简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USDCAD Breakout Stalls Ahead of US NFP Report as GDP Fails to Impress

Abstract:USD/CAD may continue to consolidate ahead of the U.S. Non-Farm Payrolls (NFP) report on tap for May 3 as it snaps the series of higher highs & lows from earlier this week.

Canadian Dollar Talking Points

加元讨论点

The near-term breakout in USD/CAD appears to have stalled ahead of the 2018-high (1.3665) as the updates to the U.S. Gross Domestic Product (GDP) report point to slowing inflation, and the exchange rate may continue to consolidate ahead of the highly anticipated Non-Farm Payrolls (NFP) report as it snaps the series of higher highs & lows from earlier this week.

美元/加元近期突破似乎已经在2018年高位(1.3665)之前停滞不前美国国内生产总值(GDP)报告显示通胀放缓,汇率可能会在备受期待的非农就业数据(NFP)报告之前继续巩固,因为它本周早些时候突破了一系列较高的高点和低点。 / p>

USD/CAD pares the advance following the Bank of Canada (BoC) meeting even though the U.S. economy expands 3.2% during the first three-months of 2019 as the core Personal Consumption Expenditure (PCE), the Federal Reserves preferred gauge for inflation, narrows to 1.3% from 1.7% per annuum in the fourth-quarter of 2018.

尽管美国经济在2019年前三个月扩大3.2%作为核心个人消费支出(美元/加元),但继加拿大央行(BoC)会议之后,美元/加元汇率进一步上涨( PCE)是联邦储备银行通胀的首选指标,从2018年第四季度的每年1.7%缩小至1.3%。

The GDP report indicates theres little to no risk of an imminent recession as economic activity picks up from the 2.2% rate of growth during the last three-months of 2018, but signs of slowing inflation may push the Federal Open Market Committee (FOMC) to adopt a more accommodative stance as the central bank plans to winddown the $50B/month in quantitative tightening (QT) over the coming months.

GDP报告显示几乎没有风险随着经济活动从2018年最后三个月的2.2%的增长率回升,即将到来的经济衰退,但通胀放缓的迹象可能推动联邦公开市场承诺三通(FOMC)将采取更加宽松的立场,因为央行计划在未来几个月内减少50亿美元/月的数量紧缩(QT)。

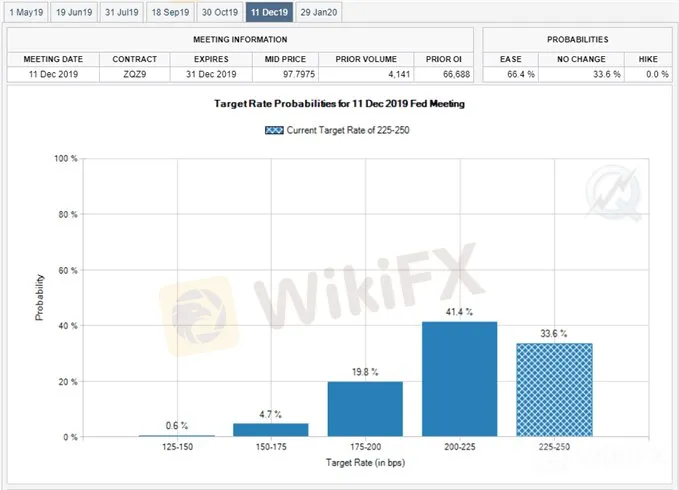

In fact, Fed Fund Futures now reflect a greater than 60% probability for a rate-cut in December as the FOMC struggles to achieve the 2% target for inflation, and it remains to be seen if Chairman Jerome Powell & Co. will continue to project a longer-run interest rate of 2.50% to 2.75% as the central bank pledges to be ‘data dependent.’ As a result, market participants may pay increased attention to the NFP report as the FOMC is widely anticipated to retain the current policy on May 1, and the fresh update may instill an improved outlook for the region as the U.S. economy is projected to add another 181K in April, with Average Hourly Earnings expected to increase to 3.3% from 3.2% the month prior.

