简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Prices Approach April Low, Hold at Symmetrial Triangle Support

Abstract:Recent changes in positioning suggest that, if a triangle breakout occurs, it would likely be to the downside.

When we last checked in on Gold prices a week ago, there was evidence (a weak US Dollar topping out) to suggest that more gains might be ahead for bullion. And while Gold prices initially rallied thereafter, the key developments that undercut the US Dollars appeal as a safe haven — dissipating concerns over the US-China trade war and Brexit – also served to undermine Gold.

In the past few days, the technical progress within the symmetrical triangle that has encapsulated price action since the start of 2019 has since been reversed. Gold prices have fallen back from near symmetrical triangle resistance and have rapidly approached symmetrical triangle support in just the span of three days.

Gold Technical Forecast: Daily Price Chart (April 2018 to April 2019) (Chart 1)

The move back towards symmetrical triangle support and the April low mean little right now as Gold prices remain within their consolidation. To this end, traders shouldnt be surprised that technical indicators are still relatively neutral.

However, there is evidence that momentum has begun to shift to the downside: price is below the daily 8-, 13-, and 21-EMA envelope; and both daily MACD and Slow Stochastics have started to turn lower below their respective median/neutral lines.

A move below the April low of 1280.80 would be a significant development in the days ahead and suggest that Gold prices may see a deeper setback towards the rising trendline from the August, September, and November 2018 lows near 1260 by the end of the month.

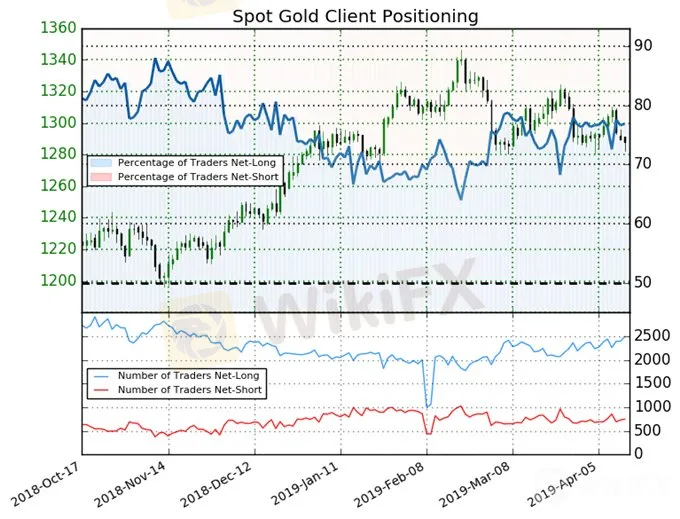

IG Client Sentiment Index: Spot Gold Price Forecast (April 15, 2019) (Chart 2)

Spot Gold: Retail trader data shows 76.9% of traders are net-long with the ratio of traders long to short at 3.33 to 1. The number of traders net-long is 4.3% higher than yesterday and 9.0% higher from last week, while the number of traders net-short is 0.4% higher than yesterday and 4.5% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Spot Gold prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Spot Gold-bearish contrarian trading bias.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Wall Street Rally on Soft CPI

The most anticipated economic indicator of the week, the U.S. Consumer Price Index (CPI), was released yesterday, coming in at 2.9%, below the 3% threshold and in line with the Producer Price Index (PPI) data from the previous day. This further sign of easing inflationary pressure in the U.S. has heightened expectations that the Federal Reserve may implement its first rate cut in September.

Wall Street Advances Ahead of CPI

The equity markets continued their upward momentum, driven by the easing of the Japanese Yen's strength. The Yen was pressured by a dovish tone from Japanese authorities, signalling that the Bank of Japan (BoJ) might keep its monetary policy unchanged amid rising global economic uncertainties.

Nasdaq Bullish, Encourage by Upbeat U.S. Job Data

The financial markets reacted positively to the upbeat Initial Jobless Claims data released yesterday, which came in at 233k, lower than market expectations. This eased concerns about a weakening labour market and the heightened recession risks that emerged after last Friday's disappointing NFP report. Wall Street benefited from the improved risk appetite, with the Nasdaq leading gains, surging by over 400 points in the last session.

Japanese Yen Eases on BoJ Dovish Statement

The Japanese Yen eased on Wednesday morning after the BoJ Deputy Governor indicated that the Japanese central bank would not raise interest rates if global markets remained unstable. This statement has calmed the market and unwound concerns about Yen carry trades. Meanwhile, the dollar has regained strength, with the dollar index (DXY) climbing above the $103 mark.

WikiFX Broker

Latest News

Attention! Goldman Sachs Cuts Gold Target to $2910

Inflation Rebounds: ECB's Big Rate Cut Now Unlikely

Carney \considering\ entering race to replace Canada\s Trudeau

High-Potential Investments: Top 10 Stocks to Watch in 2025

US Dollar Insights: Key FX Trends You Need to Know

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

Pepperstone Sponsored the "Aston Martin Aramco Formula One Team"

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Currency Calculator