简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Price Rise May Extend But Signs of Exhaustion Are Emerging

Abstract:Gold prices may continue inching upward but technical cues pointing to ebbing momentum are warning of a possible pullback before the broader rise resumes.

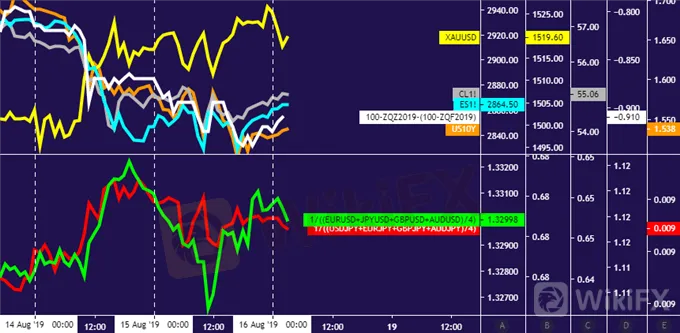

Crude oil, gold price performance chart created using TradingView

GOLD & CRUDE OIL TALKING POINTS:

Gold prices may rise as markets tilt risk-off before the weekend

Crude oil prices vulnerable, might move to retest $50/bbl figure

Progress may be limited before FOMC minutes, Jackson Hole

Commodity prices idled Thursday as a lull in pace-setting news flow made room to digest recent volatility. From here, a relatively quiet offering on the economic data docket seems likely to keep broad-based market sentiment trends in control. The path of least resistance favors a risk-off scenario.

Sudden bursts of volatility have become increasingly common recently as prices react to eye-catching headlines from Washington and Beijing amid US-China trade war escalation. This probably has traders more leery than usual of holding pro-risk exposure over the weekend.

With that in mind, a round of defensive liquidation might pull down cycle-sensitive crude oil prices alongside stocks. A parallel dip in bond yields might have scope to push up gold, especially since the metal has managed gains even as the US Dollar trades higher recently.

Absent a burst of headline-driven volatility however, significant trend development seems unlikely. The week ahead brings critical inflection points in the Fed policy outlook – a defining macro input – by way of FOMC minutes and the Jackson Hole symposium. Commitment may be scarce in the interim.

GOLD TECHNICAL ANALYSIS

Gold prices are inching toward resistance at 1540.70, the 76.4% Fibonacci expansion. A daily close above that exposes a weekly chart inflection level at 1563.00 next. Negative RSI divergence hints upside momentum is ebbing however. A turn below the 61.8% Fib at 1513.94 targets the 50% level at 1492.31.

Gold price chart created using TradingView

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices slipped back below the lower bound of the 54.72-56.09 congestion area, breaking the weekly uptrend in the process. Sellers may now move test the 49.41-50.60 zone anew. A daily close above trend resistance set from late April – now at 58.53 – seems necessary to neutralize downward pressure.

Crude oil price chart created using TradingView

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Weekly Analysis: XAU/USD Gold Insights

Gold prices have been highly volatile, trading near record highs due to various economic and geopolitical factors. Last week's weak US employment data, with only 114,000 jobs added and an unexpected rise in the unemployment rate to 4.3%, has increased the likelihood of the Federal Reserve implementing rate cuts, boosting gold's appeal. Tensions in the Middle East further support gold as a safe-haven asset. Technical analysis suggests that gold prices might break above $2,477, potentially reachin

USDJPY Predicted to Rise on Yen Depreciation

The USD/JPY pair is predicted to increase based on both fundamental and technical analyses. Fundamental factors include a potential easing of aggressive bond buying by the Bank of Japan (BoJ), which could lead to yen depreciation. Technical indicators suggest a continuing uptrend, with the possibility of a correction once the price reaches the 157.7 to 160 range.

March 21, 2024 DAILY MARKET NEWSLETTER: Fed Hints at Rate Cuts, Stocks Surge

Consider including the date in your title for clarity.

Daily Market Newsletter - March 12, 2024: Market Recap: S&P 500 and Nasdaq Decline, Bitcoin Boosts Microstrategy to Record Highs

Insights from Trading Central's Global Research Desks

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

YAMARKETS' Jingle Bells Christmas Offer!

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Currency Calculator