事实上,由于联邦公开市场委员会(FOMC)努力实现2%的通胀目标,美联储基金期货现在反映出12月降息的可能性超过60%,如果主席杰罗姆鲍威尔公司将继续下去还有待观察由于央行承诺“数据依赖”,因此市场参与者可能会更加关注非农就业报告,因为市场普遍预期联邦公开市场委员会将保留现有的利率,因此将长期利率预测为2.50%至2.75%。 5月1日的政策,新的更新可能会改善该地区的前景,因为美国经济预计将在4月再增加181,000,平均时数y盈利预计将从3.2%上升至3.3%一个月前。

The lack of urgency to alter the forward-guidance may keep the U.S. dollar afloat as some Fed officials insist that ‘if the economy evolved as they currently expected, with economic growth above its longer-run trend rate, they would likely judge it appropriate to raise the target range for the federal funds rate modestly later this year,’ but the USD/CAD breakout following the BoC meeting appears to have stalled going into the weekend, with the exchange rate at risk for a larger pullback as it snaps the series of higher highs & lows from earlier this week.

由于一些美联储官员坚持认为“如果经济按照他们目前的预期发展,经济有所改善”,那么改变前瞻指引的紧迫性可能会让美元保持运转状态。如果增长高于其长期趋势利率,他们可能会认为今年晚些时候适度提高联邦基金利率的目标范围是合适的,但在加拿大央行会议之后美元/加元突破似乎已经停滞到周末,由于本周早些时候突破了一系列较高的高点和低点,汇率面临较大回调的风险。

Keep in mind, the near-term outlook for USD/CAD remains constructive as the exchange rate clears the range-bound price action from March, with the Relative Strength Index (RSI) highlighting a similar dynamic as the oscillator takes out the bearish formation from a similar timeframe.

请记住,美元的近期前景/由于汇率从3月开始清除区间限制价格行动,加元仍然具有建设性,相对强弱指数(RSI)突显了类似的动态,因为振荡器从类似的时间框架中取出看跌形态。

{7}

Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

{7}

USD/CAD Rate Daily Chart

USD / CAD Rate Daily Chart

USD/CAD may stage a larger pullback following the failed attempt to test the 1.3540 (23.6% retracement) region, with the former-resistance zone around 1.3420 (78.6% retracement) to 1.3460 (61.8% retracement) back on the radar as the exchange rate searches for support.

Nevertheless, the string of failed attempts to close below the 1.3290 (61.8% expansion) to 1.3310 (50% retracement) region instills a constructive outlook for USD/CAD, with the key resistance zone coming in around 1.3630 (38.2% retracement) to 1.3660 (78.6% expansion), which lines up with the 2019-high (1.3665).

尽管如此,一连串失败的尝试收盘价低于1.3290(61.8%扩张)至1.3310( 50%回撤区域为美元兑加元建立了建设性前景,关键阻力区位于1.3630附近(38.2%回撤位)至1.3660(扩大78.6%),与2019年高点(1.3665)一致。

Will keep a close eye on the RSI as it continues to track the upward trend from earlier this year.

将密切关注RSI,因为它继续跟踪早先的上升趋势今年。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Safe-haven yen, Swiss franc rise on Omicron fears, Fed policy uncertainty

The dollar ticked higher on Friday amid a broadly calmer tone in markets as fears over Omicron’s impact eased, but currency moves were muted ahead of a key U.S. payrolls report that could clear the path to earlier Federal Reserve interest rate hikes.

Safe-haven yen, Swiss franc rise on Omicron fears, Fed policy uncertainty

The dollar ticked higher on Friday amid a broadly calmer tone in markets as fears over Omicron’s impact eased, but currency moves were muted ahead of a key U.S. payrolls report that could clear the path to earlier Federal Reserve interest rate hikes.

Dollar stands tall as Fed heads toward taper

The dollar held within striking distance of the year's peaks on the euro and yen on Wednesday, as investors looked for the Federal Reserve to begin unwinding pandemic-era policy support faster than central banks in Europe and Japan.

Gold Price, Silver Price Jump After Saudi Arabia Oil Field Attacks

Gold and silver turned sharply higher after the weekend‘s drone attacks on Saudi oil fields saw tensions in the area ratchet higher with US President Donald Trump warning Iran that he is ’locked and loaded.

WikiFX Broker

Latest News

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Broker Review: Is Exnova Legit?

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator