange trading | Suspicious regulatory licenses |

| Enables trading of precious metals | Listed as a potential scam broker |

| Provides access to various stock indices | Multiple complaints and negative reviews |

| Allows trading of crude oil | Lack of disclosed spreads and transparency |

| Offers a range of financial trading products | Reports of fraudulent activities |

| Utilizes Mirror Trade System for account management | Unclear compensation plans |

Is MIA Legit?

Based on the provided information, the Money Cat Group Pty Ltd, which is claimed to be regulated by the Australia Securities & Investment Commission (ASIC), is suspected to be a suspicious clone. The license type mentioned is an Investment Advisory License, and the license number is 224022. However, there is no sharing of the license type or the website of the licensed institution. The address of the licensed institution is Suite 802, 815 Pacific Highway, Chatswood NSW 2067.

Similarly, the My Group Fintech Co Pty Ltd, which is claimed to be regulated by the National Futures Association (NFA) in the United States, is also suspected to be a suspicious clone. The license type mentioned is a Common Financial Service License, and the license number is 0509912. However, there is no sharing of the license type, website, address, or phone number of the licensed institution.

Based on the provided information, it is stated that this platform is a Ponzi Scheme and has been verified to be illegal. The platform is mentioned to be a potential scam and is listed in WikiFX's Scam Brokers list. It is advised to stay away from it due to the risk involved.

Additionally, the information suggests that there have been 14 complaints received by WikiFX about this broker in the past 3 months, further highlighting the potential risks and concerns associated with it. The ASIC regulation claimed by this broker is suspected to be a clone, as well as the NFA regulation claimed by them.

Furthermore, it is mentioned that the current information indicates that this broker does not have a trading software, which is another aspect that raises concerns. It is advisable to exercise caution and be aware of the potential risks associated with this platform.

Market Instruments

FOREIGN EXCHANGE: Mia offers foreign exchange trading, allowing investors to participate in the global currency markets. Foreign exchange trading involves buying and selling currencies to profit from fluctuations in exchange rates. Traders can access a wide range of currency pairs to trade, including major, minor, and exotic currency pairs.

PRECIOUS METALS: Mia enables investors to trade precious metals, such as gold, silver, platinum, and palladium. Precious metals are often considered as a safe-haven investment during times of economic uncertainty. Traders can speculate on the price movements of these metals and potentially benefit from their value fluctuations.

INDICES: Mia provides access to various stock market indices, allowing traders to speculate on the overall performance of a specific stock market or a group of stocks. Popular indices, such as the S&P 500, Dow Jones Industrial Average, or FTSE 100, can be traded through Mia's platform. Traders can take positions based on their expectations of the index's direction.

CRUDE OIL: Mia allows investors to trade crude oil, one of the most actively traded commodities in the financial markets. Crude oil trading involves speculating on the price movements of oil, influenced by factors such as global demand, geopolitical events, and supply disruptions. Traders can take advantage of both upward and downward price trends.

OTHER FINANCIAL TRADING PRODUCTS: In addition to the above-mentioned instruments, Mia may offer access to a range of other financial trading products. These may include commodities, such as natural gas, agricultural products, or industrial metals. It's important to note that the specific range of trading products offered by Mia may vary and it is advisable to refer to their official website or contact the broker directly for detailed information on available instruments.

Pros and Cons

| Pros | Cons |

| Foreign exchange trading allows participation in global currency markets | Regulatory licenses claimed by MIA are suspicious |

| Enables trading of precious metals as a safe-haven investment | MIA has been listed as a potential scam broker |

| Provides access to various stock market indices for speculation | Multiple complaints and negative reviews associated with MIA |

Accounts Management

MIA offers an accounts management service that utilizes the Mirror Trade System (MIRROR TRADE) to facilitate trading activities within the international foreign exchange trading platform. The Mirror Trade System employs advanced technology to support trading strategies and potential outcomes.

Spreads & Commissions

The spread information for MIA is not available as the official website cannot be accessed. The absence of disclosed spreads raises concerns about the transparency of trading conditions offered by this broker.

Compensation plans

MIA offers four different investment plans: Regular, Manager, Agency Manager, and Regional Manager. The Regular plan requires affiliates to purchase at least one Mia pax, while the Manager plan has a minimum investment requirement of $3,000. For the Agency Manager plan, the minimum investment amount is $5,000, and the Regional Manager plan requires a higher investment of $10,000. The exact cost of one Mia Pax is not disclosed on the site, but it is indicated to be less than $10,000.

| Pros | Cons |

| Offers multiple investment plans | Lack of transparency regarding the exact cost of Mia Pax |

| Provides options for different investment levels | Minimum investment requirements may be high for some investors |

| Potential for higher returns with higher investment levels | Limited information on the benefits and rewards of each plan |

| Allows affiliates to earn through the referral program | Lack of detailed explanation on how the compensation system works |

Reviews

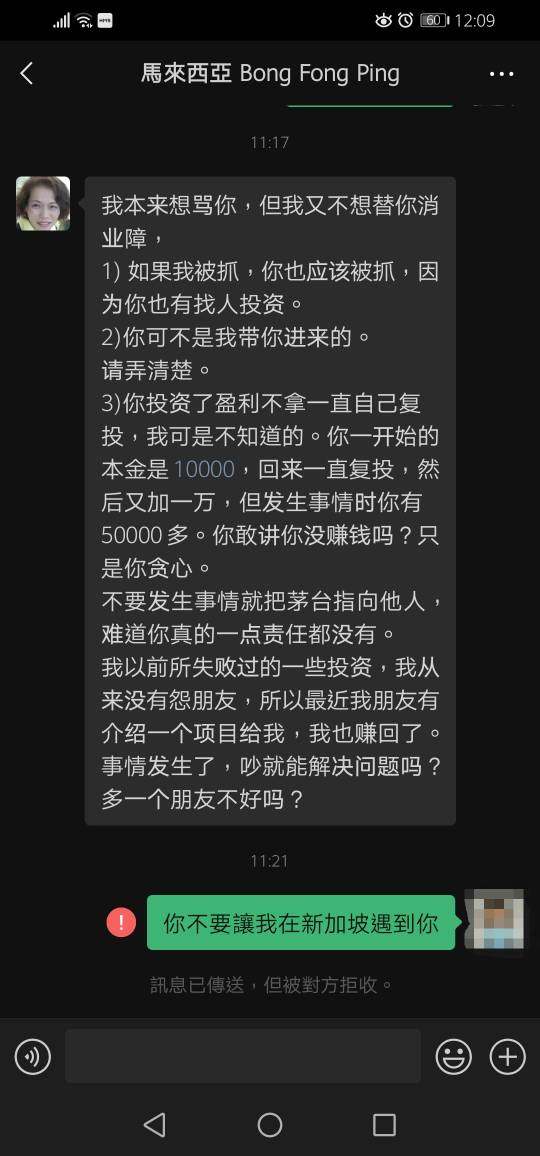

MIA has received multiple negative reviews on WikiFX, with a total of 14 exposures. The reviews highlight various issues and concerns. One victim, Mr. Li, invested a significant amount of money but experienced losses instead of the promised profits. The platform's analysts used professional terms to confuse and persuade him to increase his investments, resulting in a loss of over $170,000. Another reviewer mentioned that MIA cheated all clients and disappeared overnight, leading to substantial financial losses. There are claims of fraudulent practices, such as making orders at will and trading abnormally. Some reviewers also expressed frustration with the platform's inability to withdraw funds. Overall, the reviews suggest a lack of trust and indicate that MIA has been involved in fraudulent activities, causing financial harm to its clients.

Conclusion

In conclusion, based on the information provided, MIA raises several concerns and disadvantages. The regulatory licenses claimed by the company, such as the ASIC regulation and NFA regulation, are suspected to be clones, as there is no sharing of important license details or contact information for the licensed institutions. The platform is listed as a potential scam and has been associated with illegal activities, including being listed in WikiFX's Scam Brokers list. Multiple complaints have been filed against MIA in the past few months, further emphasizing the potential risks involved. Additionally, there is a lack of transparency regarding trading conditions, as the spread information is not available. The negative reviews on WikiFX indicate fraudulent practices, substantial financial losses, and difficulties in fund withdrawals. Given these factors, caution is advised when considering MIA as a trading platform.

FAQs

Q: Is MIA a legitimate broker?

A: Based on the provided information, MIA is suspected to be a scam broker involved in fraudulent activities.

Q: What trading instruments does MIA offer?

A: MIA offers foreign exchange (forex), precious metals, stock market indices, crude oil, and potentially other financial trading products.

Q: Does MIA offer account management services?

A: Yes, MIA offers an accounts management service utilizing the Mirror Trade System.

Q: Are the trading conditions transparent with MIA?

A: The absence of disclosed spreads raises concerns about the transparency of trading conditions offered by MIA.

Q: What are the compensation plans offered by MIA?

A: MIA offers four investment plans with varying minimum investment requirements.

Q: What do the reviews say about MIA?

A: Negative reviews on WikiFX indicate that MIA has been involved in fraudulent practices, causing financial harm to its clients.

Q: Should I trust MIA?

A: Based on the available information, it is advised to stay away from MIA due to suspicions of being a scam broker.

Review 14

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now