简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Spot EURNZD Could Swing Tomorrow from ZEW and CPI Data

Abstract:High-impact economic data out of the Eurozone and New Zealand tomorrow has potential to send EURNZD gyrating in an otherwise quiet market.

EURNZD CURRENCY VOLATILITY – TALKING POINTS:

EURNZD could garner the attention of forex traders considering high-impact economic releases expected with German ZEW Survey of Expectations and New Zealand Consumer Price Index on deck for tomorrow

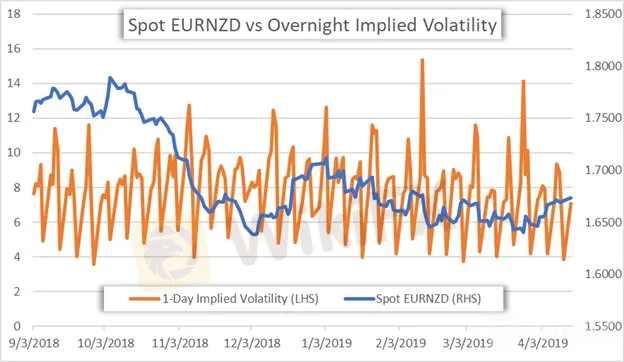

EURNZD overnight implied volatility remains muted, however, with the 1-day price action measure sitting at 7.1 percent headed into Tuesdays session

Check out this article for information on the Top 10 Most Volatile Currency Pairs and How to Trade Them

EURNZD overnight implied volatility remains below its 6-month average of 8.25 percent despite upcoming economic data out the Eurozone and New Zealand that has historically caused sizable market reactions.

The German ZEW Survey of Expectations will be released at 9:00 GMT and looks to provide a health-check on economic sentiment in the Eurozone while New Zealands latest inflation reading will cross the wires later in the session at 22:45 GMT.

EURNZD OVERNIGHT IMPLIED VOLATILITY

FOREX MARKET IMPLIED VOLATILITIES AND TRADING RANGES

Implied volatility measures have dropped elsewhere in the forex market, too. Sterling implied volatility took a nose-dive following the latest Brexit development pushing the UKs departure from the EU back from April 12 to October 31. Although, rising market sentiment and collapsing volatility has bolstered the relative attractiveness of some currency crosses such as AUDJPY for possible carry trades. Another possible factor causing a lack of expected price action this week in particular could be forex traders stepping away ahead of Easter Sunday.

FOREX ECONOMIC CALENDAR – EURNZD

Visit the DailyFX Economic Calendar for a comprehensive list of upcoming economic events and data releases affecting the global markets.

The Euro could come under pressure if the ZEW Survey shows bleak outlook for the Eurozone, particularly if the actual reading comes in below consensus for German expectations. On the contrary, improving outlook will likely echo recent EUR upside.

On the other side of the equation, New Zealand inflation could cause EURNZD to swing later in Tuesdays session if NZ CPI materially surprises. Inflation reported above estimates has potential to boost the New Zealand Dollar while a number below expectations could put downward pressure on NZD.

EURNZD PRICE CHART: 4-HOUR TIME FRAME (MARCH 25, 2019 TO APRIL 15, 2019)

EURNZD overnight implied volatility suggests that the currency pair will trade between 1.6671 and 1.6795 with a 68 percent statistical probability. Interestingly, the 1-day implied high and implied low line up almost precisely with EURNZD‘s recent top on April 11 and the 23.6 Fibonacci retracement line drawn from its low on March 26 to this month’s high. As such, price action tomorrow could provide possible range-trading opportunities if spot prices continue to hold this recent range.

TRADING RESOURCES

{17}

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

{17}{18}

- Written by Rich Dvorak, Junior Analyst for DailyFX

{18}

- Follow @RichDvorakFX on Twitter

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 23 August: JPY Gains Ground Against USD as BoJ Signals Possible Rate Hike

JPY strengthened against the USD, pushing USD/JPY near 145.00, driven by strong inflation data and BoJ rate hike expectations. Japan's strong Q2 GDP growth added support. However, USD gains may be limited by expectations of a Fed rate cut in September.

KVB Market Analysis | 22 August: Gold Stays Strong Above $2,500 as Fed Rate Cut Hints Loom

Gold prices remain above $2,500, near record highs, as investors await the Federal Open Market Committee minutes for confirmation of a potential Fed rate cut in September. The Fed's dovish shift, prioritizing employment over inflation, has weakened the US Dollar, boosting gold. A recent revision showing the US created 818,000 fewer jobs than initially reported also strengthens the case for a rate cut.

KVB Market Analysis | 21 August: USD/JPY Stalls Near 145.50 Amid Diverging Economic Indicators

USD/JPY holds near 145.50, recovering from 144.95 lows. The Yen strengthens on strong GDP, boosting rate hike expectations for the Bank of Japan. However, gains may be limited by potential US Fed rate cuts in September.

KVB Market Analysis | 20 August: Gold Prices Remain Near Record High Amid US Rate Cut Expectations

Gold prices remain near record highs, driven by expectations of a US interest rate cut and a weakening US Dollar. Investors are focusing on the upcoming Jackson Hole Symposium, where Fed Chair Jerome Powell's speech will be closely watched for clues on the Fed's stance. Additionally, the release of US manufacturing data (PMIs) is expected to influence gold's direction.

WikiFX Broker

Latest News

Ghana Trader Jailed for $300K Forex and Crypto Scam

US Dollar Surge Dominates Forex Market

Hong Kong Police Bust Deepfake Crypto Scam Syndicate Involving $34 Million

Is it a good time to buy Korean Won with the current depreciation?

Pepperstone Sponsored the "Aston Martin Aramco Formula One Team"

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Soegee Futures Review: Should You Trust This Broker?

Malaysian Pilot Loses RM1.36 Million in UVKXE Investment App Scam

Indonesia officially joins the BRICS countries

Attention! Goldman Sachs Cuts Gold Target to $2910

Currency Calculator